Borrower Voices: The Impact of Wage Garnishment During the Coronavirus Pandemic

By Tamara Cesaretti | April 14, 2020

On March 25th, more than 7 million federal student loan borrowers in default received a temporary reprieve from the threat of wage garnishment when the Trump administration announced that the government would stop seizing wages and give refunds for wages that were taken after March 13th, the date the national crisis was declared. This important consumer protection is also contained in the CARES Act, the stimulus bill passed by Congress.

The government can garnish wages to recover on student loans when a borrower enters default due to not making payments. Up to 15 percent of an individual’s paycheck can be withheld to collect on defaulted debts. During the economic devastation of the coronavirus crisis, this money can be especially critical for people to make ends meet.

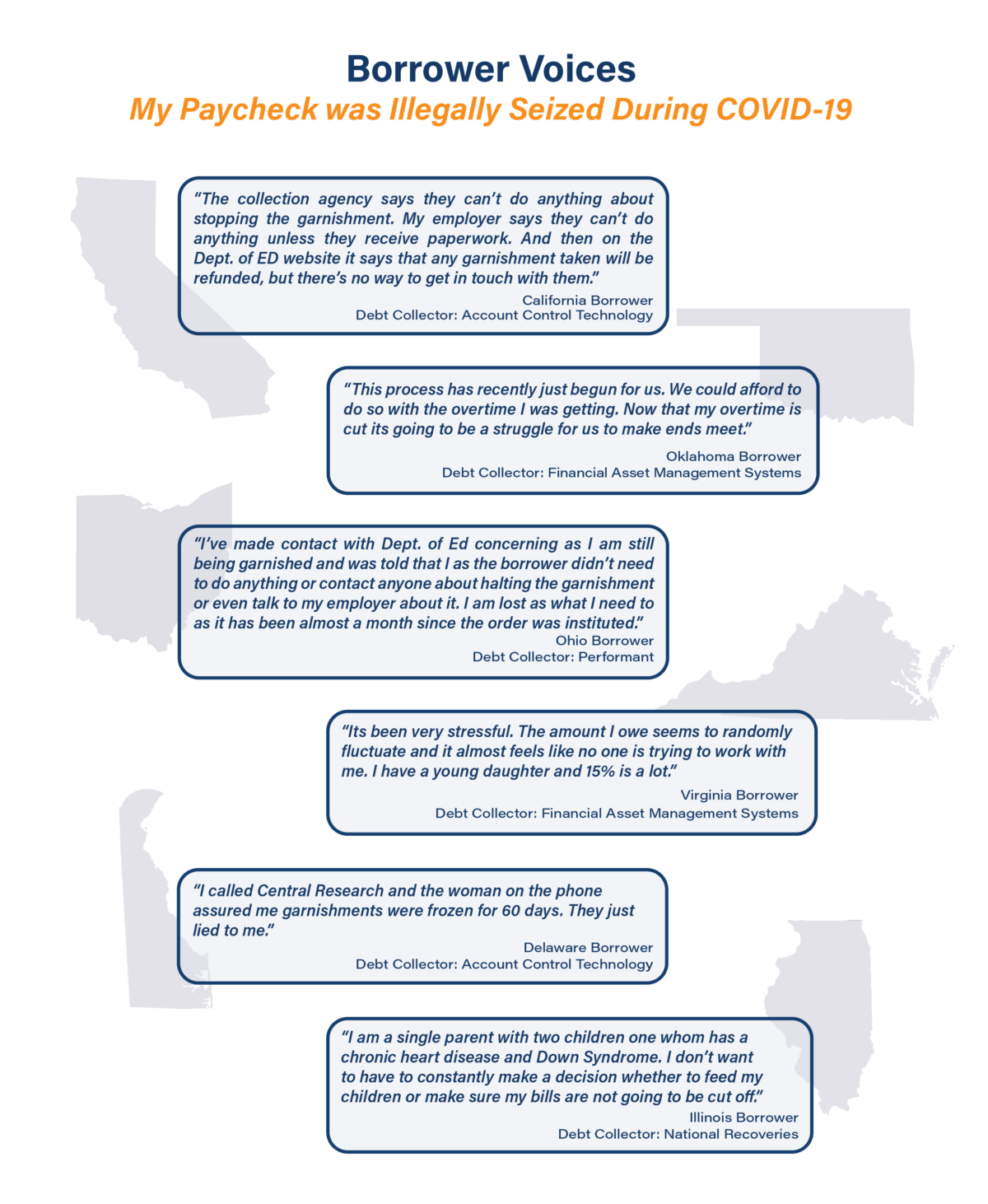

Unfortunately, the order to temporarily halt wage garnishments has been met with confusion and carried out with a lack of accountability. Over the last two weeks, the SBPC team has heard from dozens of borrowers who are still having their wages seized. We fear this happening to thousands more. In fact, the Department of Education has admitted garnishment is still likely to happen.

A refund months from now, however, will do little to help those in distress today. As Americans face unprecedented economic and financial pressure, having wages seized can mean the difference between having enough money to pay rent or to put food on the table.

In borrowers’ own words, we can see how this practice is creating significant hardship for American families across the country. Not only is this tragic, it is illegal. Companies violating the ban on wage garnishment must act quickly to stop— or be held accountable for violating the law.

If your wages are being seized because of your federal student loans please consider sharing your experience with us by following the link below. We will continue fighting for policymakers to take action to protect borrowers.

Administrative Wage Garnishment Borrower Response Form

###

Tamara Cesaretti is a Counsel at the Student Borrower Protection Center. Prior to joining SBPC, Tamara was a civil rights policy advocate for both educational opportunities and economic justice at the Lawyers’ Committee for Civil Rights Under Law.