By Ben Kaufman | September 9, 2021

Passed on a bipartisan basis in 2007, the Public Service Loan Forgiveness (PSLF) program was premised on a simple promise: teachers, nurses, servicemembers, and other dedicated public service workers who had taken on student loan debt to pursue their careers would get their loans forgiven in exchange for a decade of service in their communities. Years after the first cohort of borrowers was meant to become eligible for PSLF, however, it is clear that this promise has been disastrously broken. PSLF now has a 98 percent rejection rate—and the expansion that Congress enacted to fix this dismal outcome has its own denial rate of 97 percent. Moreover, a wave of lawsuits, investigations, and harrowing borrower stories over the past decade have revealed that a combination of incompetence and malfeasance by the student loan industry and the Department of Education (ED) have been at the root of this mess, harming and derailing borrowers at every turn.

New evidence that the Student Borrower Protection Center (SBPC) uncovered through a Freedom of Information Act (FOIA) request indicates that without bold and swift action by Secretary Cardona and President Biden, PSLF is likely to fail the vast majority of borrowers working in public service over the long term. In particular, never-before-seen internal projections from the company ED hired to manage PSLF show that on our current path, four of every five borrowers will still not have secured promised loan forgiveness through PSLF half a decade from now—and both ED and its contractors know it.

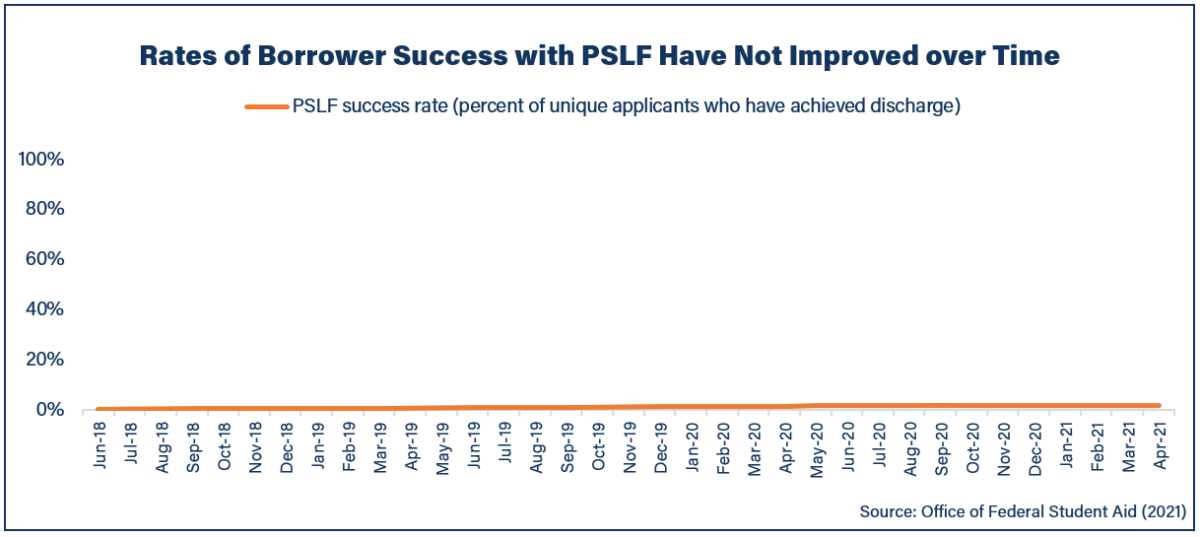

This revelation matters not just because of the ongoing harm it foreshadows for borrowers, but also because it debunks a key talking point parroted by defenders of the status quo: that PSLF’s approval rates will simply improve over time through a purported “snowball effect” involving the program’s problems figuring themselves out and cascading cohorts of borrowers subsequently securing relief. The CEO of the Pennsylvania Higher Education Assistance Agency (PHEAA)—the company ED contracted to implement PSLF—has even recently said that PSLF outcomes have already “begun to improve,” touting tiny changes in rejection rates over time as a supposed breakthrough.

It’s time for ED to take the steps necessary to ensure that everyone who has worked in public service for a decade or more gets the relief that Washington promised. The data revealed here show that the only way to ensure that this happens for the millions of servicemembers, teachers, and social workers across the country with student loan debt is to end the era of piecemeal attempts at fixes and to enact sweeping change.

After almost 15 years of failed policies, ED has a legal and moral obligation to public service workers to make things right.

Background: the Department of Education and PHEAA’s “Task Force” on PSLF

Among the many companies that ED contracts with to manage the federal student loan program on its behalf, only PHEAA is tasked with servicing the loans of borrowers who have declared their intention to pursue PSLF. PHEAA’s time as the designated PSLF servicer has been marked by extensive managerial failures that have blocked borrowers from securing student loan relief, leading two states to sue the company for the harm it caused public service workers. PHEAA’s mismanagement has been a key driver of the near-universal breakdown of PSLF.

