With Historic Inflation Hitting Wallets Nationwide and Steady Support for the Payment Pause, President Biden Would Receive Broad Backing for Extending Repayment Deadlines

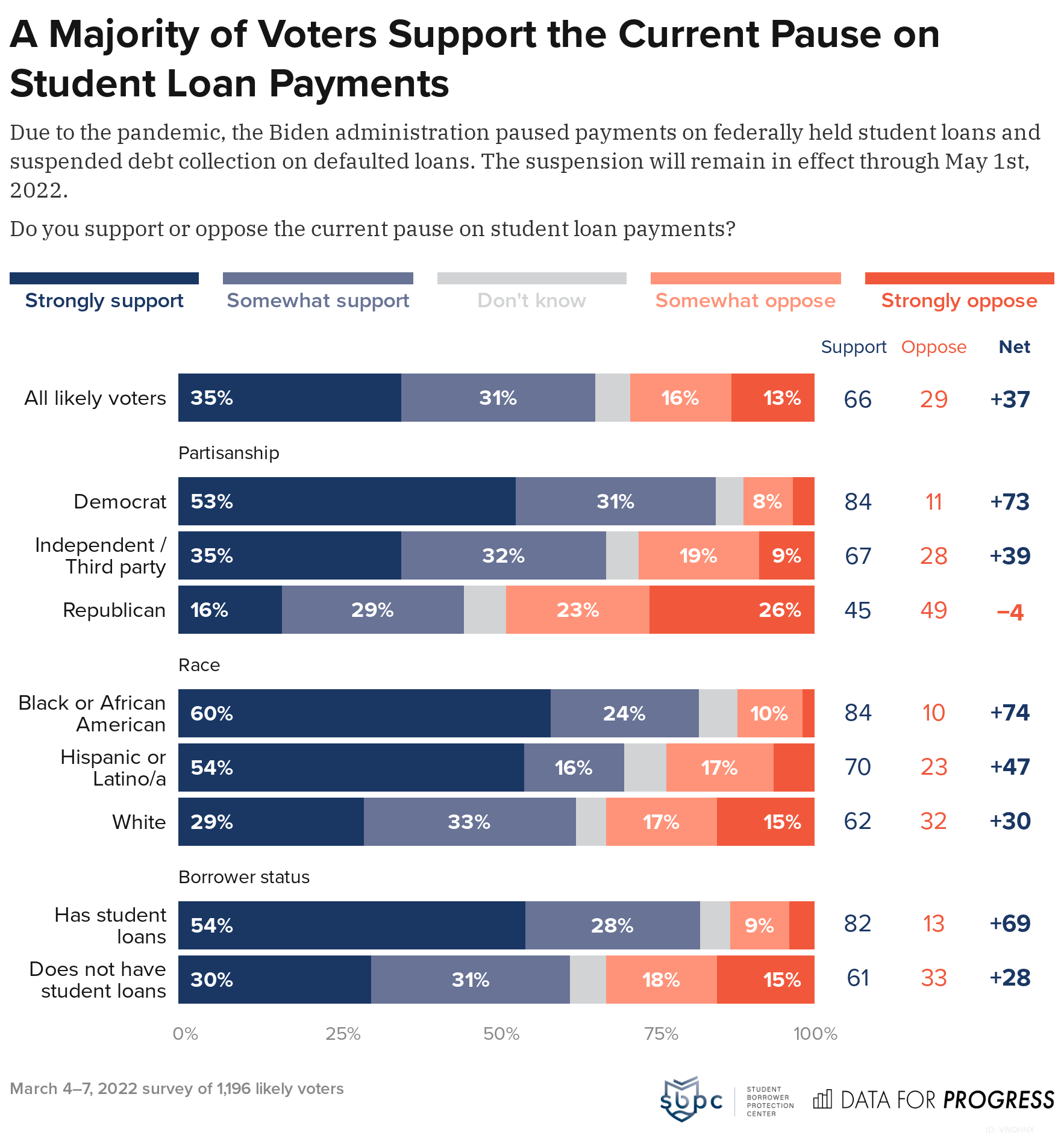

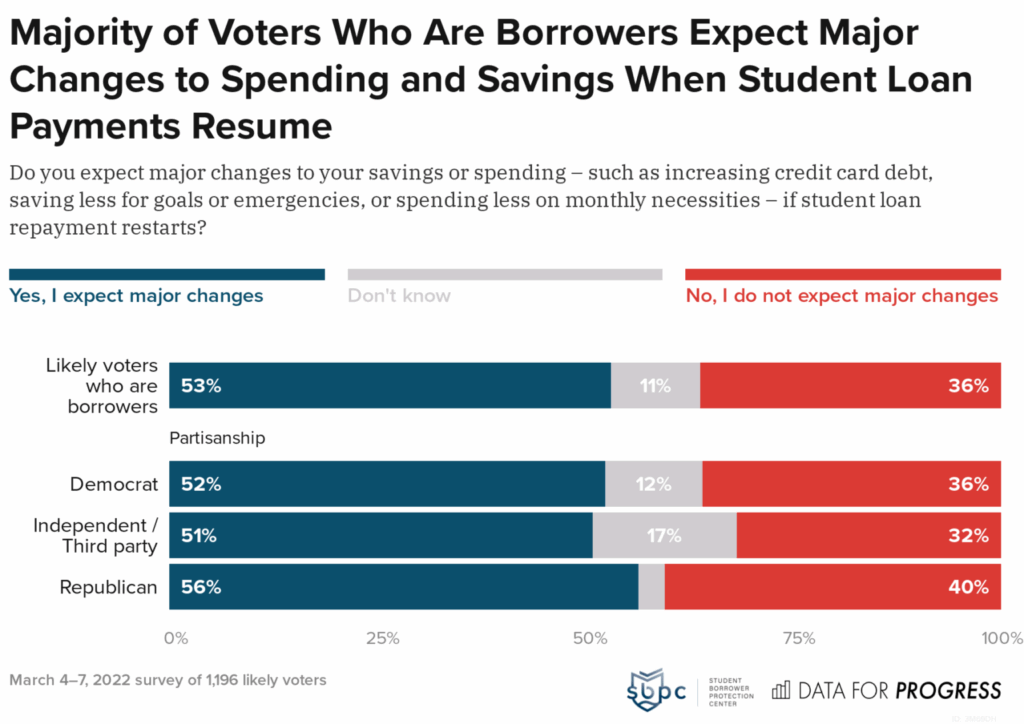

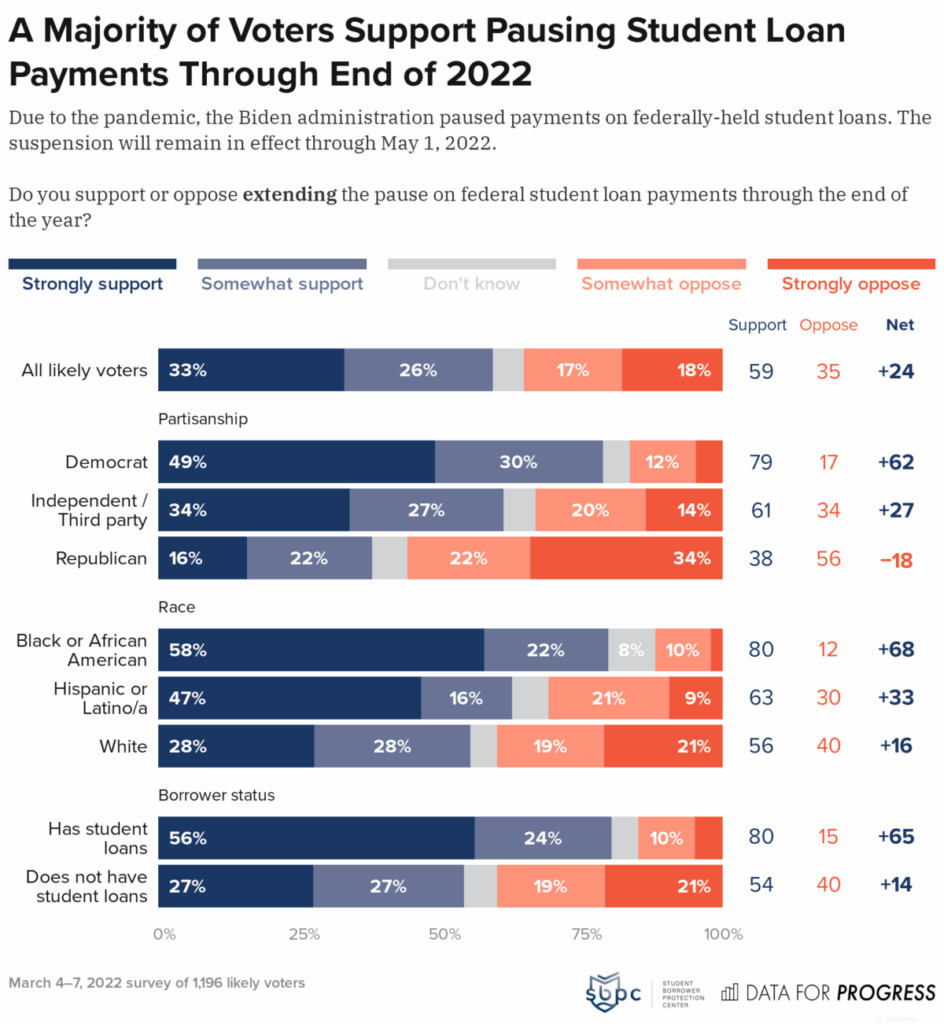

March 11, 2022 | WASHINGTON, DC — With rumors swirling that President Biden is considering a fourth student loan payment pause, Student Borrower Protection Center and Data for Progress today released their latest tracking poll demonstrating widespread public support for federal action to protect people with student debt. The new poll reveals that two-thirds of likely voters support the current pause on student loan payments, last extended by President Biden in December 2021. Similarly, about 6-in-10 likely voters support an additional extension of the pause on student loan payments, including a majority of likely voters who do not have student loans. Among respondents with student debt, a majority expect to make “major changes to saving or spending” if student loan payments resume. In contrast, just 1-in-5 likely voters with student debt are “very confident” in their ability to resume making payments in May. These results underscore that extending the payment pause will offer tens of millions of families badly needed relief as the cost of basic necessities continues to skyrocket. Without action by President Biden, the current pause on student loan payments is slated to expire on May 1, 2022.

“The cost of living in America has skyrocketed in the aftermath of the pandemic and amid rising conflict in Europe. People with student debt are already paying a heavy price for events beyond their control,” said SBPC executive director Mike Pierce. “President Biden and Vice President Harris need to use every tool in America’s toolbox to protect families from the economic shock, which includes keeping the student loan system shut down.”

