For years, predatory for-profit schools have plagued the American higher education system, aggressively recruiting students into high-cost, low-quality education and training programs with false promises. As the abuses of this industry continue to come to light, the SBPC has launched investigations into the companies and practices that allow these schools to operate with impunity, raking in billions of dollars in federal student aid while student loan borrowers are driven deeper into debt.

Shadow Lenders

Student financing companies that partner with for-profit schools to drive students to take on risky, high-cost student debt.

This report examines the web of predatory schools and financial services firms that drive students to take on risky, high-cost shadow student debt.

Selling Out Students: A Case Study in Brand-Name Schools Partnering with For-Profit Scammers to Make a Buck

This report exposes a scheme by the failed for-profit coding bootcamp Make School, Inc. and the private non-profit college Dominican University to drive hundreds of largely low-income students to each take on thousands of dollars of predatory private student loans and, for some, federal student loans.

Morally Bankrupt: How the Student Loan Industry Stole a Generation’s Right to Debt Relief

This report investigates a decades-long scheme by the student loan industry to rob borrowers of their right to debt relief on many types of private student loans.

Point of Fail: How a Flood of “Buy Now, Pay Later” Student Debt is Putting Millions at Risk

This report documents the results of an SBPC investigation finding that emerging point-of-sale lending firms, particularly those in the rapidly growing BNPL space, are driving students toward risky loan products and propping up a startling array of questionable for-profit schools in the process.

Advocates Sound Alarm on PayPal Education Financing Partnerships with Over 150 For-Profit Schools

The SBPC, Allied Progress, Americans for Financial Reform, and Student Debt Crisis sent letters to the CEO of PayPal, Inc. and its regulators warning that the tech firm may be driving significant harm to borrowers attending for-profit schools.

The SBPC sent a letter to the CFPB warning of troubling business practices and possible borrower harm by Climb Credit, a specialty lender that provides financing for education and vocational training courses.

Advocates Outline a Path Forward for California to Rein in Shadow Student Debt

Advocates commented on proposed rules for education financing products in California aimed at protecting borrowers from predatory education financing products.

Legal Analysis, and Need for Increased Enforcement, of the Student Loan Sunshine Act

In a memorandum, Sabita Soneji and Leora Friedman of Tycko & Zavareei, LLP outline the legal tools available to hold bad actors accountable for an ongoing scheme to drive students toward predatory private credit.

