By Mike Pierce | August 24, 2021

In California, this week a key Senate committee will consider a bill that would grant new protections to struggling private student loan borrowers across the Golden State. These are the same student loan borrowers left out of the pause in student loan payments enacted by Washington in response to the pandemic, many of whom are newly vulnerable as other COVID-era protections, like expanded unemployment insurance and the eviction moratorium expire. This new California bill, Assemblymember Mark Stone’s AB 424, would protect borrowers from abusive debt collection lawsuits and rein in bad practices by creditors and debt collectors.

Today, the SBPC released a new report exposing the punishing consequences for private student loan borrowers in California who fall behind on their debts. This study, authored by Claire Johnson Raba, an SBPC fellow and a clinical teaching fellow at the University of California Irvine School of Law’s Consumer Law Clinic, shows why California’s AB 424 is urgently needed.

A Decade of Abuse Across the Golden State

For more than a decade, private student loan borrowers, particularly those who went to for-profit schools, have been targeted with debt collection lawsuits, often for debts or amounts that they may not owe and cannot be proven in court. These loans were made by some of the biggest banks in the country, including US Bank, JP Morgan Chase, and Bank of America, along with student loan giants like Sallie Mae. Although borrowers with these private loans have not benefited from new protections granted to those with federal student loans, states across the country have considered or passed new borrower protections in Washington’s absence.

In fact, AB 424 is a direct response to federal regulators’ struggles in the face of a defiant student loan industry. In 2017, the Consumer Financial Protection Bureau brought an enforcement action against one of the largest creditors in the private student loan market, the National Collegiate Student Loan Trusts, for falsifying thousands of court records and defrauding student loan borrowers.

Unfortunately, the big banks and Wall Street investors that stood to benefit from this debt collection scheme have fought to block federal consumer protection officials, tying this enforcement action up in court for more than four years.

This leaves tens of thousands of California student loan borrowers newly vulnerable to abuses by predatory private student loan companies like NCSLT.

New Evidence of a Crisis for Private Student Loan Borrowers in California

Based on twelve years of court records in student loan debt collection cases filed across California, this new report paints a bleak picture for borrowers who fall behind on private student loans:

1. Student loan debt collection lawsuits targeted nearly 12,500 California borrowers between 2008 and 2020.

2. The vast majority of student loan debt collection lawsuits were brought by large, out-of-state creditors including the National Collegiate Student Loan Trusts.

3. The effects of private student loan-related court actions are widely distributed and affect Californians throughout the state.

4. Borrowers lack legal counsel in 9-in-10 private student loan debt collection lawsuits.

5. In the vast majority of cases, borrowers hauled into court ultimately lose.

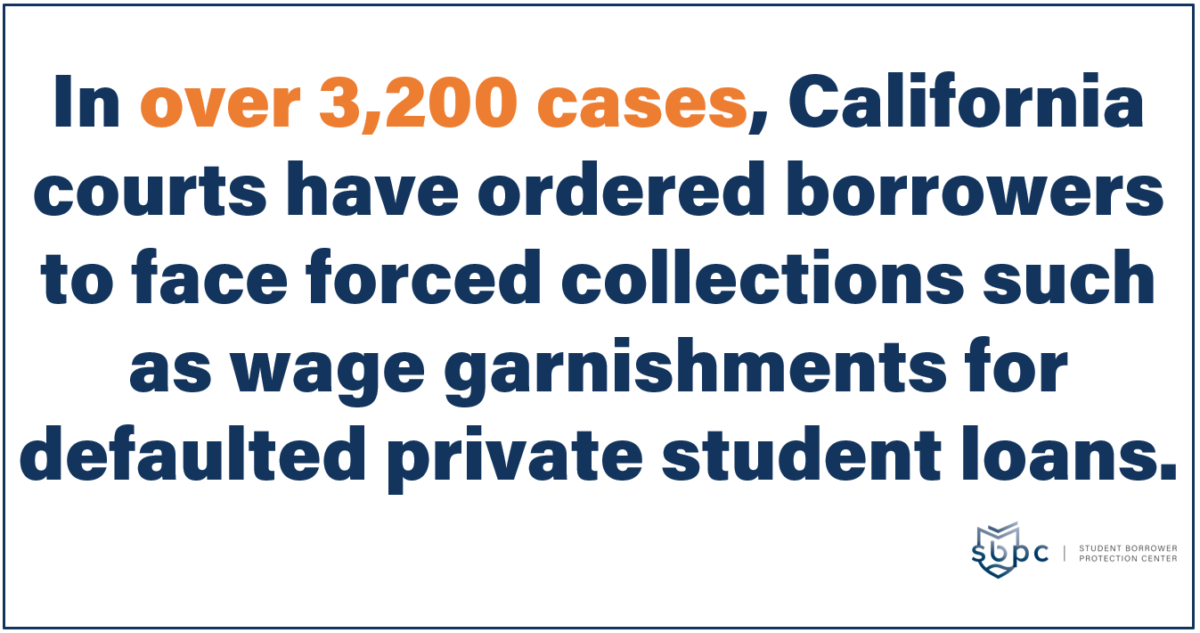

6. After a judgement is entered, creditors often “execute” the judgement– garnishing wages and forcing collections in thousands of cases across California.

Taken together, this shocking new data shows that the crisis facing private student loan borrowers across California isn’t limited to bad practices by one creditor or in one county– it spans communities across the state and touches tens of thousands of California families.

This week, California lawmakers have an opportunity to stand up against these abuses and protect California borrowers with private student loans. It is time to pass AB 424.

###

Mike Pierce is the Policy Director and Managing Counsel at the Student Borrower Protection Center. He is an attorney, advocate, and former senior regulator who joined SBPC after more than a decade fighting for student loan borrowers’ rights on Capitol Hill and at the Consumer Financial Protection Bureau.