What Betsy DeVos’s Brush with the Law Reveals About Our Broken Student Loan System

By Mike Pierce | October 24, 2019

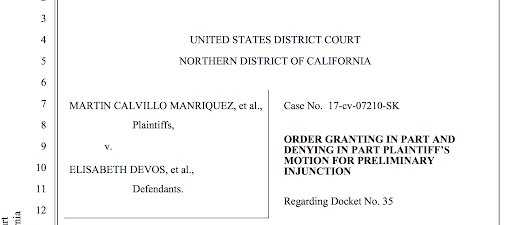

Earlier this month, a federal judge in California held a hearing to consider whether Education Secretary Betsy DeVos should be held in contempt of court. At issue: student loan servicers’ and debt collectors’ continued attempts to collect money from 16,000 student loan borrowers cheated by a for-profit school, all in violation of a federal court order.

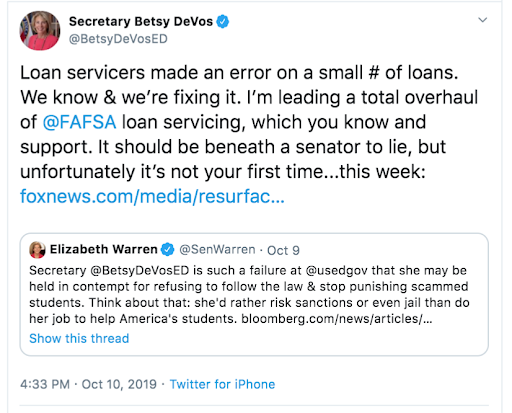

The court is trying to address an unprecedented disregard for its authority– holding Secretary DeVos accountable for violating a court order more than sixteen thousand times. In response to the threat of contempt, DeVos is pointing the finger at loan servicers for the violations, which brings us exactly to the issue we are trying to address: Who is responsible for overseeing financial companies who are profiting off student debt?

What went wrong

Over the past two years, Betsy DeVos has used every tool at her disposal to give the student loan industry free rein to cheat borrowers. Under DeVos, the Department of Education sided with industry over borrowers in court cases across the country. It “reinterpreted” federal law to block enforcement efforts. It obstructed independent oversight by federal regulators and state banking departments.

And industry took these moves as a permit by the federal government to declare open season on borrowers’ rights.

Seemingly every week, lawsuits are being filed against student loan companies for preying on servicemembers, teachers, older borrowers and millions of others. During this same time, these private-sector firms have returned hundreds of millions of dollars to their investors.

Up to this point, industry has largely been shielded by DeVos, and asserted, in the words of Navient CEO Jack Remondi, “it’s just false narrative, and really doesn’t show a lot of appreciation for how a servicing operation works.”

But now, for the first time, Secretary DeVos is being forced to acknowledge that amid charges of widespread abuse, these big financial companies are beyond the government’s control and accountable to no one, including her agency. As the Department of Justice, representing the Department of Education, explained to the court:

At this point I can say the department was surprised to learn the extent of the non-compliance issues once it kind of dug into this issue further in response to the last order. It definitely has become aware of the need to have better oversight of its servicers going forward. It’s been an eye-opening experience — definitely take responsibility and understand that the buck stops with the department.

Here, for the first time, the U.S. Department of Education echoed government watchdogs, law enforcement officials, regulators, and tens of thousands of student loan borrowers, explaining to a federal judge that the system is broken.

How we got here

At the center of this case rests the financial fates of 80,000 student borrowers who attended schools owned by the now-defunct Corinthian Colleges. These are some of the most vulnerable people in the student loan system, preyed upon at every step.

First, Corinthian lied to students to get them in the door, using misleading marketing materials and false promises. Then, Corinthian loaded these students up with debts they knew could never be repaid, with the ultimate goal of driving large bonuses to executives and profits to shareholders.

These students have been fighting for years to invoke their rights to debt relief under the Higher Education Act (known as “Borrower Defense to Repayment”), represented by our partners at the Harvard Legal Services Center Project on Predatory Student Lending.

