By Student Borrower Protection Center | September 20, 2021

Military service is the ultimate public service. These brave Americans rose to the moment to defend and protect our nation, often taking on student debt before or during their service so that they might pursue the promise of higher education. But servicemembers across the country are continually being denied promised student loan relief through the Public Service Loan Forgiveness (PSLF) program even after a decade or more of service in uniform. This fact is a national disgrace.

Now, for the first time, the federal government is asking those who depend on the program to help decide what comes next. Military borrowers are standing up to share their stories and drive policy change. It’s time to restore the promise of PSLF to student loan borrowers in uniform.

ED and the Student Loan Industry Failed Servicemembers

PSLF stems from a simple, bipartisan idea: those who work in public service for ten years should have their remaining federal student loans forgiven. In fact, since its introduction, PSLF has emerged as a key recruiting and retention tool for nearly every branch of the U.S. military. An estimated 200,000 servicemembers collectively now owe more than $2.9 billion in student loan debt.

Unfortunately, Washington has failed to uphold its end of the bargain with regard to PSLF. Instead, borrowers have been let down at every turn and buried under debt due to mismanagement and abuse by the Department of Education and the student loan industry.

A recent GAO report clearly illustrates how extensively PSLF has failed servicemembers:

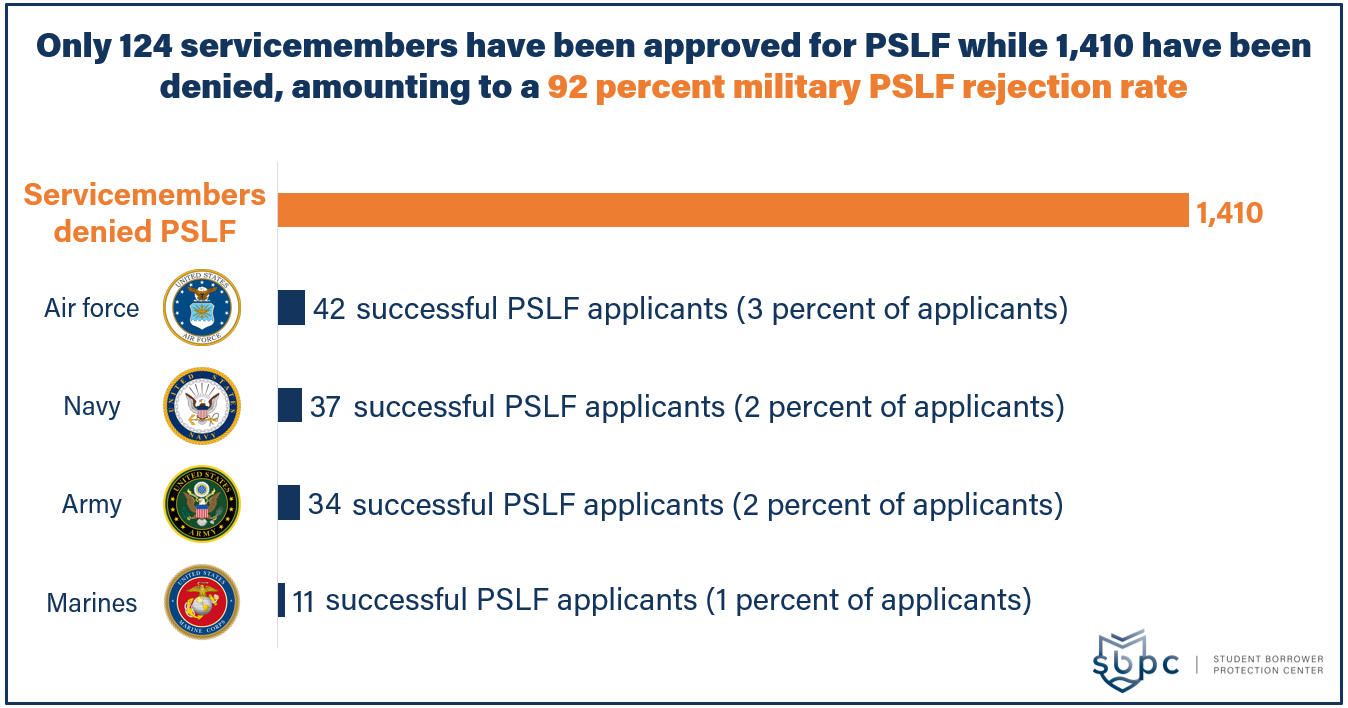

- Over 94 percent of servicemembers and Department of Defense employees who pursued PSLF have been denied.

- Only 124 servicemembers have been approved for PSLF while 1,410 have been denied, amounting to a 92 percent PSLF rejection rate. Among the 124 servicemembers who have been approved are 42 from the Air Force, 37 from the Navy, 34 from the Army, and 11 from the Marine Corps.

- Tens of thousands of servicemembers still have federal student loans that must be consolidated in order to be eligible for PSLF—otherwise, if these borrowers try to apply for forgiveness, they will be denied.

This GAO report was only the latest in a long line of analyses and investigative reports. For example, research published last year by the Student Borrower Protection Center found the following:

- Only 17,534 military borrowers have submitted employee certification forms expressing their intent to pursue PSLF.

- Almost a quarter of these borrowers’ employer certification forms have been rejected—even though their employer is the military.

- As a 2018 report from the Department of Defense had already indicated and as our report confirmed, as few as 6,800 military borrowers could be on track for PSLF.

