By Ben Kaufman | November 3, 2021

Since 2010, all federal student loans have been made directly by the government. But before that, most federal student loans were made by private creditors such as banks and backstopped by the Department of Education (ED). More than 10 million Americans still owe more than $238 billion in loans originated under the older system, called the Federal Family Education Loan Program (FFELP). Although ED now owns some of these older loans, many—referred to as “commercial” FFELP loans—are still owned by private companies.

The largely arbitrary fact of whether a borrower happens to be a FFELP borrower—and whether their FFELP loans happened to have been bought by the government during the bailout of the student loan industry during the last financial crisis—has been the deciding factor for millions of borrowers in whether they have been able to secure student loan relief during the pandemic.

Many borrowers may not have even known whether their loans were FFELP loans before COVID, when CARES Act relief for federal student loan borrowers made this distinction both clearer and critical. The largely arbitrary fact of whether a borrower happens to be a FFELP borrower—and whether their FFELP loans happened to have been bought by the government during the bailout of the student loan industry during the last financial crisis—has been the deciding factor for millions of borrowers in whether they have been able to secure student loan relief during the pandemic. In particular, commercial FFELP loans were generally cut out of protections for student loan borrowers during COVID.

This situation was particularly harmful for borrowers in default on commercial FFELP loans, who may have faced severe collections efforts during much of the pandemic such as wage garnishment and the confiscation of stimulus checks.

In March 2021, the Biden administration acted to offer borrowers in default on commercial FFELP loans the same protections as borrowers in default on other federal student loans, including immunity from ongoing collections efforts. ED also dictated that commercial FFELP loans in default must be handed over to the Department of Education instead of being “assigned” to private debt collection agencies. This move effectively converted commercial FFELP loans into ED-held loans. In turn, this change protected borrowers from becoming the prey of Wall Street, which has made a brisk business of profiting off of defaulted borrowers’ high likelihood of re-defaulting in instances where they successfully restore their loans through the federal “rehabilitation” program.

ED can and must choose to make this safeguard permanent, and to end the practice of industry cashing in on borrower re-defaults. Until it does, borrowers will remain the victims of industry’s perverse incentive to offer poor servicing and assistance to borrowers who have already defaulted and paid their way back to being temporarily current.

When FFELP Borrowers Default, They Have Few Paths for Relief—But the Companies Holding their Loans Get Windfall Profits

Before COVID, nearly one-in-five student loan borrowers was in default, with more than one million borrowers defaulting per year and a new federal student loan borrower defaulting every 26 seconds. The consequences of these defaults are devastating and far-reaching for borrowers, as default on a federal student loan can impede borrowers’ ability to find a job, rent a home, or maintain a professional license, all on top of harsh collections measures.

In instances where these borrowers defaulted on FFELP loans, a company called a Guaranty Agency (GA)—which acts as a servicer, insurer, and debt collector for these loans—would pay out to the note holder an amount equal to the defaulted loan’s principal and any accrued interest. In turn, the federal government would make a reinsurance payment to the GA to cover the cost of the payout to note holders, and the GA would begin managing the loan.

Borrowers could restore their loan out of default through the “rehabilitation (or “rehab”) program, where they agree to make nine reduced, voluntary payments on their loans over a ten-month period. If a borrower completes rehabilitation, they are once again current on their loan, and—for FFELP borrowers whose loans are not owned by the government—their loan can be sold off by the Guaranty Agency to a private company. At that point, collection fees and accrued interest are added to the balance of the loan, and the FFELP loan is once again insured for the purposes of its new owner against default.

Research from the Consumer Financial Protection Bureau shows that poor servicing and other program failures lead almost half of borrowers who cure their loans through rehab to ultimately end up back in default.

However, there are huge problems for borrowers associated with rehabilitation. In particular, research from the Consumer Financial Protection Bureau shows that poor servicing and other program failures lead almost half of borrowers who cure their loans through rehab to ultimately end up back in default. When that happens, note holders get paid out again by GAs using the sequence described above, but borrowers can face compounded distress due to the accrual of fees and interest alongside additional damage to their credit history.

