By Katherine Welbeck and Ben Kaufman | July 31, 2020

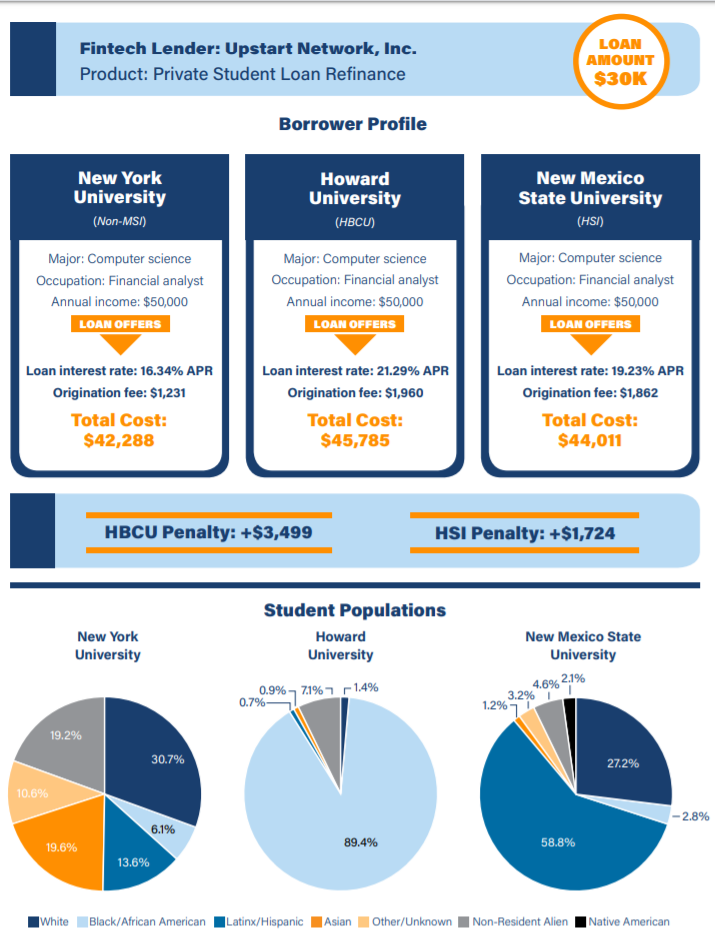

In February, the Student Borrower Protection Center (SBPC) published the results of an investigation of fintech and online banking products, uncovering cases where a prospective borrower may be hit with thousands of dollars in additional credit costs if he or she attended a community college, an Historically Black College or University (HBCU), or an Hispanic-Serving Institution (HSI). As part of this research, we examined Upstart Network, LLC, a fintech company that uses machine learning and alternative data — including the borrower’s level of degree attainment, school attended, and area of study — in its underwriting processes. We found that the company’s use of this data resulted in ‘educational redlining,’ penalizing borrowers who attended minority-serving institutions. Upstart’s practices highlight key problems related to the use of educational criteria in underwriting, federal fair lending laws, and equal credit access.

In response to our findings, five United States Senators wrote to Upstart and a range of companies involved in the collection and use of educational data to demand detailed explanations of this data’s utilization in credit underwriting.

Today, Upstart’s response to the Senators’ letters has been made public along with the results of these Senators’ own independent investigation into educational redlining. Upstart’s reply only heightens concerns raised in our initial research. To inform this important policy discussion, below is a breakdown of why Upstart’s use of certain educational data in underwriting remains a significant fair lending concern and threatens to continue penalizing borrowers who attend minority-serving institutions (MSIs).

- Upstart is making credit determinations based on SAT scores, a deeply flawed and biased metric. In its letter, Upstart reports that “average incoming standardized test scores is the primary characteristic used” from among various educational criteria considered in its model. This ignores the extensive body of research indicating that standardized tests are methodologically flawed, biased, and causally related to systemic discrimination.

