The First Survey in a Series Exploring the Impact of Student Debt on American Families Finds More than 6-in-10 Borrowers Will Need to Make Major Changes to Saving and Spending if Payments Resume in May; Nearly 4-in-10 Expect to be Unable to Pay

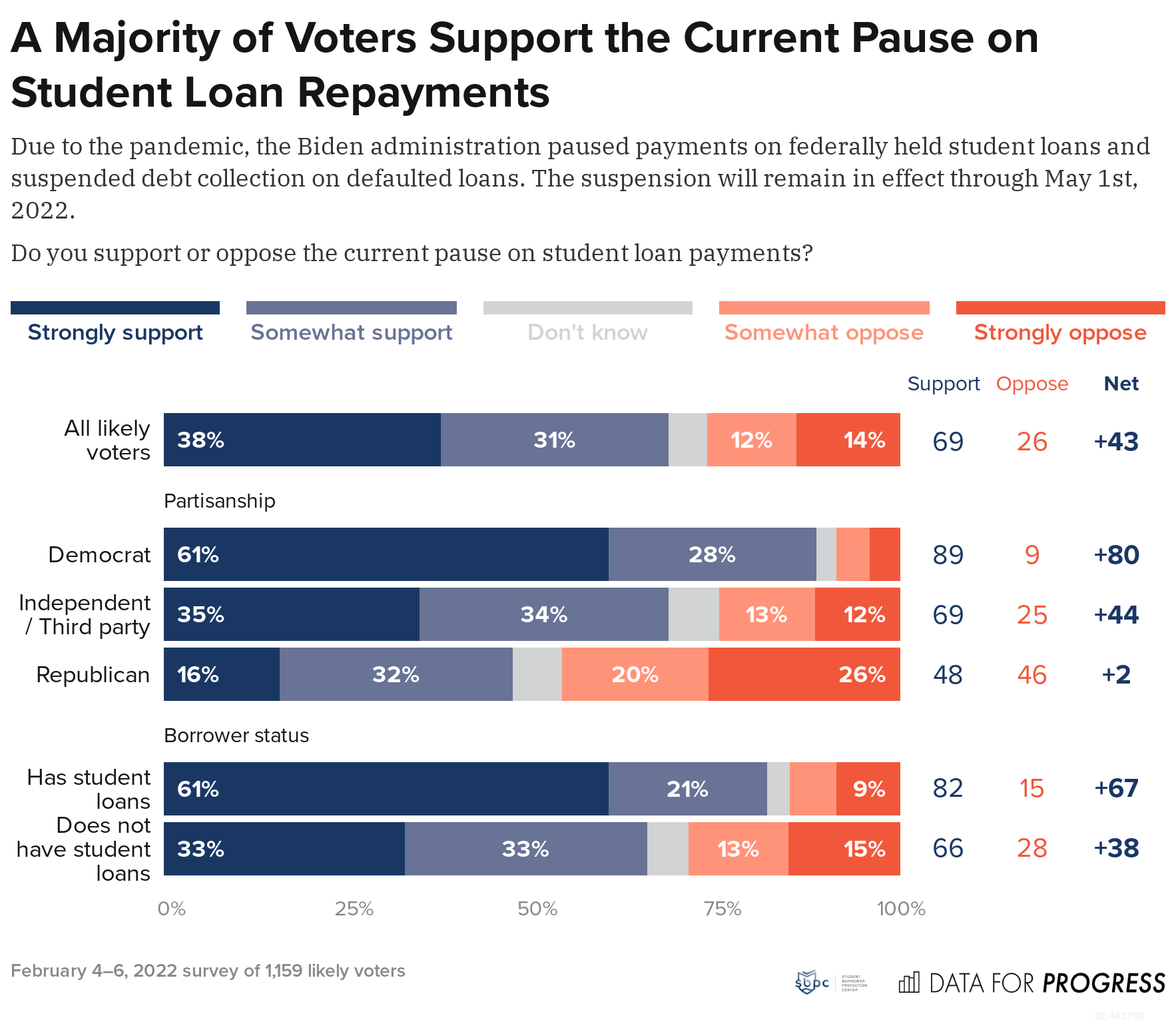

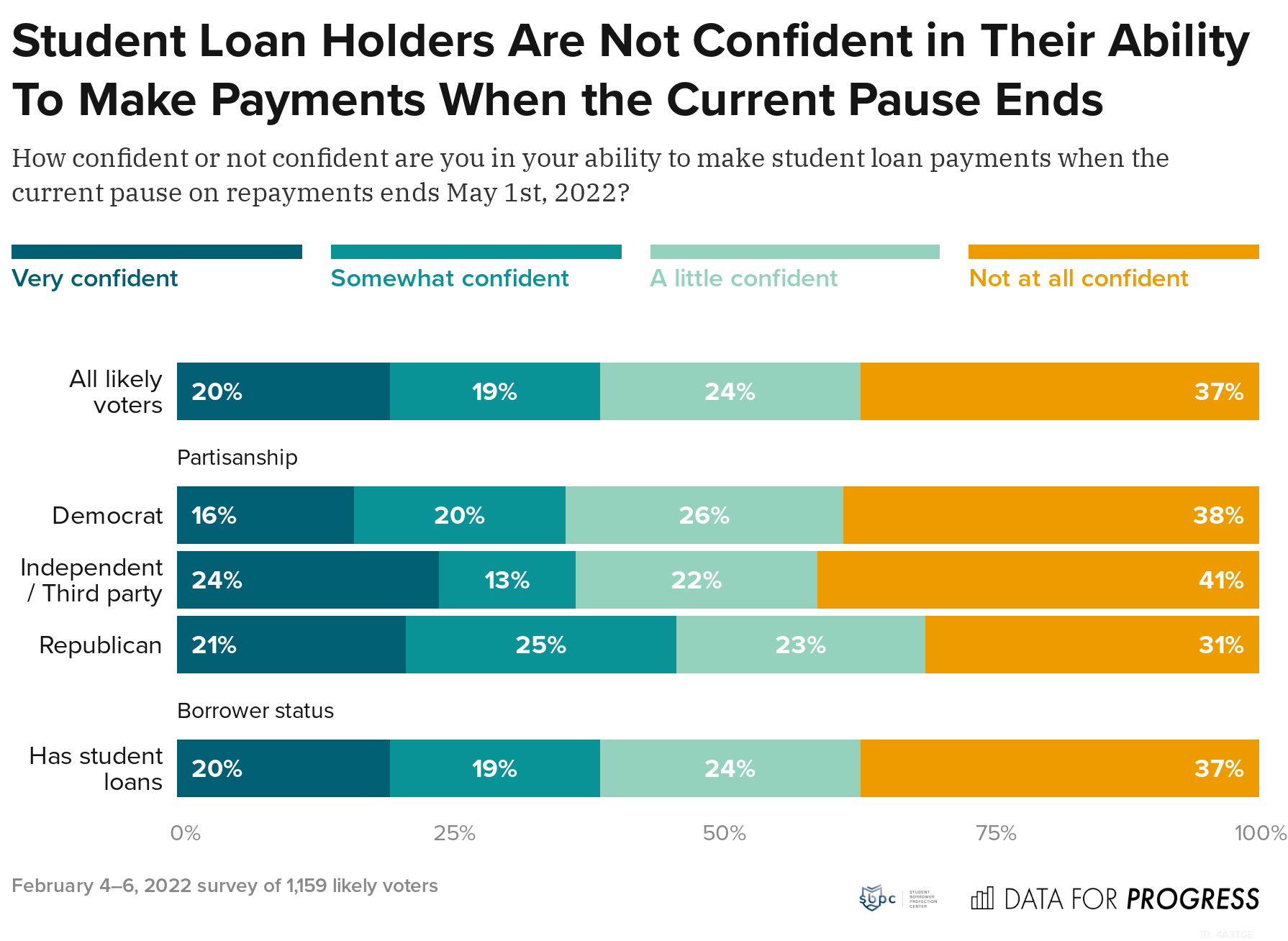

February 10, 2022 | WASHINGTON, DC — Today, Student Borrower Protection Center and Data for Progress released the first in a series of tracking polls exploring the impact of student debt on American families. The new poll reveals that 69 percent of likely voters support President Biden’s continued pause on student loan payments, including majorities of Democrats, Republicans, and Independents. The current pause on student loan payments, last extended by President Biden in December 2021, is slated to expire on May 1, 2022. Among respondents with student debt, 65 percent expect to make “major changes to saving or spending” if payments resume. Nearly 4-in-10 borrowers are “not confident at all” in their ability to manage a student loan payment, while just 1-in-5 borrowers are “very confident.” These results underscore the need for the Biden Administration to delay the planned restart of federal student loan payments until the end of the COVID-19 pandemic.

