Our Team

FUN FACT: When Mike is not protecting borrowers, he spends his time trying to teach his puppy how to kayak.

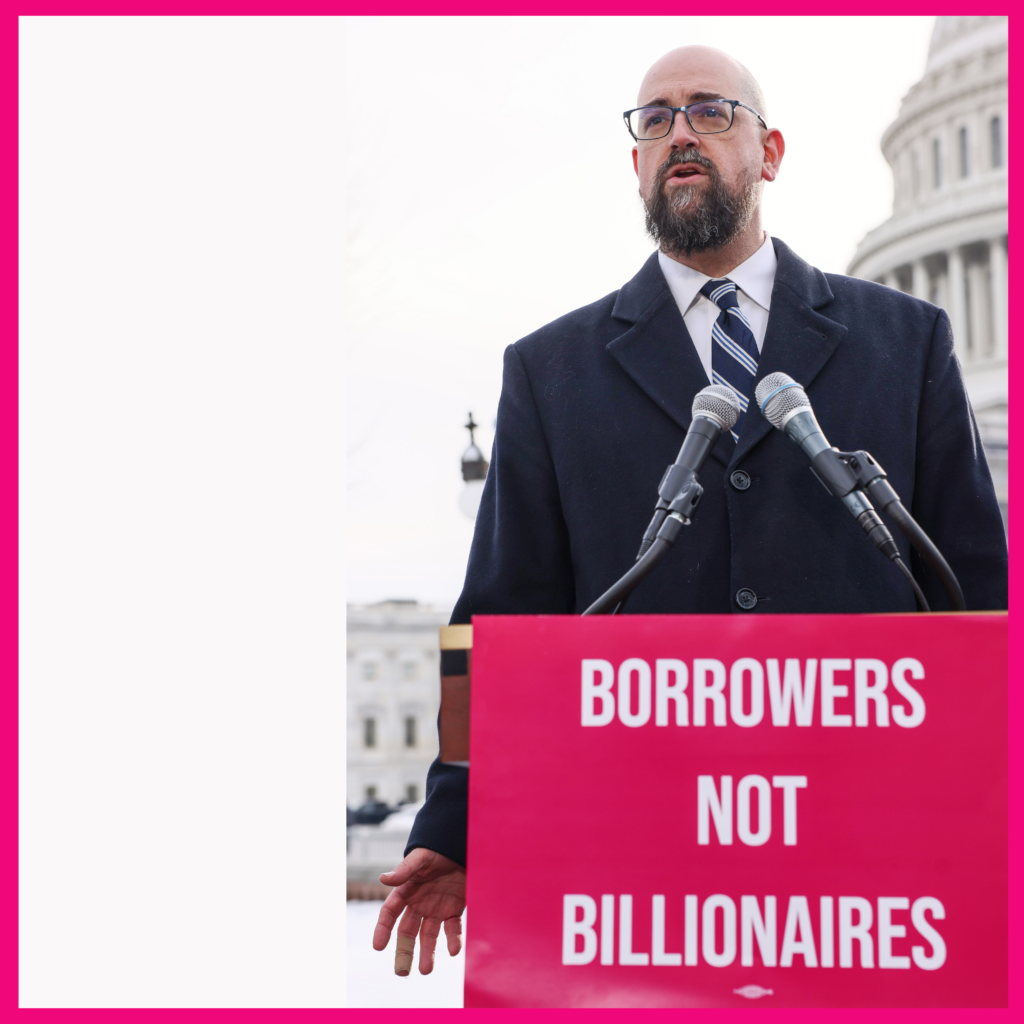

Mike Pierce

Mike Pierce is the Executive Director and co-founder of Protect Borrowers (formerly Student Borrower Protection Center). He is also co-founder of the Student Loan Law Initiative at University of California, the nation’s only academic center focused solely on student debt and the law.

Mike is an attorney, advocate, and former senior regulator who started the Student Borrower Protection Center after more than a decade fighting for borrower rights on Capitol Hill and at the Consumer Financial Protection Bureau (CFPB). Mike was the CFPB’s lead subject-matter expert on higher education and consumer protection for seven years. From 2015 to 2017, Mike also served as a Deputy Assistant Director of the Bureau, leading the day-to-day operations of the Bureau’s Office for Students and Young Consumers. As a law student, Mike worked in the Office of Federal Student Aid at the U.S. Department of Education. Mike is licensed to practice law in Maryland.

