By Ben Kaufman | April 30, 2020

Today, the SBPC released a new report examining the private student loan market. The report offers a snapshot of recent trends and borrower outcomes in the space, indicating a critical need for more rigorous borrower protection at the federal, state, and local level.

For years, the private student loan market has been overshadowed by the much larger federal student loan market. However, as our new report demonstrates, the private student loan market is growing rapidly while many vulnerable borrowers struggle under the weight of their debts. Further, because this market lacks many of the transparency and reporting requirements present in other consumer financial markets, borrowers face a substantially heightened risk of harm. Significant accountability and consumer protection reforms are needed to safeguard the millions of borrowers whose lives this market touches.

The full report can be viewed here.

Key takeaways:

The private student loan market is booming, growing faster than other major consumer financial markets.

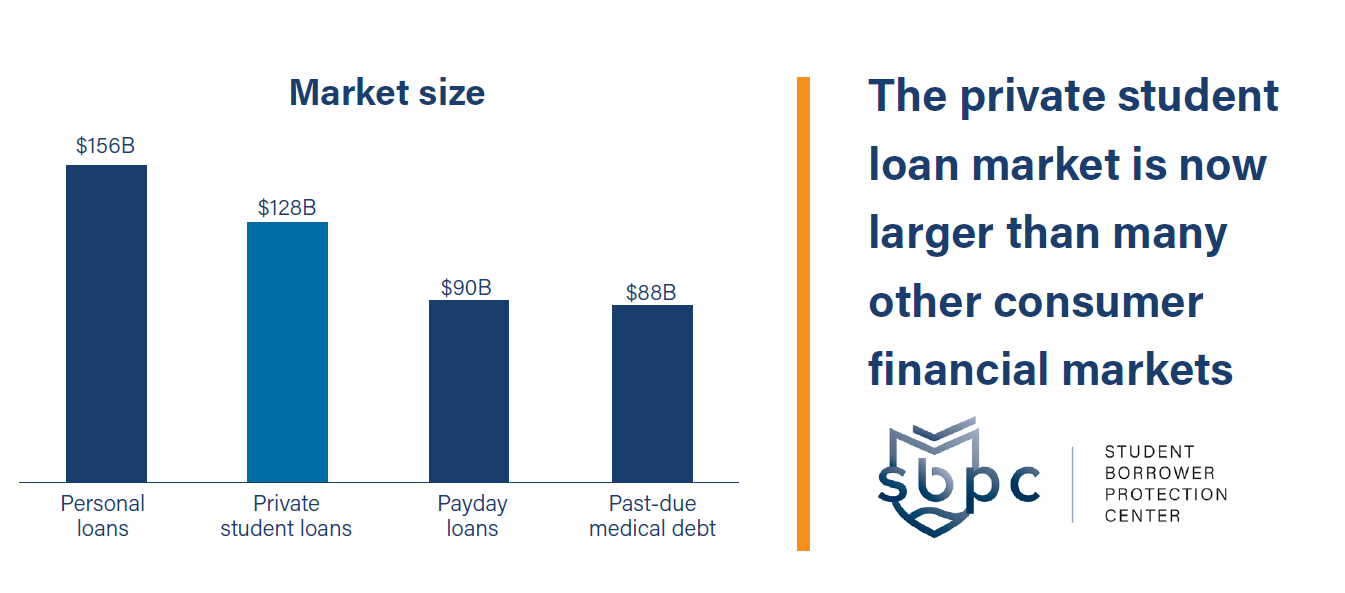

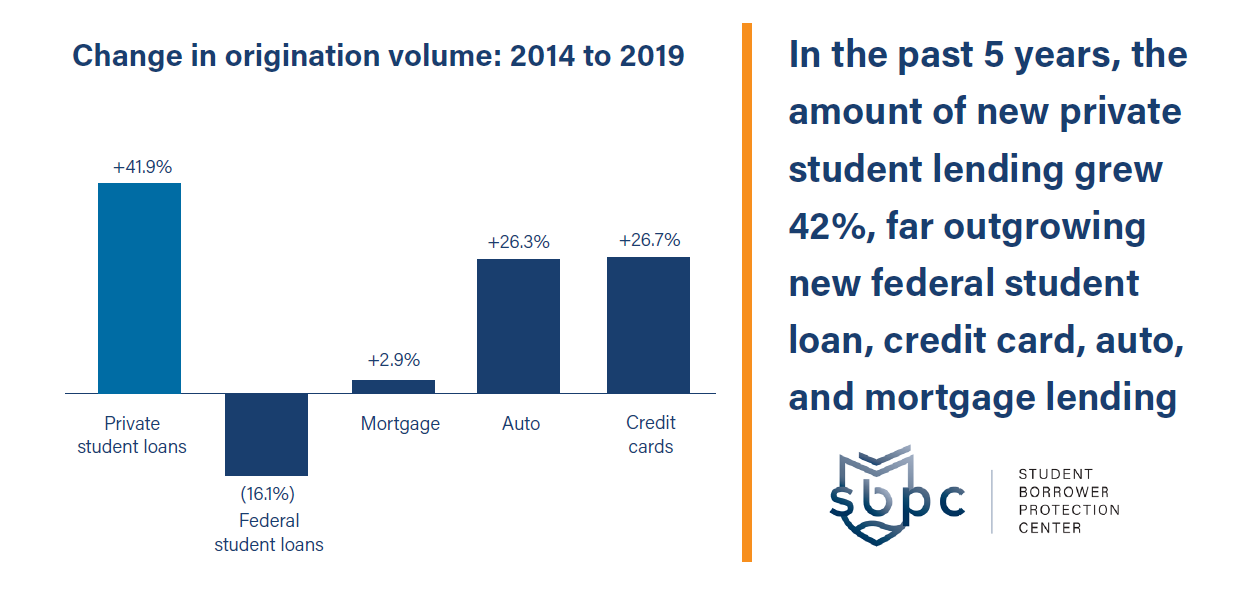

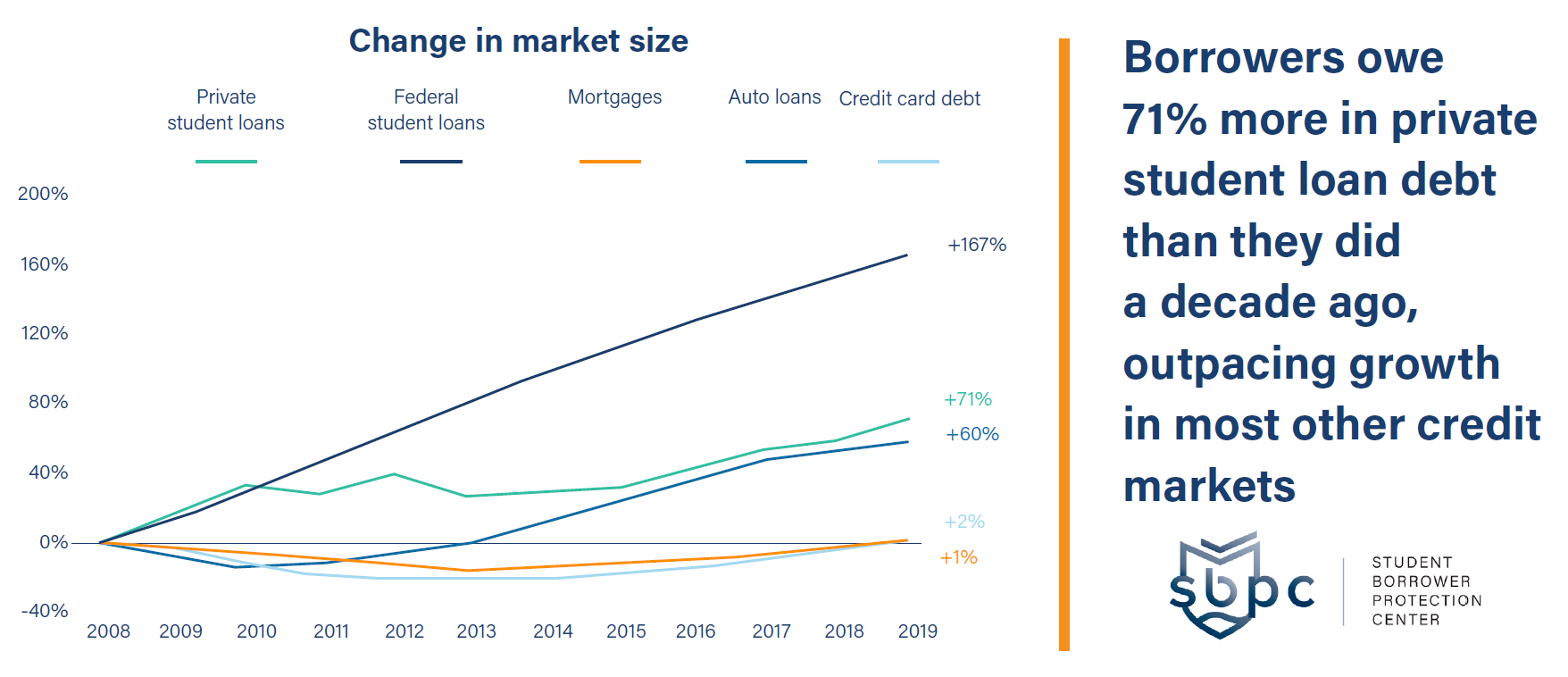

