Private Student Loan Borrowers Need to be Part of the Next Congressional Relief Package

By Tariq Habash | April 30, 2020

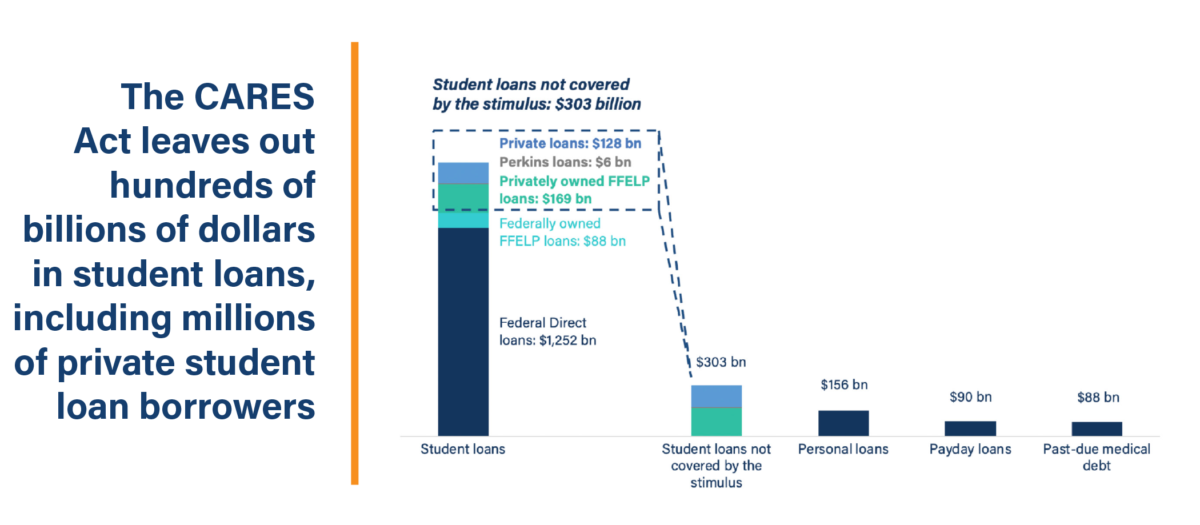

More than a month after Congress passed the CARES Act, over nine million borrowers and $300 billion in student loan debt continue to be excluded from the federal response to provide meaningful relief to student loan borrowers. These borrowers owe on a combination of older federal loans owned by private creditors, school-held Perkins Loans, and nearly $130 billion in private student loans.

We know relatively little about the millions of borrowers who currently owe private student loan debt. Researchers and policymakers have been forced to rely on vague assurances from industry proclaiming that the market is strong and that private student loan borrowers are generally doing fine.

But today, the SBPC released a comprehensive analysis showing a growing cause for concern within the private student loan market. The report finds that the rapidly growing private student loan market is putting the most vulnerable borrowers at risk. Even before the current coronavirus-fueled crisis, these borrowers struggled to get help when they needed it. Now, private student loan borrowers continue to suffer from the burden of this debt while borrowers with federal loans are offered protections by Congress.

The report’s findings present an urgent case for policymakers to take action. Here are some of the key findings that show the need for immediate action:

