By Ben Kaufman | February 23, 2023

Early this month, the Federal Deposit Insurance Corporation (FDIC) decreased the Community Reinvestment Act (CRA) rating of Utah’s Transportation Alliance Bank (TAB Bank) to “needs to improve.” CRA is a 1977 anti-redlining statute that subjects banks’ lending practices to extra government oversight, and the FDIC’s move against TAB meant that the agency viewed the bank’s conduct as falling short of expectations under the law. This important change came after consumer advocates detailed how TAB Bank had been supporting predatory online puppy loans, car loans, and other personal loans with APRs of up to 189 percent via a so-called “rent-a-bank” partnership with a fintech firm.

More than marking an important victory for consumers and puppies, however, the FDIC’s action illustrates one of various strategies that the agency can and should use more broadly to weed out harmful rent-a-bank schemes. Because while CRA downgrades do not involve demands for any specific remedial action, they are an unusual black eye that financial institutions are likely to want to fix. For TAB Bank, that certainly means reining in its rent-a-bank deals, which the FDIC described as involving “illegal” conduct that harmed “a large number of consumers over an extended period of time.” And for the wide range of companies operating their own rent-a-bank schemes in the student loan space, it could be a warning that the party and its associated consumer harms are over.

The FDIC’s action illustrates one of various strategies that the agency can and should use more broadly to weed out harmful rent-a-bank schemes.

The FDIC should not stop here. Instead, it should build on this opening salvo by embracing a wider use of CRA to weed out predatory bank partnerships while also grasping the full range of additional tools already at its disposal to break up these harmful deals. Given how long many of the FDIC’s member banks have been profitably skirting the law and harming consumers via rent-a-bank under the agency’s nose, such a change is more than a necessity—it’s the least the FDIC can do.

Predatory student loan rent-a-bank is long-standing and widespread

There is a long, unfortunate history of enterprising scammers using rent-a-bank arrangements to take advantage of students.

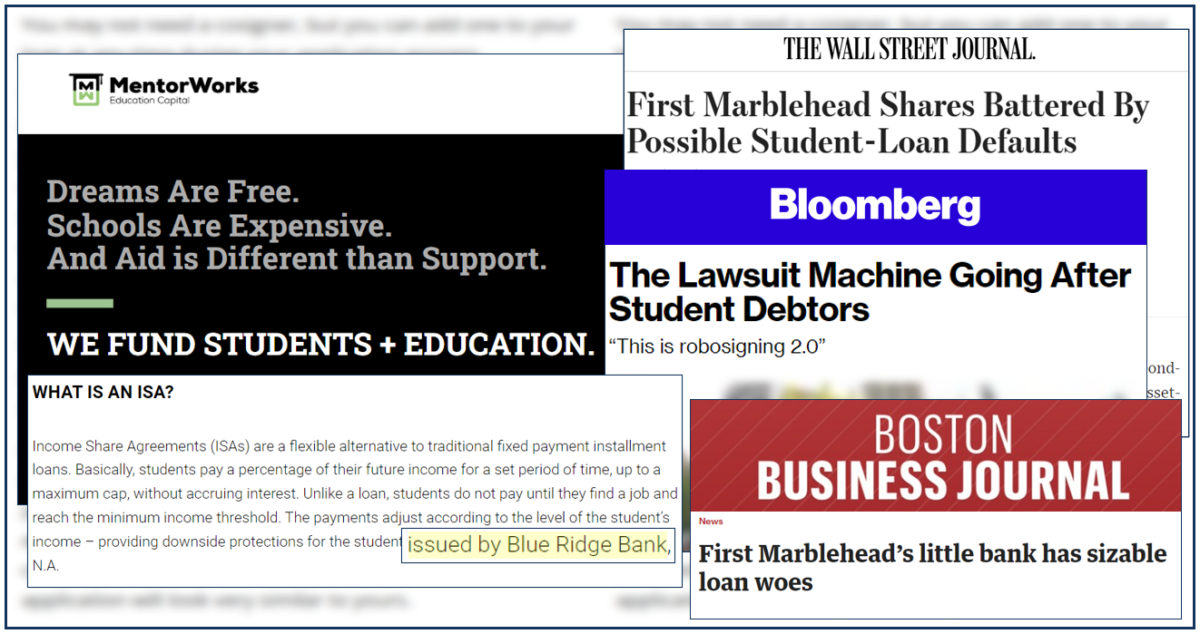

Perhaps the most notorious of these deals is the one that existed in the early 2000s between the consulting firm First Marblehead Corporation (FMC) and several massive banks including Bank of America, US Bank, and Citizens. Under this scheme, FMC arranged high-cost loans to students generally attending shady for-profit schools, and the banks provided origination services for a fee. FMC would then immediately buy back the loan, package it into one of various securitization vehicles collectively referred to as the National Collegiate Student Loan Trusts (NCSLTs), and sell off portions of that package to investors on Wall Street.

The students who took out loans under this rent-a-bank plan ultimately faced sky-high default rates, and the NCSLTs have been caught trying to make up for their losses by preying on communities of color with aggressive and sometimes illegal debt collection tactics. But the banks walked away scot-free after pocketing the fee revenue this scheme generated.

More recently, the SBPC and several partners sent a letter to the Office of the Comptroller of the Currency (OCC) outlining how an arrangement between the nationally chartered Blue Ridge Bank and the lender MentorWorks introduced a risky form of private student loan called an income share agreement (ISA) into the banking system. As the letter detailed, ISAs and the companies that peddle them have a track record of deploying deceptive business practices and driving disparate impacts that harm students of color. MentorWorks and Blue Ridge Bank’s rent-a-bank agreement threatens to add jet fuel to this emerging risk. Unfortunately, while Blue Ridge Bank has faced sanctions from the OCC for some of its rent-a-bank deals, this particular one appears to still be in place.