- Over the past decade, the amount of outstanding private student loans grew 71 percent. The market now stands at nearly $130 billion, surpassing the payday loan market in size. Recent growth in private student loans has outpaced the rate of growth in auto loans, credit cards, and mortgages. In the past five years, the amount of new private student lending grew 42 percent.

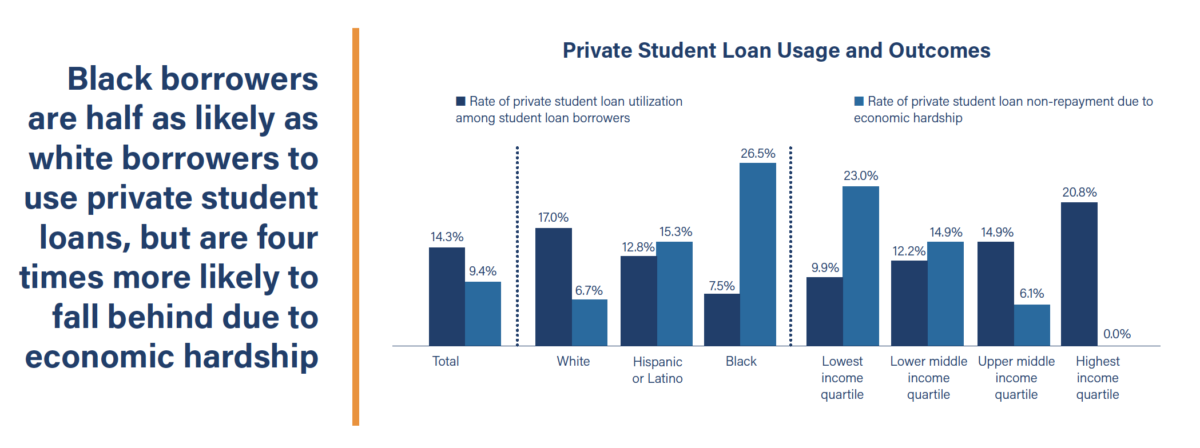

Borrowers of color and low-income borrowers frequently face distress when repaying their private student loans.

- Black borrowers are half as likely as white borrowers to use private student loans, but black borrowers who do are four times more likely to fall behind in repayment due to economic hardship.

- Nearly a quarter of low-income private student loan borrowers report falling behind due to economic hardship. Although low-income borrowers are less likely to take on private student loan debt compared to borrowers in other income groups, they have the highest rate of financial distress.

Students at for-profit schools are more likely to rely on private student loans and more likely to experience student loan distress.

- Students at for-profit institutions are 36 percent more likely than students at public or private nonprofit colleges to rely on private student loans, and they fall behind on student loans at more than three times the rate.

- A quarter of private student loan borrowers at for-profit schools have private student debt balances of $11,600 or more, and one-in-ten has debts of $16,505 or more.

Tens of thousands of private student loan complaints and ongoing lawsuits in courtrooms across the country point to extensive consumer harm in the private student loan market.

- More than 36,000 private student loan borrower complaints have been submitted to the CFPB as of April 2020. In other words, the CFPB receives more than 12 complaints every day about private student loans.

Older consumers are increasingly saddled by tens of thousands of dollars of private student debt.

- One-in-ten private student loan borrowers aged 55 or older owes a balance greater than $40,000.

- Currently, 93 percent of outstanding private student loans are cosigned. 57 percent of all private student loan cosigners are age 55 or older.

Private student loans lack the same transparency and public reporting requirements present in many other consumer financial markets, heightening the risk of consumer harm.

- Mortgage lenders and credit card companies have reporting requirements under federal consumer financial laws that promote accountability and allow policymakers and law enforcement to spot problems in the market. In contrast, there are no catch-all reporting requirements for private student lenders, creating a $130 billion blind spot for regulators and the public.