“These findings make clear that hard-working Americans, already grappling with rising prices and stagnant wages, will have to make tough sacrifices if student loan repayments resume,” said Anika Dandekar, Polling Analyst at Data for Progress. “Extending the pause on payments – or canceling student loan debt altogether — will both relieve the middle class of yet another financial burden and deliver a political win for President Biden.”

Yesterday, the U.S. Bureau of Labor Statistics released new economic data indicating that the American economy is currently experiencing the highest level of inflation in four decades. Prices rose 7.9 percent in February when compared to last year. For families across the country, this means that the cost of food, housing, and other basic necessities has spiked, even as the prospect of a student loan bill looms.

Today’s poll is the next in a series from Data for Progress and the Student Borrower Protection Center tracking public opinion on issues related to student debt and economic security. This new poll, conducted by Data for Progress between March 4 to 7, 2022, also shows that among student loan borrowers who express anxiety about the economic effects of looming student loan payments, many expect to offset new financial pressure by taking on more debt or forgoing basic necessities.

In January, White House press secretary Jen Psaki suggested that the Biden White House and the U.S. Department of Education are considering a further extension of the pause on student loan payments, interest charges, and debt collection in response to the ongoing public health emergency. Today’s poll shows that an extension through December 2022 is broadly popular–more than 6-in-10 likely voters support an extension, including a majority of likely voters who do not owe student debt.

From March 4 to 7, 2022, Data for Progress conducted a survey of 1,196 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

