By Aissa Canchola Bañez | February 25, 2024

Today, House Republicans are moving forward with their plans to pass a budget that will allow them to deliver $4.5 trillion in tax cuts to billionaires and big corporations by cutting education, lifesaving healthcare and food assistance, and other critical social programs that working families rely on.

Only a few months ago, then-candidate Donald Trump promised Americans quick action to bring down the costs of everyday goods from food and education to childcare, housing, and healthcare. Instead, President Trump has given his full-throated endorsement to the House Republican plan, which would require $2 trillion in mandatory spending cuts largely focused on gutting programs like Medicaid, SNAP, and federal education programs that working families rely on to meet their everyday needs, pay for college, and manage their student loan debt. Americans have now begun taking to social media to express their worries about whether their vote this past November could result in cuts to programs they rely on.

Congressional Republicans plan to make these massive cuts through a process known as budget reconciliation—a budget tool that allows the Senate to bypass the filibuster and pass legislation with a simple majority. Senate Republicans kicked off this process last week by passing their budget framework, which represents a down payment on President Trump’s plan to slash taxes for the wealthiest households and decimate many vital domestic programs. Senate and House leaders have differed for weeks now on strategy and whether to use this special tool to legislate President Trump’s agenda in one or two bills. While the process remains uncertain, the reality is crystal clear—students and working families with student debt will be forced to pay the price.

Congressional Republicans plan to make steep cuts to programs that help students and families pay for college.

Earlier this year, SBPC sounded the alarm on a leaked menu of policy options that Republican Budget Committee leaders circulated as potential areas for cuts. Among the 50 pages of policies included a proposal to dramatically cut the Pell Grant program, which provides vital funding for the lowest income students and families to help pay for college. Policymakers are considering capping Pell Grant awards for millions of students who attend higher-cost programs by capping awards at the median cost of attendance—a move that will make college even more expensive for millions and push the dreams of a higher education even further out of reach.

House leaders have also endorsed deep cuts to public benefit programs like SNAP, which can help low-income students, especially those with children, pay for food while they are enrolled in college, as well as Medicaid, which can help low-income independent students ensure that high healthcare costs do not force them to take on more debt or drop out of school.

In addition to cutting grants and safety net programs that help students and families cover the cost of college, Congressional leaders are planning to make massive cuts to the federal student loan program itself, including potentially eliminating the Parent PLUS and Graduate PLUS loan programs for new borrowers. SBPC has warned that efforts to gut these programs would make financing a college degree even more expensive and risky. Particularly lower income, Black, and Latino families could be forced into the predatory private market with loans that contain fewer protections and safeguards. These cuts could also weaken the student loan safety net by limiting benefits and protections available to borrowers. Research has also shown that repealing these programs could spell disaster for Historically Black Colleges and Universities and other Minority Serving Institutions, and the students who attend these institutions because they are more likely to have to take on Parent PLUS or Graduate PLUS loans to pay for their higher education.

Policymakers are looking to spike monthly student loan bills for millions and make student loan debt a life sentence.

In addition to cutting critical financial aid resources that millions of students and families rely on, policymakers are looking to make cuts to the student loan safety net, primarily through eliminating student loan repayment options that allow Americans to tie their monthly payment to their income and provide a pathway to debt relief after 20 or 25 years of payments.

Congressional Republicans have openly touted their plans to eliminate the Saving on a Valuable Education (SAVE) Plan—the most affordable repayment option that was available to most borrowers before it was blocked in Federal court. Repealing this program will force 8 million borrowers currently enrolled in SAVE to pay significantly more on their monthly bills—in some cases, borrowers could even see their payments double or triple.

