States are Leading the Fight to End the Student Debt Crisis

By Seth Frotman | June 15, 2020

The SBPC is proud to be part of a growing movement of advocates reaching from coast to coast — consumer groups, grassroots organizers, labor organizations, elected officials, law enforcement, and regulators — who have thoughtfully and tenaciously taken critical steps to stand up for the millions of Americans with student loan debt.

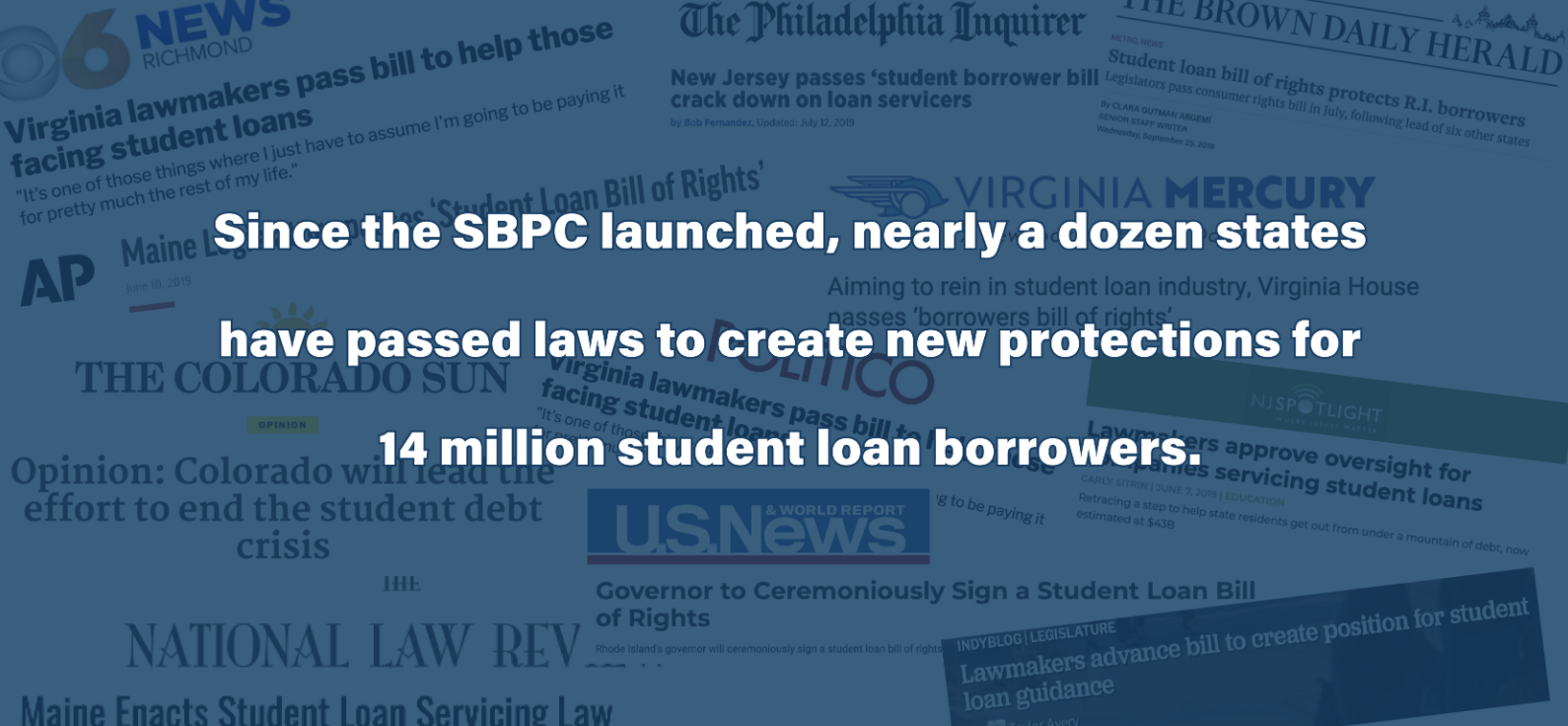

Since we opened our doors in November 2018, millions of student loan borrowers — roughly one-in-three Americans with student debt — have gained critical rights and protections through hard-fought state legislative efforts.

And because of this movement, millions of Americans who took on student debt to chase a better life for themselves and their families — to chase the American Dream — are better protected against predatory student loan companies that view their plight as a chance to make a quick buck.

