When the Student Loan System Fails, Payment Relief Becomes Just Another Empty Promise

By Ben Kaufman | March 23, 2020

Last Friday, the Trump Administration announced that federal student loan borrowers could have their monthly payments paused “without incurring interest or penalties” for at least 60 days. This came on the heels of the Administration’s recent announcement that interest on federal student loans would be waived “until further notice.”

The Administration’s proposal fails to meet the scale of the student debt crisis, but it also suffers from a much more mundane, yet equally fatal flaw: borrowers will generally have to contact their student loan servicer over the phone or online to secure a pause in their payments.

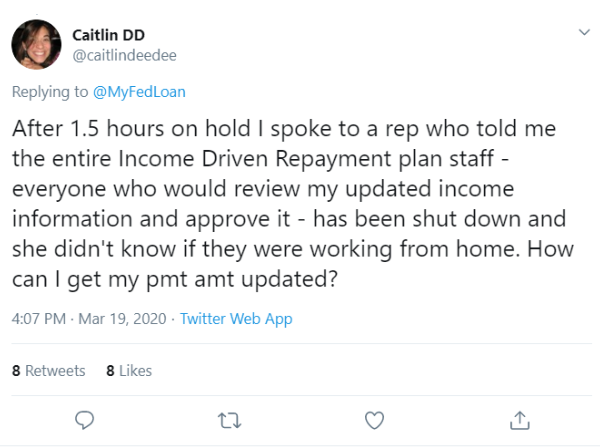

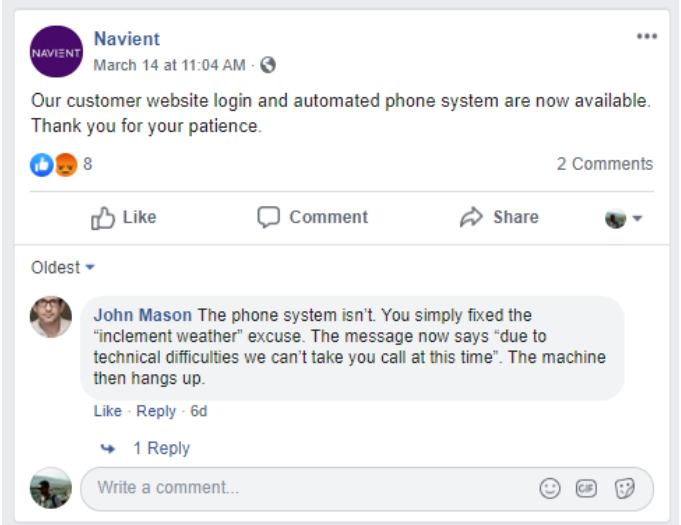

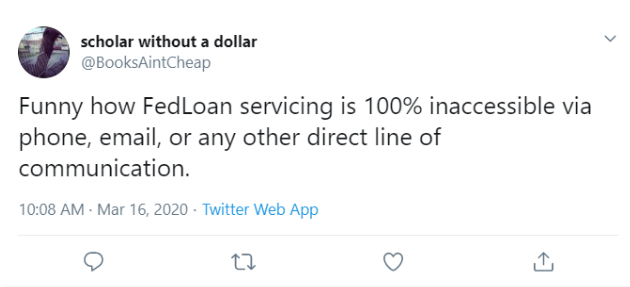

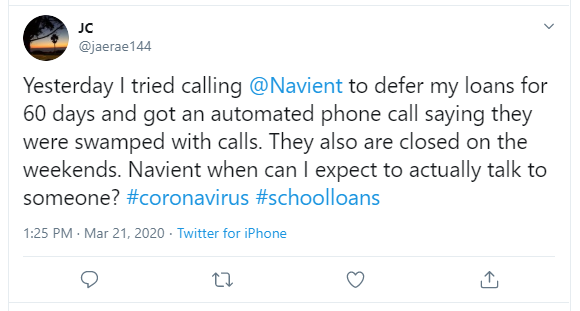

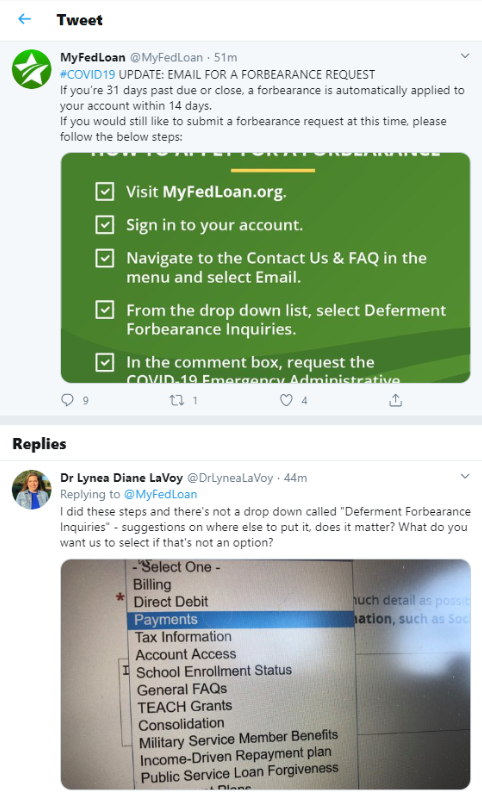

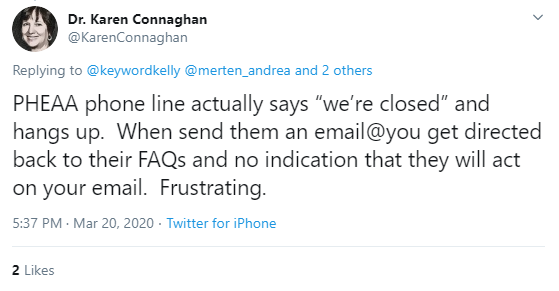

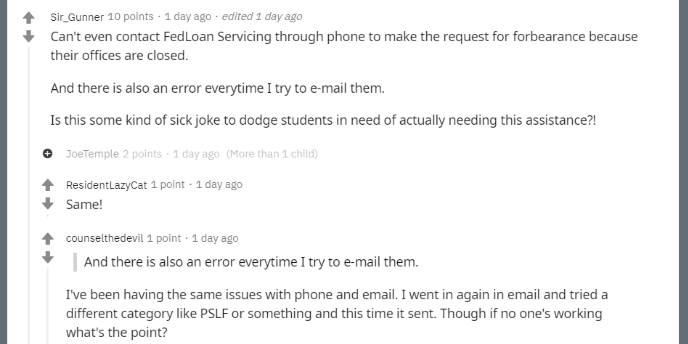

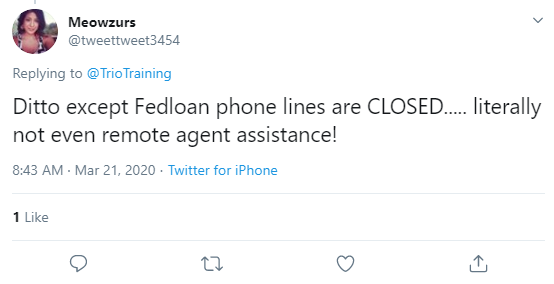

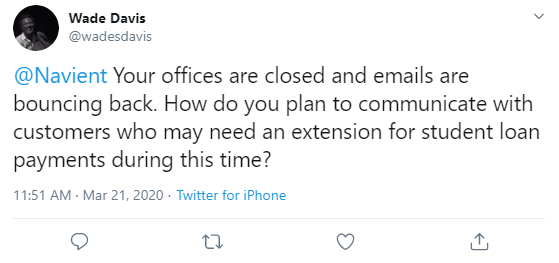

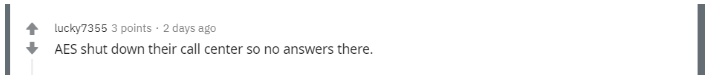

This ostensibly small hurdle is likely to further jam the gears of our broken student loan system, adding enormous headaches and unnecessary costs to borrowers already reeling from the fallout of the coronavirus pandemic. Even before the Administration announced a pause in payments on Friday, borrowers seeking help with their student loans were unable to get in touch with student loan servicer because of call center closures and new capacity issues amid the coronavirus outbreak:

