By Tariq Habash and Ben Kaufman | May 5, 2020

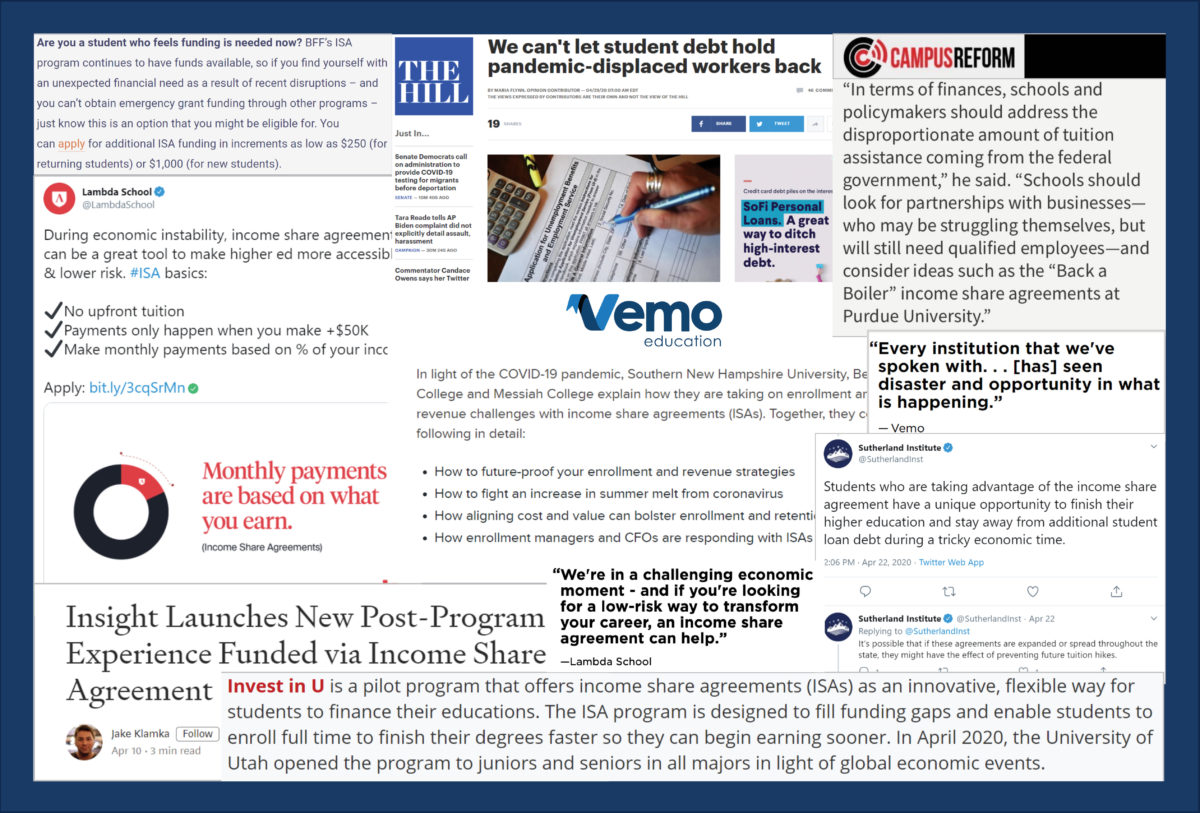

Over the past six weeks, our country plunged into crisis with unprecedented unemployment stemming from the coronavirus pandemic. Before the ink had dried on 30 million Americans’ layoff notices, companies peddling “income share agreements” (ISAs) were already trotting out crafty pitches, misleading marketing materials, and new predatory programs aimed at exploiting this crisis.

Before the ink had dried on 30 million Americans’ layoff notices, companies peddling income share agreements were already trotting out crafty pitches, misleading marketing materials, and new predatory programs aimed at exploiting this crisis.

These products, which advocates have long-warned lack critical consumer protections, require students to pledge future income in exchange for money to pay for college. Amid the coronavirus pandemic, ISAs are being touted by industry as a fix for financing education during uncertain economic times, but policymakers and institutions need to beware of the significant potential harm they could involve.

What we’ve observed since the beginning of the crisis includes:

- Unaccredited schools positing that “[d]uring economic instability, income share agreements can be a great tool to make higher ed more accessible & lower risk” for borrowers.

- Traditional schools steering students toward these problematic financial products in an attempt to “future-proof . . . enrollment and revenue strategies” in anticipation of diminished state aid.

- Direct-to-consumer ISAs masquerading as low-cost, non-debt alternatives for those who “can’t obtain emergency grant funding,” when in reality these products can be extremely high-cost with harmful borrower terms.

- Companies that facilitate investment in ISAs promising Wall Street an “attractive monthly cash return” well into the double digits, pointing to job retraining needs caused by the coronavirus pandemic.

Attempts to capitalize on the crisis…

…with huge investor returns on

the backs of vulnerable borrowers

As these companies ramp up to capitalize on a national emergency, the players in the emerging ISA market are poised to repeat many of the higher education finance scandals that followed the 2008 financial crisis. During that time, millions of Americans went back to school to develop new skills and avoid the ailing labor market. As students worked to dig themselves out of this hole, predators dug in their heels, pushing to capitalize on the economic catastrophe. For-profit schools engaged in egregious recruiting practices to convince new students to enroll and take on massive amounts of unaffordable student debt, only to leave them with worthless degrees. These schools often partnered with shady financial companies to create predatory loan products that were designed to fail the most vulnerable students.

ISA providers echo the worst of these practices by peddling high fees and predatory loan terms under a veneer of so-called “innovation.” ISAs can cost borrowers as much as 40 percent of their pre-tax income and frequently include unconscionable contract terms like mandatory arbitration agreements or unfettered access to borrowers’ bank accounts. ISA providers also argue they should be able to operate wholly outside of basic consumer protection laws.

Moreover, the programs that these ISAs prop up often have a poor track record of student success, including a history of actively misrepresenting students’ academic and employment outcomes.

As millions of Americans look for a way to recover from the current crisis, it is clear that companies promoting ISAs see an opportunity to capitalize on borrowers’ vulnerability and make a quick buck. No company should be allowed to exploit students made newly vulnerable by a recession stemming from a global health pandemic.

###

Tariq Habash is Head of Investigations at the Student Borrower Protection Center.

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center.