By Tamara Cesaretti and Ben Kaufman | February 2, 2021

Since the start of COVID, advocates have repeatedly warned that student loan borrowers were at risk of widespread servicing breakdowns, predatory debt collection tactics, and unnecessary hardship due to policy choices made by the leadership of Betsy DeVos’s Department of Education. In particular, as lawmakers, investigative reporters, scholars, and law enforcement have all demonstrated, Betsy DeVos took extensive and unprecedented administrative action during her time as Secretary of Education to block the CFPB and state consumer protection agencies from overseeing and enforcing state consumer protection laws against federal student loan servicers.

Betsy DeVos took extensive and unprecedented administrative action during her time as Secretary of Education to block the CFPB and state consumer protection agencies from overseeing and enforcing state consumer protection laws against federal student loan servicers.

This obstruction has meant that student loan borrowers could not and still cannot depend on independent, vigorous oversight of the companies that borrowers rely on to deliver badly needed COVID-related student loan relief. In turn, this lack of oversight implies that borrowers can be taken advantage of or be left with low-quality service when they are most vulnerable.

Now, a new report from the Consumer Financial Protection Bureau (CFPB) shows that student loan servicing companies’ conduct during COVID has been even more error-ridden and harmful to borrowers than advocates feared. Titled “Supervisory Highlights COVID-19 Prioritized Assessments Special Edition,” the publication offers a catalog of breakdowns across consumer financial markets during the pandemic. In this report, the CFPB details widespread errors in the implementation of the CARES Act and startlingly insufficient measures by servicers to meet the demands of the current moment, leaving borrowers on the brink as COVID has worsened.

Moreover, while the Bureau’s “Supervisory Highlights” publications are usually based on observations gleaned through industry examinations that the CFPB undertakes, this publication featured observations drawn from so-called “prioritized assessments,” which, in the Bureau’s view, were based on “higher-level inquiries than traditional examinations.” In the student loan market, Betsy DeVos’s obstruction has meant that findings related to federal student loans were made in isolation—in sharp contrast with every other regulated financial market supervised by the CFPB and subject to regular examinations, in addition to the oversight described in this report. The level of borrower hardship and industry failure visible even in this limited review makes clear that the federal student loan servicing market is in desperate need of the thorough oversight and enforcement already required under federal and state law.

In fact, the CFPB has now identified more COVID-era problems in the student loan servicing market than in any other financial market it oversees aside from mortgage servicing.

The policies put in place by the Trump-era Education Department continue to obstruct critical law enforcement work required to clean up the market. Unless Betsy DeVos’s policies are immediately rolled back by the Biden administration, student loan companies will still have free rein to harm borrowers during the pandemic without accountability.

