New Poll Shows Should the Supreme Court Strike Down Student Debt Relief, Large Majority of Voters Want Payment Pause Extension

May 30, 2023 | WASHINGTON, D.C. — Today, Congresswoman Ayanna Pressley filed an amendment to strike a provision in proposed legislation to raise the federal debt limit that would force President Biden to restart student loan payments later this year. The debt limit bill, which is expected to pass this week, binds the federal government to a reckless and aggressive timeline to restart loan payments, irrespective of the outcome of a pair of cases before the U.S. Supreme Court that will determine whether President Biden’s August 2022 plan to cancel up to $20,000 in student loan debt can go into effect. Congresswoman Pressley’s amendment would preserve the Administration’s legal authority to extend the payment pause in the future.

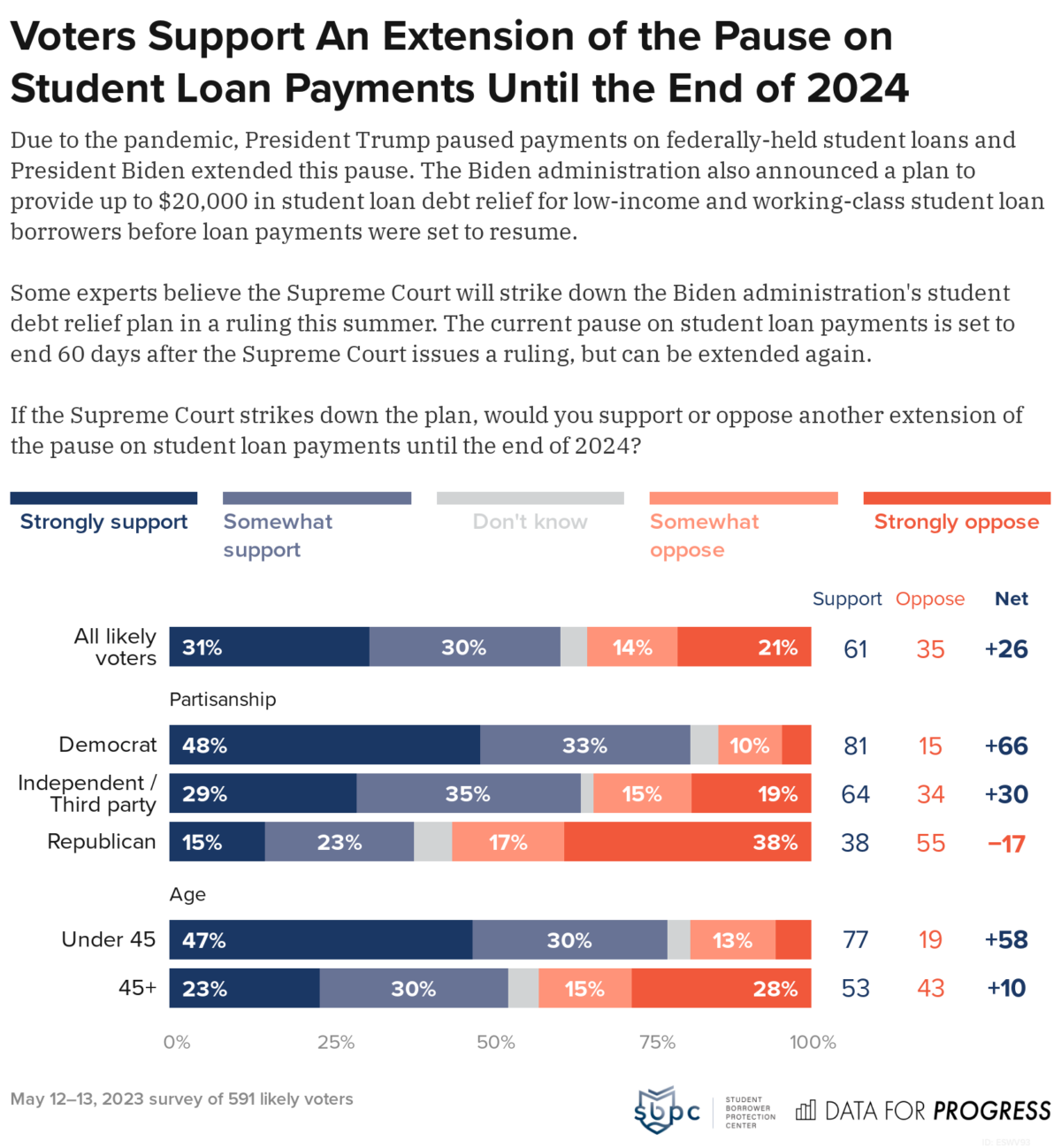

The Administration has repeatedly argued that this cancellation of debt is critical to ensure that student loan borrowers are not economically harmed in the event the payment pause concludes. Today, the Student Borrower Protection Center and Data for Progress released the results of a new poll showing that, by a lopsided 61-35 majority, voters want Washington to extend the pause on student loan payments should President Biden’s student debt relief program be struck down by the Supreme Court next month.

“The pause on student loan payments remains one of the most durably popular pieces of economic policy because the American people recognize what Washington has long struggled to understand: the student loan system is broken and the burden of student debt creates a barrier to economic opportunity for all of us,” said Mike Pierce, SBPC executive director. “The debt limit deal raises the stakes even higher for millions of working people with student debt. We applaud Congresswoman Pressley for standing up for borrowers and their families and fighting to preserve this critical economic lifeline.”

The new poll found strong support among Democrats and Independents, and among voters regardless of age, race, or gender. The new poll also found strong support among voters who never went to college, among voters who never took out a student loan, and among voters who had repaid a student loan and were no longer in debt. This weekend, President Biden and Speaker McCarthy announced a deal to raise the federal government’s debt limit. This deal includes a bipartisan agreement to codify an end to the pause on federal student loan payments, interest charges, and debt collection that has been in effect for more than three years.

Student loan borrowers with a federally held loan have not been required to make a loan payment since March 2020, when President Trump signed the CARES Act, pausing student loan payments and suspending interest charges for tens of millions of borrowers. This critical lifeline was extended eight times via executive actions taken by President Trump in August and December 2020, and by President Biden in January, August, and December 2021, and April, August, and November 2022.

When Biden announced his intent to restart student loan payments after implementing broad debt relief, he explained that the Administration’s monumental debt relief plan was a necessary first step to protect borrowers and prevent disastrous loan defaults and other financial distress, particularly in light of the ongoing economic challenges facing our nation as a result of the pandemic.

In November 2022, a coalition of more than 220 organizations representing students, workers, and people of color called on President Biden to extend the pause on federal student loan payments until he kept his promise to cancel student debt, and utilize every legal authority available to enact that debt relief.

A copy of the November 2022 letter to President Biden can be found here:

https://protectborrowers.org/wp-content/uploads/2022/11/2022.11.21-Payment-Pause-Extension-Letter.pdf

###

About Student Borrower Protection Center

The Student Borrower Protection Center (SBPC) is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.