By Benjamin Roesch and Ben Kaufman | October 21, 2020

As part of our work on behalf of borrowers, SBPC has been highlighting the consumer risks present in the marketplace for “shadow” student debt—the high-cost, risky funds borrowed for education outside traditional student lending options. Companies in this market prop up some of the most predatory for-profit schools in the country while driving students to take on billions of dollars in possibly dangerous loans.

Over the course of our ongoing investigation into this space, we have uncovered additional evidence of troubling practices and possible borrower harm by Climb Credit, a specialty lender that offers loans students can use to finance attendance at job training programs ranging from coding bootcamps to teacher training courses. As part of its underwriting model, Climb purports to have carefully vetted—and lends in part based on—the institution and program the borrower is looking to attend.

Climb raised alarms this summer when the company stated in response to a U.S. Senate probe that it does not conduct any fair lending testing, despite the fact that the school and program a borrower chooses to attend—two key metrics Climb uses when making lending decisions—are known to be closely associated with race, making their use potentially discriminatory.

Digging deeper, the SBPC has identified new evidence that Climb may be engaging in misleading and dangerous practices, and that it might be taking advantage of borrowers through several other breaches of consumer protection law. These violations could even implicate Climb’s partner schools.

Today, we released these findings in a letter to the Consumer Financial Protection Bureau (CFPB) calling on it to stand up for students and borrowers. In sharing our findings with CFPB Director Kathleen Kraninger, we highlighted the following areas of concerning conduct for the Bureau to immediately investigate and address:

