By Kat Welbeck | August 7, 2020

Across the country, approximately 45 million borrowers owe a collective $1.7 trillion in student loan debt, including more than $140 billion in private student debt. Private student loans—made by banks and other private lenders without the involvement of the federal government—are taking on an increasingly significant role in the broader student loan market, and consequently, the student debt crisis. The private student loan market has grown rapidly in the years following the Great Recession, outpacing the rate of market growth in mortgages, auto loans, and credit cards. Despite industry assurances that the private student loan market is free from borrower distress, a closer examination of outcomes suggests that certain subsets of borrowers disproportionately struggle with private student debt—namely, Black and Latinx borrowers.

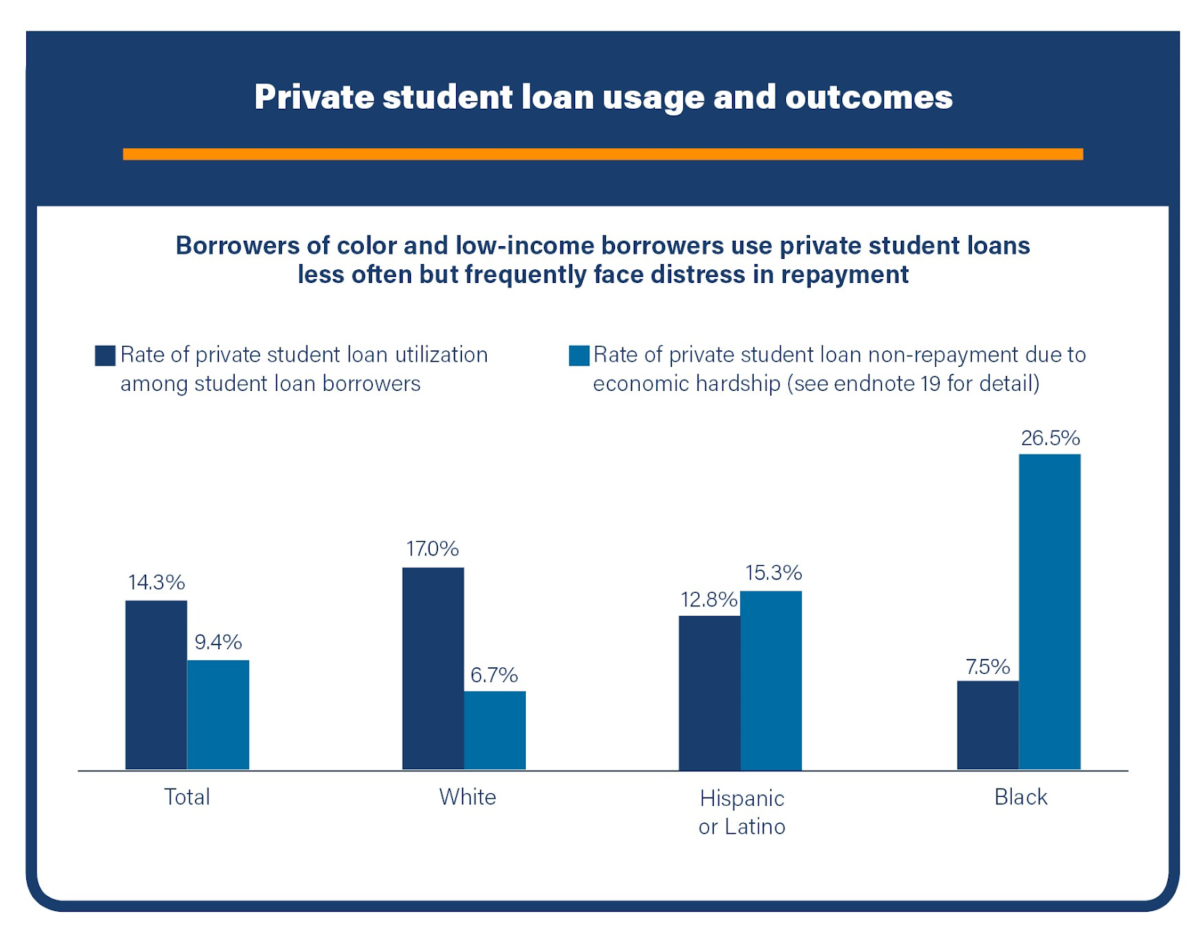

Adapted from Figure 4 of the Student Borrower Protection Center report Private Student Debt

These disparities are particularly acute in the private student loan market. Despite being less than half as likely to take out private student loans, Black students are four times as likely to struggle in repayment on private student debt in comparison to their white peers. This disparity is alarming, particularly given that private student loans come with additional risks for borrowers. Unlike federal student loans, private student loans contain fewer safeguards to help mitigate default when borrowers face economic hardship. Struggling borrowers then have fewer options to seek help if they fall behind, as default mitigation programs are left to the lender’s discretion.