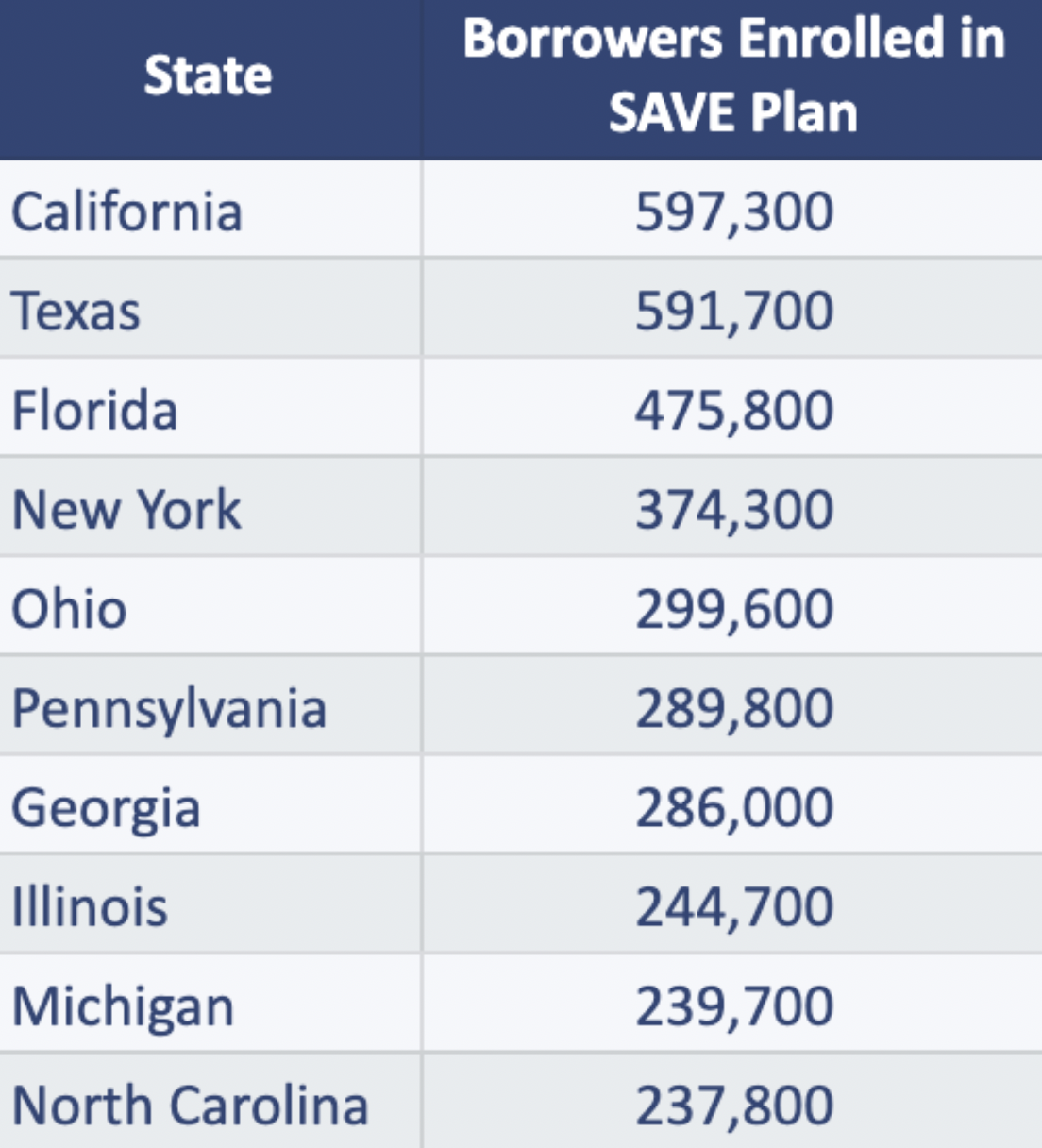

Earlier this year, SBPC unveiled a series of fact sheets that shed light on the number of borrowers enrolled in SAVE across every state and Congressional District, who could see their payments spike if this critical repayment option is eliminated.

Just last week, the 8th Circuit Court of Appeals sided with seven Republican-led states that challenged the program, further underscoring the plan’s uncertain fate in the courts. Regardless of the challenge in the courts, Senate and House Republicans remain steadfast in their plans to repeal a benefit that has helped more than 3.5 million borrowers residing in Republican-led states access more affordable monthly payments. Ironically, among the 10 states with the highest number of borrowers enrolled in the SAVE plan are Texas, Florida, Georgia, Pennsylvania, and Ohio.

In addition to repealing SAVE, reporting indicates that House leaders will advance reforms to the student loan repayment system that mirror the College Cost Reduction Act. Last year, we wrote about the economic harm this bill would cause and how it would lock many borrowers into repayment for the rest of their lives. Recent analysis from our partners at The Institute for College Access and Success shows that all borrowers could expect to see their monthly bills spike by nearly $200 per month, and force millions of the lowest income and most vulnerable borrowers into delinquency and default.

Trump and Congressional leaders are giving the green light to for-profits and other sham schools to prey on students and cutting off pathways for relief and justice.

Not only would President Trump and Congressional leaders be targeting benefits and protections that help millions of working families responsibly repay their student loan debt, they also want to make it easier for some of the shadiest for-profit colleges to prey upon and abuse students and leave them saddled with mountains of student debt. As part of their reconciliation plans, Congressional Republicans want to repeal rules like Gainful Employment and the 90/10 rule, which have helped hold for-profit colleges accountable for ripping off veterans, single mothers, and other vulnerable students and leaving them with fraudulent loans. They also want to make it harder for students who were scammed by their college or attended a school that suddenly closed to get justice and debt relief they are entitled to, by eliminating Borrower Defense to Repayment and Closed School Discharges. Eliminating critical accountability measures and consumer protections aimed at shielding students and borrowers from abuse will only pad the pockets of the for-profit industry and exacerbate the student debt crisis already crushing working families.

Trump and Musk are continuing attacks on public service workers across our nation by limiting eligibility to Public Service Loan Forgiveness.

Continuing President Trump and Elon Musk’s ongoing attacks on public service workers across the federal government, Congressional Republicans are considering limiting eligibility for Public Service Loan Forgiveness (PSLF), which could have major implications for nurses, servicemembers, educators, and first responders with student loan debt. This drastic proposal is not surprising since both Project 2025 and the first Trump Administration proposed eliminating the program altogether, which would saddle 3.6 million public service workers with more than $250 billion in additional student loan debt. Over the last four years, over 1 million public service workers were able to benefit from the bipartisan promise that Congress made when they created the PSLF program. Now, it appears that Republicans in Congress are willing to turn their backs on this promise and push public service workers in their own states and districts further into debt.

Taken together, this is an agenda that will decimate working families’ finances in order to deliver President Trump’s massive tax cuts to the richest Americans and biggest corporations. It will add hundreds of dollars in additional monthly expenses onto already-stretched household budgets, make college even more expensive, drive up prices, and leave borrowers and families with less of a safety net when they struggle with their loans. Lawmakers are also moving as quickly as possible to enact it.

In the weeks ahead, House and Senate Committees will mark up more detailed measures, which will shed even more light on how these cuts will harm working families with student debt. Time is of the essence and it is critical that borrowers and allies contact their representatives and urge them to prioritize borrowers not billionaires.

###

Aissa Canchola Bañez is the Policy Director at the Student Borrower Protection Center. Previously, Aissa led outreach and engagement efforts for the Office for Students and Young Consumers at the Consumer Financial Protection Bureau.