By Tamara Cesaretti | March 4, 2020

Today, borrowers in courtrooms across the country are being sued for faulty or unsubstantiated private student loan debt. Many of these borrowers are saddled with predatory, high-cost loans or worthless degrees from for-profit schools. In too many instances, they have both.

This morning, we released new analysis showing how these private student loan collection practices are harming borrowers across the country—and hitting borrowers in Maryland particularly hard. Creditors are dragging Maryland borrowers into court for debt they often do not owe. Lacking the documents necessary to back up their claims, these companies are manipulating courts into garnishing borrowers’ wages for illegitimate debt.

Predatory collectors and creditors have made this nightmare a reality for more than 100,000 student loan borrowers in courtrooms across the country. Additionally, our new analysis shows that in Maryland, these deceptive lawsuits disproportionately target communities of color.

Instead of blocking these cases, current state laws permit creditors to provide mass-produced, often fraudulent, loan ownership documentation to the courts when they bring a collection lawsuit. Dubbed “robo-signing,” this practice was infamously used a decade ago by big banks to foreclose on homes in the aftermath of the financial crisis.

While numerous creditors and debt collectors have engaged in these predatory practices, the largest and most notorious is known as the National Collegiate Student Loan Trusts. NCSLT, an investment vehicle, packaged $12 billion of unaffordable loans to borrowers across the country. Because NCSLT is the largest owner of private student loan debt, we know that these predatory practices have a far reach to borrowers and courts across the country.

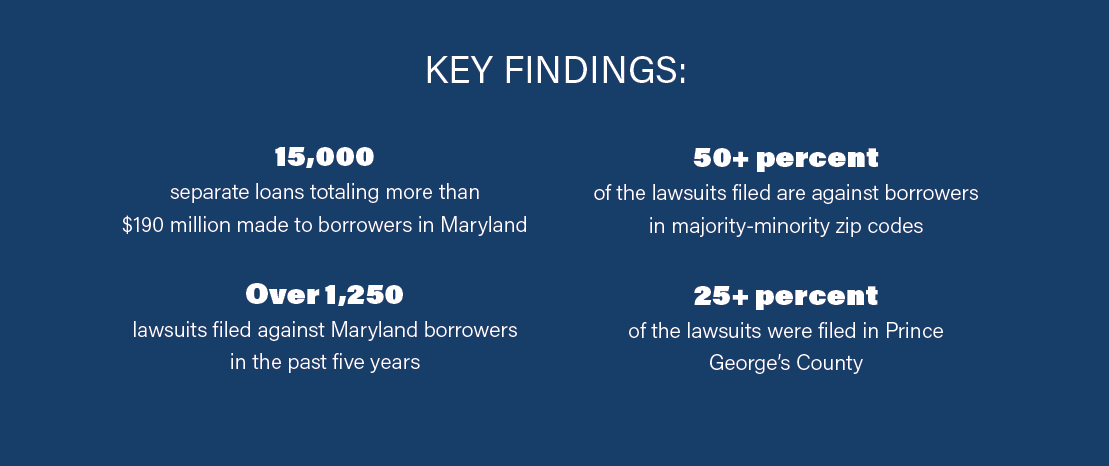

Our brief reveals that, in Maryland alone between 2015 and 2019:

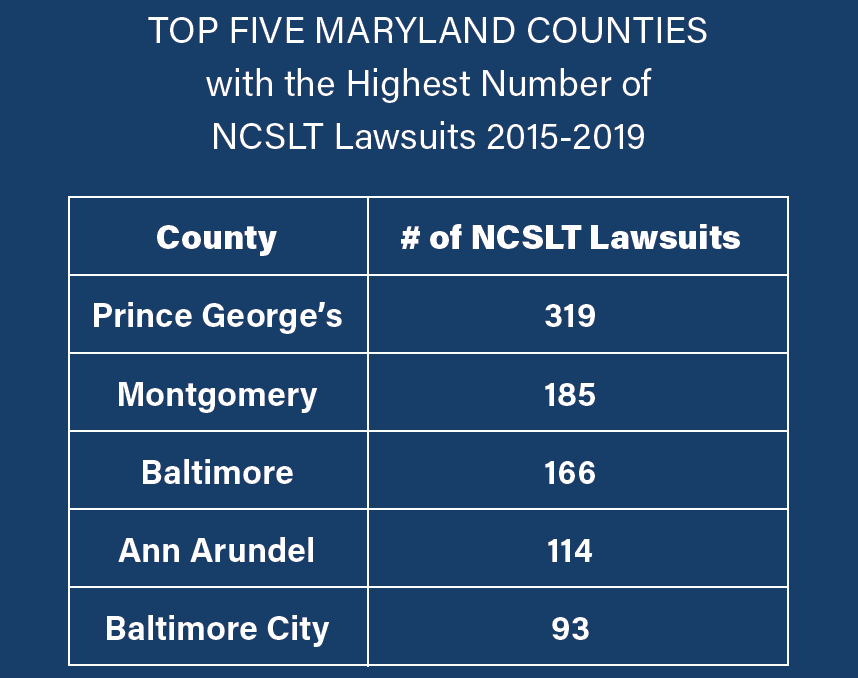

Therefore, the economic consequences of these lawsuits are not felt equally—borrowers from majority-Black zip codes face a far higher volume of debt collection lawsuits, when compared to borrowers in majority-White zip codes. And Prince George’s County, the largest majority-Black jurisdiction in Maryland, tops the list of counties with the highest number of NCSLT lawsuits against borrowers.

Thankfully, state lawmakers can solve this problem by requiring debt collectors and creditors to present proper documentation before they are ever able to sue a borrower. Maryland is positioned to be the first state to do just that—on March 4, Maryland will hold a hearing on a bill by Delegate Lesley Lopez that would ban “robo-signing” for private student loans and set harsh new penalties when private student loan creditors mislead courts or abuse borrowers. Such legislation could dramatically improve the financial lives of tens of thousands of borrowers across the state—and pave the way for other states to act. Other states should take heed and create similar protections for their citizens.

###

Tamara Cesaretti is a Counsel at the Student Borrower Protection Center. Prior to joining SBPC, Tamara was a civil rights policy advocate for both educational opportunities and economic justice at the Lawyers’ Committee for Civil Rights Under Law. She graduated from the New York University School of Law in 2018 and the University of Southern California in 2015 with a Bachelor of Arts in International Relations. Throughout law school, she held internships both working on policy in New York City government and in direct services as a public defender.