By Mark Huelsman | December 4, 2024

On the heels of the 2024 election, two key themes have emerged in the national policy conversation, particularly as it pertains to addressing student debt and college affordability. On one hand, there has been a renewed focus and reflection on how best to address, and lower, everyday costs facing working- and middle-class households, particularly given the financial and economic upheaval over the past several years. On the other hand, as nominations and the staffing picture for the incoming Trump Administration and Congress come more clearly into focus, advocates are raising alarms. Concerns are growing about the need to prepare for and respond to potential incoming attacks on higher education, proposed rollbacks of consumer protections, plans to dismantle the student loan safety net, and cuts to aid and benefit programs that help students and families pay for college and basic necessities.

One thing remains clear: despite stray arguments to the contrary, voters and families overwhelmingly support action to address the student debt crisis and lower the substantial and persistent burden of college costs on their lives. To that end, a new national poll from Protect Borrowers Action (PBA), Student Borrower Protection Center (SBPC), and Seven Letter Insight, shows that student debt remains a major driver of economic angst and motivated voters to engage in the election. Further, voters overwhelmingly believe that the incoming Trump Administration must prioritize lowering the cost of higher education, and bipartisan majorities support steps to making college more affordable, both by making community college tuition-free and guaranteeing a pathway to degrees at public colleges without debt. Among the findings:

- One-third (35%) of all voters said student debt was at least a “very motivating” issue in their decision to cast a ballot this past election.

- There remains a bipartisan consensus around the high cost of college, with more than 75% of voters saying that college is currently unaffordable.