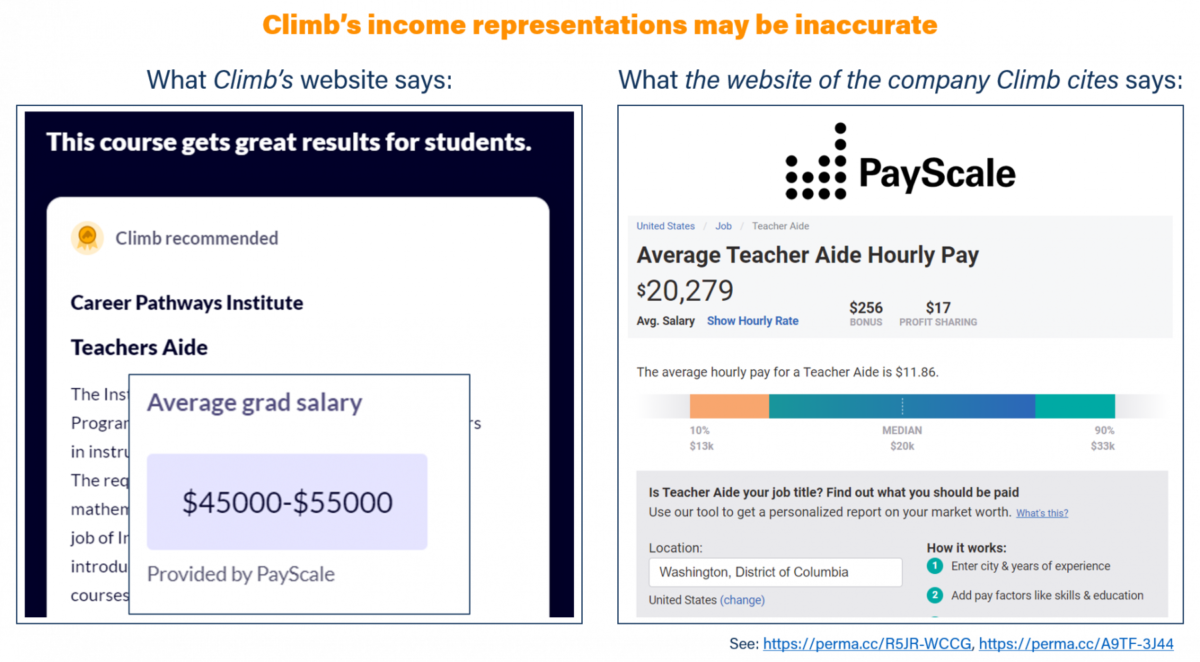

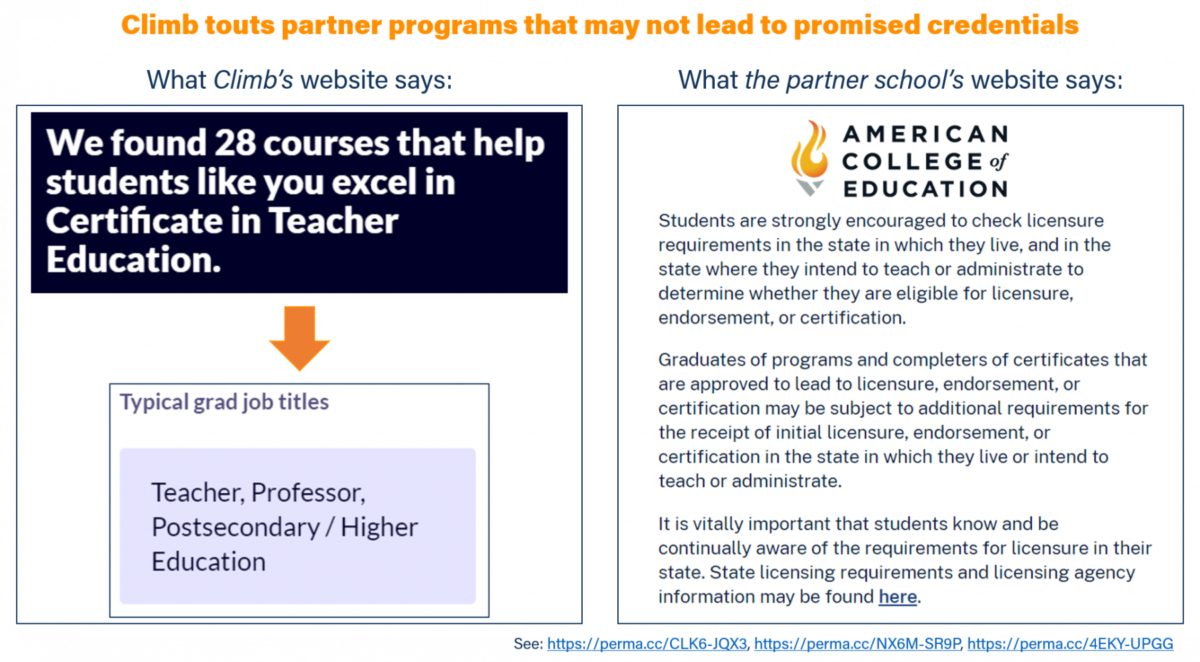

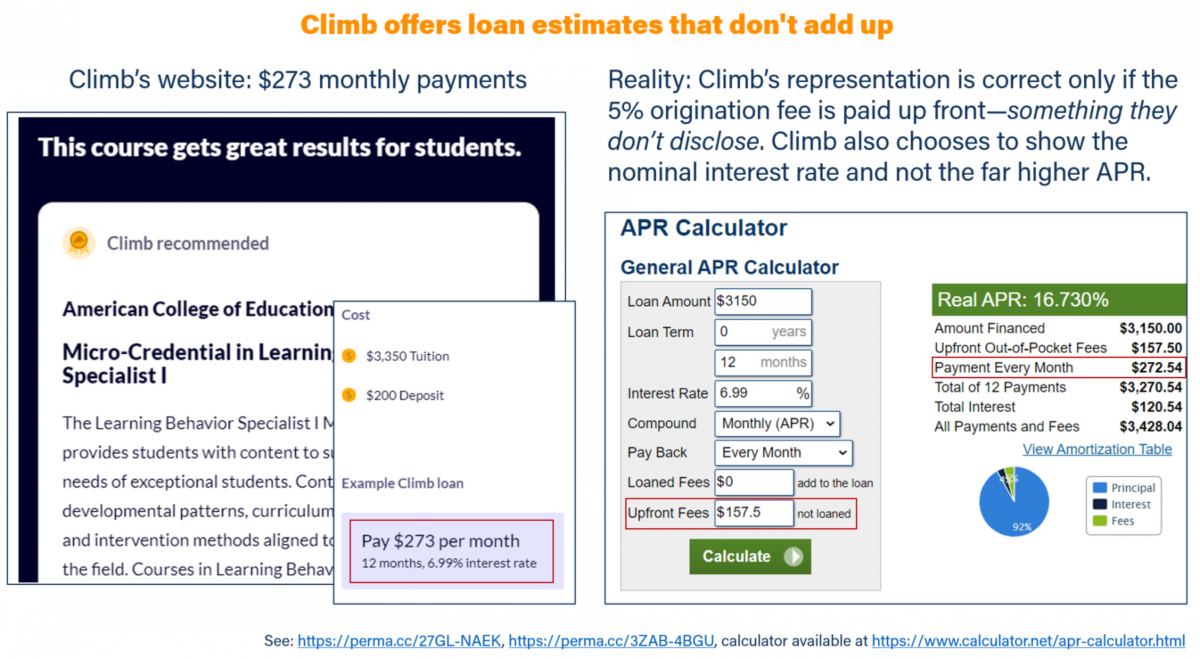

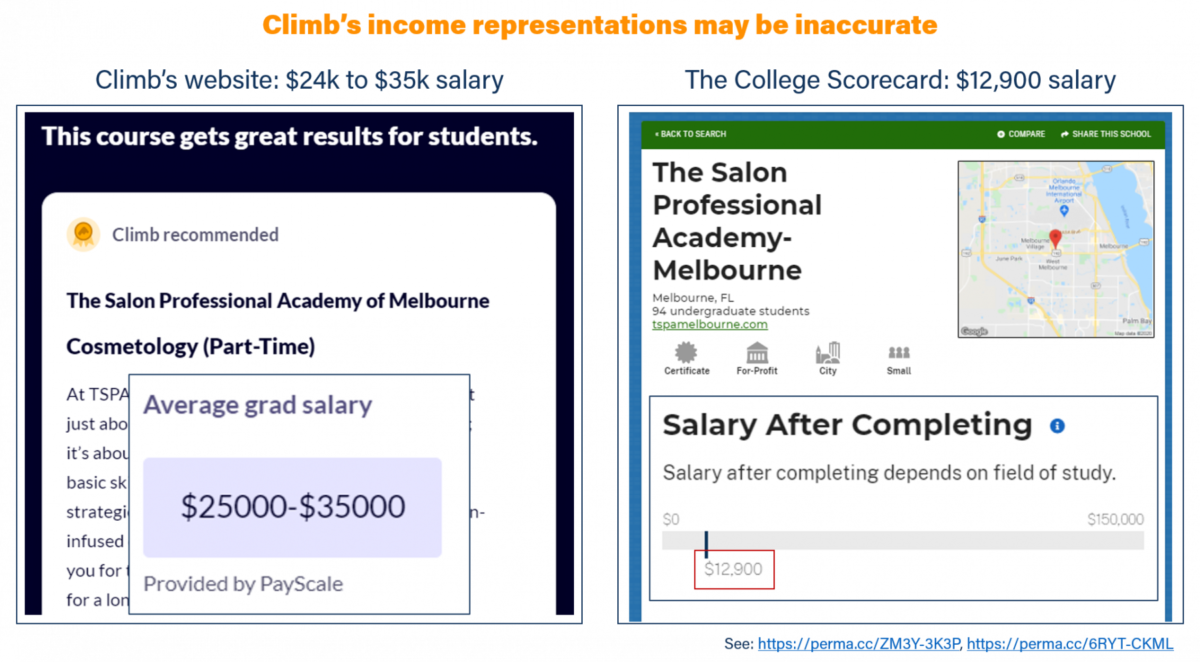

- Climb’s advertising appears to deceive borrowers, tricking them into taking out loans that are more expensive than represented for programs that may be of lower quality than Climb assures. Climb’s central value proposition to students is not just that it offers loans they can use to get an education, but that it does so at schools and programs that it has carefully vetted for positive student outcomes and high return on educational investment. However, we found that Climb’s promises of quality assurance may leave borrowers to falsely believe these programs are a surer bet than they actually are. For example, Climb presents programs as leading to “great outcomes for students” even when they can’t actually lead to a professional license, uses inaccurate or misleading information on student outcomes for certain programs, and uses dubious methodology to determine that its partner programs have a “high ROI [return on investment].” Climb also attracts students by providing details on “example climb loans” that systematically underrepresent the true cost of Climb’s credit—possibly in violation of the Truth in Lending Act. Overall, Climb’s business practices warrant an immediate response from regulators, lawmakers, and law enforcement at all levels, as well as relief for harmed borrowers.

- Climb’s lending practices, including the use of “alternative” data in underwriting, may be violating fair lending law. Climb’s public statements to Congress and the press raise the question of whether the company is complying with the Equal Credit Opportunity Act. Climb makes lending decisions in part based on