This blog is part of an SBPC report series about using consumer financial law to protect borrowers of Income Share Agreements, emerging and risky higher education financing products that require students to pledge a portion of their future income in exchange for money to pay for college or certain non-degree programs. More information on ISAs can be found here. Information on the upcoming SBPC virtual conference on ISAs can be found here.

Innovation or Discrimination?

Fair Lending Risks and ISAs

By Stephen Hayes and Alexa Milton | July 28, 2020

Income Share Agreements (ISAs) have been touted as a solution to the staggering increase in student debt. This debt is a civil rights crisis. On average, Black Americans have more student debt, which they face against a backdrop of immense wealth, income, homeownership, and debt gaps. Although the U.S. is desperately in need of solutions for the student debt crisis—and the accompanying racial and ethnic disparities—features of existing ISAs threaten to exacerbate these inequalities.

Civil rights laws like the Equal Credit Opportunity Act (ECOA) are a bulwark against these dangers. For decades, these laws have prevented discriminatory practices in a range of markets. Although ISAs come in a variety of forms—including differences in terms, the parties offering them, and the quality of educational programs funded—established civil rights principles apply to guard against fair lending risks.

First, there is evidence that some ISAs are used to facilitate targeting of minority communities for exploitative and predatory products. This type of practice is illegal under a legal concept known as reverse redlining: it’s illegal for creditors to target predatory products to customers because of their race or other protected characteristics. Reverse redlining has been used to challenge predatory or unfair practices in a variety of settings, including mortgage lending, rent-to-own housing, and for-profit vocational education.

The new report, Solving Student Debt or Compounding the Crisis? can be found here: https://protectborrowers.org/wp-content/uploads/2020/07/SBPC_Hayes_Milton_Relman_ISA.pdf

Reverse redlining cases often share a common characteristic: relatively complicated financial transactions designed to take advantage of vulnerable consumers’ misunderstanding and, often, misplaced trust. Public allegations about practices at some for-profit vocational education programs that rely on ISA financing—such as coding bootcamps—echo conduct typically cited in reverse redlining cases, including discriminatory targeting, costly and opaque financing, unfair contract terms, and misrepresentations or omissions about the transaction or product being financed.

Second, even absent predatory targeting, some ISAs rely on features like school- or major-based distinctions to set terms and pricing. These types of criteria risk perpetuating disparities adverse to historically underserved groups, and could be subject to challenge under traditional disparate impact analysis. Disparate impact doesn’t require evidence of discriminatory intent. Instead, a facially neutral practice—meaning a practice that doesn’t explicitly rely on a protected class like race—that nonetheless causes an adverse effect on a protected class is illegal if it either doesn’t advance a legitimate interest, or if that interest could be achieved with a different practice that has a less discriminatory effect.

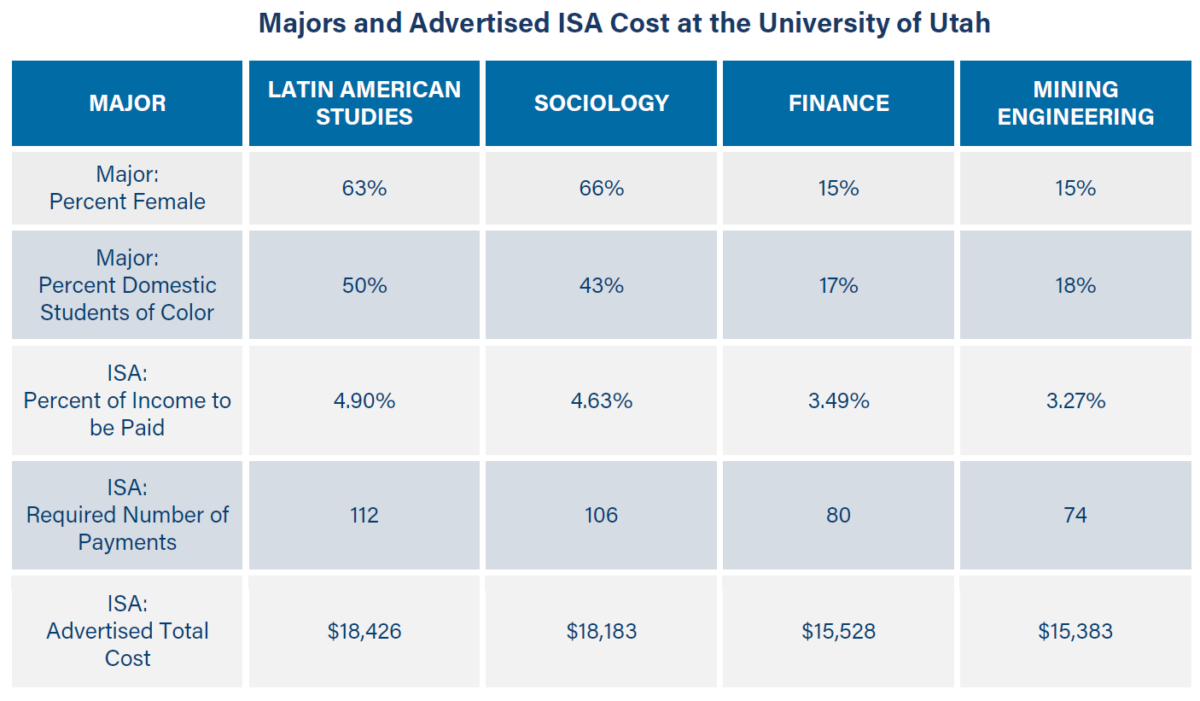

Factors some providers use to design ISAs are based on criteria that reflect race and gender disparities. In particular, a number of ISA providers use college major or school selectivity to determine ISA pricing and terms. Both of these factors reflect serious gender and racial disparities; ISA terms that vary based on these criteria are likely to replicate these disparities. Indeed, these disparities are evident when comparing predominantly male and female majors using publicly-available ISA calculators. For example, candidates in predominantly female majors are required to pay higher percentages of their income, over longer periods, resulting in higher total costs, as illustrated below:

Disparities alone aren’t enough for a product to be illegal. But entities do have an obligation to ensure that practices causing disparities are necessary to advance legitimate businesses interests. Even if they advance legitimate interests, liability might still exist if there are ways to accomplish those interests with fewer disparities. In the case of existing ISAs, there’s reason to be optimistic that less discriminatory alternatives exist.

Major changes to higher education financing are needed. The tremendous—and inequitable—burden of educational debt is unsustainable. Any responsible entity that designs or offers ISAs should step forward and confirm their use won’t exacerbate the existing crisis. Regulators, attorneys general, and policymakers should hold them to that obligation.

###

Stephen Hayes is a Partner at Relman Colfax. Stephen originally joined the firm in 2011 and returned in 2018 after several years at the Consumer Financial Protection Bureau (CFPB). His work focuses on designing best-in-class practices on a range of civil rights and consumer protection issues.

Alexa Milton is an Associate at Relman Colfax, where she practices civil rights litigation and civil rights counseling. In her litigation practice, Alexa has represented individuals and organizations challenging discrimination in housing, lending, education, health care, and public accommodations.