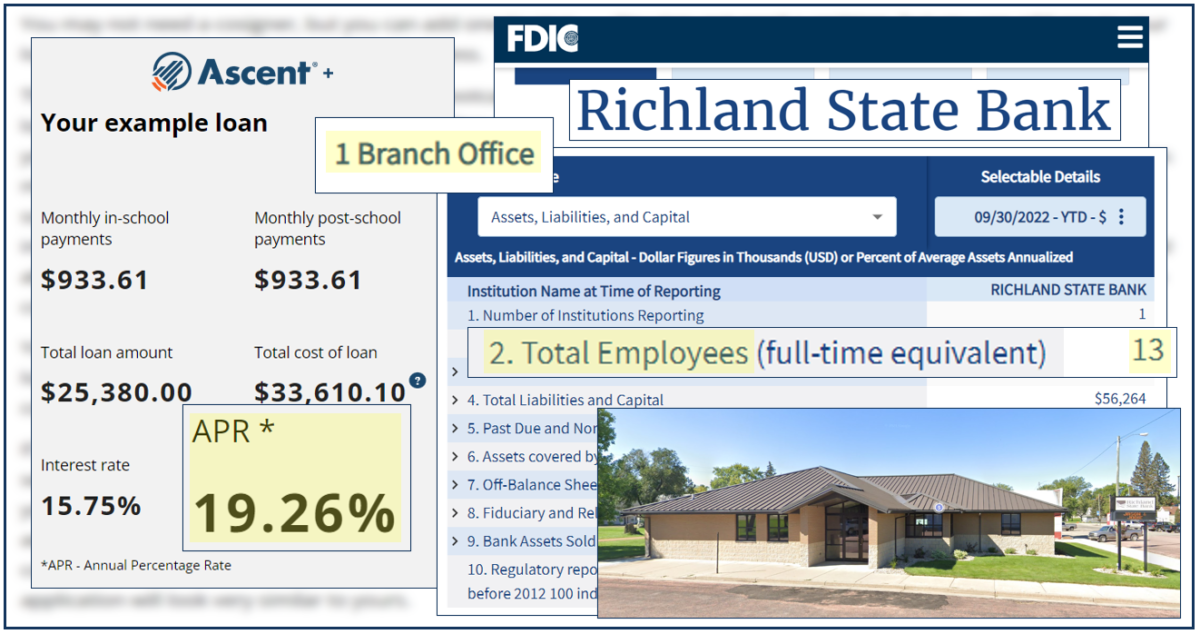

Worse, conduct along these lines is spreading. For example, SBPC has warned for years about the market of shady lenders that finance students’ attendance at for-profit coding bootcamps. These creditors, such as Ascent, trap students in tens of thousands of dollars of double-digit APR debt laced with the full gamut of contractual traps and junk fees.

But Ascent does not carry out this scheme alone. Instead, it relies on the rent-a-bank services of Richland State Bank in Bruce, South Dakota.

Does Richland State Bank have expertise in appropriately underwriting and lending to students at fringe coding bootcamps? There is every reason to doubt that it does. The bank notes that it is “committed to expanding its markets and services beyond the traditional trade area through niche student loan programs” and that its subsidiary, Richland Loan Processing Center, has experience in the area of “privately insured student loans” (it is not clear if Ascent’s loans fit that description). But Richland is nevertheless a bank staffed by only 13 employees, with only about $56 million in assets, and only a single storefront location in a remote town of roughly 260 people.

It is unclear how this bank could possibly be providing prudent risk management and oversight within its rent-a-bank deal with Ascent—let alone how that deal and its nationwide online lending might serve the community that CRA contemplates.

The FDIC can protect students from runaway rent-a-bank schemes

When the advocates mentioned above called for the FDIC to downgrade TAB Bank’s CRA rating, they stated that “The Community Reinvestment Act requires that banks meet the convenience and needs of the communities they serve” but that “Predatory credit at high interest rates that borrowers cannot afford to repay, credit designed to evade state interest rate laws, credit that is the result of deceptive practices, and credit that leads to violations of debt collection, credit reporting, and other laws does not meet the convenience and needs of communities.” (emphasis added)

The same logic—and the same response from the FDIC—should apply to the full range of banks supporting predatory student lending through unsafe third-party partnerships.

But the FDIC need not limit itself to relying on CRA to address harmful rent-a-bank deals. In particular, the FDIC has broad authority to declare that certain lending practices are “unsafe or unsound,” meaning generally that they are “contrary to generally accepted standards of prudent operation, the possible consequences of which, if continued, would result in abnormal risk of loss or damage to an institution, its shareholders, or the Deposit Insurance Fund.” Noting the sky-high default rate on most rent-a-bank loans, the FDIC could simply declare that lending along these lines is presumptively unsafe and unsound. Doing so would call the bluff that underlies rent-a-bank agreements: that the loans in question either come from the arrangement’s nonbank partner, making them illegal, or that they come from the bank, and are inconsistent with sound banking practices.

It’s time for the FDIC to wield its power as one of the nation’s most far-reaching bank supervisors, exhaustively identify the institutions engaging in harmful rent-a-bank deals, and hold them accountable. Students can’t wait any longer.

###

Ben Kaufman is the Director of Research & Investigations at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked on issues related to student lending.