Moreover, we are just learning about the extent of the PSLF breakdowns harming servicemembers. For example, in a June 2021 letter to the CEO of the student loan servicer PHEAA, which manages PSLF on behalf of ED, Senators Elizabeth Warren and John Kennedy revealed that “[i]n March 2021, the Department [of Education] conducted a PSLF review of military PSLF applications, finding a 20% error rate.”

These harrowing outcomes are in part a reflection of a basic fact: key aspects of military life—from the difficulty of enrolling in and recertifying for required repayment plans while in a warzone, to the widespread reports of student loan servicers driving servicemembers toward endless non-qualifying deferments—conflict with the qualifications for PSLF. This is particularly true for servicemembers with older federal student loans originated under the now-defunct Federal Family Education Loan Program (FFELP). These loans are not eligible for PSLF, but taking the steps necessary to consolidate into loans that are eligible for PSLF can mean giving up key consumer protections available to servicemembers.

Servicemembers and Veterans are Speaking Out About the Failure of PSLF

In July 2021, ED published a notice and request for information seeking public comment on issues related to the mismanagement of PSLF. In the weeks since launching this public inquiry, ED has received more than 40,000 comments from affected student loan borrowers and other stakeholders, including those from many servicemembers and veterans.

These servicemembers’ stories make clear that the consequences of errors and breakdowns surrounding PSLF go far beyond a simple rejection rate. The following are only a few illustrative examples of the harrowing narratives that servicemembers and veterans with student loan debt have submitted:

- Hugh Williams, a veteran in O’Fallon, Illinois: “My loans never qualified for the PSLF. I’ve moved my family around the country, I’ve deployed to Afghanistan, I’ve served for almost 15 years and I’m still paying student loans because this program helps hardly no one. . . . I don’t understand why a program would be created to financially assist public servants but [then] only be offered to a select few. This program was one of the primary reasons I joined the military, but no one told me I had the wrong type of loan and wouldn’t qualify for the PSLF in the first place.”

- James Schroeder, a veteran in Stafford, Virginia: “As a disabled Operation Iraqi Freedom veteran and retired U.S. Army Sergeant First Class currently working both as a federal government employee and as an adjunct professor at a land grant university, I accepted student debt as the cost of being able to attain positions that would allow me to provide the best service to the American people. . . . Borrowers such as in my position are still using our education and experience to honorably benefit the American public. We’re still paying as agreed on our debt. That debt still weighs heavily on every economic decision we make, especially if we consider trying to obtain additional education to fill knowledge or qualification gaps that we know need to be filled in order to best serve the public good.”

- Suzanne Caudill, a veteran in Grosse Pointe Farms, Michigan: “I served 8 1/2 years Active-Duty Army and then later came to realize that those first years of my service don’t count as I refinanced my student loans despite my serving my country. Second, I am a Medical Provider and federal and DOD contractor ever and an Army Reservist for the past 3 years. Since I was a government contractor and not in a direct federal GS position, this time doesn’t count as well. My spouse is Active Duty Coast Guard, and finding GS employment while being stationed with him is very different. . . . Serving in these sectors alone is a hardship that all family members are subjected to. Do not let trivial matters such as reconsolidating loans reset time served as we still served that time honorably.”

- Peter Zmijewski, a veteran in Chagrin Falls, Ohio: “”I am a veteran of Iraq and Afghanistan and currently a major and general surgeon in the Army Reserve. As a civilian, I work as a critical care surgeon for a 501c3 hospital and did so during my residency and fellowship as well. . . . I was continually told,year after year when I would recertify my income for my IBR plan from 2015-2019 that my only option was forbearance. . . . I have been on the frontlines of the pandemic as a civilian critical care surgeon and on the battlefields as a soldier in Iraq and Afghanistan and feel very let down by our government regarding PSLF and the promise of forgiveness after public service it was supposed to offer.”

- Bonnie Wilson, a veteran in Plainfield, Illinois: “I have spent my entire life serving my country in one way shape or form. I spend 8 years on active duty, did a tour in in IRAQ, and now I am a GS employee with the DOD therefore you would think somehow I could qualify for something. I could make more in the private sector but I love my job and working with the military.”

- Travis Cook. a veteran in Fairfax Station, Virginia: “From October 2011 until now, I have either served in the U.S. Navy (2011-2019) or as a Federal government employee (2019-2021), meeting the service requirement. . . . I have faithfully served in public service for 20 years and have never missed a payment for my student loans. I feel like I am a poster child for who the PSLF program is supposed to benefit. This, however, is not the case. I’m far from becoming eligible for forgiveness based on current guidance and my payments don’t seem to be making a dent in the principal since I’m paying a lower amount. I feel that my loan will never be paid off at this rate and that I will never obtain loan forgiveness from this program. If anything, it makes me want to leave public service.”

Enough is enough. Now is the time for our government to honor America’s commitment to servicemembers with student loans.

- Do you have an older federal loan that is not eligible for PSLF and did you get bad or no information from your student loan company about how to become eligible for PSLF?

- Did you spend months or years on military deferments while never being told that you needed to be in an IDR plan to qualify for PSLF?

- Did you have trouble enrolling in an IDR plan or staying on track because of your military service?

- Did you have problems certifying that your employer was “qualified” even though you served in the Armed Forces?

- Are you one of tens of thousands of servicemembers whose pursuit of PSLF was derailed by poor servicing, unfair technicalities, or for any other reason?

So, we are urging borrowers: it’s time to raise your voices, share your stories, and call for President Biden and Secretary Cardona to deliver promised debt relief to men and women in uniform. Together, borrower stories can make a difference.

###

The Student Borrower Protection Center is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.