FAQs: Student Loan Repayment During COVID-19

By The Student Borrower Protection Center | July 14, 2020

Since the coronavirus pandemic began, millions of Americans have struggled to manage their student loans as the country faces economic and financial shocks. The CARES Act passed by Congress gave many student loan borrowers temporary relief, but there is still uncertainty about how to deal with student loans during this challenging time.

To help answer some of these questions and provide guidance to borrowers, the SBPC has paired with over a dozen organizations to host webinars, providing answers and information to thousands of student loan borrowers.

Visit our Coronavirus Student Loan Resource Hub

Below are answers to some frequently asked borrower questions about managing student loans during the coronavirus pandemic and beyond.

Q: What period does CARES Act relief cover for student loan borrowers?

A: The CARES Act payment relief extends from March 13th, the date the national emergency was declared, until September 30th. Once the payment pause relief lifts on October 1st, borrowers will again need to make payments on their loans.

Q: What types of student loans are covered under the CARES Act?

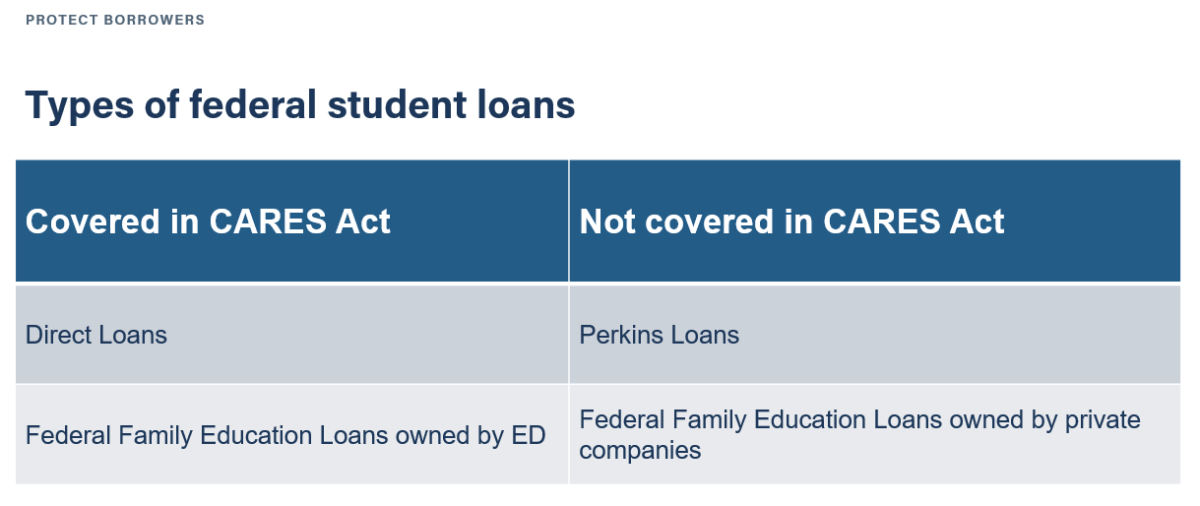

A: Only some types of federal student loans are covered under CARES Act relief. Here is a breakdown of which federal loans are covered and which are not:

Check out our handout to figure out why type of loan you have

Q: What do federal student loan borrowers need to do to take advantage of relief provided under the CARES Act?

A: Borrowers with federal Direct Loans and Federal Family Education Loans owned by the Department of Education (ED-held FFEL) should not have to do anything to receive relief. Student loan servicers, the companies that collect student loan payments each month, will automatically apply the payment suspension and 0% interest rate reduction to borrowers’ accounts. If the changes have not been made to eligible accounts, borrowers should contact their loan servicer immediately.

Q: What happens if a borrower’s student loan payment was auto-debited after March 13, 2020, the date the CARES Act payment pause coverage began?

A: Borrowers can request a refund of any payments made on Direct Loans or Federal Family Education Loans owned by the Department of Education (ED-held FFEL) on or after March 13, 2020. Borrowers should contact their servicer directly to request the refund, but note that it may take some time to receive the refund.

Q: If a borrower’s loans were placed in an economic hardship deferment prior to the CARES Act, what steps do they need to take in order to access protections provided by the CARES Act?

A: Borrowers whose loans are currently in economic hardship deferment should consider instead enrolling in an income-driven repayment (IDR) plan. For most borrowers, IDR provides additional interest rate protections not found with economic hardship deferment. Moreover, enrolling in IDR will automatically provide borrowers with the protections granted under the CARES Act. Usually borrowers who are eligible for economic hardship deferment are also eligible for $0 payments under IDR. Keep in mind that while prior months spent in economic hardship deferment will count toward IDR forgiveness, those months it will not count towards Public Service Loan Forgiveness.

Q: Will interest accumulate on a borrower’s loans during the CARES Act payment suspension?

A: Between March 13, 2020 and September 30, 2020, interest rates are reduced to 0% on federal Direct Loans and Federal Family Education Loans owned by the Department of Education (ED-held FFEL). After the CARES Act relief expires on September 30, 2020, 0% interest rates on these loans will go back to what they were prior to March 13th. Borrowers who stopped auto-debit after the passage of the CARES Act should consider re-enrolling into auto-debit in order to receive the associated interest rate reduction.

Check out our handout to figure out why type of loan you have

Q: For federal student loan borrowers who were already in a grace period when the CARES Act was enacted, does their grace period extend until October?

A: The CARES Act only applies to federal student loan borrowers who were actively in repayment. If a borrower’s grace period ends during the period covered by the CARES Act (March 13, 2020 – September 30, 2020), then the borrower will enter repayment and receive the full relief available under the CARES Act beginning on the date repayment starts.

Q: Is there any federal relief related to CARES Act and COVID-19 that applies to borrowers with private student loans?

A: The CARES Act does not provide any relief targeted at borrowers with private student loans. However, since the pandemic began, some states have announced protections for private student loan borrowers. The relief varies by state and by lender, so borrowers should reach out directly to their private student loan servicers to find out what options are available to them. Some lenders are only offering relief if borrowers are facing financial distress directly related to the pandemic, so be sure to ask for what options are specifically available for COVID-19-related hardship.

Q: If borrowers keep making payments during the suspension period, will those payments go towards the loan’s principal or interest?

A: Payments made during the payment suspension period will be applied first to any outstanding interest accrued prior to the CARES Act, and then to the loan’s principal balance. For example, if a borrower was enrolled in an income-driven repayment plan prior to the CARES Act and those payments did not cover the interest that accrued each month on his or her loans, then any payments made during the payment suspension period will be applied to that outstanding interest before being applied to principal.

Q: Will having student loan payments deferred under the CARES Act affect a borrower’s credit score?

A: No. The payment suspension provided by the CARES Act means that borrowers should not see any negative impact on their credit score. Unfortunately, we have seen that some student loan companies have mishandled the implementation of CARES Act relief by illegally providing inaccurate information about millions of borrowers to credit reporting agencies causing credit score changes in violation of the CARES Act. If a student loan borrower has seen their credit score drop, we want to hear from them.

Get in Touch

Are you an organization interested in providing a webinar to your members on managing their student loans during the coronavirus pandemic? If you are, please reach out to walter@protectborrowers.org for more information.