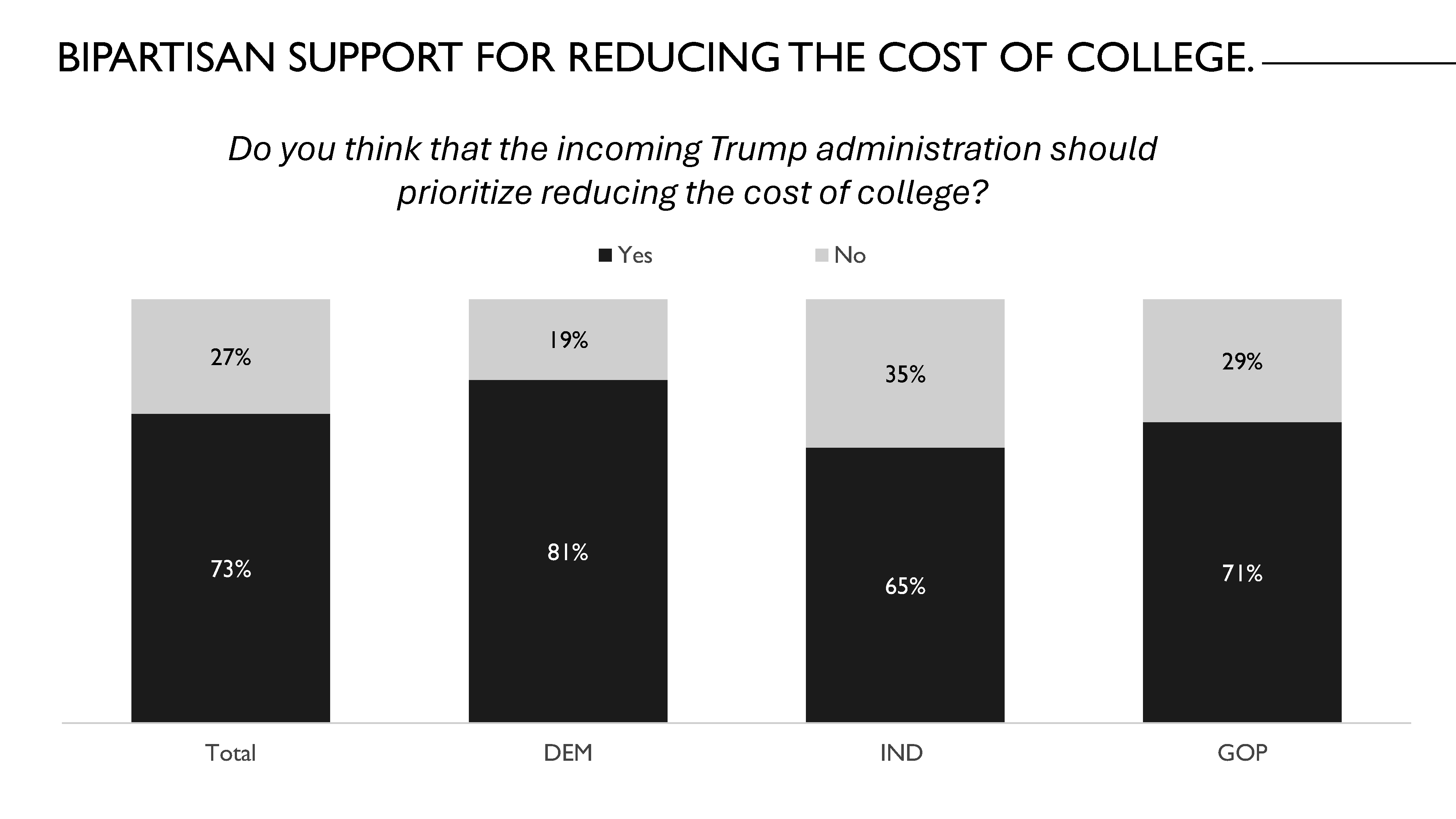

- Large majorities, including over 70% of Republicans and over 80% of Democrats, believe that the incoming Trump Administration should prioritize reducing the cost of college.

Winning the Economic Argument Means Also Addressing the Price of College

Too often, commentators make a critical mistake when talking about student debt and college affordability by situating these costs as outside of other kitchen table financial challenges, such as groceries, housing, or child care. Some even argue that policymakers should turn their focus away from addressing the needs of students and borrowers and toward other household economic concerns.

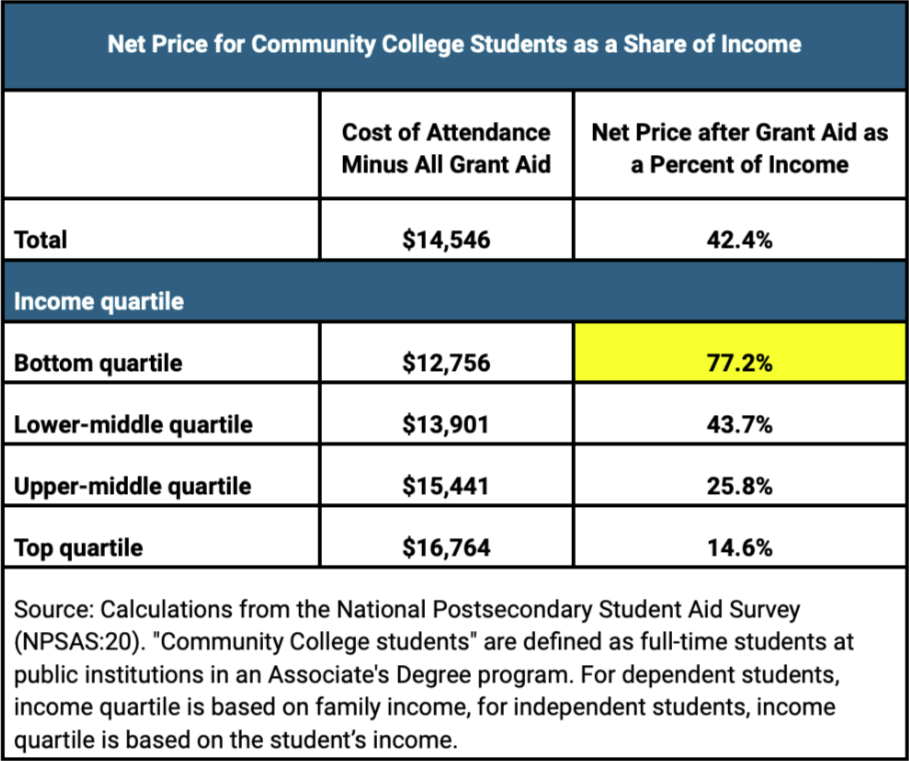

This is misguided for a few major reasons. First, the price of college includes and is reflective of other costs that are continually weighing on workers and families. Consider that at community colleges—which not only enroll more students than any other type of college, but also enroll students who are typically older, low-income, first-generation, and more likely to be parents—the cost to attend is overwhelmingly made up of non-tuition costs like housing, food, transportation, and child care. Given rising costs and stagnant grant aid, these costs can suck up over three-quarters of a low-income student’s annual household income, forcing them into debt even for degrees that are deemed “affordable.”

