By Ben Kaufman | June 27, 2022

In June 2021, Colorado Governor Jared Polis signed the Student Loan Equity Act into law, securing key new safeguards for private student loan borrowers in the Centennial State. Those protections involve a new and badly needed array of transparency measures for private student loan companies operating in Colorado, including requirements for annual public reporting on lending and borrower outcomes by firms operating in the “shadow” student debt market. Shadow student debt covers a wide range of private financing products that fall outside of the mainstream of private student loans, such as income share agreements and institutional financing owed directly to schools. But while shadow student debt can be extremely expensive and risky, it has historically evaded regulators’ successful scrutiny.

Near the anniversary of the passage of the Student Loan Equity Act, it is clear that Colorado’s nation-leading work to shed light on shadow student debt and private student loans in general is paying off. In particular, Colorado Attorney General Phil Weiser recently published the first round of public disclosures that private student loan companies made under the state’s new law. The lenders’ reports offer a first-of-its-kind glimpse into the inner workings of some of the most notorious private student creditors and shadow student debt companies, including information on their portfolios and the contracts they offer students.

What this glimpse revealed is not pretty. Instead, the disclosures that lenders submitted under Colorado’s new law show that borrowers are being driven into high-cost private financing for dubious programs, that lenders are sneaking aggressive and possibly illegal contract terms into consumers’ contracts, and that the student loan industry may not be complying fully with Colorado’s new borrower protections. These findings confirm the importance of the steps Colorado has taken—and they heighten the need for governments at all levels to follow suit.

Our analysis of private education lenders’ disclosures pursuant to the Colorado Student Loan Equity Act uncovered the following:

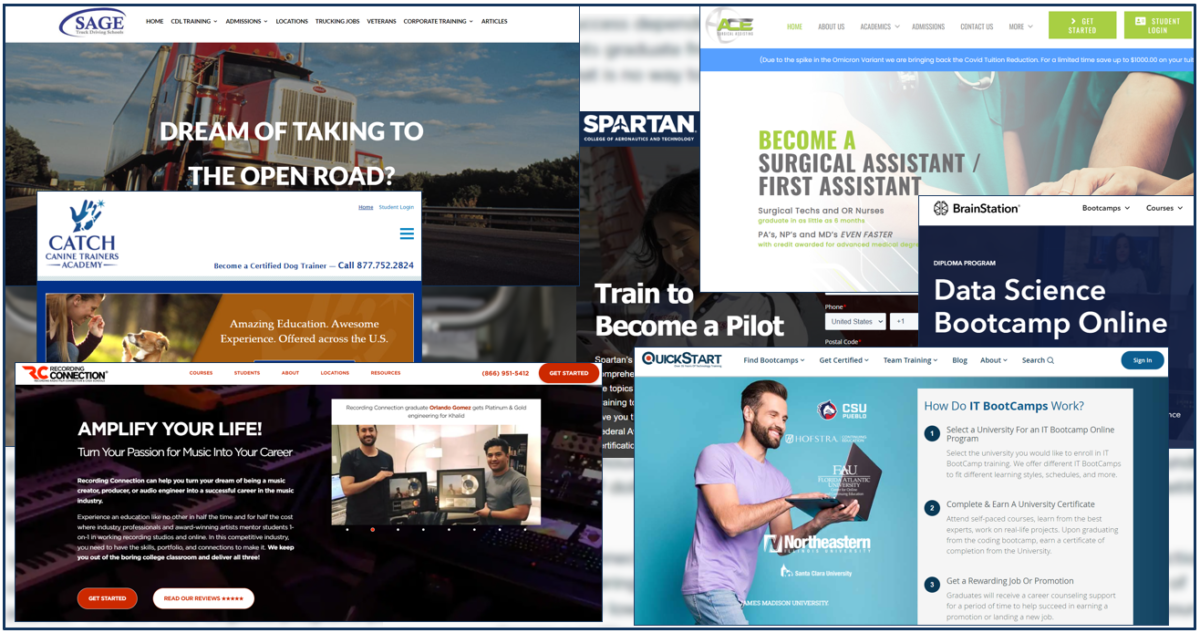

- Shadow student debt companies appear to be driving students into high-price debt for low-quality programs, producing widespread borrower defaults. Under the law, private student lenders in Colorado are required to disclose a list of all schools where they have provided credit to Colorado students, the volume of loans made to students at those schools, and the default rate on those loans. The disclosures lenders made for 2021 point to massive ongoing borrower harm. For example, the third party shadow student debt companies Climb Credit and Meritize, which offer hugely expensive financing that is mostly directed to students at short-term vocational programs, appear to have lent hundreds of thousands of dollars to students at schools that have produced default rates ranging as high as 99.9 percent. Similarly, institutional loan programs such as those available at the Academy of Natural Therapy and the Pima Medical Institute, which involve colleges lending directly to students, appear to have generated millions of dollars of debt that now face default rates well into the double digits. These findings eerily echo a long line of past scandals where fly-by-night operators have used expensive private credit at short-term credentialing programs to profit at students’ expense.