While these student borrowers’ claims were considered by the court, the presiding judge, Magistrate Judge Sallie Kim granted borrowers’ request for a preliminary injunction, declaring that the “Secretary is ORDERED to cease all efforts to collect debts from Plaintiffs until the Court can determine the proper course of action.” This order went into effect in May 2018.

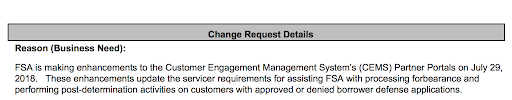

Newly disclosed court records show that, in response to Judge Kim’s May 2018 order, the Department of Education’s Office of Federal Student Aid (FSA) directed its student loan contractors to cease collection attempts on borrowers pursuing “Borrower Defense” claims, consistent with the order:

Yet in these same court records, the Education Department reluctantly acknowledges that, for 16,000 borrowers, it failed to comply.

Servicers and debt collectors pursued these debts, and, in thousands of cases, garnished borrowers’ wages, damaged their credit, or seized their tax refunds.

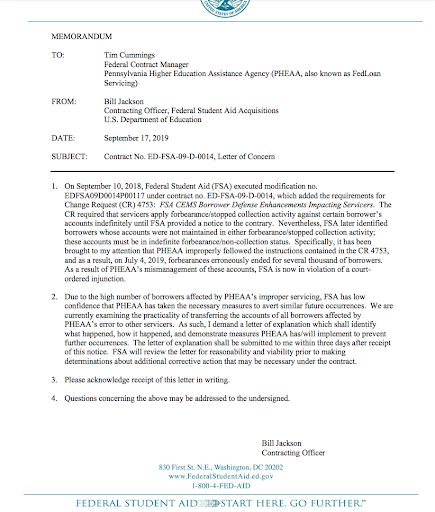

The situation appears to be particularly dire at PHEAA, one of the largest student loan servicers in America and one of the government’s principal contractors. On September 17, 2019, as the Department was preparing to appear before Judge Kim, a senior FSA contracting official sent a “Letter of Concern” to PHEAA, explaining that “as a result of PHEAA’s mismanagement of these accounts, FSA is now in violation of a court ordered injunction” and further demanding “a letter of explanation which shall identify what happened, how it happened, and demonstrate measures PHEAA has/will implement to prevent further occurrences.”

These recent revelations are no surprise to those who have watched the embattled student loan giant cheat borrowers out of their rights for a decade.

Yet they seem to have shocked the court and rattled the Justice Department attorneys representing the Department of Education, who explained that “the Department is cognizant of the Court’s desire to “aid[] the Plaintiffs and strongly deter[] future violations of the Court’s orders”….and is committed to implementing further mechanisms… to atone for its errors and ensure full compliance with the Court’s preliminary injunction going forward.” (emphasis added).

The Justice Department has it right: it is past time that Betsy DeVos and the Department of Education “atone for its errors” in this case. But the Department also needs to do right by the rest of us– the tens of millions of student loan borrowers across the country who interact with these companies every day.

That means unwinding its dangerous efforts to shield its loan contractors and to obstruct independent oversight. And that means making accountability a priority as FSA revamps its servicing contracts and implements its planned NextGen servicing overhaul.

Yet the lesson here is even broader: if the government’s student loan contractors cannot be trusted to obey a court order, should it surprise any of us that these companies have been credibly accused of damaging the credit profiles of thousands of disabled veterans, illegally steering millions of borrowers into high-cost repayment options, cheating teachers and other public service workers out of loan forgiveness, and denying military borrowers’ access to protections earned through their service?

Each allegation of abuse flows from the same source– the government’s gross negligence in its management of a trillion dollar loan portfolio and industry’s willingness to exploit this negligence to maximize its profits.

Unfortunately, it doesn’t appear that Betsy DeVos is poised to learn the right lessons from the fiasco in the Manriquez case. This means that, even if she’s able to avoid being held in contempt this time, she’ll be back in court again before too long.

###

Mike Pierce is the Policy Director and Managing Counsel at the Student Borrower Protection Center. He is an attorney, advocate, and former senior regulator who joined SBPC after more than a decade fighting for student loan borrowers’ rights on Capitol Hill and at the Consumer Financial Protection Bureau.