Latest Survey Exploring the Impact of Student Debt on American Families Finds Action to Strengthen Financial Security for People with Student Debt is Broadly Popular among Likely Voters; Supermajorities of Latino and Black Voters Support Action by President Biden

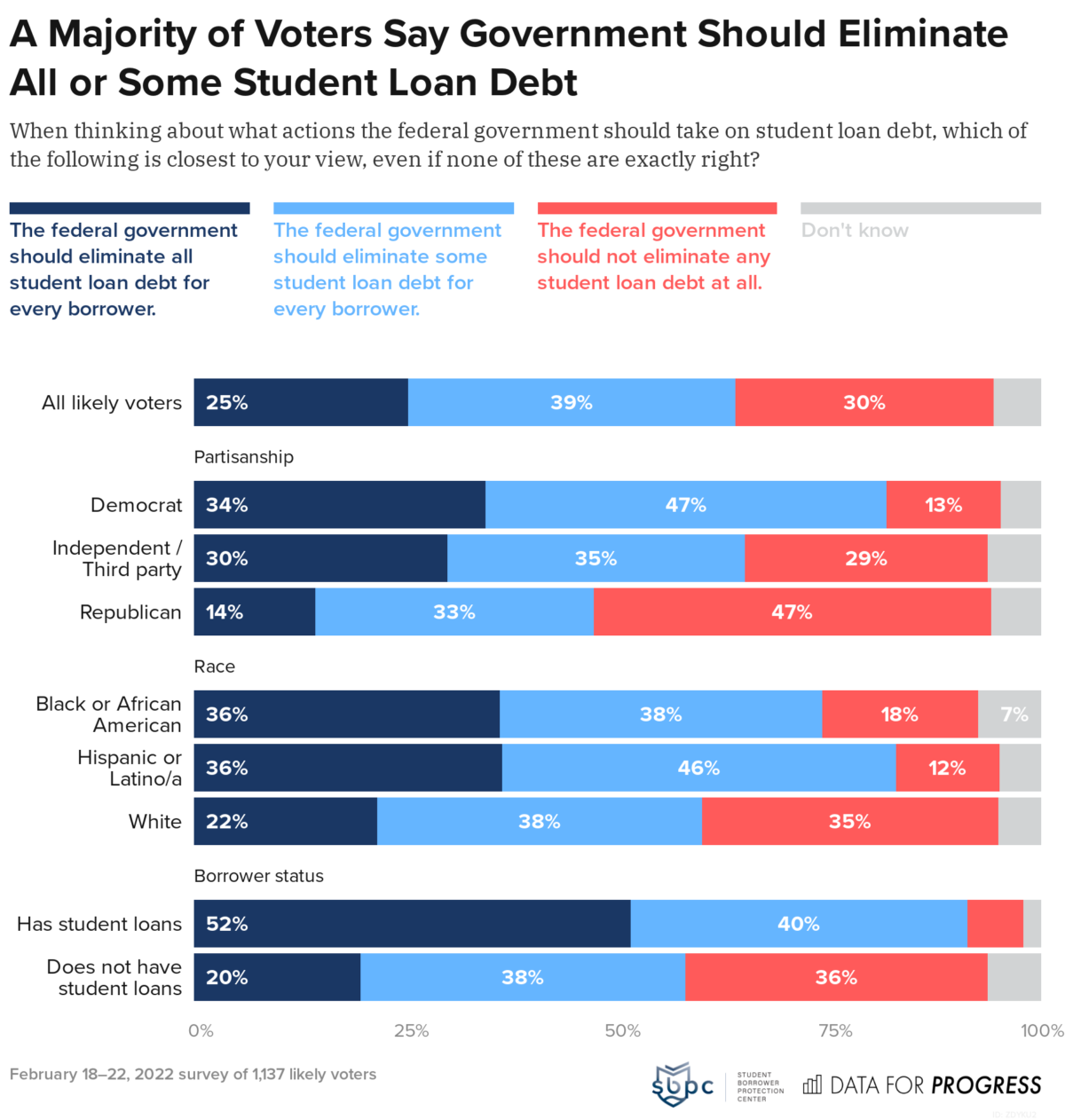

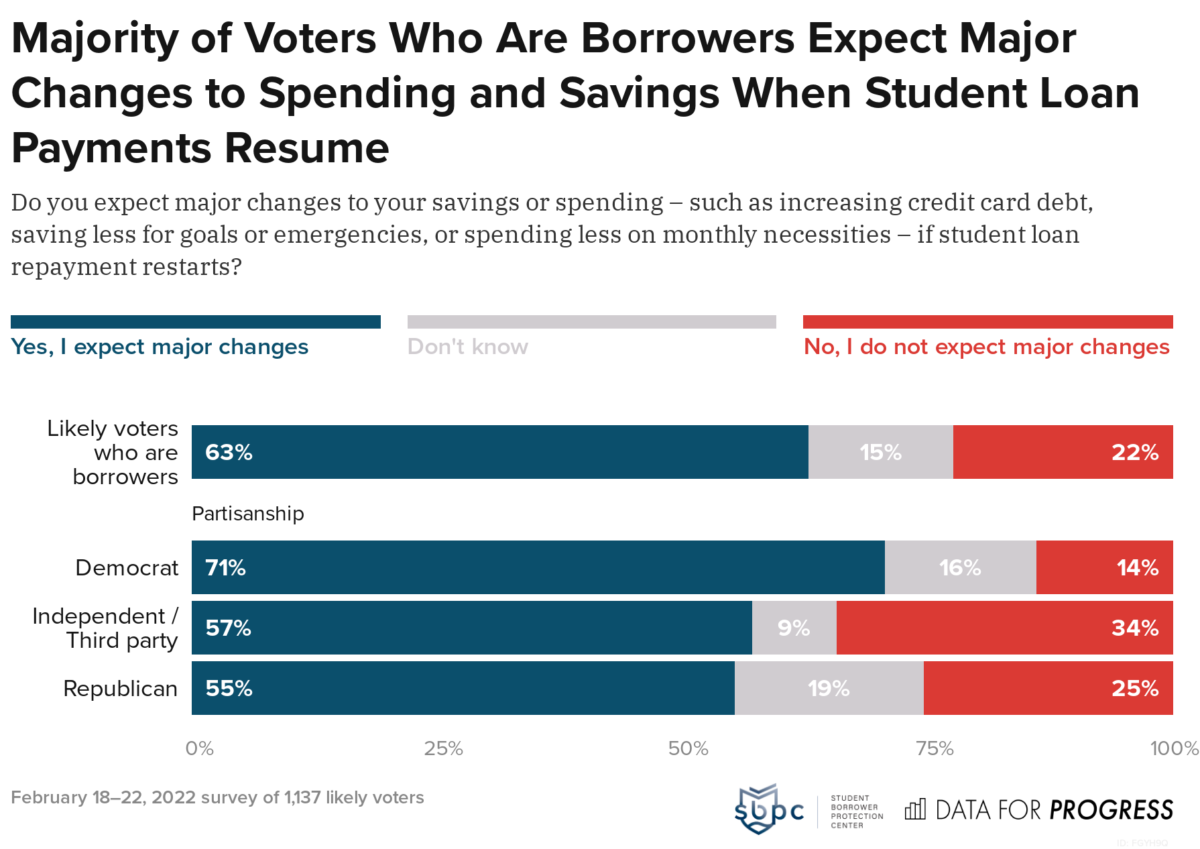

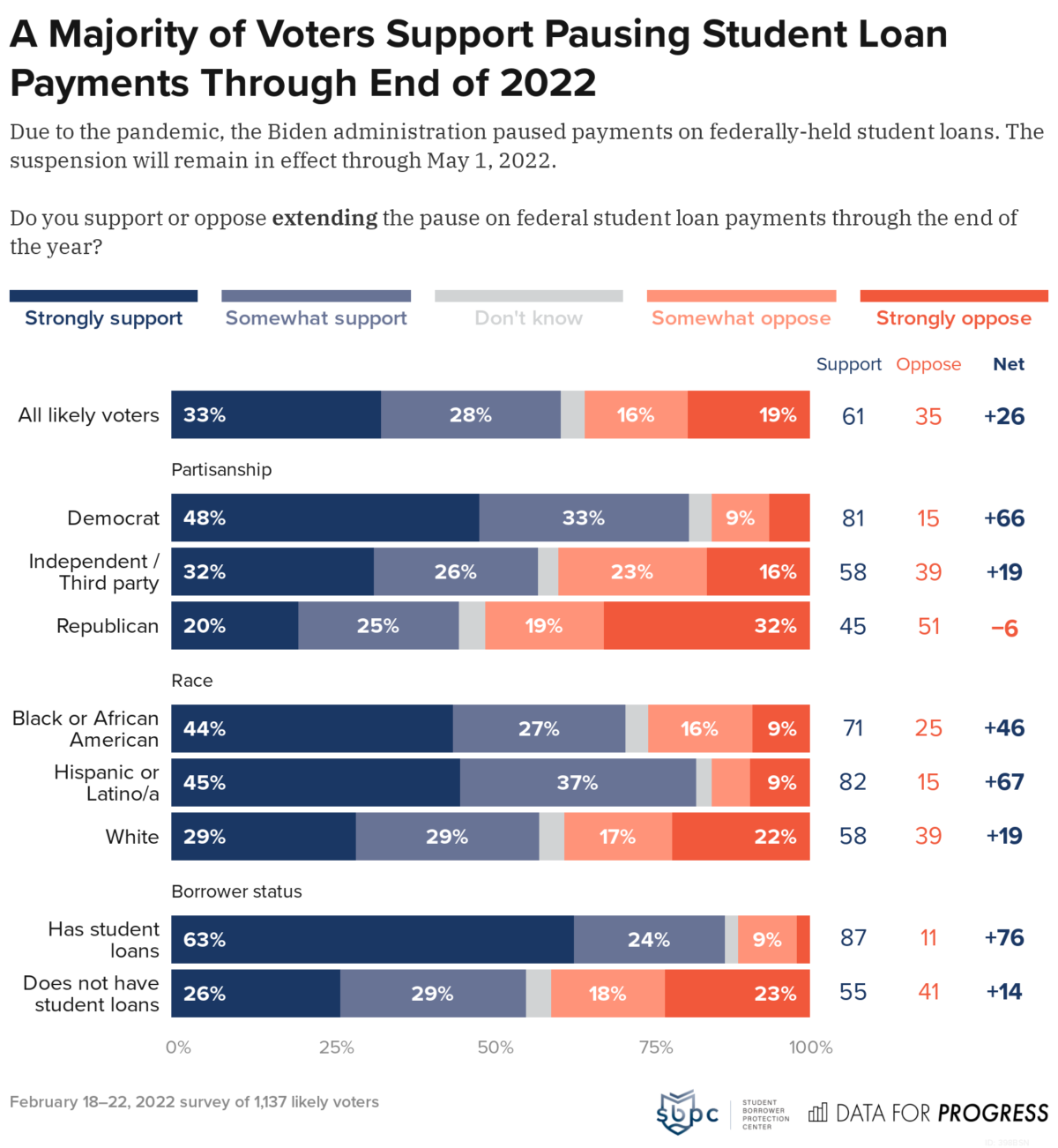

February 28, 2022 | WASHINGTON, DC — Today, the Student Borrower Protection Center and Data for Progress released their latest tracking poll exploring the impact of student debt on American families – with today’s release examining voters of color. The new poll reveals that more than 6-in-10 likely voters support extending President Biden’s pause on student loan payments, including 70 percent of Black likely voters and 76 percent of Latino and Latina likely voters. Similarly, nearly two-thirds of likely voters support government action to cancel some or all student loan debt for all borrowers, including three quarters of Black likely voters and 80 percent of Latino and Latina likely voters. The current pause on student loan payments, last extended by President Biden in December 2021, is slated to expire on May 1, 2022. Among respondents with student debt, a large majority expect to make “major changes to saving or spending” if student loan payments resume. In contrast, just 1-in-5 likely voters with student debt are “very confident” in their ability to resume making payments in May. These results underscore that extending the payment pause will offer tens of millions of families badly needed relief—and that doing so would be extremely popular across the political spectrum.

