The CARES Act Leaves Behind Millions of Student Loan Borrowers

By Tariq Habash | March 27, 2020

Updated September 1, 2020: SBPC estimates that there are 6.35 million private student loan borrowers in the U.S. based on data from the Federal Reserve Bank of New York [1] and the Department of Education [2]. To date, these borrowers continue to be denied even the limited protections offered to—and recently extended for—federal student loan borrowers.

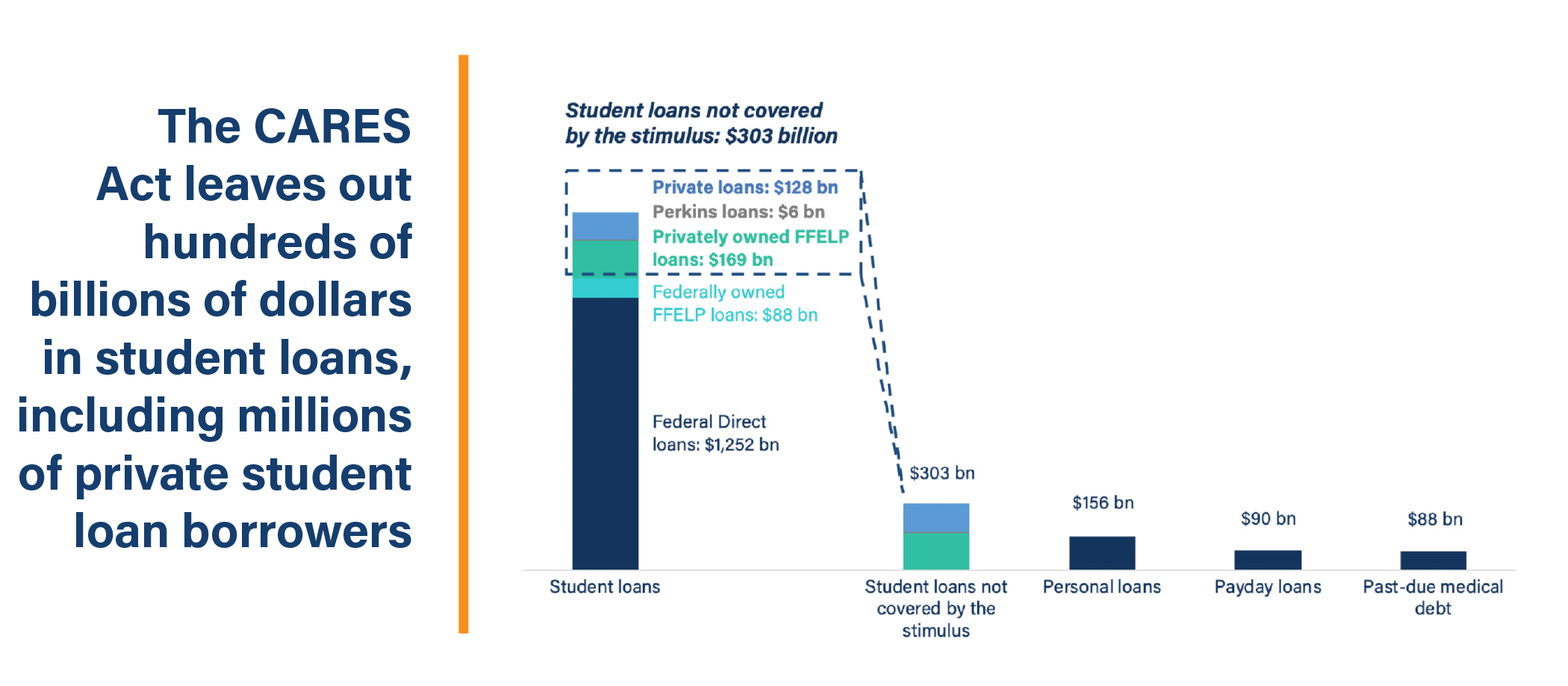

Late Wednesday night, the Senate passed the CARES Act in the hope of providing an economic stimulus to Americans and businesses during the ongoing COVID-19 pandemic. As part of the package, the Senate included a number of provisions to offer relief to student loan borrowers. In particular, the bill halts the accrual of interest and suspends payments on all Direct Loans and federally held Federal Family Education Loans (FFEL) for the next six months. But the bill falls short in many ways, including by not providing these same benefits to borrowers whose federal loans happen not to be owned by the Department of Education (ED).

When the last financial crisis hit in 2008, Congress bailed out student loan companies to the tune of over $100 billion. Many of these same companies then went on to rip off servicemembers, teachers, and borrowers who were simply trying to repay their student loans. But in the past few days, we have seen policymakers once again take extraordinary action to ensure that the student loan industry and its friends on Wall Street stay afloat during this storm. Clearly, the lessons of the past decade have fallen on deaf ears.

As the world grapples with the fallout of the coronavirus pandemic, student loan companies cannot be allowed to continue making billions on the plight of student loan borrowers. And yet, even for many borrowers of federal student loans, this is precisely what the CARES Act will permit.

