The CFPB and States Can and Must Hold Ejudicate Accountable for its Key Role in Prehired’s Illegal Debt Collection Scheme

By Ben Kaufman | July 18, 2023

Last week, the Consumer Financial Protection Bureau (CFPB) and 11 states took action against Prehired, a sham “tech sales” bootcamp that used a stunning web of lies to trap thousands of students in millions of dollars of predatory debt. As the CFPB and states outlined in their filing, Prehired followed its deception with a series of illegal efforts to forcibly collect on these illegitimate loans. In February 2022, SBPC exposed the first stage of this scheme, where Prehired tried to turn Delaware state courts into their personal debt collection machine.

The CFPB and the states’ action is a massive step forward for consumer protection. There is still much more work to do to secure justice for Prehired students and others harmed by predatory bootcamps, but the CFPB and the states’ filing is a sign that the kid gloves may finally be coming off in law enforcement’s handling of this scandal-plagued market.

The CFPB and the states’ next step should be to take action against Ejudicate (now operating under the name “Brief”), the company that tried to help Prehired silence students by locking them out of court and into lopsided back-room “arbitration” to address their grievances. Ejudicate facilitates companies’ insertion of arbitration provisions into their consumer contracts, and then offers an online platform and other services to carry out proceedings that might arise under those agreements. Accordingly, given its central role in Prehired’s escapades, Ejudicate fits snugly within the CFPB and the states’ authority to go after service providers and anyone that provides substantial assistance to companies that break the law. Law enforcement should use these powers.

The CFPB and the states’ next step should be to take action against Ejudicate (now operating under the name “Brief”), the company that tried to help Prehired silence students by locking them out of court and into lopsided back-room “arbitration” to address their grievances.

A decade without accountability for predatory behavior in the bootcamp space may finally be ending. As law enforcement scopes out its next move, action against Ejudicate is an obvious place to start.

Ejudicate (now “Brief”) was a Key Cog in Prehired’s Illegal Debt Collection Gambit

Ejudicate bills itself as an “online settlement and adjudication platform” that can “help businesses resolve disputes.” The company’s website appears glossy and tech-focused, but its business is fundamentally an online repackaging of a well-known product: helping companies deploy tricky contract language that lets them rob harmed consumers of their right to seek justice through the courts. These shady contract terms are called “arbitration agreements,” and they generally mandate that if a consumer has a problem with a company, the consumer hasto enter into a private negotiation outside of the public eye with that company instead of being able to sue them in court. Worse, the company generally gets to choose the arbitrator who will oversee the proceedings, helping produce lopsided outcomes. SBPC and other advocates have written at length about how for-profit colleges, predatory employers, and other bad actors regularly leverage arbitration agreements to silence the public and evade accountability.

That’s exactly what Prehired tried to do with Ejudicate. The relationship between the two companies is detailed both in the joint CFPB/state action from last week and in an earlier lawsuit that the state of Washington filed on its own in June 2022. Joshua Jordan, the CEO of Prehired, brought Ejudicate on as a contractor in March 2022, soon before Delaware courts began halting the almost 300 lawsuits that he had levied against his former students earlier that year. (Recall that Joshua Jordan sued 290 of his former students in early 2022—all in Delaware court, though they lived across the country—for $25,000 apiece after they could not or would not pay on the private loans that Jordan had trapped them in via his scam program.)

Then, Prehired quietly and unilaterally updated its website’s terms of service to say that any Prehired students with complaints against the company had to resolve them through arbitration “administered by Ejudicate” instead of being able to sue. Finally, Jordan voluntarily walked away from his 290 Delaware lawsuits, only to follow up by sending a wave of emails to students via Ejudicate demanding that they enter into arbitration.

