By Ella Azoulay | March 23, 2023

In September 2021, the Student Borrower Protection Center (SBPC) published internal Department of Education (ED) records showing that student loan servicers called Guaranty Agencies (GAs) had violated orders to halt collections on defaulted borrowers during the pandemic. The documents we revealed showed that millions of dollars were still improperly being taken out of borrowers’ pockets each month during the collection pause, and that an even greater sum had yet to be returned to borrowers as required.

Now, SBPC has uncovered new evidence that GAs inflicted even more harm on borrowers during COVID-19 than previously understood.

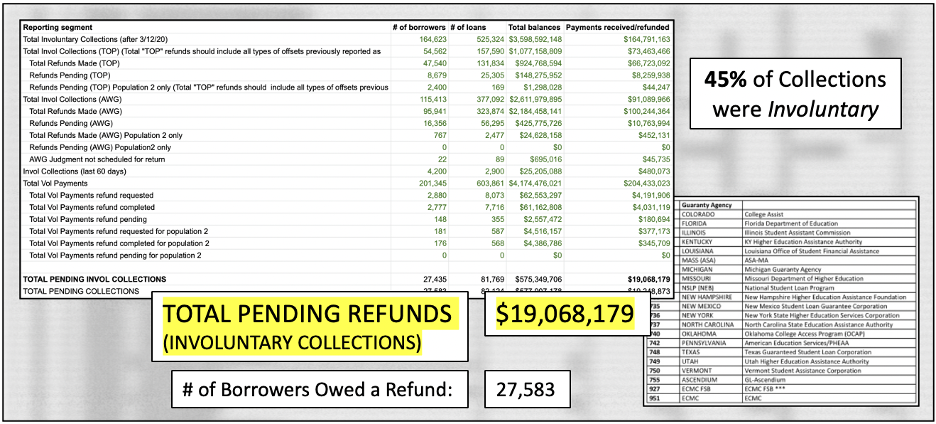

In particular, in response to a Freedom of Information Act (FOIA) request, SBPC has obtained data showing that as of October 2021 (that is, six months after they were told to halt involuntary collections on defaulted borrowers and return collections made since March 2020) GAs had still failed to return almost $20 million in unduly seized borrower funds. Moreover, these data show that in the month after our initial report finding they had engaged in illegal collections, GAs stole another $11 million from defaulted borrowers in violation of the law.

These failures were likely ruinous for borrowers—and they are yet another piece of evidence that ED’s debt collection machinery is out of control.

GAs are the Predatory Remnants of the Defunct, Bank-Based Student Loan System—and They Proved Particularly Harmful to Borrowers During COVID-19

GAs are the vestiges of the older, bank-based federal student loan system known as the Federal Family Education Loan (FFEL) Program. Under the FFEL Program, ED worked with private lenders to encourage them to make privately owned student loans that were guaranteed by the federal government. The program ended in 2010, but hundreds of billions of dollars in loans that were made under it still exist. The majority of these remaining FFEL Program loans are still owned by private companies and called “commercially held” or “commercial” FFEL.

GAs exist to insure, service, and collect on defaulted commercial FFEL borrowers’ loans. GAs have expansive powers to involuntarily extract money from borrowers who default, including through Administrative Wage Garnishment (AWG)—where a portion of a borrower’s paycheck is seized by their employer—and the Treasury Offset Program (TOP)—where the government takes vital benefits such as Social Security payments, the Earned Income Tax Credit, and more from borrowers to put toward defaulted loan balances. These collections come with outlandish fees and interest, while GAs can both choose many of the costs they pass on to borrowers and get a cut of the defaulted debt they collect.

Worse, GAs have a long record of deploying predatory practices when it suits them, making profits at the severe expense of borrowers, and not letting minor obstacles like the law stop them in their ways. For example, the Consumer Financial Protection Bureau recently accused a GA called Ascendium of improperly causing borrowers to incur unjust fees and using abusive tactics to collect on them. But this isn’t a new tactic for GAs; as far back as in 2015, a GA called United Student Aid Funds sued ED. Why? ED had implemented a rule to prevent GAs from charging a collection fee when borrowers were already taking action to make payments within 60 days of being told they were in default. GAs like USA Funds wanted to reserve their right to impose on borrowers these unreasonable charges. ECMC, one of the worst offenders, has been jumping through loopholes in the law since the 1990s to squeeze every last dollar out of borrowers in bankruptcy.

The situation for FFEL borrowers got even worse during the COVID-19 pandemic. In particular, commercial FFEL borrowers were initially excluded from protections that federal borrowers got during COVID, leading tens of thousands to default. Then, the federal government announced in May 2021 that commercial FFEL borrowers in default would be safe from new collections and that they would be eligible for refunds of involuntary payments stretching back to March 2020. But as discussed above, we already know that GAs didn’t comply with this mandate, instead choosing to continue collecting on borrowers while failing to refund them as required.

