Government Action to Cancel Student Debt is Broadly Popular, Supported by Large Majorities of Voters with No Student Debt and Voters with No College Degree

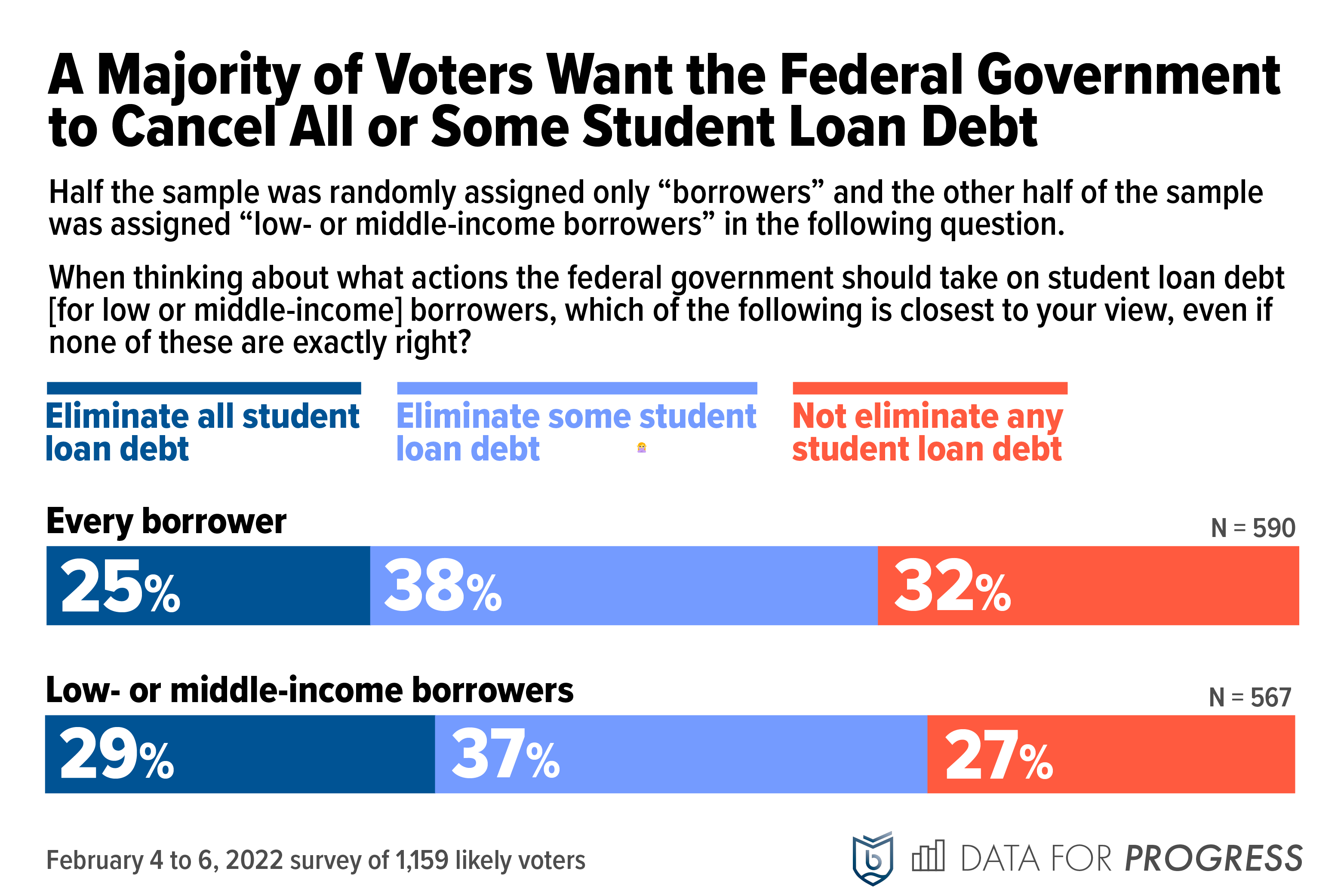

February 14, 2022 | WASHINGTON, DC — Today, Student Borrower Protection Center and Data for Progress released a new tracking poll revealing that 63 percent of likely voters support action by the federal government to cancel some or all student debt for all borrowers. Canceling student debt is broadly popular, supported by 61 percent of voters without a college degree, 58 percent of voters who do not owe student debt, and 57 percent of voters over 45. In contrast, fewer than 1-in-3 voters surveyed believe that the federal government should not cancel any debt at all.