-

Private lenders are preying on students with highly aggressive contract terms and a staggering range of junk fees. Beyond reporting on their lending volumes and default rates, private student creditors in Colorado are required under the Student Loan Equity Act to offer up a copy of the model contracts or promissory notes they direct borrowers to sign when taking out a loan. Our review of the contracts lenders published for 2021 shows that these companies are subjecting Colorado students to a wide range of troubling, aggressive, and possibly even illegal loan terms and junk fees.

-

Lenders’ contracts show that they locked students into late fees of as much as $25, origination fees, administrative fees, transaction fees, income documentation fees, penalty interest rates and other fees for borrowers in default, and other hidden or unfair charges that mark the worst corners of the shadow student debt market. One institutional lender added provisions to its contract stating a borrower could be dropped from their course of study if they fell behind on their debts to the school. Worse, several creditors added fees of $20 or more for instances where a loan payment was returned because the borrower had insufficient funds in their bank account to cover it. These fees are likely to be particularly harmful, as a borrower’s bank can also impose a so-called “non-sufficient fund” fee on top of the student lender’s in cases where their balance isn’t enough to meet a given charge. Noting that non-sufficient fund fees average $34 apiece, a borrower could be out $54 or more in one fell swoop—all as punishment for being too financially strained to afford a shadow student lender’s bills.

-

Adding insult to injury, lenders also included in their contracts strict class action waivers and mandatory arbitration provisions that block harmed borrowers from seeking redress against lenders in the courts. At the same time, at least one lender left out key anti-fraud language that is legally required to be included in consumer contracts, making it all the more likely that borrowers will be in a legal lurch when they are taken advantage of by a scam school. Further, one lender included vague language saying borrowers would be in default if they could not show they were making “good faith efforts to seek full-time employment” clarifying what constitutes a good faith job search. This vagueness could be exercised aggressively to borrowers’ detriment, just like private student lenders have harshly applied tricky loan terms in the past. And finally, lenders peddling income share agreements—a form of shadow student debt with certain income-contingent features—deceptively included language in their contracts insisting that their product is “NOT A LOAN OR CREDIT,” even though federal law enforcement has already made clear that such assertions are false.

- In all, the disclosures lenders made under Colorado’s Student Loan Equity Act show that borrowers in the state are being driven into a wide variety of troubling terms and huge fees when taking on shadow student debt.

- Major shadow student debt companies that are known to operate in Colorado may not be complying with the Student Loan Equity Act. In publishing the disclosures that creditors made under the Student Loan Equity Act, Colorado included a list of all the private education lenders that are currently registered with the state. However, a review of publicly available information shows that several student loan companies apparently active in Colorado may have failed to register as necessary under the law. For example, the shadow student debt company Ascent advertises on its website that it provides financing to students at a coding bootcamp at Colorado State University—Pueblo (something the SBPC has highlighted before), but the company does not appear on the registry. Other lenders apparently active in Colorado that do not appear on the state’s private student lender registry include MPower and Stride Funding.[1] Further, it is likely that several income share agreement providers active in the online learning space such as Leif, Blair, MentorWorks, and Edly have lent to Colorado students via their bootcamp partners, but these companies appear not to have registered with the state. In all, while 17 lenders identified themselves for Colorado’s current round of disclosures, it is likely that many additional firms still need to meet their registration and reporting obligations under state law.

Lenders’ disclosures in Colorado provide a stark reminder of the startling variety of harmful strategies that shadow student debt companies deploy to prey on students. It’s long past due for policymakers and law enforcement at every level to wake up to the risks that shadow student debt poses for the public, take up Colorado’s mantle, and install the protections necessary to safeguard borrowers.

The path forward is clear. States that have already passed private student loan registry bills—a group that stretches from Maine to California, and that is growing at a brisk pace—must accelerate their work to hold shadow lenders accountable. States that have not begun cracking down on harmful practices in this space need to get to work, including by passing bills modeled after those already on the books in Colorado and elsewhere. And federal agencies such as the Consumer Financial Protection Bureau need to use the expansive authorities already at their disposal to rein in abuses by predatory firms exposed by this data.

For too long, companies in the shadow student debt market have hidden from responsibility for the damage they have wrought on students. It’s time for governments at every level and in every corner of the country to shed light on this risky space—and to follow wherever that light leads.

###

Ben Kaufman is the Director of Research & Investigations at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked on issues related to student lending.

[1] Note that various private companies in the student loan market that might otherwise have to register as private education lenders under Colorado law are exempt if they already have to have certain other licenses or registration, such as a license to operate as a student loan servicer. A list of licensed servicers is available here.