Mike is based in Atlanta, Georgia.

FUN FACT: When not collecting bar admissions, Persis is baking three dimensional cakes and assembling baos and dumplings in her haunted house in Boston.

Persis Yu

Persis Yu is Deputy Executive Director & Managing Counsel at Protect Borrowers. Persis is a nationally recognized expert on consumer protection and student loan issues and has over a decade of hands-on experience representing low-income consumers. She has also testified before Congress on multiple occasions regarding the impact of student loan debt on borrowers and the need for reform in the student loan system.

Persis was previously a staff attorney at the National Consumer Law Center and the director of its Student Loan Borrower Assistance Project. Prior to joining NCLC, Persis was a Hanna S. Cohn Equal Justice Fellow at Empire Justice Center in Rochester, New York. Her fellowship project focused on credit reporting issues facing low-income consumers, specifically in the areas of accuracy, housing, and employment.

Persis is a graduate of Seattle University School of Law, and holds a Masters of Social Work from the University of Washington, and a Bachelor of Arts from Mount Holyoke College. Persis is licensed to practice law in Massachusetts, New York, and Washington, D.C. She is also admitted to practice before the Supreme Court of the United States, the District of the District of Columbia, the District of Massachusetts, the Western District of New York, and the First Circuit and Eleventh Circuit Courts of Appeals.

FUN FACT: When not vigorously fighting for borrowers, you can find Aissa chasing after her two little ones…and after bedtime is over…binging on the newest reality TV show.

Aissa Canchola Bañez

Aissa is the Policy Director at Protect Borrowers, where she oversees the organization’s work advancing policies that alleviate the crushing burden of debt on working families across the country. Previously, she led legislative development and strategy as Legislative Director and Deputy Chief of Staff for Congresswoman Ayanna Pressley. Prior to that she served as a Policy Advisor for the Senate Health, Education, Labor and Pensions Committee where she handled higher education affordability and access issues and also spent time at the Consumer Financial Protection Bureau where she fought to protect students and young consumers from being ripped off.

She has a bachelor’s degree in American Studies and Political Science from California State University, Fullerton (and is a proud product of California’s public education system). After spending more than 12 years in Washington, D.C. taking the halls of Congress by storm, she is now based back in Los Angeles, California where she reps the ‘West Coast, Best Coast’ and can be reached at aissa@protectborrowers.org.

Winston Berkman-Breen

Winston Berkman-Breen is the Legal Director at Protect Borrowers, where he leads the organization’s legal strategy, litigation, and state policy work. Previously, he was the Director of Consumer Advocacy and Student Loan Ombudsman for the State of New York at the state’s financial regulator, the Department of Financial Services. Prior to that, he was a legal services attorney with the New York Legal Assistance Group and with the Project on Predatory Student Lending, where he represented low-income clients in affirmative and defensive litigation related to debt collection, student loans, and foreclosure. In addition to his work at Protect Borrowers, Winston teaches a seminar on consumer law at NYU School of Law.

Winston has a bachelor’s degree in International Relations from Tufts University, is a graduate of NYU School of Law and the NYU Wagner Graduate School of Public Service, and is licensed to practice in New York.

You can reach him at winston@protectborrowers.org.

FUN FACT: She has embraced new hobbies as an adult, including improv, Irish dance, and singing in a Slavic folk singing group.

Amy Czulada

Amy Czulada is the Senior Advisor for Outreach & Engagement at Protect Borrowers, where she leads a lot of their partnership and coalition work both at the national level and within various states. Throughout her career, she has worked on a variety of immigration and labor issues, including VAWA and U visa casework and yelling at employers who have committed wage theft. Prior to joining Protect Borrowers, she did research on highway fast food contracting for 32BJ SEIU.

She holds a master’s degree in International Studies from the University of Denver and a bachelor’s degree from La Salle University. She is currently based in Philadelphia, PA, where she mostly caters to the whims of her dog.

FUN FACT: She doesn’t play video games, but she DOES play saxophone in an orchestra that performs arrangements of video game music.