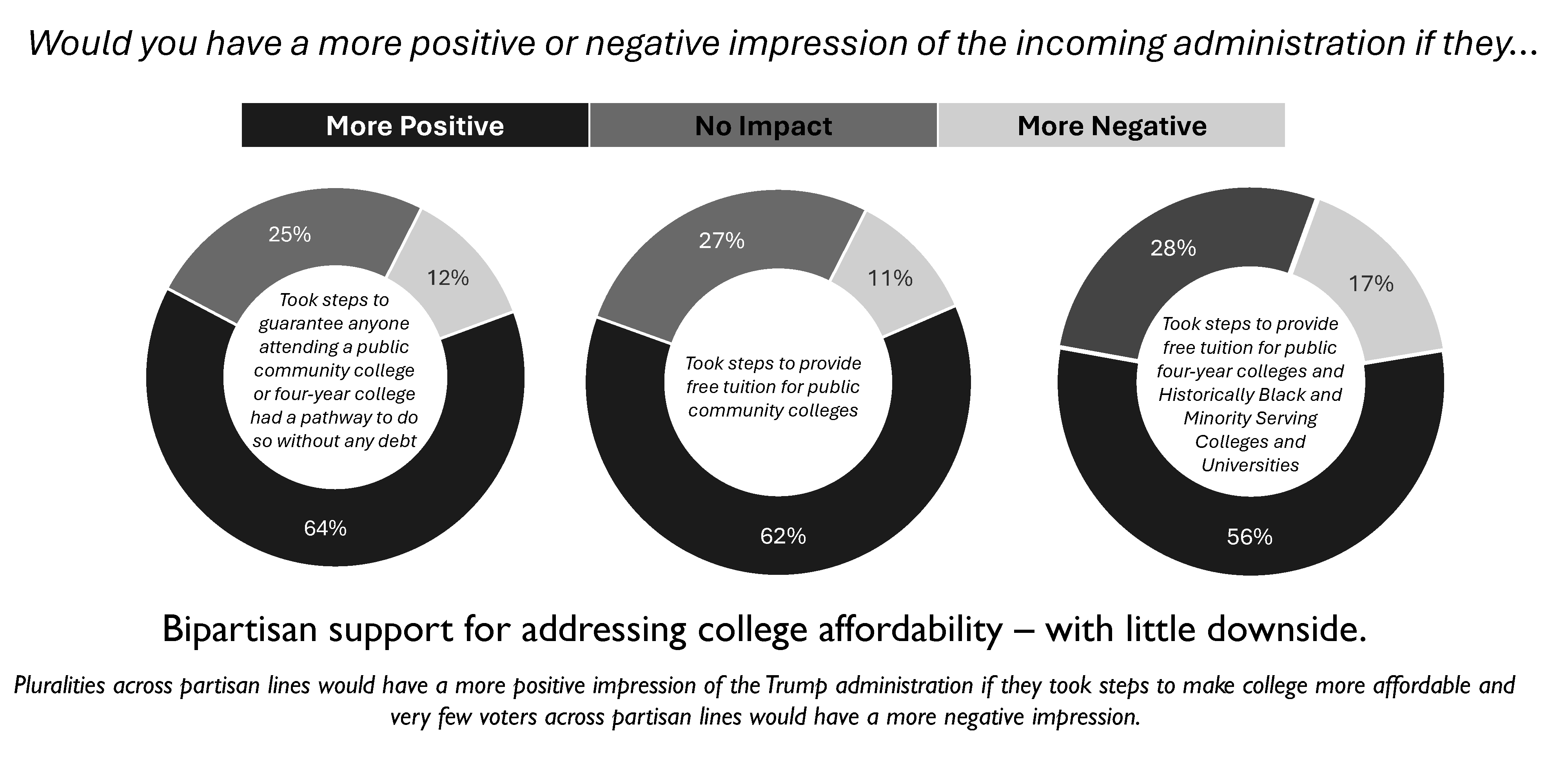

This can prevent students from attending or persisting, and erodes voters’ faith in public goods like public higher education. Indeed, our poll shows that nearly two-thirds (62 percent) of voters, including over 60 percent of Republicans, noted that policies to make college tuition-free would increase the likelihood that they or their family would pursue more education and training.

