By Amber Saddler | August 18, 2022

Millions of federal student loan borrowers have been in repayment for more than a decade and could receive significant debt relief—possibly even total cancellation of their loans—under President Biden’s recent Public Service Loan Forgiveness (PSLF) Waiver and Income-Driven Repayment (IDR) Account Adjustment. But far too few borrowers have been able to access these programs. Most Federal Family Education Loan (FFEL) and Federal Perkins Loan Program (Perkins) borrowers must apply to combine their older loans into a new Direct Loan, a process known as “consolidation,” in order to access these programs—and time is running out.

Has a student loan servicing company told you that you would lose previous credit towards PSLF if you consolidated your student loans? Tell us about your experience and help us hold student loan companies accountable here.

For those who have been able to access it, the Department of Education’s (ED) temporary overhaul of PSLF has been a huge success, beginning remediation of years of servicer misconduct that resulted in a 98 percent rejection rate for those who applied for loan relief through the program. Launched in October 2021, this PSLF Waiver has already fulfilled the promise of student loan relief for nearly ten times as many borrowers as the standard PSLF program did in close to half a decade. PSLF was enacted in 2007 to provide a pathway to student debt relief for teachers, nurses, social workers, and others who dedicate 10 years of service to the betterment of their communities and country. Given its noble origins, it is bittersweet that it took an entire programmatic overhaul for PSLF to bear real fruit for borrowers.

The PSLF Waiver deadline is October 31, 2022, and the Account Adjustment for IDR is expected to finish in January 2023. However, FFEL and Perkins borrowers must act even sooner than those deadlines suggest since they must complete the Direct Consolidation Loan process before becoming eligible for these critical reforms—and that process itself can take weeks to complete. The bottom line is that more than nine million borrowers must take additional steps to be eligible for these programs, but fewer than 170,000 borrowers have done so since the announcement of the PSLF waiver, in part due to misrepresentations by student loan servicing companies. These borrowers have just a few more weeks to begin their applications, or they will lose the opportunity to access loan relief under these programs.

ED’s more recent announcement of the IDR Account Adjustment is another signal that this administration is on the right path toward remedying the underlying problems that have prevented borrowers, especially those with low incomes, from accessing the relief they were promised. Under this executive action, ED will make an adjustment to borrowers’ accounts to award IDR credit for any past time spent in repayment, even if no payment was made, and for certain time spent in deferment and forbearance. Overdue as they are, the PSLF Waiver and IDR Account Adjustment actions are strong signs of the Biden Administration’s commitment to tearing down systemic problems baked into our dysfunctional student loan system.

Unfortunately, there is much more work to be done before the Biden Administration can reasonably allow either of these initiatives to end. Because borrowers with older FFEL and Perkins loans must consolidate their loans into a Direct Consolidation Loan to qualify for these executive actions, the PSLF Waiver’s success has not been spread evenly across the federal student loan portfolio. The IDR Account Adjustment is set to follow in its footsteps. As the PSLF Waiver rapidly approaches ED’s self-imposed deadline of October 31, 2022, only 168,000 of the more than nine million borrowers owing on loans in the FFEL program have consolidated their student loans into the Direct Loan Program. Loan consolidation entails a maze of paperwork and administrative burden these borrowers must navigate before becoming eligible and benefiting from either the PSLF Waiver or the IDR Account Adjustment which ED estimates it could finish implementing as soon as January 1, 2023.

Student loan borrowers in the FFEL program owe on older loans that were issued by private lenders but are subsidized and guaranteed by the federal government. Although the FFEL program was discontinued in 2010, nearly 10 million borrowers still owe more than $200 billion originated under the program. Like other student loan borrowers, those with FFEL program loans have long struggled to access promised student loan debt relief due to the miscommunications, loan servicer misconduct, and confusing eligibility requirements that plagued the original PSLF program and IDR plans. Unlike other borrowers, the lifelines cast by the PSLF Waiver and IDR Account Adjustment initiatives are still out of reach for FFEL borrowers who must overcome the hurdle of consolidation before reaching them.

A Direct Consolidation Loan allows federal student loan borrowers to combine multiple student loans into one new loan. While there are some special circumstances where consolidating may not be in a borrower’s best interest, consolidation generally affords FFEL borrowers the same rights and protections as borrowers in the Direct Loan program. This includes eligibility for the PSLF Waiver and IDR Account Adjustment and also a host of other benefits like access to additional income-driven repayment plan options. Unfortunately, borrowers found the process of consolidating FFEL loans into the Direct Loan program difficult to navigate even before ED announced that these reforms would be time-limited and that accessing them would be contingent upon successfully completing a loan consolidation.

