By The Student Borrower Protection Center | August 28, 2020

Even before the coronavirus pandemic, the United States was dealing with a student debt crisis that had left millions of borrowers drowning under the weight of historic student debt. Forty-five million Americans are struggling with $1.7 trillion in student loan debt, as one-in-four fell behind on their payments and the number of borrowers in default climbed even before the pandemic struck. And now, as tens of millions of Americans face furloughs and job losses stemming from COVID-19, borrowers are facing financial ruin and need immediate, meaningful relief from their student debt.

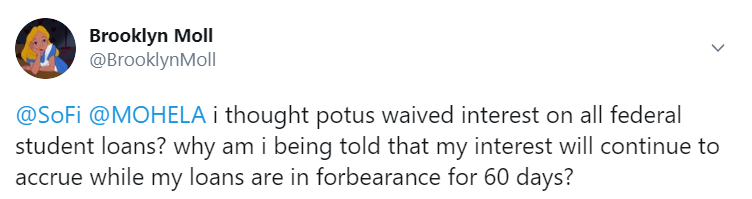

In March 2020, Congress provided some relief to struggling borrowers as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Unfortunately, bad information and servicing breakdowns left far too many borrowers struggling to access this relief. The CARES Act suspended payments and waived interest for the majority of borrowers. Yet, the pandemic has exposed how student loan companies’ decade-long failure to address systemic flaws in their operations denied these new protections to borrowers and failed to provide large-scale borrower relief.

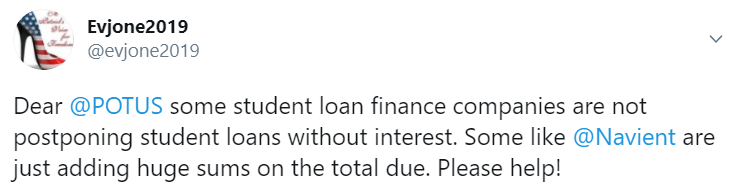

To make matters worse, more than nine million borrowers owing $300 billion in student debt not owned by the Department of Education were left without any relief whatsoever, leaving them to navigate a patchwork of limited options offered by the companies managing their loans. The student loan system has failed to respond to the changing economic reality that borrowers are currently facing.

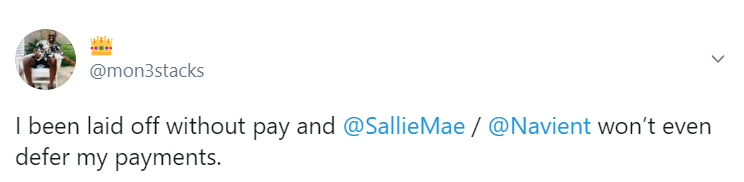

We’ve heard directly from borrowers across the country who have faced a range of breakdowns that denied them promised relief or increased the financial hardship caused by the pandemic. For example, borrowers describe:

- Being unable to access refunds owed to them on payments they made in March

- Facing unexpected fees and surprise bills when applying for relief

- Spending days or weeks trying to reach their student loan company when looking to understand or modify their monthly bills and prepare for when payments resume

- Having their wages illegally garnished—a problem experienced by hundreds of thousands of borrowers nationwide

Left unaddressed, the student debt crisis will deepen our current recession, exacerbate inequality, widen the racial wealth gap, and slow our economic recovery. We know borrowers are hurting as a result of shoddy servicing and bungled relief implementation by student loan companies and the Department of Education. Policymakers and regulators have failed to address these shortfalls that are leaving millions of borrowers worse for the wear.

We want to hear your story. Take the survey now.

We want to better understand the pain points student loan borrowers are facing when navigating their finances amid the coronavirus pandemic. That is why we are encouraging borrowers to share their stories by participating in our new survey aimed at identifying where these widespread errors and breakdowns are occurring in the student loan system. We are committed to doing our part to fight for borrowers. Your voice can help to spotlight the effects of our broken student loan system during this national crisis and the urgent need for action. It is time to hold bad actors accountable for denying borrowers access to the rights and protections they deserve.

###