The Biden Administration Takes Unprecedented Action to Protect Borrowers from a Long-Broken, Predatory and Abusive Student Loan System; Half of Student Loan Borrowers May be Debt Free; New SBPC-Data for Progress Poll Shows Broad Public Support for Action

August 24, 2022 | WASHINGTON, D.C. — Today, President Biden announced an historic action to cancel student debt for tens of millions of Americans. Today’s action will provide up to $20,000 in debt cancellation to people with student debt who used a Pell Grant to pay for college and up to $10,000 in debt cancellation for all other borrowers, so long as borrowers earn less than $125,000 per individual or $250,000 per household. More information about this historic announcement is available here.

This announcement comes after years of advocacy for cancellation from a broad and diverse coalition. Most recently, more than 550 organizations from all 50 states called on President Biden to keep his promise to working families by immediately cancelling student loan debt via executive action.

These organizations—which include the NAACP, UnidosUS, American Federation of State, County and Municipal Employees (AFSCME), American Federation of Teachers (AFT), Communications Workers of America (CWA), International Brotherhood of Teamsters (Teamsters), International Federation of Professional and Technical Engineers (IFPTE), International Union, United Automobile, Aerospace, and Agricultural Implement Workers of America (UAW), National Education Association (NEA), National Nurses United (NNU), Service Employees International Union (SEIU), and United Food and Commercial Workers (UFCW), among many other economic justice and student debt-focused organizations—represent a major movement to cancel student debt in this country.

Statement from Student Borrower Protection Center Executive Director Mike Pierce:

“With the stroke of a pen, President Biden has kept his promise to voters and stepped in after decades of inaction, freeing millions from a long-broken, predatory and abusive student loan system. The Biden-Harris Administration has also made major strides in its effort to overhaul the student loan system itself, delivering billions of dollars in additional debt relief to public service workers, low-income people, people with disabilities, and people defrauded by predatory colleges.

“For decades, our government has made big promises to people with student debt but repeatedly failed to deliver. This time must be different. President Biden must ensure no one who now has a right to have their debt wiped away will be forced to pay a student loan bill in January. This means that the student loan system must remain shut off until the President keeps his promise to every single American with student debt.

“This progress is historic, but also just a start. Debt-free higher education remains out of reach for most people. On our current course, tens of millions of families will continue to struggle under the weight of student debt for decades to come. We applaud today’s action but we also recognize that we cannot rest until every American can climb the economic ladder free from the extraordinary burden of student debt.”

Statement from Student Borrower Protection Center Policy Director Persis Yu:

“As a result of President Biden’s action today to cancel $20,000 for borrowers who used a Pell Grant to pay for college and up to $10,000 in debt cancellation for all other borrowers, for the first time ever, as many as 20 million people will see their debts completely wiped out. For those borrowers—especially those who were in default on their loans—being relieved of this debt will be life-changing.

“With this announcement, the President has made clear that he understands better than any other president that our student loan system is too broken to continue with business as usual. The sad truth is: even the President’s unprecedented and remarkable action today is not enough. More relief is needed to end the national student loan crisis. Millions of borrowers, in particular low-income borrowers and borrowers of color who typically must take on more debt to get an education and are more likely to struggle to repay that debt, will remain trapped in debt.

“For decades, the U.S. Department of Education and its servicers have denied borrowers access to critical relief programs and imposed punitive collection measures, resulting in the borrowers who can least afford it paying more and for longer on their loans. President Biden’s action today is an important down payment on addressing many of the urgent problems facing our student loan system. Make no mistake, with proper implementation, it will deliver life-changing relief to millions of federal student loan borrowers. We look forward to the next steps.”