But there is much more work to be done on behalf of borrowers.

Amid a global pandemic and unprecedented unemployment, student loan companies have continued to prey on vulnerable borrowers. Emergency service workers living paycheck to paycheck had their wages illegally seized. Nearly five million borrowers had their credit illegally damaged. Essential workers, including nurses and social workers, are being denied critical loan forgiveness earned through their service. Meanwhile, Betsy DeVos and the Trump Administration have actively worked to shield industry from any accountability.

This needs to end.

And that is why we are working with states to double down on efforts to increase borrower protections and to ensure states are using every authority at their disposal to stand up for the tens of millions of Americans struggling under this unprecedented burden.

[us_map]

As states step up and expand their efforts to protect borrowers, the SBPC is bringing new tools, resources, and ideas to this fight. We are excited to be working with states, territories, and tribal governments to build on this momentum in the following key areas:

Expand and Strengthen Student Loan Borrower Bills of Rights

States have overseen financial markets for more than a century — the student loan market should be no different. To date, nearly a dozen states have passed a Student Loan Borrower Bill of Rights to give borrowers common sense protections. Moreover, this legislation ensures that states can oversee this critical market and hold companies accountable for breaking the law. But there is more work to be done. More than a dozen states and territories are expected to introduce Borrower Bills of Rights in 2021, and where states have already passed this legislation, we’re working to make these protections even stronger.

Establish Protection for Private Student Loan Borrowers

The $140 billion private student loan market goes largely unchecked at the federal level. Meanwhile, this market is rife with disparities and unscrupulous actors that prey on the most vulnerable borrowers. For example, Black borrowers are half as likely as white borrowers to use private student loans, but Black borrowers who do use private student loans are four times more likely to fall behind in repayment due to economic hardship. Moreover, borrowers who attend for-profit schools disproportionately rely on private student loans and face higher delinquency and default rates.

The SBPC is working with states to establish critically needed oversight in the private student loan market by creating protections for borrowers with existing debt from abuses by lenders, servicers, debt buyers, and debt collectors. This legislation will make new loans safer for borrowers and rein in the worst abuses by financial services companies across the lifecycle of a private student loan.

Increase Accountability Across the For-Profit School Industry

Over the last decade, for-profit schools have perpetrated some of the most egregious abuses in the student loan market. Now, the Trump Administration has rolled back a series of federal protections designed to help defrauded student loan borrowers. In response to new Trump Administration rules, Congress passed a bipartisan vote under the Congressional Review Act to reject this attempt to limit relief to defrauded students and restore schools’ ability to use forced arbitration to block access to the courts. Despite this effort, Trump recently vetoed this legislative rebuke in favor of protecting predatory schools. States have the power to fight back and stand up for the millions of borrowers with nowhere left to turn.

The SBPC is working with states to hold these bad actors to account, including by banning abusive debt collection tactics favored by for-profit institutions and ensuring borrowers retain access to the courts when these schools commit fraud.

Together, through this work with our state, territory, and tribal partners, the SBPC remains committed to expanding and enhancing state-level oversight and accountability across the student loan market and ensuring that borrowers can seek justice when they are ripped off. We are fighting to protect senior citizens from crippling debt that threatens their financial security. We are fighting to shed light on the shady underbelly of the education finance market so states can stop predatory student lenders. We are fighting to stop unscrupulous collectors from dragging borrowers to court over debts they cannot prove. We are fighting to hold for-profit schools accountable so that they cannot rip off borrowers and then slam the courthouse door shut.

For too long, student loan companies have been allowed to operate in the shadows, enabled by the federal government’s ongoing failure to act. After the last financial crisis, the student loan industry seized the opportunity to make record profits off the backs of borrowers, ignoring every law that got in their way. Since the start of the Trump Administration, things have gone from bad to worse.

Now, it is time for states to step in and stop the abuse. Washington couldn’t solve this problem before, and it certainly won’t solve it now. More than ever, states must step up to end the student debt crisis.

Now is the time. Now is the place. It’s time to fight back. Join us.

###

Seth Frotman is the Executive Director of the Student Borrower Protection Center. He previously served as Assistant Director and Student Loan Ombudsman at the Consumer Financial Protection Bureau, where he led a government-wide effort to crack down on abuses by the student loan industry and protect borrowers.