By Ben Kaufman | January 26, 2021

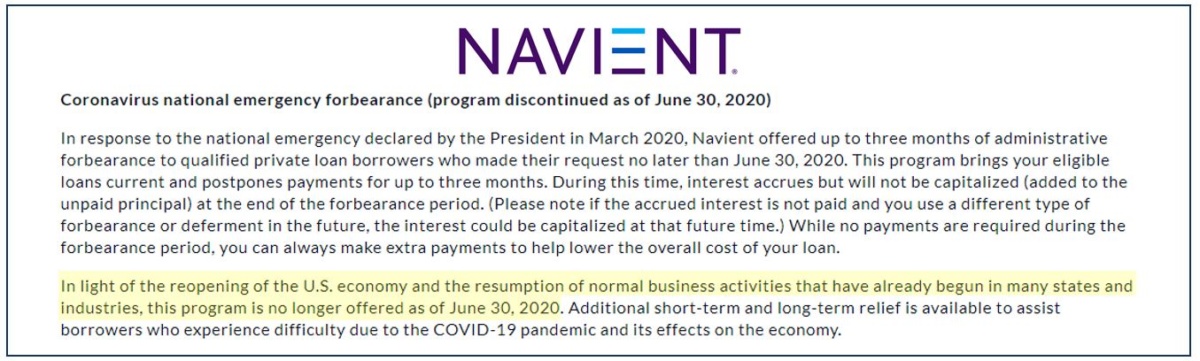

Throughout the pandemic, millions of borrowers owing hundreds of billions of dollars in privately owned student loans have been left with little or no relief even as they have been pushed to the brink during this challenging time. These borrowers were not covered by the protections of the CARES Act, the administrative extension of payment relief for federal student loans, and much of the conversation surrounding possible future aid. Almost a year into COVID, the patchwork of short-term solutions that the companies that own this debt offered borrowers in distress have largely expired. In at least one case, a company companies have been caught claiming that the end of these protections is justified, as the pandemic—in their telling—is simply over.

In other instances, the availability of private student loan relief during the pandemic was illusory to begin with, as borrowers in dire financial straits struggled to get someone from their student loan company simply to pick up the phone. Worse, like the coronavirus itself, the lack of protections for private student loan borrowers during the pandemic is likely to hit low-income communities and communities of color the hardest.

But while private student loan borrowers across the country have struggled to make ends meet during COVID, their creditors have been offered generous relief from the federal government.

The Term Asset-Backed Securities Loan Facility

First, some of the largest names in the private student loan market have been saved by massive assistance from the Federal Reserve through the Term Asset-Backed Securities Loan Facility (TALF), a lending program that the Fed set up when COVID hit to keep credit markets afloat. Under the TALF, the Fed provides ultra-cheap financing to kickstart the purchase of “asset-backed securities” (ABS), which are bundled pools of loans such as student loans, auto loans, or credit card loans.

In theory, the TALF is simply meant to keep loans flowing when the market might otherwise seize up. But in practice, the TALF has provided a massive sales opportunity for private student lenders. For example, student loan ABS issued by the infamous student loan giant Navient were used to collateralize over $276 million in loans through the TALF, creating a more-than-a-quarter-billion-dollar market for Navient’s ABS products. Similarly, student loan ABS issued by the student lender SoFi were used to collateralize more than $12 million in loans made through the TALF, making a multi-million-dollar market for SoFi’s securities. But we shouldn’t be surprised about federal agencies intervening to offer industry a hand during a crisis. After all, when the last financial meltdown hit in 2008, a little-known program set up through the Treasury Department offered well over $100 billion to companies like Sallie Mae, JPMorgan Chase, and Wells Fargo to protect these companies from absorbing losses on their student loan books—in addition to almost $9 billion in support from the original version of the TALF program.

The Paycheck Protection Program

Private student loan companies have also received direct relief from Congress. In particular, companies spanning every corner of the private student loan market—from big-name refinancing specialists to shadow student loan companies and ISA providers—have received substantial assistance through the Paycheck Protection Program.

Here are a few private student loan companies enjoying the benefits of PPP loans and how much they have received:

Along with the assistance provided through the TALF, this aid amounts to over $300 million in pandemic relief for private student loan companies. And should even a dollar of PPP loans to student lenders be forgiven—as these loans are intended to be under the design of the program—that dollar will amount to more relief than borrowers have received on their private student loans throughout the entire coronavirus crisis.

The coronavirus pandemic continues to worsen, tens of millions remain unemployed, and—adding insult to injury—private student loan companies have recently flipped the switch to restart their debt collection machine. Private student loan companies received help. It’s time for policymakers at all levels of government to step up and offer private student loan borrowers the same.

###

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau where he worked as a Director’s Financial Analyst on issues related to student lending.