This polling is part of SBPC’s ongoing series in collaboration with Data for Progress tracking public opinion of policy proposals aimed at reducing the burden of student debt. The first release from this series showed large majorities would support President Biden for extending the pandemic-era payment pause in student loans—as nearly two thirds of likely voters would need to make “major changes” to spending if student loan payments came due again in May, as planned. Future releases will continue to track these issues, including support for debt cancellation and the threat student debt poses to voters’ economic security.

“Today’s poll shows that if policymakers got out of the Washington mindset, they’d find support for government action to address student debt spans age, education, and political party,” said SBPC executive director Mike Pierce. “At a time marked by historic division, Americans are united on this issue. President Biden and Vice President Harris must keep their promises and cancel student debt.”

“This is one of the most popular issues in America — across the board, not just with students who have debt, but with everybody,” said U.S. Senate Majority Leader Chuck Schumer (D-NY), who was on hand with Data for Progress to release this poll. “Let’s fight to get this done.”

“These findings make clear that student debt weighs on the minds and pockets of everyday, hard working Americans, and that student debt cancellation could offer President Biden a political win through relief for millions of Americans,” said Ethan Winter, Senior Polling Analyst at Data for Progress.

Last week, the SBPC and Data for Progress released a new poll showing that the pause on student loan payments was broadly popular, and that people with student loan debt expressed significant economic anxiety about the prospect of restarting payments in May. Among respondents with student debt, 65 percent expect to make “major changes to saving or spending” if payments resume. Nearly 4-in-10 borrowers are “not confident at all” in their ability to manage a student loan payment, while just 1-in-5 borrowers are “very confident.”

Rising support for government action to cancel student debt comes as historic inflation continues to batter household balance sheets. Last week, the U.S. Bureau of Labor Statistics released new economic data indicating that the American economy is currently experiencing the highest level of inflation in four decades. Prices rose 7.5 percent in January when compared to a year prior. American families are forced to stretch their finances to cover the rising costs of basic necessities including food, transportation, and heat.

During the 2020 presidential campaign, President Biden pledged “immediate cancellation of a minimum of $10,000 of federal student loan debt.” In January, White House Press Secretary Jen Psaki pointed to the ongoing pause on student loan payments in response to a question about the administration’s continued inaction, touting the fact that “no one has been required to pay a single dime in federal student loans since the president took office over a year ago.” The current pause on student loan payments, last extended by President Biden in December 2021, is slated to expire on May 1, 2022.

From February 4 to 6, 2022, Data for Progress conducted a survey of 1,159 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

BACKGROUND

President Joe Biden repeatedly pledged to cancel student debt on the campaign trail. There is a growing consensus among experts, scholars, and lawmakers that the President has the legal authority to cancel student debt without any additional action by Congress. One year ago, President Biden instructed the U.S. Department of Justice and the U.S. Department of Education to determine whether such an action can be taken legally. A review of the President’s authority is reportedly complete, but has not been released to the public.

In April 2021, Americans for Financial Reform, the Center for Responsible Lending, the National Consumer Law Center, Student Borrower Protection Center, Student Debt Crisis, and Young Invincibles led a coalition of more than 415 labor, civil rights, consumer, student, veterans, disability, and professional organizations in urging President Biden to take executive action and cancel student debt for everyone.

No student loan borrower with a federally-held loan has been required to make a student loan payment since March 2020 when former President Trump signed the CARES Act, pausing student loan payments and suspending interest charges for tens of millions of student loan borrowers. This set of protections was extended via executive actions taken in August 2020, December 2020, January 2021, August 2021, and December 2021. However, these protections are set to expire with payments to resume for federal student loans on May 1, 2022.

###

About Data for Progress

Data for Progress is a progressive think tank and polling firm which arms movements with data-driven tools to fight for a more equitable future. DFP provides polling, data-based messaging, and policy generation for the progressive movement, and advises campaigns and candidates with the tools they need to win. DFP polling is regularly cited by The New York Times, The Washington Post, MSNBC, CBS News, and hundreds of other trusted news organizations.

Learn more at dataforprogress.org or follow DFP on Twitter at @dataprogress.

About Student Borrower Protection Center

Student Borrower Protection Center is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.