Borrowers can only successfully rehabilitate a loan once (after that, the loan is not eligible for the program), but there are opportunities for industry to profit at every step along the path of default, rehabilitation, and re-default. For example, Guaranty Agencies get to keep fees charged to borrowers during the default period plus any money paid by the borrower through collections. GAs can also sell successfully rehabilitated loans at a balance equal to the original balance that the borrower defaulted on plus 18 to 20 percent of that amount, which is added to the original loan balance as collection costs during default. Meanwhile, the companies holding FFELP loans both before and after the initial default remain insured against losses.

It’s the ultimate “heads I win, tails you lose” situation for the companies holding FFELP loans—borrowers land back in default, but GAs and creditors enjoy windfalls either way.

Where Some May See Borrower Harm, Wall Street Sees Dollar Signs

The situation for borrowers in default on commercial FFELP loans may sound broken, as the government’s own data show that its main pathway out of default often leaves borrowers in long-term distress. But it works perfectly well for one notable buyer of rehabilitated commercial FFELP loans: firms in the Student Loan Asset Backed Securities (SLABS) market.

SLABS are investment vehicles that are stuffed with student loans. With help from Wall Street banks, student loan companies take their loans off of their balance sheet, place them in SLABS, and then sell off pieces of the SLABS to investors.

Loans that borrowers have already defaulted on and successfully brought current through the rehabilitation process are particularly choice additions to SLABS, and investors will sometimes create SLABS that consist only of rehabilitated loans. These loans are valuable for SLABS because borrowers are extremely likely to default on them again, triggering a payout by a Guaranty Agency that flows through to the SLABS’s investors.

If borrowers were likely to end up making less than their expected payments without defaulting—for example, by entering a deferment or a forbearance, falling delinquent without reaching default, or even by accessing an income-based repayment option that might beneficially lower the borrower’s monthly payments—that could pose a problem for the SLABS, as less cash would come in. But when struggling borrowers are expected to simply default, the companies structuring SLABS can rest assured that they will receive a payout from a GA, eliminating any cashflow concerns.

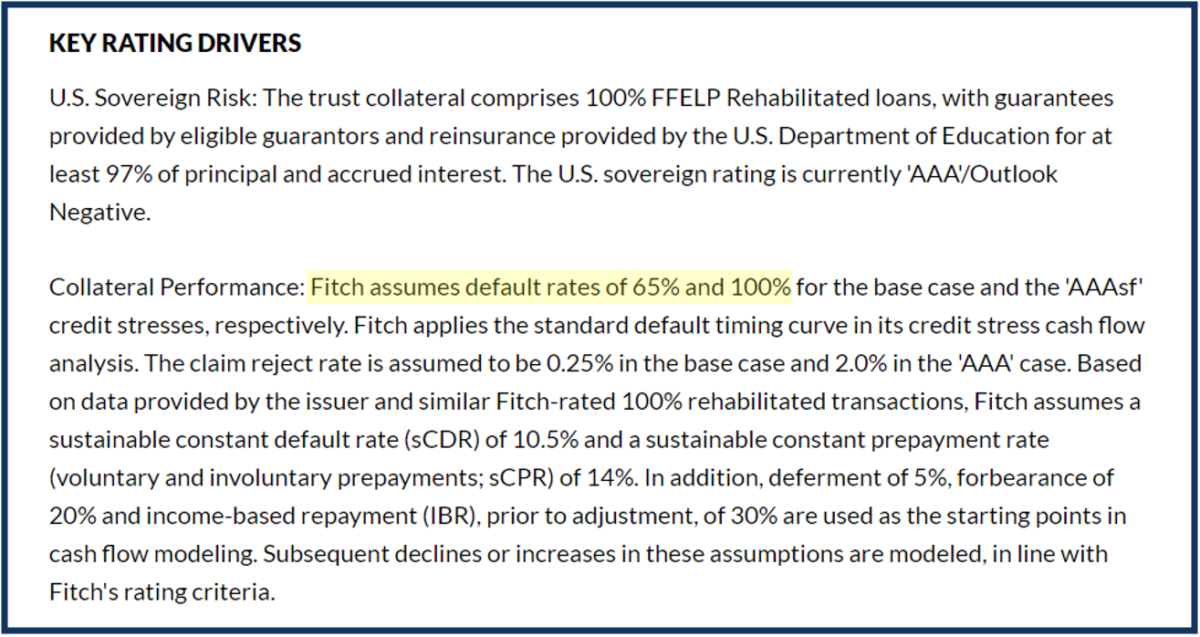

The financial structures that firms have built on top of this logic are striking. For example, in examining a SLABS security from the student loan company ECMC that consists only of rehabilitated FFELP loans, a rating agency estimated that 65 percent of the loans in the investment vehicle will default in a base case stress scenario, and that up to 100 percent of borrowers could default under a more severe stress scenario.