New Poll Shows Continued, Widespread Support for Action to Cancel Student Debt

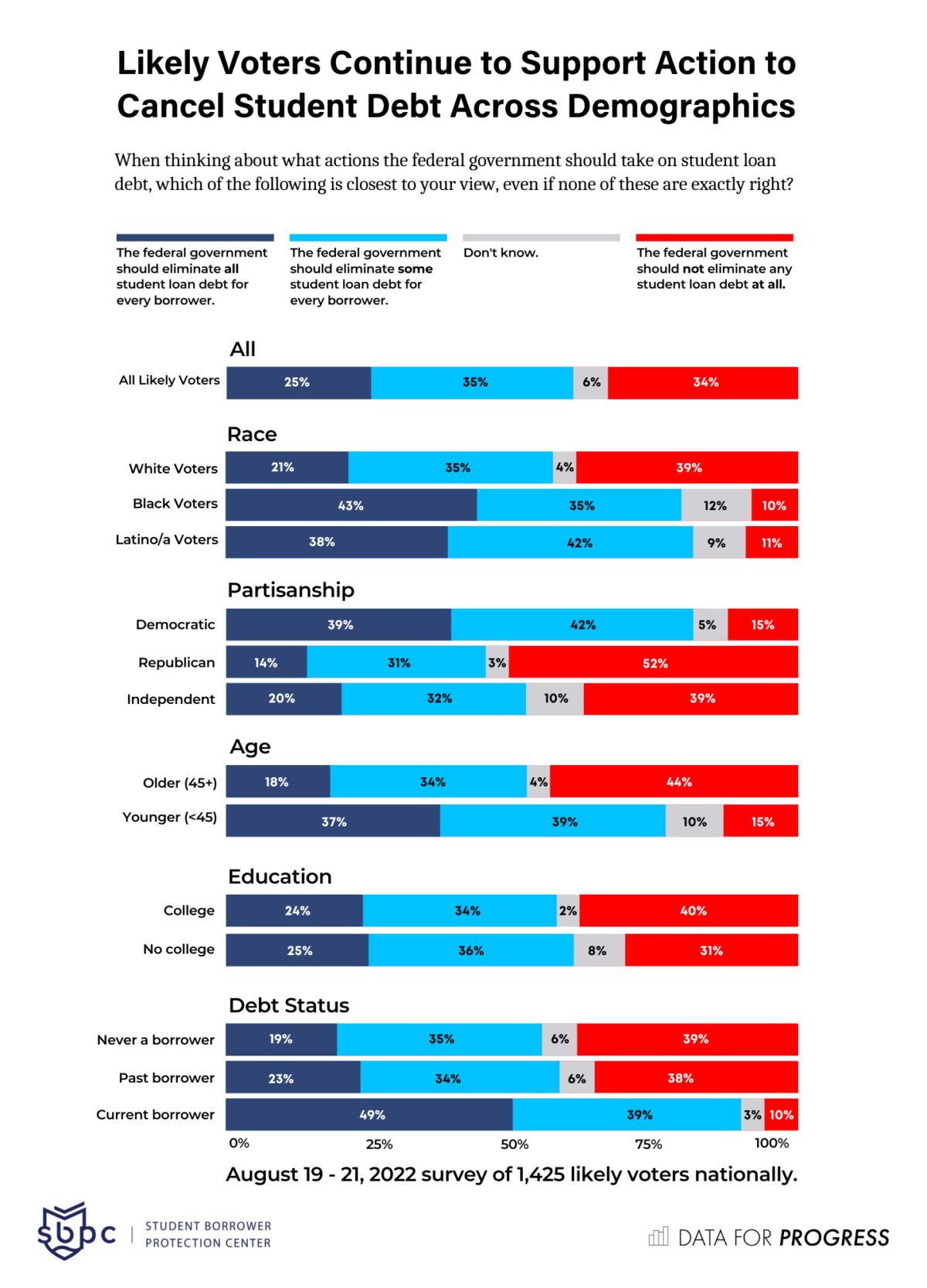

Today, Data for Progress (DfP) and the Student Borrower Protection Center (SBPC) also released their latest tracking poll finding that likely voters continue to support action to cancel student debt by nearly a 2:1 margin. According to today’s poll, 60 percent of likely voters support action to cancel “some” or “all” student debt “for every borrower,” including 61 percent of likely voters without a college degree, 54 percent of likely voters who have never had a student loan, and 57 percent of likely voters who previously paid off a student loan.

From August 19 to 21, Data for Progress conducted a survey of 1,425 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

Background

President Joe Biden repeatedly pledged to cancel student debt on the campaign trail, including as part of the Biden-Harris campaign commitment to center racial equity in policy making.

On May 27, 2022, Americans for Financial Reform, the Center for Responsible Lending, the National Consumer Law Center, Student Borrower Protection Center, Student Debt Crisis Center, and Young Invincibles led a coalition of more than 529 labor, civil rights, consumer, student, veterans, disability, and professional organizations in urging President Biden to take executive action and cancel student debt for everyone.

The organizations also highlight the disproportionate effects of student debt on borrowers of color, particularly Black borrowers. “To minimize the harm to the next generation and help narrow the racial and gender wealth gaps, bold and immediate action is needed,” these 529 organizations wrote. “President Biden should protect all student loan borrowers, by cancelling existing debts.”

This announcement comes after a growing consensus among experts, scholars, and lawmakers that the President has the legal authority to cancel student debt without any additional action by Congress. One year ago, President Biden instructed the U.S. Department of Justice and the U.S. Department of Education to determine whether such an action can be taken legally.

No student loan borrower with a federally-held loan has been required to make a student loan payment since March 2020 when former President Trump signed the CARES Act, pausing student loan payments and suspending interest charges for tens of millions of student loan borrowers. This set of protections was extended via executive actions taken in August 2020, December 2020, January 2021, August 2021, December 2021, April 2022, and now through December 31, 2022.

Further Reading

SBPC Blog Calling for an Extension to the Payment Pause as a Civil Rights Issue: The End of the Payment Pause is a Civil Rights Issue

Bethany Lilly and Persis Yu’s Op-Ed in Inside Higher Ed on the Need for Automatic Relief: Targeted Loan Relief Doesn’t Work

SBPC and NCLC Blog Highlighting New Revelations of Mismanagement and Abuse Compromising the Student Loan Safety Net: Explosive New Evidence of Mismanagement of Student Loan Program Shows Need for IDR Waiver

Persis Yu’s Op-Ed in The Hill on the Need for a Fresh Start for Borrowers in Default: There’s a Fair and Humane Way to Restart Student Loan Repayments

SBPC Blog Analyzing Government Data on Borrowers in Default: ED Must Build Back a Better Student Loan System, and That Means Giving Borrowers a Second Chance

2021 SBPC and NCLC Letter Calling for a “Fresh Start” for Defaulted Borrowers: SBPC and NCLC Demand President Biden Give a Second Chance to Millions of Student Loan Borrowers in Default

2021 SBPC and NCLC Blog on Student Loan Default and the Child Tax Credit:Without Action, Millions of Families Will Be Denied Biden’s Top Anti-Poverty Lifeline Because of Student Loans

###

About Student Borrower Protection Center

The Student Borrower Protection Center (SBPC) is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.