In light of these issues, PHEAA CEO Jim Steeley revealed during testimony before the Subcommittee on Economic Policy of the U.S. Senate Committee on Banking, Housing, and Urban Affairs in April 2021 that “[i]n December 2019 . . . the Department [of Education] agreed to establish a joint task force with PHEAA to meet at least bi-weekly to review and implement further improvements to [PSLF].” However, beyond claiming that this task force had already generated “several crucial enhancements” to PSLF, little additional detail was offered.

To dig into the matter, the SBPC filed state and federal open records requests related to PHEAA and ED’s PSLF task force. We received over 1,800 pages of emails, research, meeting materials, and other internal documentation from both ED and PHEAA in response.

The full set of documents received in response to our open records requests is available here.

PSLF is Projected to Remain Broken—and Both PHEAA and ED Know it

PHEAA CEO Jim Steeley was not telling the whole truth when he told the U.S. Senate in April that PSLF rejection rates are improving. Instead, as the documents we uncovered through our FOIA request reveal, his own company’s internal projections show that even by January 2026, nearly four-in-five borrowers pursuing PSLF will continue to be failed by the program.

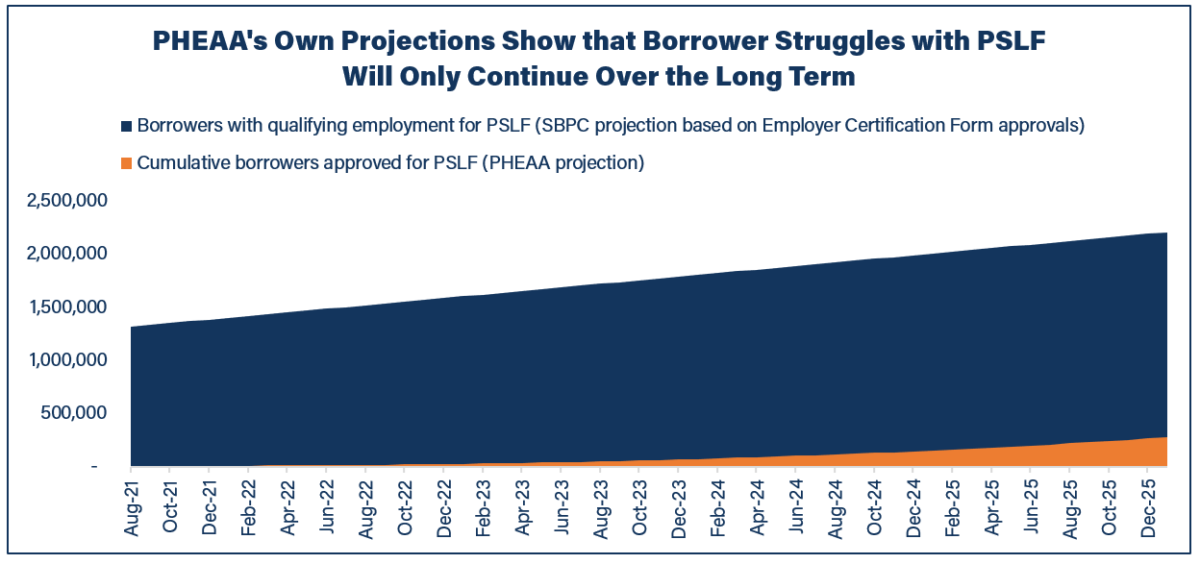

Records we discovered show that in February 2021, PHEAA provided estimates to ED of the number of borrowers that the servicer expects to receive PSLF each month through January 2026. These projections include the number and dollar value of loans that PHEAA expects borrowers will have forgiven over that time. PHEAA’s projections, taken from the full set of responsive documents linked above, are available here.

Our analysis of these projections reveals the following:

- PHEAA’s projections indicate that only one-in-five borrowers currently pursuing PSLF will have secured relief by 2026, almost a decade after the first borrowers were meant to become eligible. Adding together PHEAA’s monthly projections, it becomes clear that the company expects only 276,370 borrowers to secure PSLF through January 2026, nearly ten years after borrowers were meant to begin becoming eligible for PSLF in 2017. These borrowers represent only roughly one-in-five borrowers from among the 1,250,373 who have currently declared their intent to pursue PSLF. Simply put, PHEAA’s estimation is that almost four-in-five borrowers will still not have secured PSLF almost a decade after the first borrowers were meant to become eligible.

- PHEAA’s projections are likely even more damning in light of expected future borrower enrollment in PSLF. The comparison above involved the number of borrowers whom PHEAA expects to secure PSLF through January 2026 and the number of borrowers currently pursuing PSLF. However, many more borrowers are likely to declare their intention to pursue PSLF between now and January 2026, including many who have been in repayment for several years. In particular, based on current enrollment trends, we estimate that over 2.2 million borrowers will likely have declared their intent to pursue PSLF by January 2026.[1] At that rate, PHEAA’s projection of 276,370 borrowers securing relief through January 2026 will amount to only one-in-eight borrowers getting PSLF, making the one-in-five figure mentioned above an unfortunate best-case scenario unless the Biden administration intervenes.