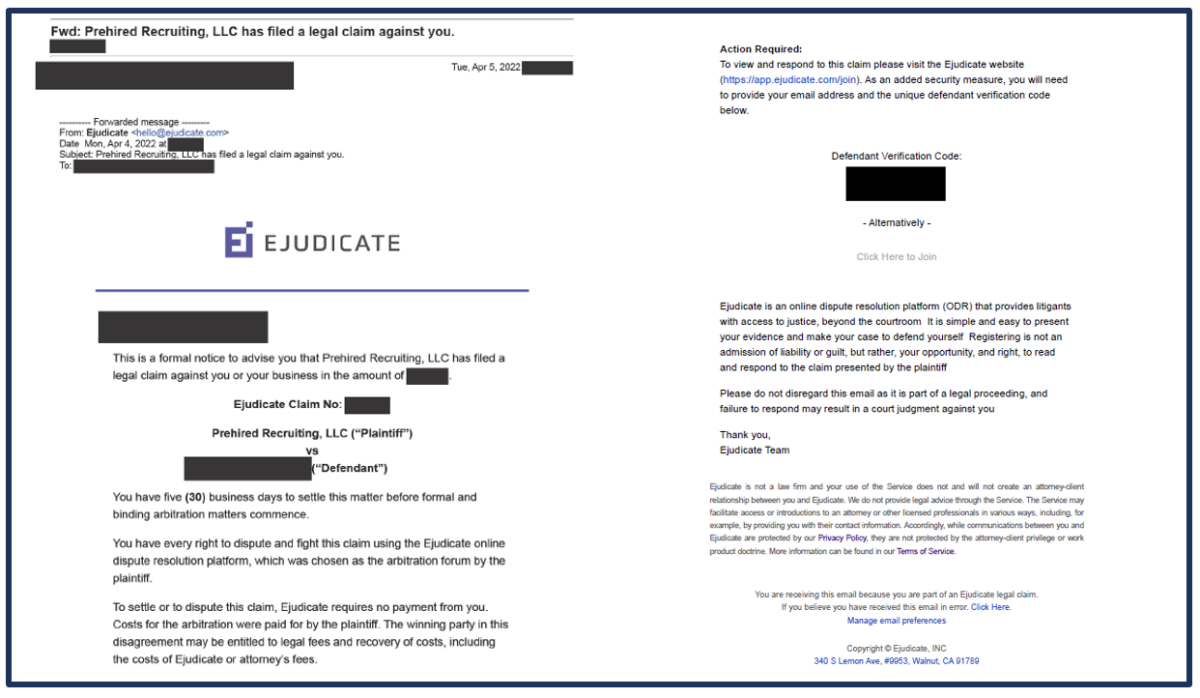

Through contact with Prehired’s victims, we at SBPC were aware at the time that Jordan and Prehired had sent these arbitration demands. The email below is one of the many notices that Jordan sent through Ejudicate to try to get students to pay on their illegitimate debts to Prehired after Delaware shut down the company’s court-based gambit.

Simply put, these were likely scary emails for students to receive. Students were unlikely to fully understand their rights or these missives’ implications (to our knowledge, none of the Prehired students had a background in the law), and many students may have clicked through and entered into arbitration.

The Delaware attorney general’s office ultimately shut down Prehired’s attempt to force debt collection through Ejudicate (they were already paying attention after the deluge of lawsuits into their state courts), noting that Prehired had updated its terms of service to require arbitration after students had already agreed to them. But in a sense, the damage had already been done. Ejudicate had already demonstrated its ability and apparent willingness to partner with shady actors and help them carry out abusive, illegal debt collection campaigns.

And perhaps worse, if Joshua Jordan had skipped the step of trying to abuse Delaware courts and had instead gone straight to Ejudicate, he may have avoided public scrutiny in the process. If that had been the case, he may have succeeded in collecting on the bogus loans that undergirded his scam, and last week’s joint CFPB/state action may have never happened. (Indeed, other scammers may have already taken this more effective route.)

The CFPB and States Should Hold Ejudicate Accountable for its Central Role in the Prehired Saga

The CFPB and its state partners can and must hold Ejudicate accountable for the part it played in Prehired’s scheme. The Dodd-Frank Act gives the CFPB and states wide-reaching authority to go after unfair, deceptive, and abusive acts and practices carried out not just by anyone who “engages in offering or providing a consumer financial product or service,” but also “any affiliate [that] acts as a service provider to such person,” and anyone who “knowingly or recklessly provide[s] substantial assistance” to such a person.

Ejudicate clearly fits that expansive bill. Consider the full suite of services Ejudicate claims to provide on its website (noting again that the company now operates as “Brief”). It is likely that Ejudicate drafted the arbitration agreement Prehired ultimately relied on and advised Prehired on how to insert it into the company’s terms of service, and it is not disputed that Ejudicate carried out delivery of demands for arbitration on Prehired’s behalf. Had Delaware not stepped in and arbitration taken place, Ejudicate would have selected an “E-Judge” to oversee the proceedings and would have provided an online platform on which they would have taken place. Taken as a whole, to the extent that Prehired aimed to achieve its goal of illegal debt collection through forced arbitration, Ejudicate was the central tool that would have allowed those dreams to become a reality.

The CFPB and states cannot and need not let Ejudicate slide. They can already demand accountability for the company’s brazen act of collaboration in Prehired’s equally brazen and illegal debt collection efforts. On behalf of the countless students who have been taken advantage of by bootcamp-based scammers and the companies that facilitate them, such action can’t come a moment too soon.

###

Ben Kaufman is a Fellow at the Student Borrower Protection Center. He previously worked as SBPC’s Director of Research & Investigations, and at the Consumer Financial Protection Bureau.