By Chris Hicks | May 19, 2023

Yesterday, shareholders of one of the largest student loan companies in the country gathered in Lincoln, Nebraska and reminded student loan borrowers: student debt is “good debt” if you’re the debt collector. Just ask Jeffrey Noordhoek, Nelnet’s CEO, who was paid more than $2 million last year, even as the company laid off hundreds of low-wage call center workers saying it was due to lack of work as payments remain paused.

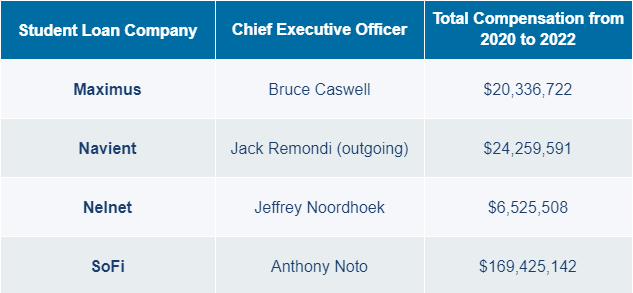

And this isn’t unusual. Take a look at pay of some of the largest student loan companies:

It’s no secret that our student loan system is broken, but many don’t realize that these companies’ CEOs are profiting enormously in the process. And these executives have used their companies’ profits and influence to ensure that they can continue profiting off students, cutting legal corners, and robbing the public of hard-earned protections. For example, Anthony Noto, the CEO of SoFi, has publicly admitted that his company sued to end the payment pause earlier this year in part because the pause had hurt SoFi’s profits, saying “our student loan business got cut in more than half. It was our largest business, it was our oldest business . . . that business has been running at about 50 percent of the pre-COVID volume for the last 20 months.”

Student loan borrowers might also be concerned with how the student loan company Maximus discusses student debt cancellation policy to its investors, including recently saying: “President Biden’s executive order to forgive certain student loan indebtedness for qualified borrowers could adversely affect our student loan servicing business.” (You can read economists’ analysis on how failing to cancel student debt would adversely affect tens of millions of borrowers and the US economy here.)

And just a few years ago, Navient all but confessed that it prioritized its profits before the best interests of borrowers in a court filing, stating: “there is no expectation that the servicer will ‘act in the interest of the consumer’” after being accused of misleading students into taking on billions of dollars of illegal and unnecessary interest charges. Navient’s statement likely rang true to borrowers, as Senator Warren and Representative Pressley questioned if the company had “attempt[ed] to scam borrowers out of student debt relief by encouraging them to refinance their loans under Navient’s private lender.”

America’s embrace of a debt-financed higher education model has been a catastrophe. By placing predatory, for-profit financial institutions at the core of our higher education system, we’ve created a model in which these companies have every incentive to lobby against public policy supporting borrowers, and try to further their own bottomline. And now the potential lost profit of these companies is the very thing Republican attorneys general are pointing to as they sue to block President Biden’s student debt cancellation policy.

The fact of the matter is these for-profit companies will always prioritize their bottom lines and executives over the welfare of student loan borrowers they are supposed to serve.

But there is a simple way the Biden Administration can fix this, and do better for this generation, and for the next: fulfill the promise of student debt cancellation of up to $20,000 for all eligible borrowers, particularly the most vulnerable borrowers who have been harmed by these very companies.

###

Chris Hicks is a Senior Policy Advisor at the Student Borrower Protection Center, and focuses on the intersection of consumer and labor protections. He joined SBPC from the American Federation of Teachers, where he organized contingent faculty members.