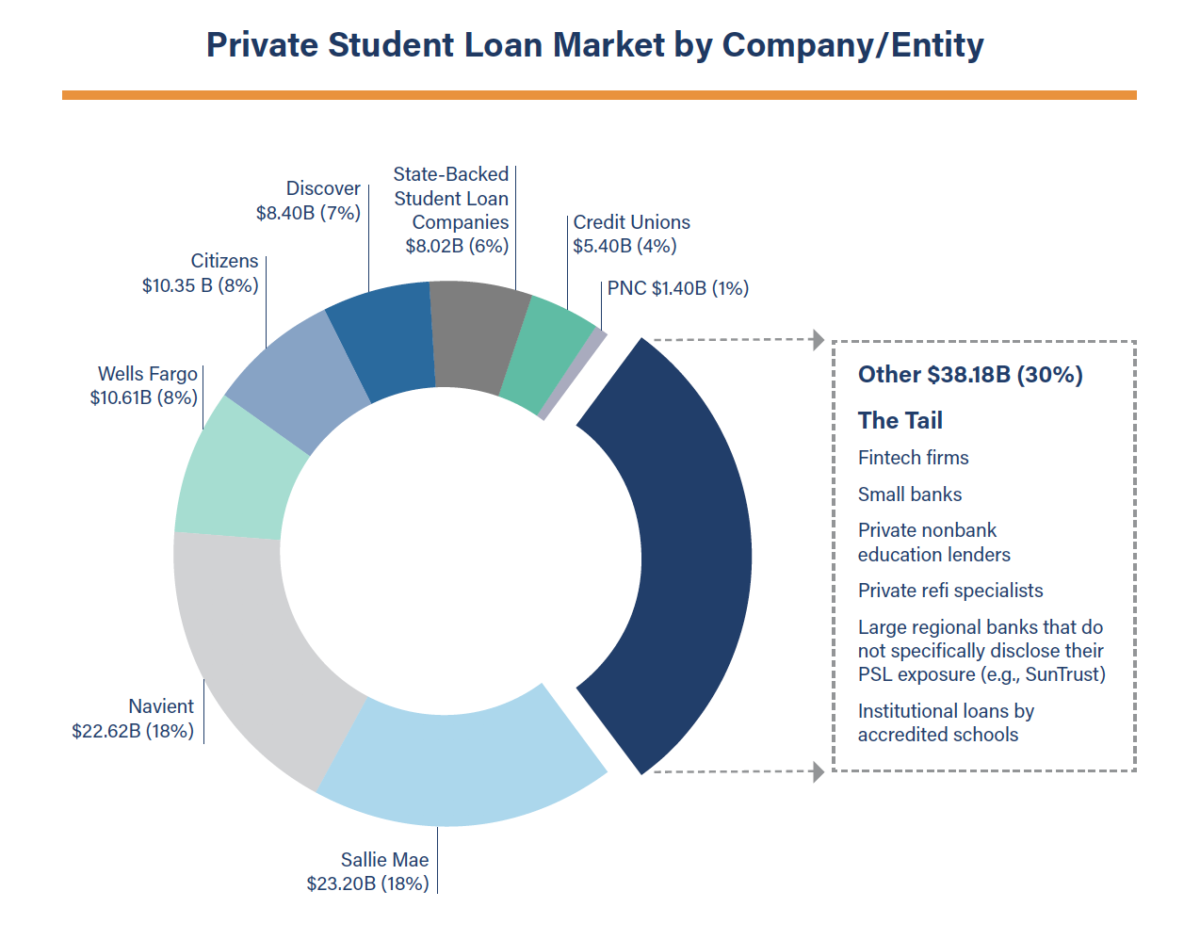

- Nearly one-third of the private student loan market has never been scrutinized, falling outside of the scope of past research compiled by regulators and private credit analysts. Little is known about the loans in this $38 billion segment of the market, including what entities make these loans, who borrows them, or how those borrowers fare in repayment.

As policymakers and law enforcement officials at every level work across financial markets to protect consumers, the private student loan market demands attention and reform. There is no time to waste in advancing the oversight measures, transparency rules, and robust enforcement mechanisms highlighted in this report to protect private student loan borrowers.

###

Ben Kaufman is a Research & Policy Analyst at the Student Borrower Protection Center. He joined SBPC from the Consumer Financial Protection Bureau, where he worked as a Director’s Financial Analyst on issues related to student lending.