Statement from SBPC Executive Director and Former Top Student Loan Regulator Seth Frotman on the CARES Act

March 26, 2020 | WASHINGTON, DC — Today Student Borrower Protection Center Executive Director and former CFPB Student Loan Ombudsman Seth Frotman issued the following statement on how the CARES Act fails to deliver critical relief for student loan borrowers.

“Even before the coronavirus outbreak, our nation was in the midst of a crippling $1.6 trillion student debt crisis. More than one million people are defaulting on federal student loans every year. Student loan delinquency rates exceed those of nearly every other financial product. And now, driven by a global pandemic, student loan borrowers are facing widespread unemployment and financial upheaval.

Unfortunately, the stimulus package put forth by Congress threatens to leave struggling borrowers even further behind. Senate Republicans stonewalling real relief for student loan borrowers is both short-sighted and dangerous. The legislation’s temporary pause of some borrowers’ payments simply kicks the can down the road, leaving millions to face inevitable hardship in a short six months. Moreover, the legislation leaves millions of vulnerable borrowers without a lifeline—receiving no assistance and no way out of this crisis.

Further, implementation of the proposed borrower relief relies on a student loan system that is fundamentally broken. Federal and state investigations have repeatedly shown how student loan servicing is rife with abuse and mismanagement. Student loan companies are ill-equipped to turn these relief benefits on and off for tens of millions of borrowers. These companies have an abysmal track record of setting up struggling borrowers for long term success—and the number of struggling borrowers is about to increase dramatically.

Lawmakers’ failed response to the last financial meltdown led directly to our current student debt crisis. Today’s relief package shows how little we have learned in the past decade. Unless the Trump Administration and Congress take significant, comprehensive additional steps on behalf of the tens of millions of American families with student loans, the next wave of the student debt crisis will be even more devastating.”

Background: Key Gaps in the Legislation

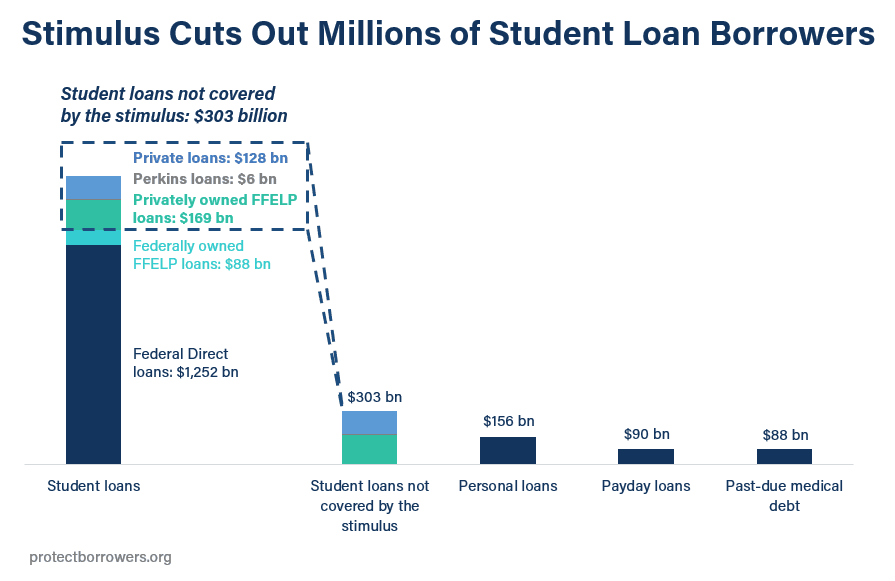

Cutting out millions of borrowers from relief: Today’s proposal cuts out hundreds of billions of dollars and millions of borrowers from relief. Those with private student loans, federal Perkins loans, and commercially-held federal student loans are not covered by the payment pause. This amounts to over $300 billion in student loans not covered by the legislation.

Temporary payments pause falls short: The legislation doles out billions to corporations and Wall Street while putting only a temporary pause on student loan payments for struggling borrowers. In only six months, payments will restart. Temporarily pausing payments and expecting borrowers facing financial hardship to bear this burden again in six months is dangerous and short-sighted.

Relying on a broken student loan industry: Implementation of the new payment pause relies on the private sector student loan servicers, an industry already rife with abuse and widespread breakdowns, especially related to borrower communication and enrollment in repayment plans. The industry also has a dismal track record of implementing similar disaster relief programs, ultimately leading to borrower confusion and spikes in defaults .

Troubling track record of disaster relief: Defaults last year spiked partly as a result of disaster-impacted borrowers exiting forbearance statuses. Specifically, following natural disasters such as Hurricanes Harvey, Irma, and Maria and the California wildfires, borrowers’ loans were placed in mandatory forbearance, or “forced-placed forbearance.” This use of forbearance was intended to help people deal with the fallout of a natural disaster, but it ultimately left a staggering number of borrowers in default, with servicers failing to guide borrowers into affordable repayment options after this forbearance ended.

###