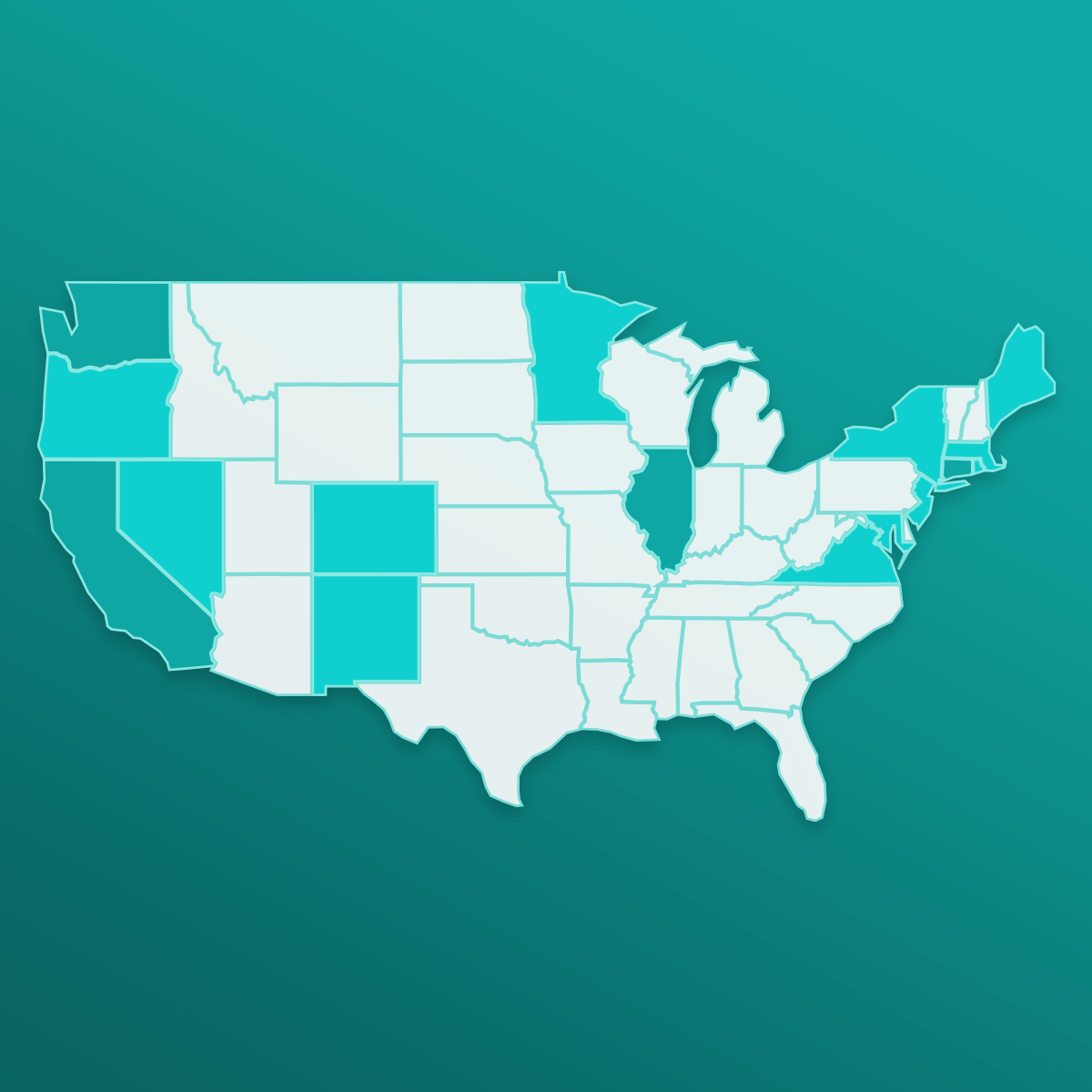

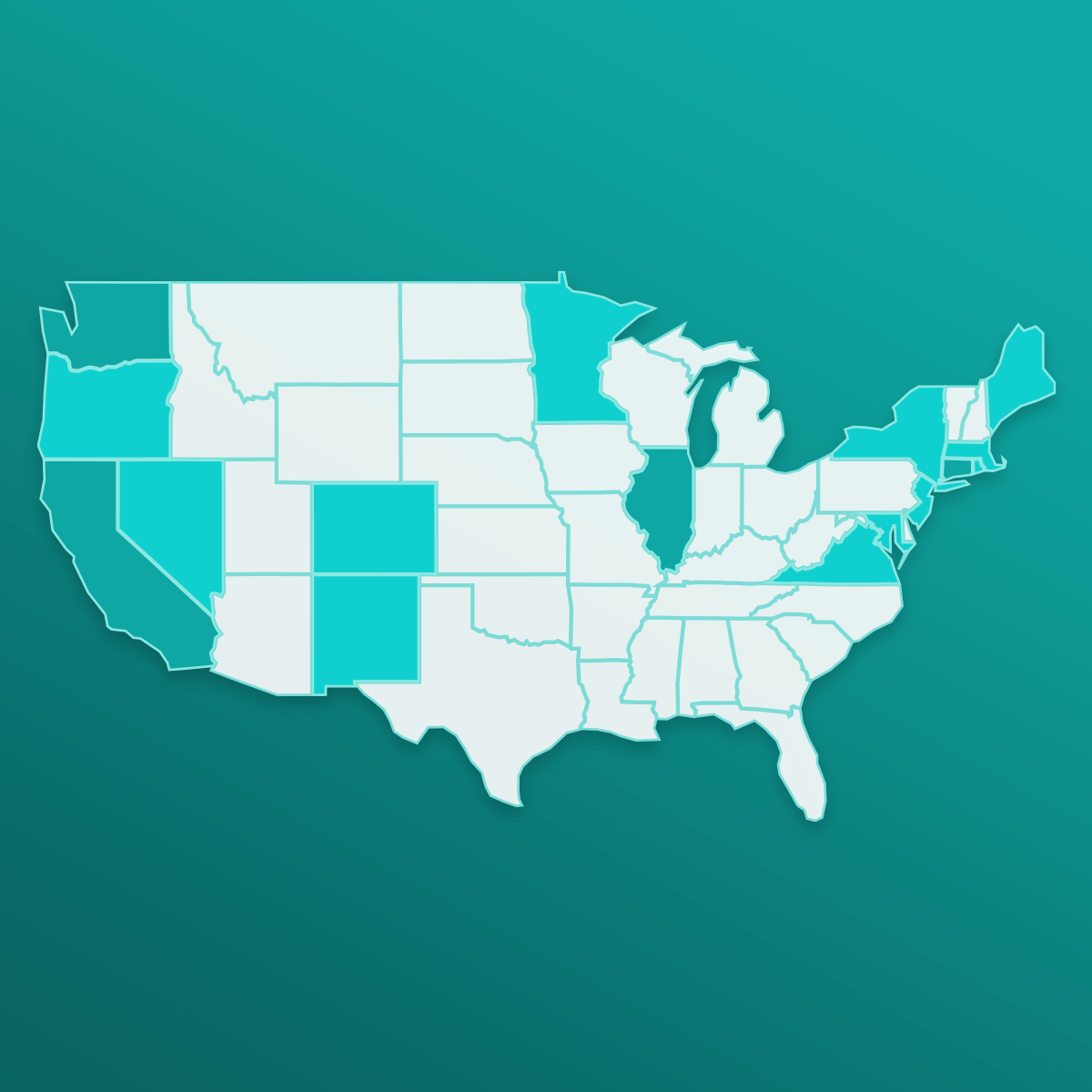

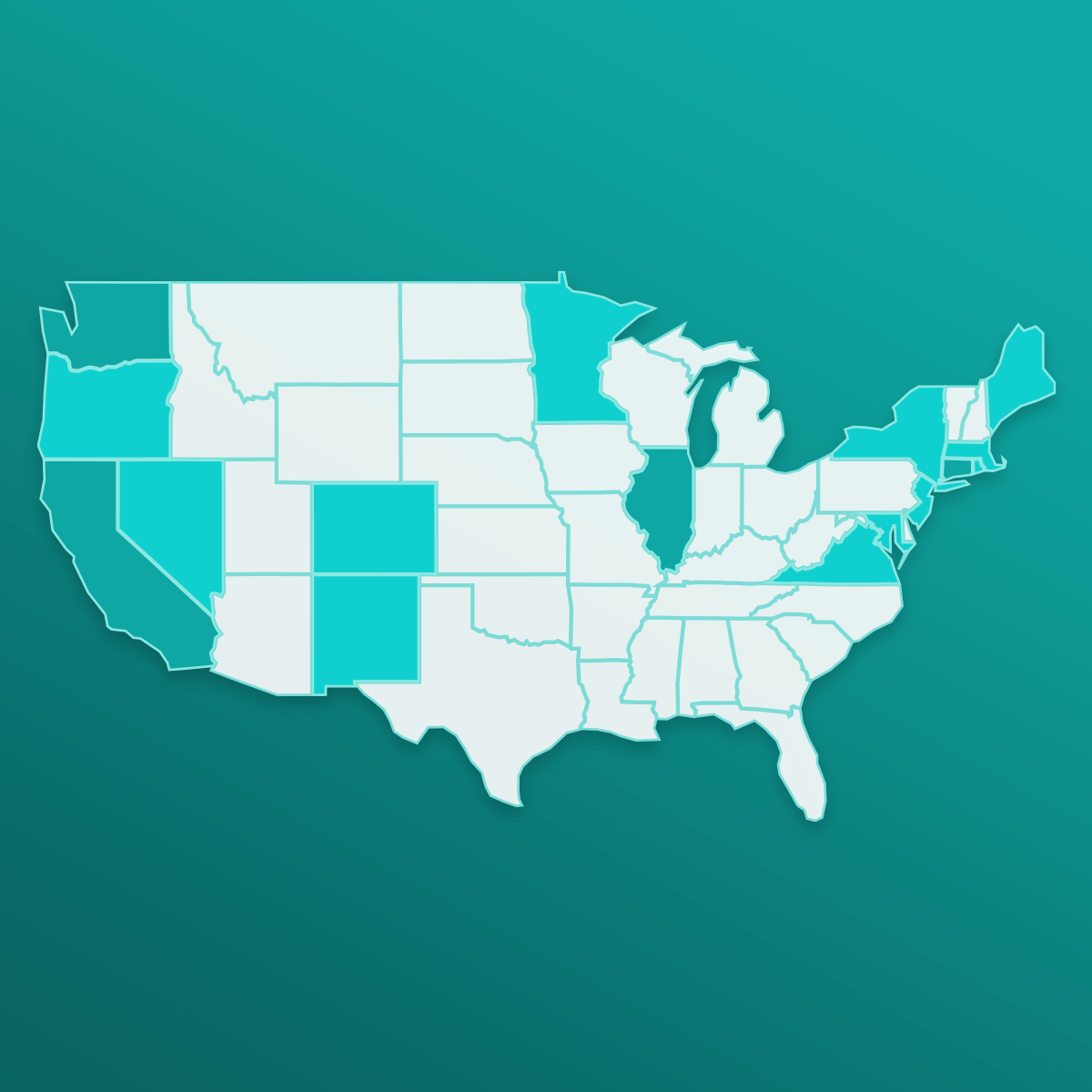

This report is the result of an investigation revealing that public colleges and universities nationwide are driving students toward expensive, predatory student debt.

