Plans to “Pause” Student Loan Payments Solve a Political Problem, But Leave Student Loan Borrowers Worse for the Wear

By Mike Pierce | March 20, 2020

As America is gripped by a once-in-a-century public health crisis and hurtles toward a long and deep recession, policymakers in the Trump Administration and on Capitol Hill are looking for policy levers to blunt the effects of this turmoil.

Last week, the Trump Administration proposed eliminating interest charges on student loans owed to the federal government — a decision that will provide relief over the long-term, but doesn’t offer a meaningful, immediate benefit to cash-strapped families struggling with student debt. Today, Secretary DeVos announced that the Education Department would pair this temporary interest freeze with a 60 day “pause” on all student loan payments.

Recognizing Trump’s initial approach did too little, and the urgent need for government action to prop up the economy, some lawmakers have also proposed pairing the temporary elimination of interest charges with a “pause” on student loan payments for certain borrowers. These proposals just kick the can down the road while adding additional stress to an already broken student loan system.

Pausing Payments Solves a Political Problem, But Leaves Borrowers Worse for the Wear

Lawmakers of both parties deserve credit for keeping borrowers front-and-center and pushing for action. Unfortunately, any plan to pause payments suffers from major flaws and the latest proposal to do so is particularly fraught. Under this plan, Congress would require Secretary DeVos to automatically pause all payments for 35 million Direct Loan borrowers for three months, then require a flailing student loan servicing industry to reboot the student loan system in the middle of this crisis.

There are already nine million borrowers in default, with millions more on the way. Analysts project two million Americans will file for unemployment this week alone. Here’s why lawmakers looking to help student loan borrowers need to do more than just “pause” student loan payments:

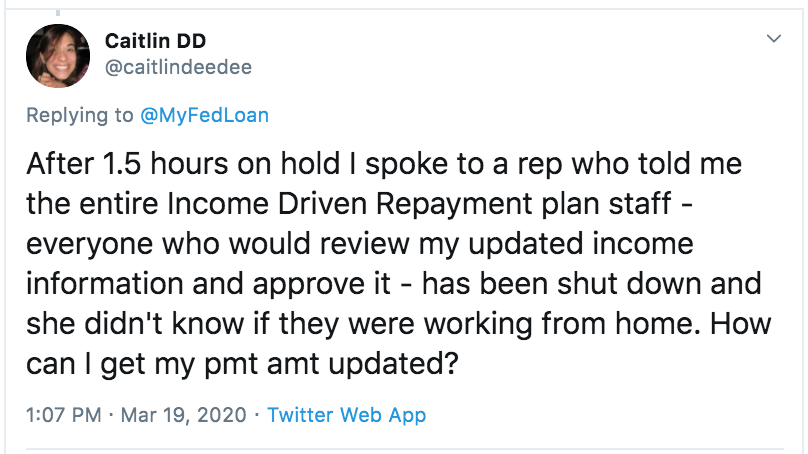

- Forcing borrowers to pause payments for a few months will *increase* student loan defaults down the road. The Department of Education and the student loan servicing industry have a terrible track record implementing “mandatory forbearances” (the technical term for pausing payments) in the event of a natural disaster or other state of emergency. The bungled handling of these interventions following hurricanes Maria and Harvey drove tens of thousands of unnecessary loan defaults last year alone. That’s because, even under the best circumstances, the student loan industry is ill-equipped to navigate the transition from forbearance back into repayment, particularly for the most economically vulnerable borrowers. Any plan that relies on servicers to do the heavy lifting fails to recognize that the servicing system is collapsing before our eyes:

- By limiting a pause in payments to only certain Direct Loan borrowers, this proposal fails to provide broad-based relief for everyone else. This will hamstring the economy and leave millions of borrowers without help. More than 12 million student loan borrowers owe a federal student loan made through a program other than the Direct Loan program. This proposal to pause payments fails to provide any relief to these borrowers and instead, leaves them at the mercy of a student loan system that is already cracking under the stress of this pandemic. As we see more call centers close and more student loan companies struggle to maintain staffing to field calls from struggling borrowers, policymakers need to recognize that every student loan borrower may soon have no way to have basic questions answered or enroll in the consumer protections that exist under current law. It is critical that any proposal to protect borrowers be inclusive of all borrowers with federal student loans.

- Pausing payments for some will still crush millions of people in the government’s student loan debt collection machine, depriving the economy of badly needed consumer spending and trapping people in poverty. More than 9 million student loan borrowers are in default, millions of whom are currently subject to wage garnishment, tax refund offset or the seizure of federal benefits, including Social Security. A recent report by the Government Accountability Office shows that the Social Security offset program alone pushed tens of thousands of older borrowers into poverty. Conversely, the government can free up badly needed cash for the most vulnerable Americans by halting its debt collection machine and banning the collection of involuntary payments until the pandemic is over. Unfortunately, this proposal appears to do nothing for borrowers subject to garnishment and offset. Of even greater concern, it appears that any checks sent to American families to boost the economy may be offset for borrowers with defaulted loans, absent action by Congress to fix this mess.

Fortunately for borrowers, there is another way forward. Yesterday, Senate Democratic Leadership announced a plan to require the Secretary of Education to make payments on borrowers’ student loans on their behalf for the duration of the pandemic and during a transition period that will allow the student loan system to come back online. Importantly, this proposal helps everyone– borrowers with all types of federal loans and borrowers in default. It also halts the gears of the government’s debt collection machine, ensuring the most vulnerable borrowers can benefit from lawmakers’ efforts to boost our flagging economy.

Borrowers deserve more than political theater– they need real relief to weather the coming storm.

###

Mike Pierce is the Policy Director and Managing Counsel at the Student Borrower Protection Center. He is an attorney, advocate, and former senior regulator who joined SBPC after more than a decade fighting for student loan borrowers’ rights on Capitol Hill and at the Consumer Financial Protection Bureau.