The second reason that student debt needs to be central to any program that helps families make ends meet is simple: borrowers are currently experiencing widespread hardship and are struggling to pay their monthly student loan bills. Just last week, the Consumer Financial Protection Bureau released alarming new data showing that the percent of borrowers missing student loan payments is slightly higher than it was before the pandemic-era payment pause, and that delinquencies on non-student loan debts remain higher than before the pandemic as well.

Recognizing this, the Biden-Harris Administration has delivered $175 billion in student loan debt relief to nearly 5 million student loan borrowers, largely by ensuring borrowers are able to access relief they are entitled to under existing federal laws. This relief has primarily gone to those earning under the median household income; in other words, it is clearly targeted toward improving the financial future of working- and middle-class households.

This new data also demonstrates why the Biden-Harris Administration’s recent proposed Notice of Proposed Rulemaking to cancel debt for borrowers who are most likely to face hardship and difficulties repaying their student loan debt would be life-changing for millions of borrowers. Even though the fate of that proposal remains uncertain, hundreds of local, state and national organizations have submitted comments in support of the proposal. Additionally, thousands of borrowers wrote in about the hardship that student debt continues to pose on their families and the urgent need for relief regardless of who is in the White House. Critically, the proposal would allow the U.S. Department of Education to consider a wide-ranging list of factors when considering whether a borrower is experiencing hardship. If the last two decades have taught us anything, it’s that economic uncertainty and hardship can manifest quickly and in different forms, and that bold action and creative policymaking in areas like student debt is not only possible, but essential to fixing this problem long-term.

The Root Causes of the College Affordability Crisis Have Not Gone Away

The dynamics that have both caused and exacerbated the student debt crisis have not gone away, and in some cases are more troubling than ever. College prices across the country continue to rise, and cost pressures on colleges will continue to tighten as pandemic-era federal support for higher education recedes into history. Even recent “good news” about slowing growth in inflation-adjusted tuition is almost entirely explained by the exceedingly high inflation of the past few years. In other words, college is not suddenly more affordable just because a family’s grocery bill has grown at an unmanageable rate. In an era when the gap in wages between college and high school graduates has actually begun to decline, rising student debt is likely to become more salient—not less.

There also remains no check on state per-student disinvestment of public colleges and universities. Despite some recent growth in public higher education funding over the past few years (again, facilitated in part by massive federal support to backstop states and colleges themselves), 32 states currently fund higher education at lower per-student levels than they did in 2001. Meanwhile, the Pell Grant covers less than one-third of the cost of tuition, fees, housing, and food at a public four-year college, which forces low-income students into debt instead of equalizing opportunity. Students consistently struggle to afford basic necessities like food and housing with next to no support from the federal government to enroll in the types of safety net programs that might defray those costs. Any long-term solution needs to build a pathway to attending higher education without the costs that drive students into debt and financial hardship.

Again, voters recognize this. In our poll, an overwhelming majority—including majorities of Republicans, Democrats, and Independents—support policies to guarantee a debt-free pathway at public colleges and universities and make community colleges tuition-free.

Instead of addressing these promises, the incoming Trump Administration threatens to dismantle the student loan safety net, raise monthly payments for borrowers, and undermine public support for higher education. And if the past provides any indication, this next administration is likely to reduce oversight of some of the worst actors in the student loan and postsecondary education system, further exacerbating the crisis for students and borrowers. Student loan debt and college affordability is already a central issue for working families struggling to keep up with rising costs and make ends meet—and it is one that is unlikely to go away anytime soon.

###

Mark Huelsman is a Student Loan Justice Fellow at the Student Borrower Protection Center.