the school and program that the borrower is trying to attend, two factors known to be strongly associated with borrowers’ demographic background. Federal regulators have already made clear that tactics similar to Climb’s raise significant fair lending risk. Climb does not seem to understand this. As mentioned above, the company recently told the U.S. Senate Banking Committee that it hasn’t conducted any testing to determine whether its underwriting model produces racially disparate outcomes. Defending this decision, Climb stated simply, “we have no reason to believe our underwriting standards have a disparate impact on members of a protected class. Accordingly, we have not conducted such empirical testing and we believe such testing would be unwarranted.” Our research suggests that Climb regularly provides student financing at schools that borrowers of color are much more likely to attend, heightening the risk for the company’s practices to generate disparate impacts.

- Climb may be taking advantage of borrowers through other violations of consumer protection laws—and its “partner” schools could be implicated. The SBPC’s investigation into Climb reveals highly suspect practices at the for-profit schools that Climb partners with. Though the details of these partnerships remain opaque, there is evidence that schools play a role as brokers of Climb’s financial products in a way that might bring them under the scrutiny of the CFPB. We call on the Bureau to investigate whether Climb or its partner schools are breaking the law, and to work with governmental partners at both the state and federal level to insure that additional laws beyond the Bureau’s purview—such as preferred lender list protections—are being complied with.

