By Ben Kaufman | July 21, 2022

In October 2021, the Department of Education (ED) announced a sweeping package of changes meant to fix the troubled Public Service Loan Forgiveness (PSLF) program. Referred to as the “PSLF waiver,” this action sought to usher hundreds of thousands of borrowers past administrative hurdles and toward the student loan relief that they had earned through a decade of service to their communities and the nation. Before this waiver, a stunning track record of malfeasance and incompetence by ED and its contractors led PSLF to have a 98 percent rejection rate, with millions of teachers, nurses, and servicemembers who had planned their lives around the promise of eventual loan cancellation being cheated out of their rights. Moreover, evidence suggests that the borrowers most in need of relief, including low-income borrowers and borrowers of color, are among those most likely to have been unduly blocked from accessing PSLF. For example, while Black Americans make up an outsized share of public service workers and are disproportionately likely to take on student loan debt, research shows that administrative burdens also make them much more likely to be deterred from key steps on the path toward PSLF, such as enrolling in income-driven repayment.

Against this backdrop, the PSLF waiver has been a phenomenal success—and it may just be getting started in delivering its powerful benefits. On the eve of the waiver’s announcement, only about 16,000 borrowers had secured cancellation through PSLF and the temporary expansion meant to fix it (TEPSLF), even though borrowers were meant to have begun qualifying for cancellation under these programs almost half a decade earlier. Now, less than a year after the announcement of the waiver, more than 146,000 borrowers—a more than ninefold increase—have had more than $9.5 billion in federal student loans erased while hundreds of thousands more have been brought months or years closer to forgiveness.

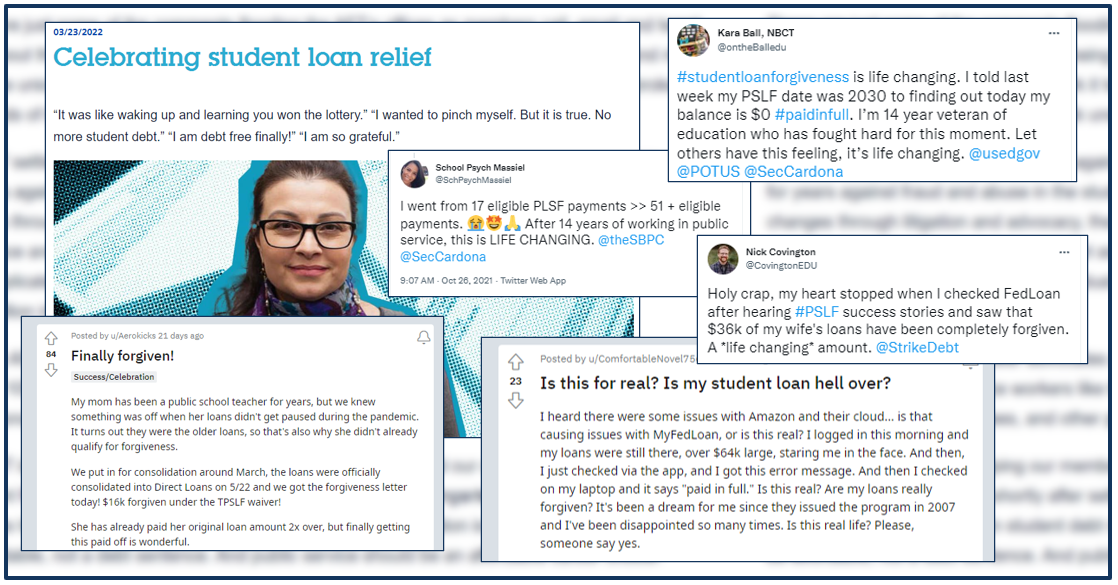

Underlying this clear win are hundreds of thousands of public service workers who have been allowed to cut through red tape and access transformative debt relief, often after years of crushing administrative and financial pain. Borrowers who have secured cancellation through the waiver report that it is “life changing,” that news of cancellation led them to cry “real tears” (and more), and that they now have a “new lease on life.” Social media sites have been flooded with deeply moving narratives of borrowers seeing their financial and personal futures change overnight after securing tens or hundreds of thousands of dollars of relief under the waiver, relief that in many cases borrowers had previously written off as a pipe dream or a cynical ruse by ED.

The Biden Administration has touted the topline numbers associated with the waiver’s success, and it deserves to. But the waiver’s positive effects may run even deeper, with subtle improvements under the hood of the PSLF program indicating that the waiver is just beginning to hit its stride in helping borrowers. In particular, it appears that the waiver has led more borrowers to engage with the PSLF program than ever before regardless of whether they already qualify for relief. This trend stands to bridge the gap between public service and loan relief in both the short and long term, setting PSLF up for lasting success.