“Two years into the COVID-19 pandemic, people with student debt are still facing financial hardship. While the payment pause has been a lifeline, borrowers and their families now face surging inflation and waves of new variants, even as the threat of a future student loan bill remains just around the corner,” said SBPC executive director Mike Pierce. “Flipping back on the switch to the student loan system ignores economic reality for tens of millions of people.”

“Amongst national likely voters, it’s clear there is significant support for the Biden Administration’s current student loan pause — and appetite for an additional extension through the end of 2022,” said Ethan Winter, Senior Polling Analyst at Data for Progress. “As Americans begin to get back on their feet after two years of a devastating pandemic, it’s clear that continuing this pause isn’t just the right thing to do — it’s good politics for Democrats.”

Inflation continues to batter household balance sheets as American families are forced to stretch their finances to cover the rising costs of basic necessities including food, transportation, and heat. Today, the U.S. Bureau of Labor Statistics released new economic data indicating that the American economy is currently experiencing the highest level of inflation in four decades. Prices rose 7.5 percent in January when compared to a year prior.

Today’s poll is the first in a series from Data for Progress and the Student Borrower Protection Center tracking public opinion on issues related to student debt and economic security. This new poll, conducted by Data for Progress between February 4 and 6, 2022, also shows that among student loan borrowers who express anxiety about the economic effects of looming student loan payments, many expect to offset new financial pressure by taking on more debt or forgoing basic necessities.

In January, White House press secretary Jen Psaki suggested that the Biden White House and the U.S. Department of Education are considering a further extension of the pause on student loan payments, interest charges, and debt collection in response to the ongoing public health emergency. Today’s poll shows that an extension through December 2022 is broadly popular– nearly two-thirds of likely voters support an extension, including nearly 6-in-10 likely voters who do not owe student debt.

From February 4 to 6, 2022, Data for Progress conducted a survey of 1,159 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

Background

In December 2021, the Student Borrower Protection Center led a coalition of more than 200 labor, civil rights, consumer, student, veterans, disability, and professional organizations in urging President Biden to extend the pause on student loan payments until the end of the COVID-19 pandemic, citing continued economic uncertainty among people with student debt and the urgent need for executive action to cancel student debt for everyone.

The SBPC and coalition partners have previously warned that the projected end of the payment pause will come precisely as badly needed benefits such as expanded monthly Child Tax Credit benefits are receding, leaving millions of American households to face hundreds of dollars in added costs even while COVID continues to ravage the country. Moreover, the SBPC has warned that the persistent failure of the student loan industry to guide borrowers toward protections that they were entitled to under the law during COVID remains unaddressed, leaving millions to languish in—and face the massive consequences of—default on their student loans.

Today, the U.S. Bureau of Labor Statistics released new economic data indicating that the American economy is currently experiencing the highest level of inflation in nearly four decades. Prices rose 7.5 percent in January when compared to last year. For families across the country, this means that the cost of food, housing, and other basic necessities has spiked, even as the prospect of a student loan bill looms.

###

About Data for Progress

Data for Progress is a progressive think tank and polling firm which arms movements with data-driven tools to fight for a more equitable future. DFP provides polling, data-based messaging, and policy generation for the progressive movement, and advises campaigns and candidates with the tools they need to win. DFP polling is regularly cited by The New York Times, The Washington Post, MSNBC, CBS News, and hundreds of other trusted news organizations.

Learn more at dataforprogress.org or follow DFP on Twitter at @dataprogress.

About Student Borrower Protection Center

Student Borrower Protection Center is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.