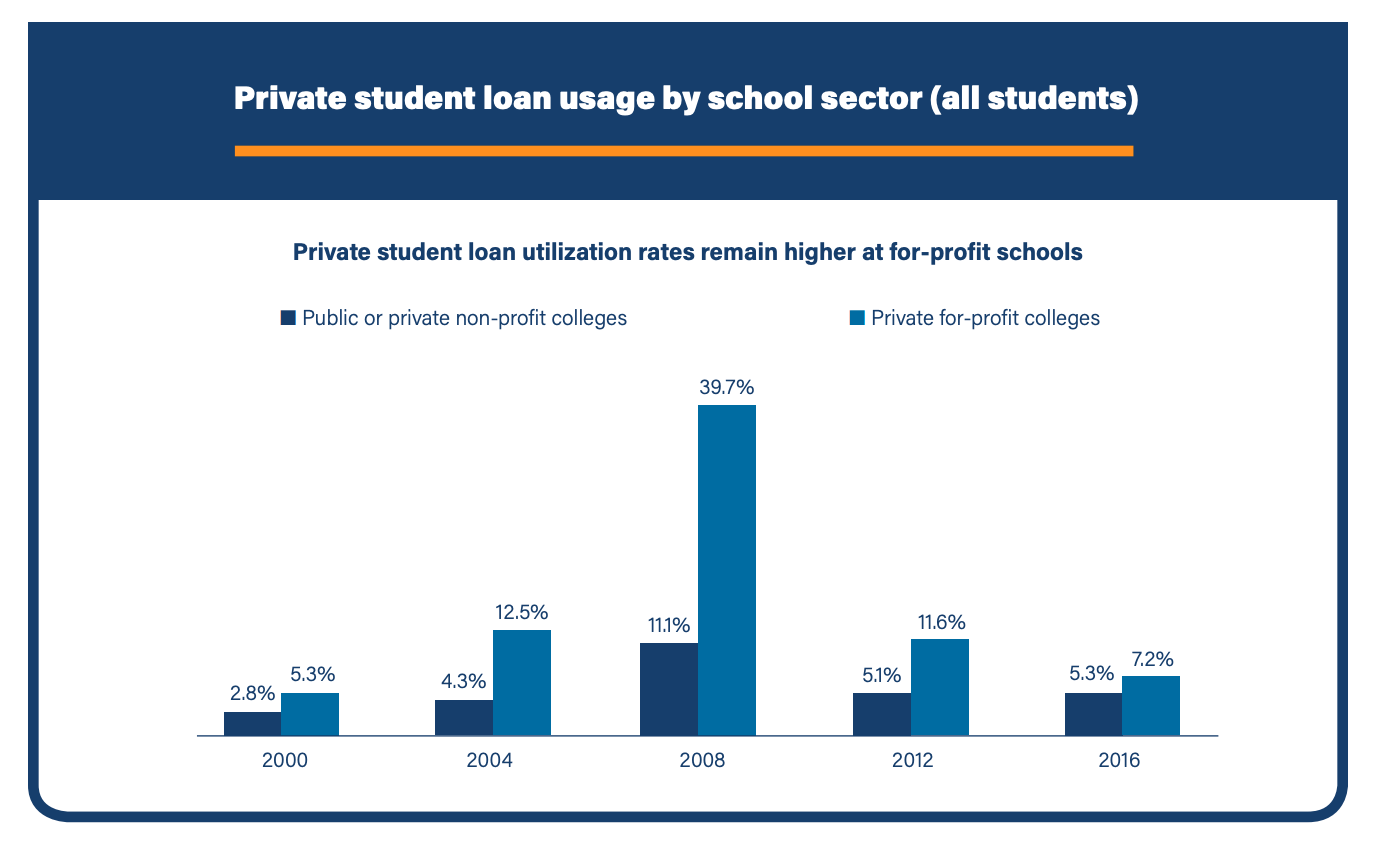

Adapted from Figure 5 of the Student Borrower Protection Center report Private Student Debt

Further, students attending for-profit institutions are more likely to use high-cost private student loans to finance their education, including largely unregulated shadow student debt—a subset of largely unsupervised and often exploitative debt and credit products targeted toward students at for-profit schools. Key features of these products often include high interest rates, misleading marketing, and risky underwriting. Because these institutions have an overrepresentation of Black students, the fallout from this predatory debt disproportionately falls on the Black community.

The burden of the student debt crisis is not borne equally—Black and Latinx borrowers shoulder some of the most severe consequences associated with this debt, stemming from systemic discrimination that extends to our nation’s financial markets. Exclusionary economic policy and racial discrimination have contributed to a racial wealth gap that leaves the median white household with 13 times the wealth of the median Black household and 10 times the wealth of the median Latinx household. Accordingly, the typical white student loan borrower will pay down nearly 95 percent of his or her loans in the 20 years from the start of college, whereas his or her black peers will still owe 95 percent of their original balance after the same period. Debt-fueled higher education only reinforces and exacerbates these systemic barriers, and a deeper dive into the nuances of borrower performance in the private student loan market point to similar trends.

The opacity of the private student loan market only compounds concerns about disparate loan outcomes and repayment distress as well as predatory targeting directed at Black borrowers. Extremely little data is available regarding the private student loan market and borrower outcomes within it, in part because the Consumer Financial Protection Bureau under the Trump Administration abandoned a 2017 effort to finally collect comprehensive information from companies operating in the space. With that in mind, the stark racial disparities already visible in the market through the limited statistics currently available should be a call to action for regulators to rigorously supervise private student lenders for practices that may have a disparate impact on Black borrowers. In the absence of rigorous CFPB oversight, states can continue to fill this gap by performing independent oversight and by passing new state level protections.

The student debt crisis is a civil rights crisis. As policymakers seek to improve economic mobility for the most vulnerable communities, it is critical that they take action to address the role of private student loans in exacerbating financial distress and wealth disparities. The disparate repayment outcomes in the private student loan market combined with for-profit institutions that target Black borrowers with predatory private student loans calls for enhanced protections for private student loan borrowers.

Borrowers need affirmative safeguards from harmful practices in the private student loan market that exacerbate systemic racial barriers within Black and Latinx communities. Higher education should open doors to economic mobility, not laden borrowers with debt that further entrenches racial inequities.

###

Kat Welbeck is a Civil Rights Counsel at the Student Borrower Protection Center. She was previously an Outreach & Engagement Specialist in the CFPB’s Office of Public Engagement & Community Liaison.