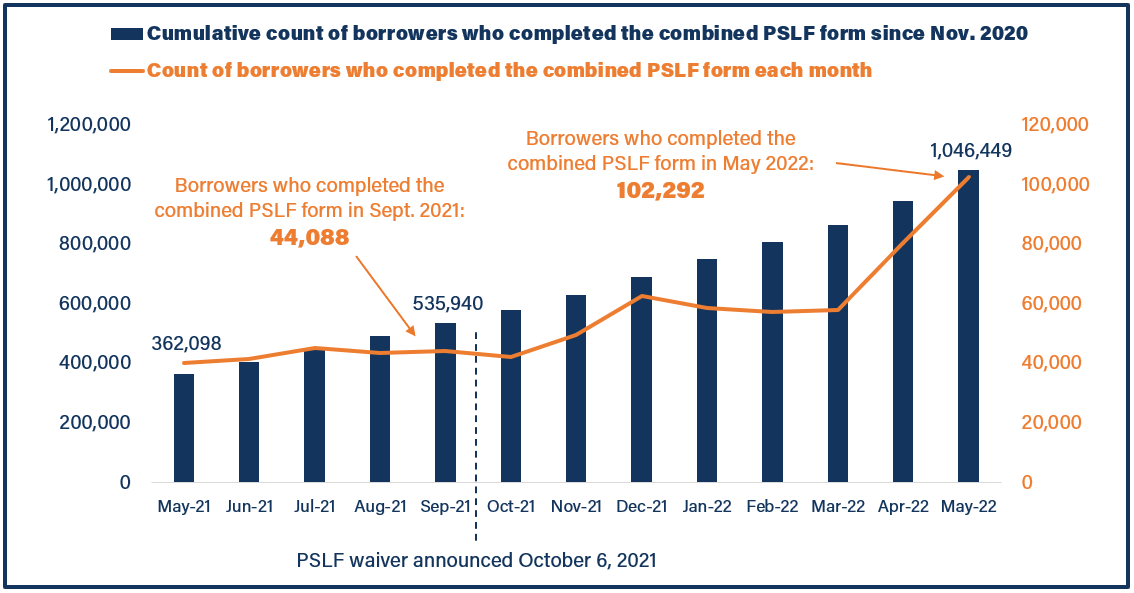

Consider the number of borrowers submitting the “combined” PSLF form that ED introduced in November 2020 to allow borrowers to apply for forgiveness under PSLF and TEPSLF, or to simply certify their employment for eventual PSLF eligibility, all in one place. ED changed how it reports data on the number of borrowers filling out this form starting in April 2021 (compare this to this), so we can begin analyzing monthly trends in form completion with ED’s May 2021 PSLF data. These statistics conveniently date back to a year before the most recent data available (that is, the data for the month of May 2022).

In May 2021, only about 362,000 cumulative borrowers had submitted the combined PSLF form since it was introduced in November 2020, with slightly more than 40,000 borrowers submitting the form in that month. By the end of September 2021, four months later and just before the waiver was announced, an additional 174,000 borrowers had submitted the combined PSLF form, and the number of borrowers submitting the combined PSLF form each month had ticked up to slightly more than 44,000 people.

After the PSLF waiver was announced in October 2021, however, engagement with PSLF quickly accelerated. In the four months that followed the end of September 2021 (that is, by the end of January 2022) an additional 212,700 borrowers submitted the combined PSLF form (a more than 22 percent increase over the roughly 173,000 from the preceding four months), and the average number of borrowers submitting the combined PSLF form per month rose more than 20 percent (increasing from 42,791 for the period from May 2021 to September 2021 to 51,358 for the period from September 2021 to January 2022).

By the period covered in the most recent data, May 2022, the cumulative number of borrowers who had submitted combined PSLF forms since November 2020 had risen to 1,046,449, nearly double the number from before the waiver in September 2022. Even more encouraging, by May 2022 the number of borrowers submitting the combined PSLF form each month had more than doubled from before the waiver period to now exceed 100,000 people per month.

Further, these borrowers are not just filling in the PSLF form to get forgiveness and walk away. In fact, even with a record number of borrowers getting cancellation, there are now more than 20,000 more borrowers in the PSLF pipeline than there were before the waiver (1,338,830 in May 2022 v. 1,318,076 in September 2021). Indeed, engagement with PSLF has improved not just among borrowers on the cusp of cancellation, but also among those further off from relief, meaning that the waiver’s success in fixing PSLF is likely to have long-lasting effects.

Plus, while ED doesn’t report on the demographics of borrowers who receive PSLF, researchers have indicated that Black borrowers are “particularly likely to benefit,” from the waiver, “with full take-up of the PSLF waiver potentially going a substantial distance to closing the racial gap in student debt burden.”

This is all great news. Record numbers of people are securing PSLF, relief under the program is most likely to help those who need it most, and more borrowers than ever before are engaging with PSLF ahead of time to set themselves up for success. Plus, as more borrowers see their peers getting on track for and securing cancellation, a virtuous cycle may arise that could help build momentum toward public service workers finally accessing PSLF en masse. The waiver’s role here is undeniable.

Right now, the PSLF waiver is slated to expire on October 31, 2022. The Biden Administration should prevent that from happening. Instead, it should allow the ongoing momentum toward fixing PSLF to continue building. ED still has the same authority it used to create the waiver in the first place—the emergency powers available under the HEROES Act—and the administration just extended the COVID-related public health emergency declaration that allows ED to wield it.

The engagement growth observed in the data appears to be a steady march, not a last-minute rush to beat the deadline, meaning that extending the waiver is likely to only improve the action’s reach. In addition, we already know that even with the waiver’s successes, many borrowers continue to get poor customer service and outright incorrect information from student loan servicers. These breakdowns create a growing risk that millions of borrowers could still miss out on the waiver entirely if it is allowed to expire. Indeed, the Student Borrower Protection Center recently estimated that there could be as many as 9 million student loan borrowers working in public service, but the most recent data show that only 1.34 million of these borrowers have formally begun the process to pursue eventual relief through PSLF. Further, given what we know about the student loan system’s longstanding failure to guide low-income people and people of color toward the protections they are entitled to under the law, the waiver’s shortcomings are likely to land hardest on those who are already most marginalized. Only by allowing the waiver to continue running can policymakers even begin to diminish that risk.

There is much work to be done to deliver public service workers the relief we owe them, and the nation is already on the path to doing it. The Biden Administration should take the commonsense step of continuing down the road toward fixing PSLF, and it should choose not to push borrowers back into the broken pre-waiver status quo.

###

Ben Kaufman is the Director of Research & Investigations at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked on issues related to student lending.