Accenture’s November 2022 Email Fiasco Points to Glaring Gaps in CFPB’s Implementation of Existing Consumer Protections

By Ben Kaufman | January 6, 2023

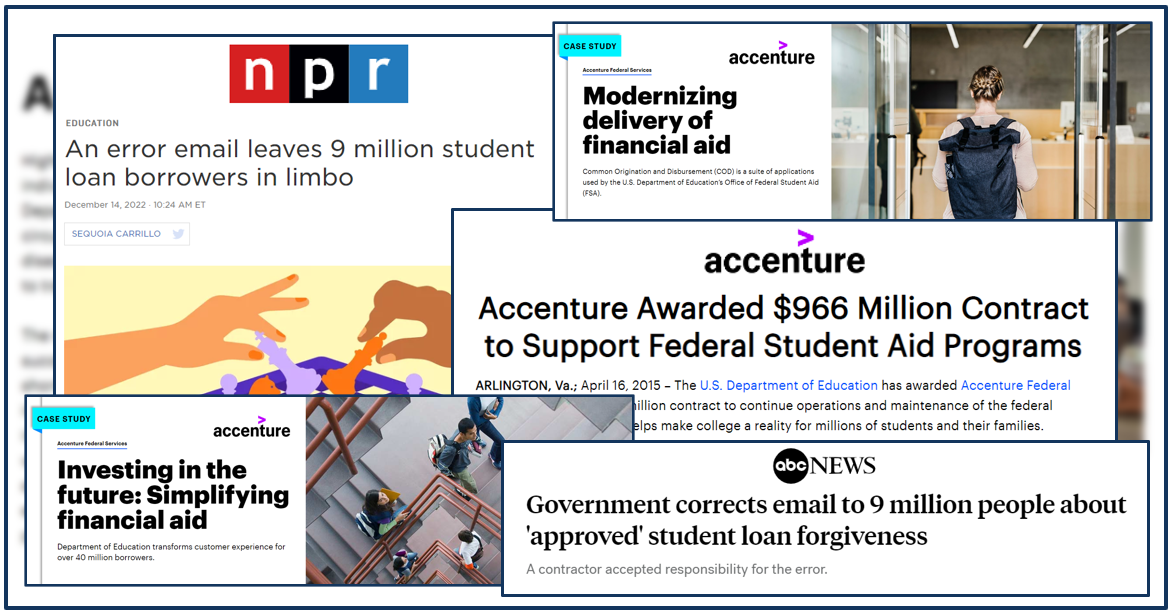

In November 2022, nine million federal student loan borrowers received an email with a subject line reading, “Your Student Loan Debt Relief Application Has Been Approved.” This email came with the branding of the US Department of Education (ED), and it appeared to mean that a group larger than the population of New York City had secured student debt cancellation per the relief plan that President Biden announced last August.

Unfortunately, the assertion in this email’s subject line was a lie. In fact, the millions of borrowers who received this November missive had not had their applications processed—and many of them would have been rejected as ineligible for relief if their applications had been reviewed. This stunning breakdown hurt borrowers, likely broke the law, and helped sow distrust in the student loan system just as the nation risks a chaotic return to repayment in 2023.

Worse, this episode was not a one-off error. Instead, it was a sign of how federal policymakers have allowed certain unaccountable contractors to act as student loan companies without requiring them to meet basic standards of industry oversight and compliance—and of the disastrous consequences borrowers have had to face as a result.

In particular, it was not actually ED that sent the November 2022 email, but a massive and unregulated student loan company called Accenture. Accenture is a Fortune 500 consulting company that operates as a contractor for ED under deals cumulatively worth more than $1.5 billion. Pursuant to these agreements, Accenture performs a wide variety of tasks core to the success of the student loan system, including regularly sending communications to borrowers that they reasonably rely on to plan repayment of their loans.

But despite Accenture’s size as a student loan company and the danger it evidently poses to the public, regulators have shied away for years from scrutinizing the firm and its operations in the way that they do for other student loan companies.

Accenture’s November 2022 email episode shows regulators cannot give the company a pass any longer. Accordingly, the Student Borrower Protection Center wrote a letter today to the nation’s top consumer watchdog, the Consumer Financial Protection Bureau (CFPB), outlining how Accenture already fits clearly within the CFPB’s “supervisory” regime. The CFPB’s supervisory tool empowers the agency to monitor and conduct periodic examinations of finance companies to make sure that they’re complying with a range of consumer protection statutes—exactly the kind of thing that might have helped prevent Accenture’s November 2022 email debacle, and that will be necessary to stave off future breakdowns.

The SBPC’s new letter to the CFPB is available here: https://protectborrowers.org/wp-content/uploads/2023/01/CFPB-Accenture-Letter-2023_Final.pdf

As this letter explains, Accenture already falls within the CFPB’s supervisory ambit both as a “larger participant” in the student loan servicing market and as a company that apparently poses substantial risks to consumers. Student loan borrowers will not be safe until the CFPB does its job, clarifies that Accenture already fits within the reach of agency supervision, and begins the work of reining in this student loan behemoth.

No company is above the law, and any organization that routinely hurts student loan borrowers in the course of its business deserves all possible scrutiny from consumer protection agencies. Luckily for the public, Accenture already qualifies for some of the strongest tools in the CFPB’s arsenal.

It’s long past due for the agency to use them.

###

Ben Kaufman is the Director of Research & Investigations at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked on issues related to student lending.