Bearing the brunt of these misdeeds are an untold number of people who turned to Climb precisely because it offered them the promise of a better life. This includes aspiring teachers, the targets of many of Climb’s most egregious misrepresentations. Our findings raise significant concerns that Climb is bundling high-cost debt with old-school deception under the packaging of “fintech” to lure in vulnerable borrowers.

In response, we have called on the Bureau to investigate Climb and its partner schools, and to prioritize using the broad powers Congress granted it in Dodd Frank to supervise the entire market of firms driving students to take on shadow student debt. Further, we have urged the Bureau to protect borrowers through the rulemaking process with a comprehensive set of regulations spanning the lifecycle of student financing, from origination and servicing through debt collection and credit furnishing.

For too long, shadow student debt companies have operated at the outskirts of the law, putting borrowers at risk. This cannot continue to be the case. It’s time for student loan companies of every kind to play by the rules—and for the rules to acknowledge the scope of the problem. It’s time for companies to stop hiding behind the smokescreen of “disruption” to mask discriminatory practices. And it’s time for America’s top consumer watchdog to utilize the supervisory and enforcement powers at its disposal to hold this vital cog in the for-profit school machine to account.

It’s time to protect borrowers.

###

Benjamin Roesch is a Senior Fellow at the Student Borrower Protection Center. He has significant experience in consumer finance and insurance issues.

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked as a Director’s Financial Analyst on issues related to student lending.