The Receipts: New Investigation Results Prove GAs Illegally Kept $20 Million Dollars from Borrowers, Collected Over $11 Million More Even After SBPC’s Exposé

Following up on our September 2021 finding that GAs had continued collecting on and had not refunded borrowers during COVID, SBPC submitted a FOIA request in October 2021 to ED demanding a range of documents related to GAs’ collection activities. In response, ED produced never-before-seen data showing that GAs failed borrowers more profoundly than existing investigations had already revealed.

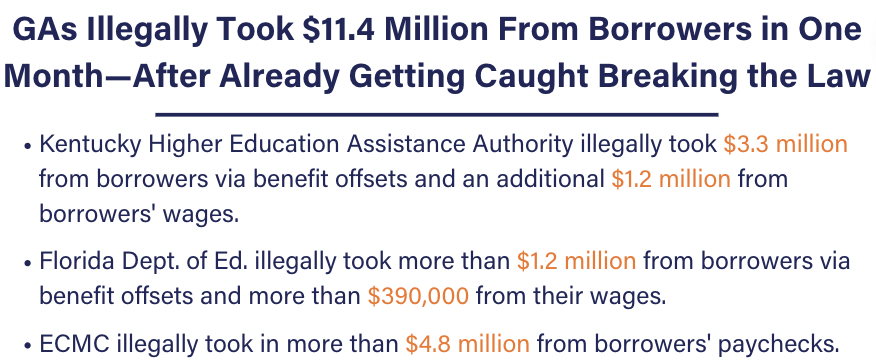

Analysis of this data shows that from September to October 2021—that is, the month following our initial report finding illegal GA collections—GAs took an additional $11.4 million out of borrowers’ pockets through $4.6 million of illegal benefit offsets and $6.8 million of illegal wage garnishments.[1]

GAs took an additional $11.4 million out of borrowers’ pockets through $4.6 million of illegal benefit offsets and $6.8 million of illegal wage garnishments.

Underlying these topline figures are damning findings attributable to specific GAs. For example, the Kentucky Higher Education Assistance Authority illegally took $3.3 million from borrowers via offsets and an additional $1.2 million through garnishment from September to October 2021, while the Florida Department of Education took more than $1.2 million from borrowers in TOP and more than $390,000 in AWG over the same period. The guarany agency ECMC, meanwhile, took in more than $4.8 million from borrowers just in AWG over that time.

Every one of these ongoing collections was illegal.

Moreover, our analysis of ED’s data shows that as late as October 2021, GAs still owed borrowers $19,248,873 in refunds on money they took in during COVID-19. Of that total, roughly 56.5 percent of the refunds still owed for illegal involuntary collections were for wages garnished, and roughly 43.5 percent were for TOP.

The failure to refund borrowers during COVID-19 was likely to leave them in extreme personal distress. Previous investigations by SBPC have shown how financial hardship imposed through involuntary collections during the pandemic led borrowers to struggle with homelessness, malnutrition, and more.

The Logical Conclusion? Abolish Both Guaranty Agencies and Involuntary Collections

GAs are still harming borrowers despite their growing obsolescence, and it is increasingly clear that ED is incapable of controlling its debt collection machinery. Precisely when borrowers most needed GAs to be able to operate within the law, they failed, leaving millions of people at the mercy of a broken system during a public health emergency.

Any entity that causes such profound harm to those it claims to serve and is unable to function within the law ought to be held accountable. If GAs can’t halt collections and provide refunds when ED tells them to, they should no longer have a place in the student loan system. It befalls ED to take an all-of-an-above approach in response to GAs’ historic breakdowns, including by laying plans for GAs’ eventual elimination and devising a complete overhaul of GA oversight in the interim.

Any entity that causes such profound harm to those it claims to serve and is unable to function within the law ought to be held accountable. If GAs can’t halt collections and provide refunds when ED tells them to, they should no longer have a place in the student loan system.

More generally, ED should reconsider the nature of the entire student debt system’s approach to debt collection. Garnishments and offsets dictate the monthly plans families make for their finances, the bills they can afford, and the necessities they might need to sacrifice. For those Americans who already face heightened risk of financial precarity, such as retirees, the loss of vital anti-poverty supports such as Social Security via involuntary collections are particularly devastating.

Cruel government systems that regularly violate the law—such as the mechanisms by which ED involuntarily collects on defaulted borrowers—should never be turned back on. Indeed, AWG and TOP are contemptible programs that punish people for being poor, and which ED clearly cannot control. Accordingly, ED should permanently retire these inhumane collection tools.

It’s long past due for ED to defend students from the mercilessness of the student loan system. Reining in and eventually eliminating involuntary collections and GAs is a great place for ED to start.

###

Ella Azoulay is the Research & Policy Analyst at the Student Borrower Protection Center. She joined SBPC from the Center for American Progress where she worked on higher education policy and advocacy.

[1] SBPC calculation based on data from the Department of Education. This sum includes data only for GAs who continued garnishments and offsets on net in the time period discussed, and it does not include data for GAs who, on net, refunded garnishments and offsets during the period.