New Poll Reveals American Families are Drowning in Debt, and Bipartisan Supermajorities Support Government Action to Lower Costs

Protect Borrowers Announces Slate of Advisors to Shape Future Fights

September 9, 2025 | WASHINGTON, D.C. — Protect Borrowers, a national policy, advocacy, and litigation nonprofit, launched today to build on Student Borrower Protection Center’s legacy—fighting for families increasingly drowning in debt just to make ends meet. A new Protect Borrowers-Groundwork Collaborative poll released today shows that Americans are struggling to keep up with rising costs, weighed down by sky-high credit card interest rates, a broken student loan system, and predatory financial products.

The Protect Borrowers team of advocates, attorneys, and experts will conduct investigations into government mismanagement and industry abuses, build and prosecute lawsuits on behalf of working families, and advocate for policy solutions that can check corporate greed and deliver debt relief to Americans. The fight for student loan borrowers’ rights, the primary focus for Student Borrower Protection Center, will remain an important area of work for Protect Borrowers.

“Across the economy, families are struggling with rising costs and turning to debt to stay afloat—a sea of red ink driven by big banks and big tech companies that promise the markers of middle class life but push financial freedom beyond reach,” said Mike Pierce, co-founder and executive director of Protect Borrowers. “As the Trump Administration turns its back on working class families, Protect Borrowers will fight back—exposing the greedy financial companies cutting backroom deals with regulators, taking corrupt government officials and corporations to court, and advancing new laws to hold the system accountable to working people.”

American families owe more household debt than at any point in history—more than $18 trillion in mortgages, car loans, student loans, credit cards, and risky new financial products engineered by companies from Wall Street to Silicon Valley. Americans are increasingly struggling to keep up: more past-due student debt, auto debt, and credit card debt has appeared on Americans’ credit reports than at any point since the Great Recession.

“At Protect Borrowers, we are taking lessons from the student debt crisis to fight to protect the pocketbooks of everyday Americans. When families are forced to turn to debt in order to cover basic necessities or to get ahead, big businesses win while everyone else is left further behind,” said Persis Yu, deputy executive director and managing counsel of Protect Borrowers. “By holding corrupt government systems and companies accountable, and demanding more for working families, we are building an economy that works for all Americans.”

