By Mike Saunders and Seth Frotman | November 11, 2020

In 2017, the CFPB reported that 200,000 servicemembers owe nearly $3 billion in federal student loan debt. As this debt looms over the lives of members of the military and their families, it also jeopardizes the ability of our nation’s Armed Forces to focus on the mission at hand. Research has long shown that financial readiness is a critical component of military readiness, and student debt has emerged as one of the leading causes of financial distress among servicemembers.

For military borrowers, the promise of Public Service Loan Forgiveness (PSLF) offers a much needed lifeline—after ten years of making affordable student loan payments, borrowers working in public service can have their loans forgiven. The protections offered through the PSLF program are so critical to military borrowers’ long term financial security that, for the past decade, PSLF has served as a key recruiting and retention tool for nearly every branch of the U.S. military.

However, as we have previously documented, the PSLF program is plagued with abuses and breakdowns that deny the promise of loan forgiveness to the vast majority of applicants. Our joint investigation with the American Federation of Teachers found routine errors, poor recordkeeping, and conflicting policies throughout the process for determining whether borrowers’ employers qualify them for federal loan forgiveness. These breakdowns are acutely affecting servicemembers seeking to access loan forgiveness.

Our investigation uncovered Education Department (ED) records showing, among other things, particularly troubling data around the overall number of active duty servicemembers submitting an Employer Certification Form (ECF)—the form used to determine whether an employer qualifies a borrower for loan forgiveness—as well as alarming rejection rates. Importantly, ECFs are the first step in documenting a borrower’s intent to pursue PSLF and track progress made during repayment.

Key findings from SBPC’s analysis include:[1]

- Despite at least 200,000 servicemembers owing student debt, only a fraction of these borrowers—roughly 17,000—submitted an Employer Certification Form.

- Military service is the quintessential public service, and yet military borrowers are continually denied access to Public Service Loan Forgiveness. Notably, despite serving in the U.S. Armed Forces or as an activated reservist, which is qualifying employment under the PSLF program, nearly a quarter of these borrowers’ ECFs were denied.

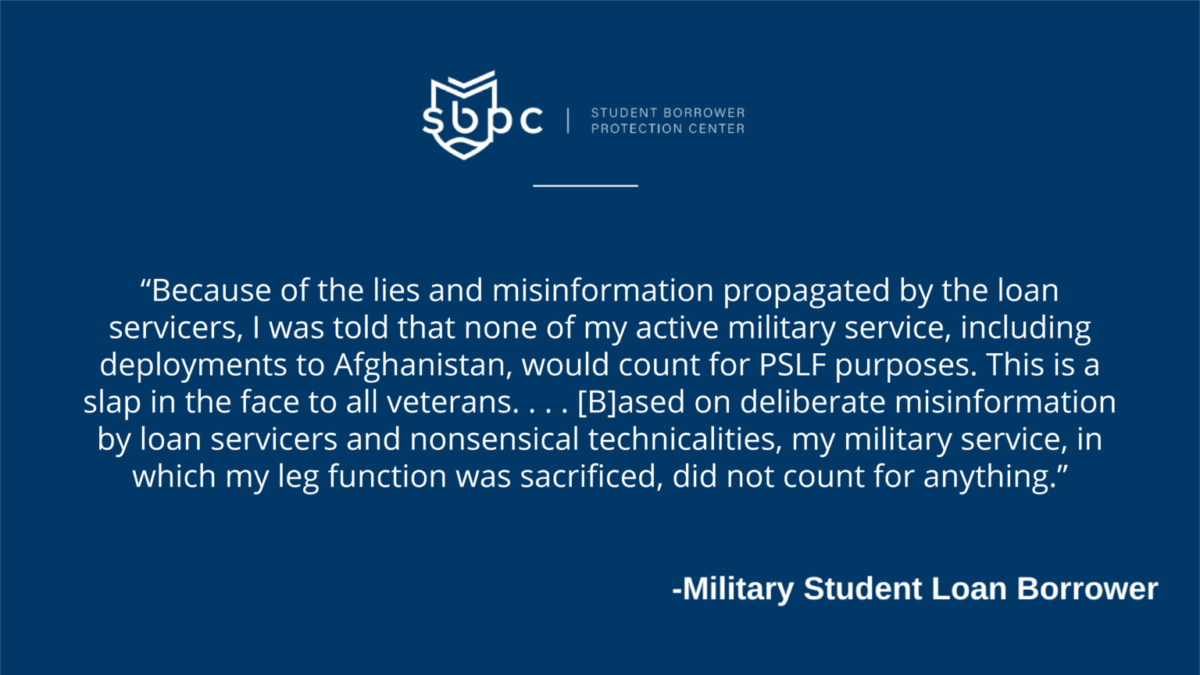

These findings highlight the problems military borrowers face when trying to access PSLF. As documented in a new report from the SBPC, Protecting Military Borrowers: How the Department of Education can restore the promise of Public Service Loan Forgiveness for American servicemembers, military borrowers face obstacles in trying to satisfy each of the requirements of the PSLF program, including having the right type of loan, the right type of employment, the right repayment plan, and the right number of payments. One military borrower described his hurdles in navigating the many servicing breakdowns he faced in trying to earn PSLF:

Members of the military deserve better.

The Secretary of Education can use the authority granted under the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 to make sure that all servicemembers with student debt receive the credit they were promised in return for their service to our country. During times of war, military operation, or national emergency, the HEROES Act allows the Secretary to waive requirements that impede military borrowers’ access to critical repayment protections. As America has remained a nation at war since 2001, the Secretary has the opportunity to provide much needed relief for all military borrowers spanning the duration of the PSLF program.

The Secretary should match student loan records against active duty service records already available to ED to ensure that military borrowers receive PSLF credit for every month they served—all periods of service, regardless of any technicalities, should provide military borrowers with credit toward PSLF. Moreover, for servicemembers who have served for at least ten years, either exclusively through military service or through a combination of military service and civilian service, the Secretary should take immediate action to forgive their student loans.

America’s student loan system is broken. As a result, we as a country have broken our promise to the men and women who have sacrificed so much to defend us. We promised them a way out of student debt, and instead we saddled them with endless red tape and servicing errors. But the Secretary can change this and in doing so, chart a path forward to ensure that no servicemember is financially left behind.

###

Mike Saunders is a Military Affairs Fellow with the SBPC and serves as Director of Military and Consumer Policy at Veterans Education Success, and previously spent nearly a decade advocating for military personnel, their families, survivors, and veterans at The Retired Enlisted Association. Mike is a 3rd generation member of the Army.

Seth Frotman is Executive Director of the SBPC and previously served as Assistant Director and Student Loan Ombudsman at the Consumer Financial Protection Bureau, where he led a government-wide effort to crack down on abuses by the student loan industry and protect borrowers. Prior to this work, Seth served in the CFPB’s Office of Servicemember Affairs as senior advisor to Holly Petraeus.

[1] There are important limitations to the data that ED provided in response to our request. For example, ED omitted the reasons for any ECF denials, and the data here are cumulative counts of ECFs received from the start of the program until late 2015 (see the discussion of the “initial list” ED produced in response to our inquiry). Nonetheless, these findings raise important questions about the quality and accuracy of the student loan servicing military borrowers receive, and are the best available data given ED’s limited public reporting of data related to PSLF, TEPSLF, and ECFs, especially as it relates to servicemembers.