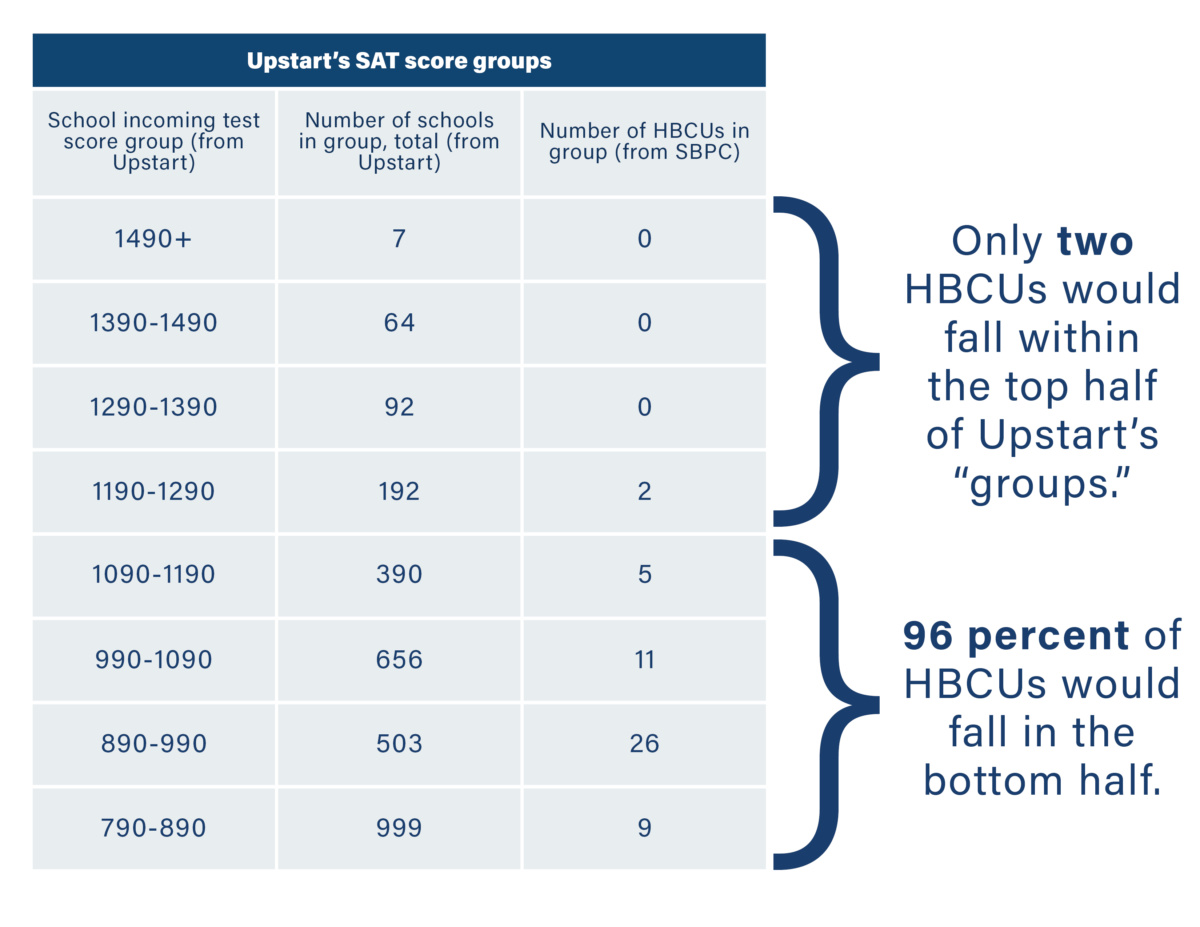

- Upstart judges applicants in part based on cohort characteristics, not only on personal credit factors. Upstart clarifies that it does not use individual applicants’ own standardized test scores in its underwriting, but rather that it “groups schools using their incoming standardized test score” and then judges each individual applicant based on which “group” the school the applicant attended lands in. In doing so, Upstart is judging applicants based on the average SAT score of a cohort that the applicant may not have even been a member of. Aside from the fact that this practice undercuts Upstart’s ostensible goal of finding new ways to judge individual creditworthiness, law enforcement and policymakers have long seen credit determinations based on cohort-level criteria as a fair lending risk, something that we noted at the release of our report. Upstart’s response letter simply confirms that it judges people based on their cohort identity.

- Upstart’s own explanation of its methodology for grouping schools only heightens concerns about the company’s fair lending compliance. Having explained that it groups schools based on “average incoming standardized test scores,” Upstart offers a table showing how many schools would fall into each group. However, Upstart dodges the question of how many HBCUs are in each score group, saying it does “not collect or use any information related to the demographic group affiliation or demographics of schools.” That information is publicly available through the Department of Education’s College Scorecard, which can be readily used to re-create Upstart’s groupings with detail on where HBCUs fall compared to other schools.