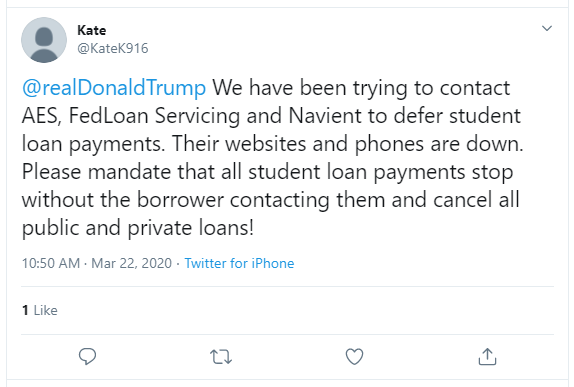

If social media are any indication, this situation has hardly improved in the weekend following the Administration’s announcement of a pause in payments:

Worse, the website of the Pennsylvania Higher Education Assistance Agency, the largest servicer of student loans owned by the Department of Education, had this to say Monday morning:

These companies were woefully unprepared to meet an influx of calls and emails before tens of millions of borrowers were told they would need to contact their student loan servicer to secure payment relief. There is no indication that these companies have since improved their capacity to assist. As borrowers in distress seek help over the coming days and weeks—looking not just to access the 60 day pause in payments, but also to enroll in income-driven repayment or invoke any of their other rights guaranteed under federal law—the student loan system, including the large private-sector financial services firms at its center, is clearly not up to the task.

These are disruptions that many borrowers cannot afford.

###

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau, where he worked as a Director’s Financial Analyst on issues related to student lending.