Source: Fitch’s rating of ECMC Group Student Loan Trust 2021-1

Nevertheless, the credit rating agency concluded that these investment vehicles deserved a triple-A rating, meaning that they were about as sure a bet as U.S. Treasuries. Even though more than six-in-ten of the borrowers underlying this investment are expected to default in a base stress case—leading them to remain trapped in debt with new interest charges and fees added on—investors are protected, because the loans are insured.

This all points to how industry has managed to turn default on commercial FFELP loans into a hugely profitable business. For them, a default is just a signal that a borrower has become a source of reliable cash flow, as it is a harbinger of future re-default with yet another insurance payout.

During COVID, the Biden Administration Took a Key Step to Protect Defaulted FFELP Borrowers from the FFELP Boondoggle. It Can and Must Make that Change Permanent.

As mentioned above, the Department of Education in March 2021 offered borrowers in default on commercial FFELP loans the same protections that had been available since March 2020 to borrowers in default on other federal student loans. These safeguards include a halt in aggressive collections efforts by debt collectors.

In addition, ED’s March 2021 announcement introducing these protections included the following key, but easily overlooked, line:

In addition, any of these [commercial FFELP] loans that went into default since March 13, 2020, will be returned to good standing. The guaranty agencies that hold those loans will assign them to the Department and request that the credit bureaus remove the record of default.

This means for the remainder of the pandemic that if a commercial FFELP borrower falls into default—which is still possible, because payments for commercial FFELP borrowers are not paused unless they are in default—the GA that pays off the note holder has to then hand over the loan to ED. In turn, that means that the borrower’s loan cannot currently be assigned to a debt collector and possibly sold off onto the SLABS market after rehabilitation, placing the borrower on track for a likely re-default.

ED can make this change permanent. It already has the authority to direct GAs to assign it defaulted FFELP loans regardless of whether there is an ongoing pandemic. Exercising that authority would mean protecting vulnerable borrowers from the dead end of default and re-default.

ED can also take action right now to hold the companies that service FFELP loans accountable for their practices. In 2017, the Consumer Financial Protection Bureau prepared the nation’s first market monitoring exercise to track the student loan servicing market. This effort was ultimately shelved by political appointees in the Trump administration, but the documents underlying it provide a framework for how policymakers can investigate how defaulted FFELP borrowers are faring after rehabilitating and hold servicers accountable for guiding borrowers toward successful repayment.

In particular, CFPB could develop an updated data collection effort to track whether FFELP servicers are continuing to trap borrowers in debt, including asking the following key questions:

- How many borrowers and loans (in dollar value and number) attributable to each servicer face the use of forbearance in excess of the amount and/or length permitted under the regulations that implement the FFEL program (generally “[i]n increments up to one year, for periods that collectively do not exceed three years”)?

- How many borrowers and loans (in dollar value and number) attributable to each servicer have faced the use of “long-term forbearance” as defined in the CFPB’s 2017 data request (“An account that has been in a capitalizing forbearance for a period of 12 consecutive months or greater.”)?

- How many borrowers and loans (in dollar value and number) attributable to each servicer have faced the “serial” use of forbearance, as defined in the CFPB’s 2017 data request (“An account that has three (or greater) periods of capitalizing forbearance applied to an account over the preceding 24 months. Individual periods of forbearance can be of any length.”)?

It’s time for Washington to end the asset-backed boondoggle that harms borrowers while lining Wall Street’s pockets. The Biden administration must act to ensure that default does not remain a lifelong burden that industry can turn into a tool for profit.

###

Ben Kaufman is the Head of Investigations and a Senior Policy Advisor at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked as a Director’s Financial Analyst on issues related to student lending.