The private student loan market is booming

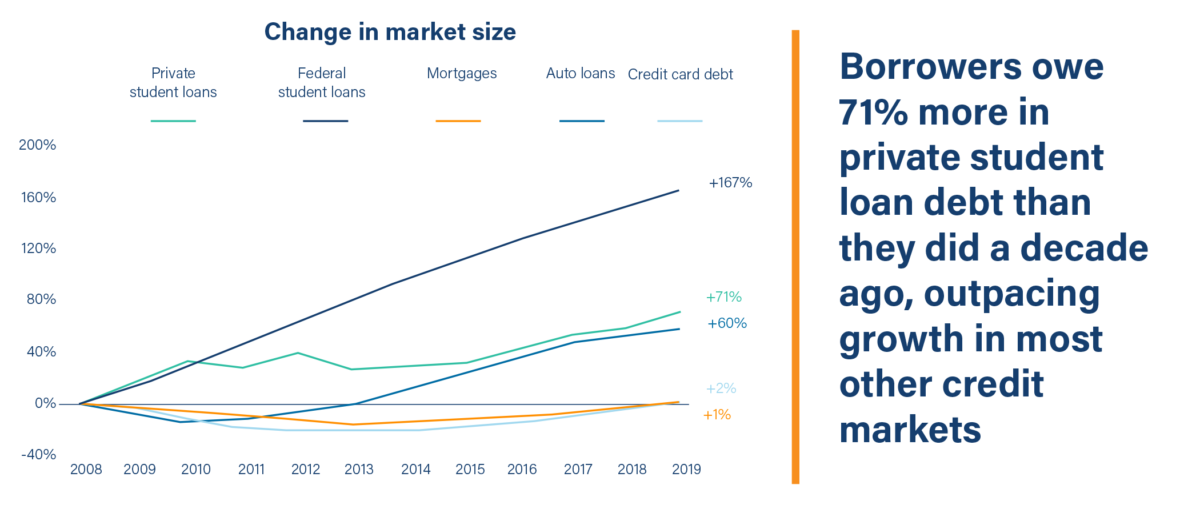

At nearly $130 billion in outstanding private student loan debt, this market is larger than both the payday loan market and the total amount of past-due medical debt. In just over a decade, the overall amount of outstanding private student loans grew 71 percent, outpacing growth in auto loans, credit cards, and mortgages.

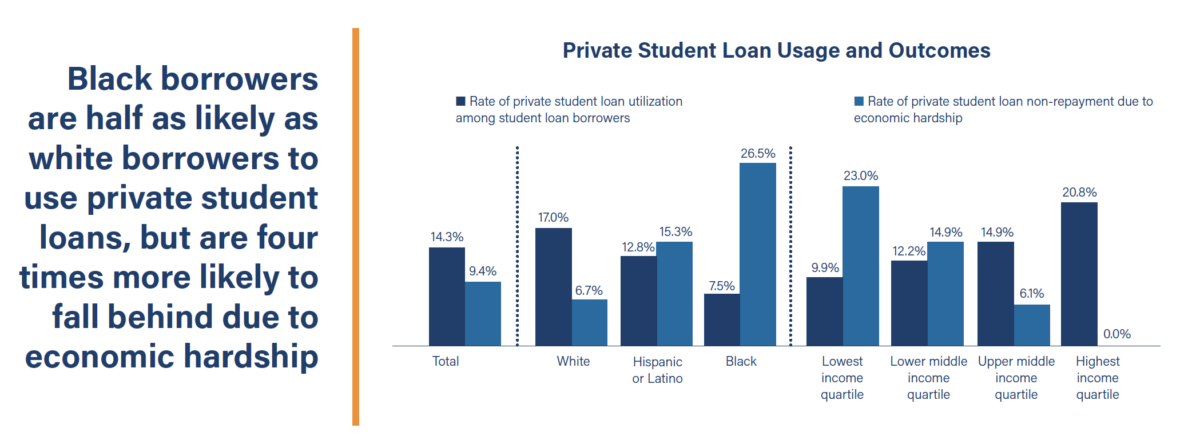

Borrowers of color and low-income borrowers frequently face distress when repaying their private student loans

While Black borrowers are about half as likely to take out private student loans as their White peers, those who do are four times more likely to fall behind in repayment due to economic hardship. Additionally, when analyzing across income groups, low-income borrowers are the least likely to owe private student loan debt but disproportionately suffer from financial distress when repaying these loans—nearly a quarter of low-income private student loan borrowers report falling behind due to economic hardship.

Private student loans disproportionately impact vulnerable populations

Students attending for-profit schools are more reliant on private student loans, often owing more than $10,000 of private student loan debt. Students at for-profit institutions are 36 percent more likely than students at public or private nonprofit colleges to rely on private student loans.

Older consumers are increasingly saddled by tens of thousands of dollars of private student debt. Currently, 93 percent of outstanding private student loans are cosigned. 57 percent of all private student loan cosigners are aged 55 or older.

We know that even before the crisis hit, private student loan borrowers disproportionately struggled to get relief. In fact, last year, the CFPB reported that nearly 90 percent of student loan borrowers who reached out to the agency were not getting the necessary help. During a pandemic, this is devastating and dangerous.

Last week, a coalition of states stepped up where Washington dropped the ball—joining in a multi-state agreement with some of the largest private student lenders to give borrowers some relief. This is good news for millions of borrowers. However, a deal that only protects borrowers in certain states and only applies to certain companies also makes the urgent case for a comprehensive federal response. The SBPC’s report shows that private student loan borrowers are too often some of our most vulnerable borrowers, owing on loans offering fewer protections and less payment flexibility than federal student loans. When Washington takes up the next relief package, policymakers must step up and protect all student loan borrowers, including those with private student loans.

###

Tariq Habash is Head of Investigations at the Student Borrower Protection Center.