“When Joe Biden ran for president, he promised to take bold action to close the racial wealth gap by canceling student debt for everyone.” said SBPC executive director Mike Pierce. “We know most Americans with student debt are worried about what it means to add a student loan bill on top of the rising cost of basic necessities. As President Biden addresses an anxious nation facing war abroad and an enduring pandemic at home, the Americans who put him in office cannot wait any longer for him to deliver.”

“These findings tell a clear story—resuming student loan repayments will impose undue financial stress on hard-working Americans already struggling with rising prices and stagnant wages,” said Anika Dandekar, Polling Analyst at Data for Progress. “Extending the pause on payments and canceling loan debt altogether are not only politically popular for President Biden, but will give much-needed relief for the middle class.”

Even prior to the COVID-19 pandemic, Black and Latino families in the U.S. have been systematically prevented from building wealth and financial security. And two years into the public health emergency, Black and Latino people remain in particularly precarious financial positions and are more susceptible to the continuing economic fallout of COVID-19. Job interruptions, layoffs, and furloughs caused by the pandemic have disproportionately affected people of color, most especially Black and Latina women. The unemployment rate for Black workers is still almost double the unemployment rate for white workers, and ongoing supply chain disruptions make clear that this issue is not on track to resolve itself. Accordingly, Black voters and Latino and Latina voters overwhelmingly support government action to address the rising burden of student debt, including debt cancellation for all borrowers and an extension of the pause on student loan payments.

Today’s poll is the next in a series from Data for Progress and the Student Borrower Protection Center tracking public opinion on issues related to student debt and economic security. This new poll, conducted by Data for Progress between February 18 and 22, 2022, also shows that among student loan borrowers who express anxiety about the economic effects of looming student loan payments, many expect to offset new financial pressure by taking on more debt or forgoing basic necessities.

In January, White House press secretary Jen Psaki suggested that the Biden White House and the U.S. Department of Education are considering a further extension of the pause on student loan payments, interest charges, and debt collection in response to the ongoing public health emergency. Today’s poll shows that an extension through December 2022 is broadly popular–more than 6-in-10 likely voters support an extension, including a majority of likely voters who do not owe student debt.

From February 18 to 22, 2022, Data for Progress conducted a survey of 1,137 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

BACKGROUND

President Joe Biden repeatedly pledged to cancel student debt on the campaign trail, including as part of the Biden-Harris campaign commitment to center racial equity in policy making. Last year, National Consumer Law Center released a compilation of statements made by then-candidate Biden pledging to cancel student debt, available here:

There is a growing consensus among experts, scholars, and lawmakers that the President has the legal authority to cancel student debt without any additional action by Congress. One year ago, President Biden instructed the U.S. Department of Justice and the U.S. Department of Education to determine whether such an action can be taken legally. A review of the President’s authority is reportedly complete, but has not been released to the public.

In April 2021, Americans for Financial Reform, the Center for Responsible Lending, the National Consumer Law Center, Student Borrower Protection Center, Student Debt Crisis, and Young Invincibles led a coalition of more than 415 labor, civil rights, consumer, student, veterans, disability, and professional organizations in urging President Biden to take executive action and cancel student debt for everyone.

No student loan borrower with a federally-held loan has been required to make a student loan payment since March 2020 when former President Trump signed the CARES Act, pausing student loan payments and suspending interest charges for tens of millions of student loan borrowers. This set of protections was extended via executive actions taken in August 2020, December 2020, January 2021, August 2021, and December 2021. However, these protections are set to expire with payments to resume for federal student loans on May 1, 2022.

###

About Data for Progress

Data for Progress is a progressive think tank and polling firm which arms movements with data-driven tools to fight for a more equitable future. DFP provides polling, data-based messaging, and policy generation for the progressive movement, and advises campaigns and candidates with the tools they need to win. DFP polling is regularly cited by The New York Times, The Washington Post, MSNBC, CBS News, and hundreds of other trusted news organizations.

Learn more at dataforprogress.org or follow DFP on Twitter at @dataprogress.

About Student Borrower Protection Center

Student Borrower Protection Center is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.