By Charlie Eaton | August 24, 2022

Contact: Charlie Eaton, Associate Professor of Sociology, University of California, Merced Ceaton2@ucmerced.edu

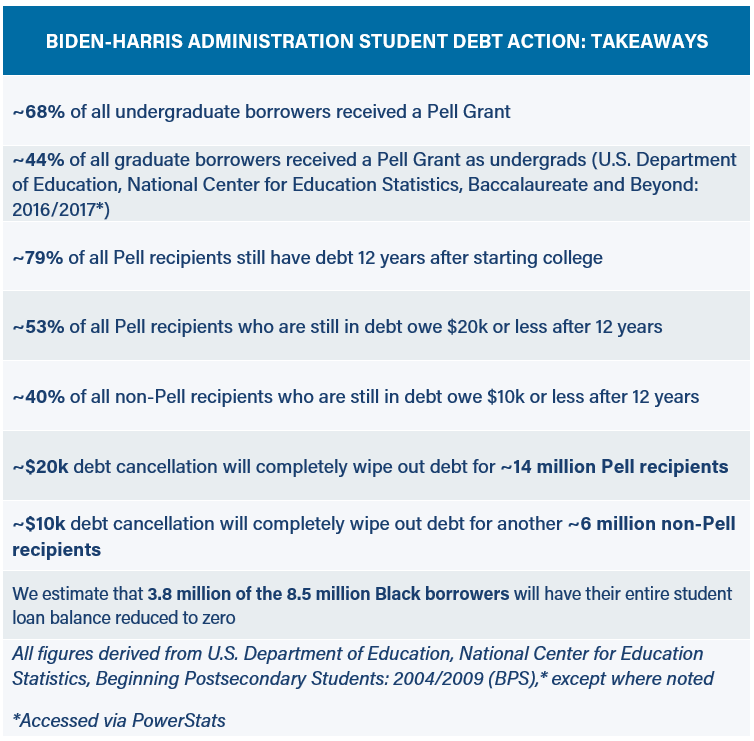

We conducted a rapid analysis of President Biden’s executive order to cancel student debt. The analysis uses survey data from the National Center for Education Statistics Beginning Postsecondary Student (04/12) survey and Baccalaureate and Beyond (2016/2017) survey and the Survey of Consumer Finances. Key takeaways include:

Consistent with statements from the White House, we estimate that around 92 percent of borrowers with federal student loan debt will receive up to $10,000 in cancellation. That amounts to 41 million out of 45 million total borrowers who will receive some cancellation. Around 20 million borrowers will have their entire federal loan debt reduced to zero. We estimate that 3.8 million of the 8.5 million Black borrowers will have their entire student loan balance reduced to zero.

At the same time, 4 million borrowers will be excluded from cancellation if they made more than $125,000, including Black borrowers who tend to carry debts at higher rates because their communities have long been excluded from home ownership and other wealth building opportunities. Another 21 million borrowers will still owe some portion of their existing debt.

These estimates are based upon all eligible borrowers receiving debt cancellation. But this assumption is complicated by the income threshold requirement. Beyond the 8 percent of borrowers who we estimate will be excluded, an unknown number of additional borrowers will not receive cancellation if they do not submit an income attestation form to the U.S. Department of Education. The White House has stated that it will waive this administrative burden for 8 million current students with debt by using income data from their FAFSA and IDR forms.

###

Charlie Eaton is Associate Professor of Sociology at the University of California, Merced, where he co – founded the HERE Lab. His book Bankers in the Ivory Tower: The Troubling Rise of Financiers in U.S. Higher Education was published by University of Chicago Press in 2022.