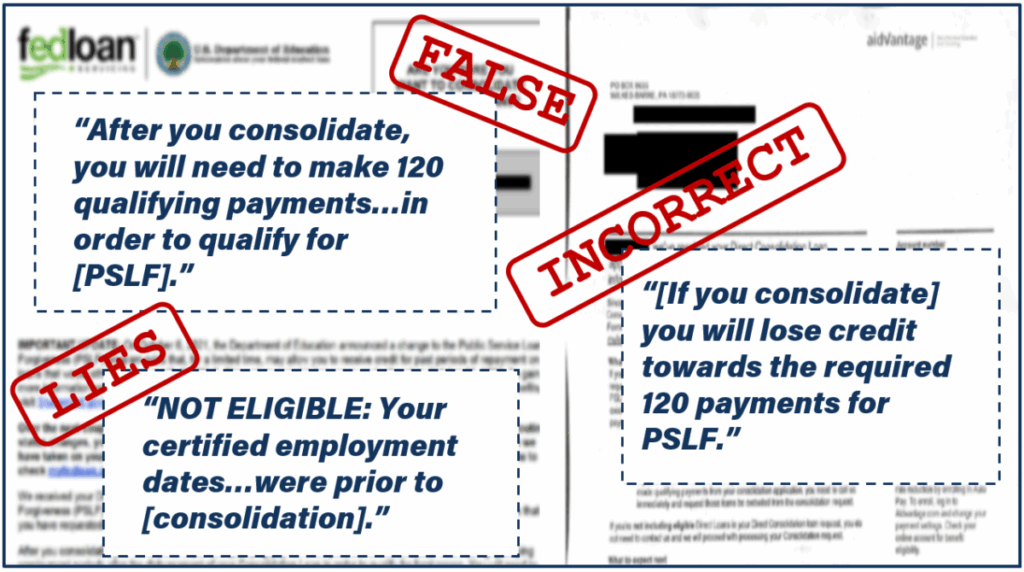

The consolidation process typically takes four to six weeks to complete, and the looming PSLF Waiver and IDR Account Adjustment deadlines have introduced a heightened sense of urgency into the already fraught process. This urgency is exacerbated by FedLoan and other student loan servicing companies misrepresenting to FFEL borrowers that they are not eligible for PSLF after consolidation or discouraging borrowers from consolidating in the first place. This guidance is explicitly contrary to PSLF Waiver terms which allow borrowers to receive credit for periods of repayment on FFEL program loans made before consolidation. These misrepresentations can be profitable. Despite sanction by the Consumer Financial Protection Bureau, FFEL lenders and the guaranty agencies, which collect on FFEL loans in default, remain perversely incentivized to hold onto—and continue profiting from—student loan accounts by discouraging borrowers from consolidating.

Statements from Student Loan Companies Misleading Borrowers About the Consequences of Consolidation

Likewise, if ED does not issue tailored outreach and guidance about consolidation for FFEL borrowers as the IDR Account Adjustment ramps up, FFEL borrowers will continue to struggle to find timely and accurate information about loan consolidation from student loan servicing companies, all of which have long histories of misleading borrowers about various student loan debt relief programs.

Further, there is likely huge overlap between the public service workers applying for loan relief through the PSLF Waiver expiring October 31st and the low-income borrowers who will benefit from the IDR Account Adjustment that ED expects to implement sometime after January 1, 2023. These initiatives must be calibrated so that their deadlines align and low-income public service workers are not cheated out of credit towards PSLF relief.

The Biden Administration must extend and coordinate the timelines of the PSLF Waiver and IDR Account Adjustment to ensure that all borrowers can access the promise of affordable and manageable student loan repayment. As the current deadline rapidly approaches, less than two percent of FFEL borrowers have consolidated their loans, servicer misconduct continues to drag out the consolidation process, and low-income public service workers have yet to benefit from the IDR Account Adjustment.

Ending the PSLF Waiver in less than three months would be disastrous for the most vulnerable borrowers and run the risk of negating much of the critical progress the Administration has made towards fixing the student loan system overall.

Are you a borrower who has attempted to consolidate your student loans since October 6, 2021? Did FedLoan Servicing or another student loan company state that you would lose previous credit towards PSLF if you consolidated your student loans? Did FedLoan encourage you to apply for PSLF before consolidating your FFEL program loans?

We want to hear from you!

Tell us about your experience and help us hold student loan companies accountable here.

###

Amber Saddler is Counsel at the Student Borrower Protection Center. Previously, she was a Dorot Fellow at the Alliance for Justice where she worked on issues related to federal judicial nominations and increasing access to the courts for marginalized people.