Only two HBCUs fall within the top half of Upstart’s “groups.” At the time our report was released, only one HBCU, Howard University, was in the top half of these groups.

Upstart’s assertion that schools are anonymized and that “[n]o cutoffs or groups are manually specified” does not change the fact that its grouping methodology would place nearly all HBCUs in its lower tiers of creditworthiness. HBCUs enroll roughly 10 percent of all Black college and university students and produce 20 percent of all Black college graduates. Through its methodology of non-individualized clustering, Upstart disproportionately penalizes Black applicants.

- Upstart is partnering with a growing number of banks, underscoring the increasing reach of its risky practices. Upstart does not make the loans advertised on its platform; instead, the company works with third-party bank partners who lend based on Upstart’s underwriting model. When Upstart secured a No-Action Letter (NAL) from the Consumer Financial Protection Bureau in 2017, it’s only bank partner was Cross River Bank of New Jersey. However, as Upstart revealed in its response to the Senators, “[s]ince 2018, seven additional bank partners use Upstart’s platform, including its model, to offer online personal loans to consumers.” The extent of Upstart’s growth—which reaches farther now than when it was granted the NAL—is alarming given evidence that its model can drive disparities and deepen financial inequality.

- Upstart’s peers in fintech acknowledge the fair lending risk associated with the use of education criteria. In addition to Upstart and four other fintech lenders, the Senators wrote to MeasureOne, a company that has developed a proprietary credit scoring model based on education data. MeasureOne explained in its response to the Senators that it does not consider applicants’ school or major in its underwriting algorithm because those fields “could serve as proxies for fair lending concerns” and “could create a disparate impact.” This underscores Upstart’s miscalculation of fair lending risk acknowledged by its peers in the market, belying the company’s stated role in increasing equitable access to consumer credit.

- The present risk extends even beyond Upstart. One company, Climb Credit—which was mentioned in our recent report on the “shadow student debt” market, disclosed to the Senators that it makes credit determinations in part based on borrowers’ major or course of study. This revelation comes even after research from the American Enterprise Institute has found that when it comes to making lending decisions based on major, “the potential for ECOA risks is high” because of race-based sorting across different programs. Worse, when asked about the types of testing it deploys to identify disparate impacts in its model, Climb Credit stated, “we have not conducted such empirical testing and we believe such testing would be unwarranted.” This response should raise immediate and substantial red flags for law enforcement and oversight bodies.

The use of education criteria in underwriting raises considerable fair lending risks and Upstart’s explanation of its practices only deepens ongoing concern that such dangers are present. However, the CFPB seems poised to renew Upstart’s No-Action Letter (NAL) in a few months, while Upstart itself recently announced an expansion into the auto lending market. The issues discussed in our report, the Senators’ subsequent letters, and both Upstart and its peers’ responses point to substantial unanswered questions and suspect business practices that go even beyond those we revealed in February—raising serious doubts over the appropriateness of the Bureau’s extension of the NAL. If the Bureau does extend the NAL, Congress must immediately step in to scrutinize the CFPB’s continued approval of possibly discriminatory business behaviors. Congress must also reexamine the Bureau’s broader NAL policy, especially as it relates to whether the CFPB should ever be able to waive its duty to supervise and enforce a company’s compliance obligations under the Equal Credit Opportunity Act (ECOA). This is particularly relevant given the CFPB’s wide-ranging rollback of fair lending enforcement under the Trump Administration.

The use of education criteria in underwriting runs the risks of reinforcing discrimination under the guise of innovation while further marginalizing the communities that it purports to help. As our nation seeks to confront the persistent scourge of racial discrimination and economic exclusion head-on, systems that perpetuate credit discrimination are unacceptable. Upstart should realize this and finally end its practices of educational redlining. If Upstart chooses to ignore these risks, Congress should step in and force it to do so.

###

Kat Welbeck is a Civil Rights Counsel at the Student Borrower Protection Center. She was previously an Outreach & Engagement Specialist in the CFPB’s Office of Public Engagement & Community Liaison.

Ben Kaufman is a Research and Policy Analyst at the Student Borrower Protection Center.