BACKGROUND

Earlier this week, a coalition of 210 organizations representing students, borrowers, workers, communities of color, people with disabilities, veterans, and millions of others sent a letter to President Biden calling for an extension of the pause on student loan payments until the President keeps his promise to cancel student debt and fix the broken student loan system.

Before the pandemic struck, tens of millions of borrowers struggled to navigate a badly broken student loan system. America’s student debt crisis wreaked havoc on the financial lives of families across the country, despite payment relief and debt forgiveness programs that promised that these debts would never be a life-long burden.

No student loan borrower with a federally-held loan has been required to make a student loan payment since March 2020 when former President Trump signed the CARES Act, pausing student loan payments and suspending interest charges for tens of millions of student loan borrowers. This set of protections was extended via executive actions taken in August 2020, December 2020, January 2021, August 2021, and December 2021. However, these protections are set to expire with payments to resume for federal student loans on May 1, 2022.

###

About Data for Progress

Data for Progress is a progressive think tank and polling firm which arms movements with data-driven tools to fight for a more equitable future. DFP provides polling, data-based messaging, and policy generation for the progressive movement, and advises campaigns and candidates with the tools they need to win. DFP polling is regularly cited by The New York Times, The Washington Post, MSNBC, CBS News, and hundreds of other trusted news organizations.

Learn more at dataforprogress.org or follow DFP on Twitter at @dataprogress.

About Student Borrower Protection Center

Student Borrower Protection Center is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.