Jackie Filson

Jackie Filson is the Communications Director at Protect Borrowers, where she directs press strategy, content creation, digital outreach, and messaging. Previously, she took on monopolies as communications director for the Open Markets Institute and organized for safe and affordable resources at Food & Water Watch—work that cemented her belief that no one should go into debt for basic needs, whether it’s education, utilities, or even a good slice of pizza.

She has a bachelor’s degree in English and Human Rights from the University of Connecticut (because in-state tuition was a better option than a lifetime of student debt!). She is now based in Baltimore, MD.

For media inquiries or Caesar salad recs, you can reach her at jackie@protectborrowers.org or (917) 310-4938.

FUN FACT: He reads clinical psychoanalytic literature “for fun”—drop a line if you want him to analyze a recent dream of yours.

Brandon Herrera

Brandon Herrera is the Communications & Digital Strategist at Protect Borrowers. Prior to joining Protect Borrowers, he was a Digital Assistant at GMMB, focusing largely on the Biden-Harris 2020 digital paid media account. Before GMMB, he spent time in organizing as Regional Organizing Director of Arizona’s sixth congressional district for Organizing Together 2020, Field Organizer in Iowa and Michigan for Elizabeth Warren, and Field Organizer in Iowa for Kamala Harris. He started out his political career at Subject Matter as a Government Relations intern and in the Connecticut General Assembly as Legislative Assistant Intern to CT Rep. Cristin McCarthy Vahey. Brandon holds a B.S. in Political Science (with a concentration in Political Theory) and Economics from Trinity College.

For media inquiries, you can reach him at brandon@protectborrowers.org.

FUN FACT: Chris is an avid Top Chef fan and is always happy to share recipes.

Chris Hicks

Chris Hicks is a Senior Policy Advisor at Protect Borrowers. He leads Protect Borrowers’ work on employer-driven debt, where he focuses on the intersection of competition, consumer, and worker protections. Prior to joining Protect Borrowers, Chris worked for several labor unions and workers’ rights organizations in various capacities. Originally from Wichita, Kansas, Chris earned his bachelor’s degree from Wichita State University. You can reach him at chris@protectborrowers.org.

FUN FACT: While a student at Tuskegee, she gave tours of Booker T. Washington’s home.

Khandice Lofton

Khandice Lofton is a Counsel at Protect Borrowers where she works on litigation matters, and advocacy related to consumers and student loan borrowers. Previously, she practiced at Legal Aid of West Virginia fighting to keep families housed and safe. There she learned that neither a person’s race or socioeconomic status should determine how they are treated by any government system.

She has a bachelor’s degree in History from Tuskegee University, and a Juris Doctor from the University of Dayton School of Law. She is licensed to practice law in Ohio, West Virginia, the United States District Court for the Southern District of Ohio, and the Fourth Circuit Court of Appeals. She is now based in Charlotte, NC, where she loves trying local coffee shops (recs are welcomed!). She can be reached at khandice@protectborrowers.org.

FUN FACT: Claire grew up in Portland, Oregon, where she attended all of the same schools as Ramona Quimby.

Claire Stein-Ross

Claire Stein-Ross is the Chief of Staff & Development Director at Protect Borrowers, leading development, planning, and strategy. She previously ran an operations consulting firm advising political and non-profit clients, following stints at the DCCC’s independent expenditure program, with Senator Martin Heinrich’s office and campaign, and in political polling.

She is a proud and active Smith College alum, and spends most of her free time planning her next meal, doing the NYT crossword (best Saturday time: 4:58), or improving her mahjong game.

FUN FACT: In her free time, Jenn enjoys hosting (and starting to bartend) dinner parties, drawing and painting, continuing a mostly unsuccessful journey of learning guitar, and growing her catalog of good, hole-in-the-wall restaurants.

Jennifer Zhang

Jennifer Zhang is a Research Associate at Protect Borrowers, where she leads investigative and research projects, analyzes policy, crunches data, and authors reports. She previously held corporations, banks, lenders, and landlords accountable by helping return millions of dollars to defrauded Americans as a Director’s Financial Analyst at the Consumer Financial Protection Bureau and mediator for the New York State Attorney General. These experiences fuel her commitment to building an economy rooted in dignity and fairness for all—not just billionaires.

Jenn has a bachelor’s degree in political science from Columbia University and is based in Washington, DC. For tips, questions, and recipe suggestions, you can contact her at jenn@protectborrowers.org.