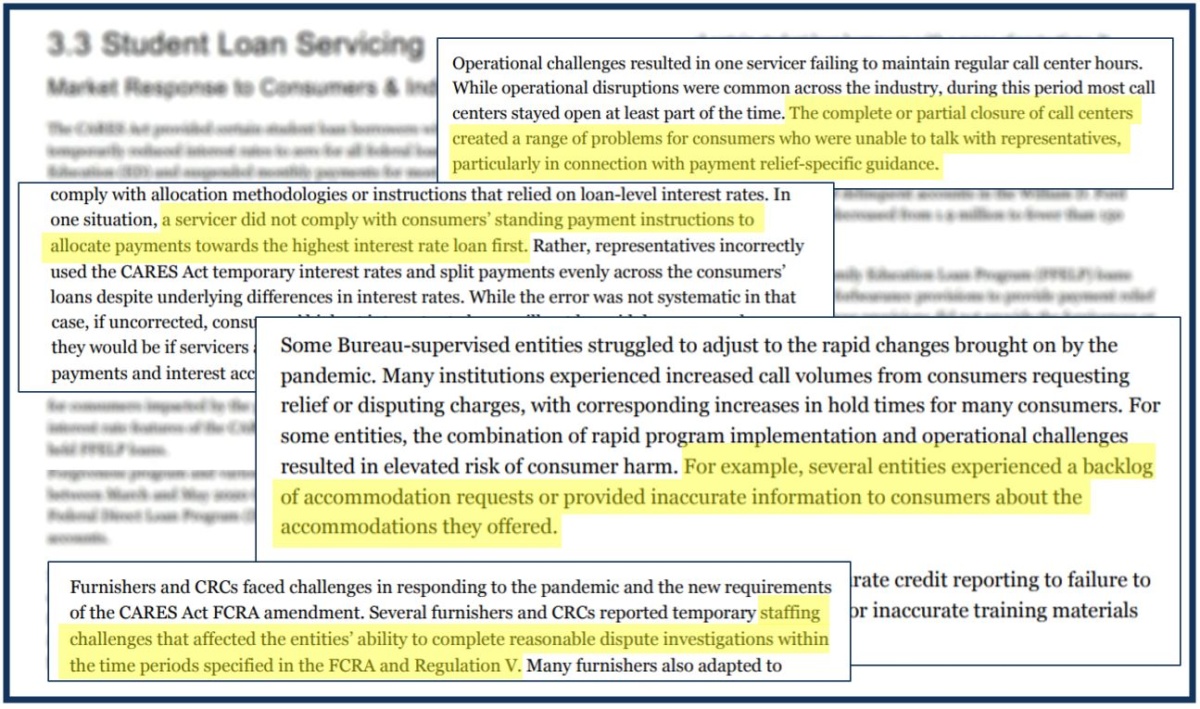

Industry conduct uncovered in the CFPB’s report includes the following:

- Borrowers were regularly given incorrect or incomplete information regarding the availability of payment relief, keeping them away from badly needed assistance;

- Federal student loan servicers broadly struggled to implement the provisions of the CARES Act, hindering borrowers from accessing relief that they were entitled to under the law; and

- While borrowers struggled, student loan companies and credit reporting agencies cut back on staffing, blocking borrowers’ access to payment relief and leaving borrowers with nobody to turn to to address errors in their credit histories.

Make no mistake—these findings are the consequence of Betsy DeVos’s decision to block supervision, oversight, and accountability for student loan servicing companies. Student loan servicers had already resoundingly failed borrowers before COVID, and it is now clear that they did so during COVID as well. And while this happened, Betsy DeVos sidelined the very people tasked by Congress and state legislatures across the country to stand up to protect borrowers. DeVos affirmatively demanded that student loan companies refuse to comply with law enforcement requests, a move so unprecedented as to even have drawn rebuke from her Trump administration colleagues.

In fact, in addition to the Bureau, there are now over a dozen states—including the future Education Secretary’s home state of Connecticut—standing at the ready to protect student loan borrowers during COVID and beyond. But because of Betsy Devos, those states have too often been sidelined and unable to help borrowers struggling in the face of widespread abuses in the PSLF program, routine failures to access payment protections that borrowers depend on even normal times, and now an inability to get help as the pandemic continues to worsen.

This needs to end.

A new day has arrived at the Department of Education. The Biden administration has a critical chance to demonstrate that—unlike Betsy DeVos—it views law enforcement and regulators as critical partners in the oversight of federal student loan servicers rather than as targets worthy of unprecedented obstruction. To seize this moment, the Administration must swiftly reassert the federal government’s commitment to consumer protection. And while there is much work to be done on that front, the Biden administration can get started immediately by rescinding the disastrous guidance that has blocked states and the nation’s top consumer watchdog from conducting robust, independent oversight and enforcement of the student loan market.

With this simple fix, borrowers will have a chance at finally securing the help they need and deserve during the pandemic and beyond. But the Department must act now.

###

Tamara Cesaretti is a Counsel at the Student Borrower Protection Center. She joined the SBPC after developing a passion for ending the student debt crisis while working as a civil rights policy advocate at the intersection of economic justice and educational opportunities.

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked as a Director’s Financial Analyst on issues related to student lending.