PHEAA’s projections point to PSLF being broken even for the vast majority of borrowers who will have spent a full decade or more being formally enrolled in the program. The disastrous scope of PSLF’s failure is most clearly visible among borrowers who formally declared their intent to pursue PSLF almost a full decade before the period that PHEAA’s 2026 estimate covers. The Department of Education reported in 2017—ten years after PSLF was signed into law—that 739,719 borrowers had already indicated their intention to pursue relief through the program. This means that three quarters of a million borrowers began making payments on a qualifying loan and progressing toward the 120 needed for PSLF so many years ago (beginning in 2016) that they should have been well positioned to have their loans forgiven on or before the date of PHEAA’s estimates (2026).

However, PHEAA’s estimates show that the vast majority of these borrowers will still not have had their loans forgiven through January 2026. Adding the number of borrowers who already secured PSLF through April 2021 to PHEAA’s projection of the number of borrowers who will secure PSLF from May 2021 through January 2026, we estimate that 283,500 cumulative borrowers total will have secured PSLF by the end of PHEAA’s projection period—barely a third of those who will have been formally pursuing PSLF for almost a decade or more at that point.[2]

Simply put, PHEAA’s own estimates show that almost two-in-three borrowers who began formally logging their intent to pursue PSLF nearly a decade or more before the period PHEAA studied—and almost two decades after Congress enacted PSLF—will still not have gotten it.

These statistics hardly point to the rosy outcome that Jim Steeley appeared intent on portraying in the testimony cited above.

ED Cannot Shy Away Any Longer from Taking the Sweeping Action Necessary to Fix PSLF

More than anything, PHEAA’s projections show that the time for half-measures and fixes around the edges of PSLF has long passed. Policymakers have already tried to restore PSLF with legislative patches, new websites, updated forms, and other temporary fixes. These strategies have had no discernable effect on borrowers’ success with PSLF.

ED already has expansive tools at its disposal that it could use to fundamentally fix PSLF. As we wrote last November, the Secretary of Education already has the power under the HEROES Act of 2003 to affect “waivers and modifications” of “any statutory or regulatory provision” applicable to federal student loans “as the Secretary deems necessary in connection with a . . . national emergency.” This authority is the same one that both Presidents Trump and Biden used to pause payments, waive interest, and offer other protections for student loan borrowers during the COVID-19 pandemic. President Biden can use this power immediately to fix PSLF on behalf of borrowers who have been denied the promise of loan relief. A broad coalition of stakeholders including veterans service organizations, legislators, consumer advocates, and labor organizations representing millions of public service workers have all called on the Biden administration to take action along these lines.

Countless public service workers with student loan debt have served their communities for a decade or more. Just as PSLF was a simple promise, the solution to its failure must be a simple affirmation that ten years of public service while owing on federal student loan debt will be counted as ten years of progress toward PSLF, regardless of any currently debilitating tricks or traps. PHEAA’s projections make clear that without sweeping change along these lines, hundreds of thousands or even millions of student loan borrowers will continue to face broken promises and shattered financial futures. We cannot continue choosing that future.

Our public service workers upheld their end of the bargain. It’s time for Washington to finish the job and step up for borrowers like Marlene Jacques in Colchester, Connecticut, who submitted the following narrative to the Department of Education in response to its ongoing request for public input regarding PSLF:

I have been a public servant for nearly four decades. And, as an older adult passed retirement age, I continue to serve my country and my community. I became a registered nurse to serve. In addition to being a nurse, I am also a social worker. My education through student loans enabled me to meet the holistic needs of individuals from both . . . medical and social models. As a Black woman, I would not have been able to acquire a professional and contribute to society without the help of student loans.

Repaying my student loans: Congress promised me PSLF in return for my service as public servant for 10 years and repayment of my student loans for 10 years.

Promise Kept: I spent over 30 years working in state government. I spent approximately 10 years working for nonprofit organizations and Municipalities. I served in the United Navy as a Nurse Corps Officer for two years and received an honorable discharge. So, I kept my end [o]f the bargain through working for qualified state agencies and repaying my student loans monthly for over 10 years.

PSLF: Unfortunately, that promised wasn’t kept. It was total deception which started with the educational institution to the student loan servicer. . . .

The Education Department needs to automatically cancel student loans for all public servants with 10 years or more of service with [a] qualified employer and not just those who are currently actively working. People need to retire after a certain age. So, as long as they served for 10 years or more and made payments for 10 years or more, their loans should be cancelled.

###

Ben Kaufman is the Head of Investigations and a Senior Policy Advisor at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked as a Director’s Financial Analyst on issues related to student lending.

[1] Projection based on the historical month-to-month average change in the number of borrowers with approved Employment Certification Forms.

[2] The count of 283,500 borrowers is distinct from the 276,370 figure cited above in that it considers all borrowers who may have received PSLF in the past based on actual ED data, whereas 276,370 is a forward-looking projection from PHEAA. This estimate assumes that PHEAA’s projections combine the number of borrowers forgiven through both PSLF and TEPSLF. It adds the number of borrowers who have received PSLF or TESPSLF through 4/30/21 to PHEAA’s projection of the number of borrowers who will receive PSLF or TEPSLF from May 2021 through January 2026.