Testimony in support of legislation which defines and addresses some of the most critical elements affecting students in the event of a disorderly school closure.

Unscrupulous Debt Collection Practices

Abusive strategies deployed by debt collectors and schools, including transcript and credential withholding, excessive robocalling, and even termination of enrollment for unpaid debts.

Accounts Receivable & Withheld Transcripts: The Quiet Higher Ed Crisis That States Could be Tackling

Recent court settlements at for-profit colleges have shed light on a less traditional type of student debt: past-due financial accounts, otherwise known as accounts receivable. While defaulted student loans can lead to long-term problems like bad credit and wage garnishment, accounts receivable have a much more immediate effect.

Private Student Loan Collections Issue Brief: Maryland Spotlight

In an issue brief, the SBPC shows how private student loan collection practices are harming borrowers across the country — with a spotlight on Maryland borrowers.

Forced Arbitration Clauses

Predatory contract terms are buried in agreements that for-profit schools require students to sign upon enrollment. These terms are used to deny students their right to sue when schools bend the law and cheat students.

Prepared Testimony of Tariq Habash Before the New Jersey Assembly Higher Education Committee

Testimony in favor of legislation to prevent state resources from flowing to schools and training programs that require students to consent to arbitration and waive other rights prior to a dispute arising.

These forced arbitration clauses are arguably some of the most damaging tools used by companies across the student loan market to shield themselves from accountability.

Deceptive Marketers and Lead Generators

Firms hired by schools to boost enrollment often do so by making false claims and utilizing aggressive sales tactics to recruit low-income students, students of color, and military-connected students.

This report is the result of an investigation revealing that public colleges and universities nationwide are driving students toward expensive, predatory student debt.

We sent a letter to the CFPB calling on the agency to step in and protect students from predatory conduct by OPMs—something ED has proven unable or unwilling to do for more than a decade.

The Predatory Underworld of Companies that Target Veterans for a Buck

In recent years, federal and state law enforcement officials have cracked down on lead generation firms that drive servicemembers, veterans, and their families into the open arms of the worst actors in American higher education. These firms are often the first interaction prospective students have with the for-profit college industry—the first step on a path that has left millions drowning in debt.

CDR Manipulation Consultants

Firms paid to manipulate federal accountability metrics, such as cohort default rates, that are designed to hold schools accountable.

The SBPC released a new issue brief detailing how predatory for-profit schools team up with cohort default rate (CDR) manipulation companies to evade critical rules designed to protect borrowers who attended schools with high default rates.

What it Means to be a Student Loan Servicer: Guaranty Agency Edition

Industry lobbyists have tried to convince lawmakers that private sector student loan companies known as “Guaranty Agencies” are not performing student loan servicing under the definition commonly included in state legislative proposals—a definition modeled on federal regulations. The truth is these are student loan servicers.

In the News

Consumer Groups Take PayPal to Task Over Student Loan Credit Line

Students at some for-profit career schools could find themselves paying hefty interest charges when using a credit line offered by PayPal, a group of consumer watchdog groups warned this week.

‘Shadow’ Lenders Can Leave College Students in the Dark

Thirty-eight percent of students borrow additional money for college via credit cards, home equity loans and other non-student loans, according to a May 2020 report from the Federal Reserve. The SBPC has dubbed this the “shadow education finance market” because these options can lack transparency.

Student Loan Watchdog Accuses Lender Climb Credit of ‘Troubling Tactics’

A nonprofit student loan watchdog is accusing private lender Climb Credit of engaging in tactics that misrepresent educational programs and projected earnings while steering borrowers towards for-profit schools.

PayPal Cracks Down on For-Profit ‘Schools’ Misrepresenting PayPal Credit

PayPal is cracking down on for-profit schools for apparently misrepresenting deferred interest loans as zero-cost loans from PayPal Credit to entice prospective students.

Ruiz Bill to Curb Forced Arbitration in Educational Enrollment Contracts Clears Committee

In an effort to curb forced arbitration, the Senate Higher Education Committee approved legislation today which would withhold state funding from institutions of higher education and employment training with mandatory arbitration agreements or class-action lawsuit waivers.