Who is being left behind? Borrowers owing two types of federal student loans do not have the option to temporarily suspend their payments through September 2020—borrowers owing on Perkins Loans and borrowers owing on commercially held FFELP loans.

What makes these loans different? The main difference between the types of federal student loans covered under the stimulus bill and those not covered is who owns them. Perkins loans are institutionally held loans, meaning that schools own and manage them for their students. Commercially held FFELP loans are guaranteed by the federal government, but they are owned by guaranty agencies and private companies. In both cases, these loans were made under federal programs, but the loans are not owned by the federal government. As a result, Perkins loans and commercially held FFELP loans fall outside of the six-month payment pause established in the CARES Act.

This difference in ownership is known to have a significant impact on whether borrowers succeed in repayment. For example, borrowers with commercially held FFELP loans are two thirds less likely than borrowers with other types of federal student loans to access affordable income-driven repayment programs provided under federal law. This discrepancy raises concerns about the incentives servicers have to withhold information from borrowers, especially given that successfully enrolling borrowers in more manageable payment plans can make student debt a less attractive investment for Wall Street.

Unfortunately, in a situation like the current pandemic, borrowers who happen to owe on commercially held FFELP loans will be left especially vulnerable.

How many of these borrowers currently exist? There are approximately eight million borrowers who owe commercially held FFELP loans or Perkins loans. Together, these borrowers owe an estimated $175 billion of student debt.

How does ED-held FFEL differ from commercially held FFEL? Before the student loan program transitioned to fully direct lending from the government to students, the vast majority of student loans were originated by banks and guaranteed by the federal government through FFELP. When the 2008 financial crisis hit, there were industry-wide concerns about lending markets’ liquidity and banks’ ability to continue to finance loans to students under the FFEL program. In response to these concerns and to ensure that students would still be able to access higher education, Congress passed the “Ensuring Continued Access to Student Loans Act” (ECASLA), authorizing ED to temporarily begin the purchasing of FFELP loans from lenders so those lenders could continue the financing of future loans.

The repurchased loans came to be known as “ED-held” FFELP loans, and over the course of the following years, the country fully transitioned to the Direct Loan program. By 2010, new student loan borrowers could only take out loans under the Direct Loan program.

But ED did not purchase all of the FFELP loans that were outstanding when ECASLA passed, and many loans remained in private hands. These have come to be known as “commercial” FFELP loans. They are owned by companies like Navient, which owns $65 billion in FFELP loans, and Nelnet, which owns $20 billion in FFELP loans.

In fact, many commercial FFELP loans have also been sliced and diced into securitized trusts that private actors expect to yield billions of dollars annually into maturity.

Did borrowers have a choice about whether their loans were purchased by ED in this transition? No, borrowers had no say in whether their loan was purchased by ED through ECASLA. And that makes the Senate’s actions to cut some FFEL borrowers out of the payment pause in the CARES Act even more problematic. The Senate’s stimulus bill arbitrarily picks winners and losers, with some borrowers getting a momentary breath of relief to reconfigure their lives during this national emergency, while others sink further into debt because they cannot access the payment suspension or interest freeze for their current loan.

Can’t borrowers with commercially held FFELP loans just consolidate into a Direct Consolidation Loan to access the protections in the stimulus bill? It is true that borrowers can consolidate outstanding commercially-owned FFELP loans into a Direct Loan. However, many FFEL borrowers have been paying on their student loans for over ten years (FFEL originations ended in 2010), and if these borrowers consolidate into new Direct Loans, they will trigger a capitalization likely to increase their principal loan balance. Additionally, FFELP loan borrowers who have been working toward income driven repayment forgiveness will lose credit for all qualifying payments they have already made. Plus, it is more than likely that the staff of the company holding the loan is not present to fill out the paperwork necessary to complete a loan consolidation.

For these borrowers trying to stay afloat in the middle of a national emergency, adding to their loan balances and thrusting them into paperwork limbo cannot be a policy option.

What could policymakers have possibly been thinking to allow so many borrowers to be overlooked by the stimulus? Maybe the opponents of meaningful relief for student borrowers were too interested in protecting their friends on Wall Street. Perhaps they simply do not think it matters whether we help millions of borrowers drowning in billions of dollars of debt. Or maybe they prefer pinching pennies for ordinary Americans while throwing billions of dollars at disgraced airplane manufacturers. Whatever the reason, the CARES Act fails to safeguard the millions of borrowers with Perkins and commercially held FFELP loans. These borrowers will be forced to decide whether to put food on their tables or make their student loan payments.

If the CARES Act becomes the last attempt to offer student loan borrowers relief during the COVID-19 crisis, policymakers’ response to this national emergency will have fallen short, making borrowers pay the price.

###

Tariq Habash is Head of Investigations at the Student Borrower Protection Center.

[1] The Federal Reserve Bank of New York reports that there are 44.7 million total student loan borrowers in the United States.

[2] The Department of Education’s National Postsecondary Student Aid Study indicates that 14.2 percent of people with any student debt have a private student loan.