New poll shows debt’s growing role across Americans’ financial lives

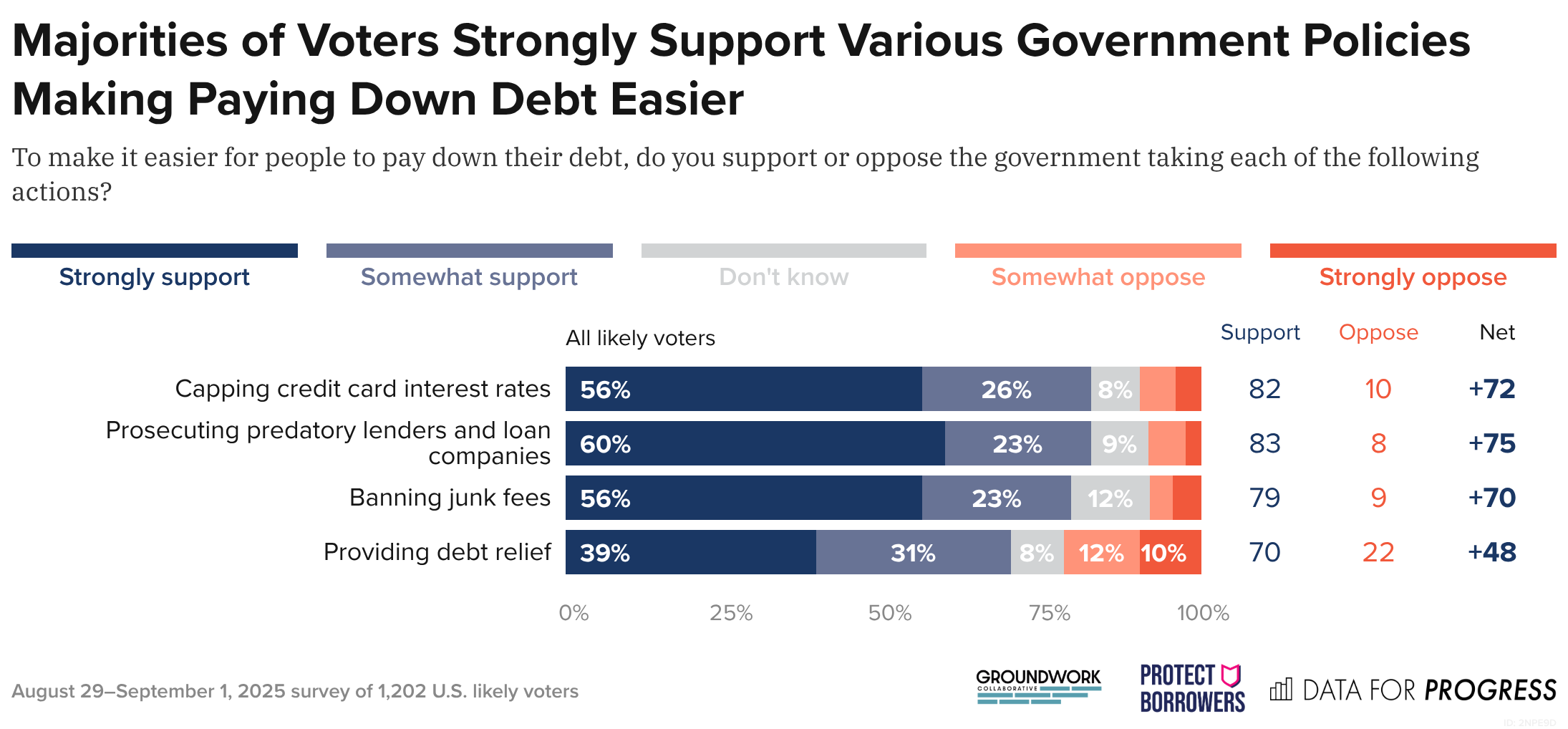

A new poll from Protect Borrowers and Groundwork Collaborative, conducted by Data for Progress, found that a bipartisan supermajority of Americans—with broad support across education, gender, and age—demand action from policymakers to address the rising burden of debt. Meanwhile, the Trump Administration is doing the exact opposite by pursuing economic policies that raise the cost of living and cutting backroom deals with the bankers and tech titans driving working people into debt.

A new strategy memo from the team at Protect Borrowers offers insight and analysis of economic data, polling, and the current landscape for working families, available here: https://protectborrowers.org/wp-content/uploads/2025/09/MEMO-The-Politics-of-Debt.pdf

A press release from Protect Borrowers and Groundwork Collaborative on the new poll is available here: https://protectborrowers.org/dfp-groundwork-protectborrowers_debt-poll_sept-2025/

For half a century, Americans relied on debt to pay for the hallmarks of a middle class life—a home, a car, and a college education. Today’s poll also shows that families are now being forced to use debt just to keep up with the rising costs of everyday living, across all parts of their economic lives. Critically, this new poll shows that families are using debt to deal with rising energy costs, to pay for healthcare, and to make rent—all sources of economic stress made worse by President Trump’s policies and the recently-enacted “One Big Beautiful Bill.”

Fighting for families drowning in debt

Protect Borrowers’ work will expose how families are driven into debt across the economy, with an initial slate of investigations, litigation, and advocacy focused on:

- Predatory lending and private credit. From Wall Street to Silicon Valley, families are pushed into debt, often through risky, subprime lending with high interest rates, predatory features, and abusive collections practices. Protect Borrowers will follow the money through the financial system—exposing the ways private lenders drive families into debt, on what terms, and to whose benefit and shed light on the crushing consequences for millions of Americans when they fall behind.

- Labor exploitation and employer-driven debt. Across the labor market, employers are driving workers into debt—forcing individual employees into debt to pay for their own training, equipment, or even to fund their own replacement if they quit their job. Protect Borrowers will spotlight employers’ use of debt to exploit workers and fight to ban the use of predatory employer-driven debt across the economy.

- Public corruption and attacks on public power. Working families’ last defense against debt traps are often the federal agencies responsible for holding corporations accountable and enforcing the rules that govern our economy. Protect Borrowers will continue to expose public corruption and aggressively pursue the officials responsible for looting the federal government to the benefit of billionaires and the biggest corporations.

- Student debt and free college. Protect Borrowers will continue to fight for student debt relief and to hold the Trump Administration as well as the private companies across the student loan system accountable for cheating borrowers out of their rights. At every step, Protect Borrowers will tell borrowers’ stories about rising college costs, exploding student debt burdens, and the role of education and training in the modern economy—calling out the Trump Administration’s actions that raise costs for working families and drive millions deeper into debt.

Over the remainder of 2025 and into 2026, Protect Borrowers will also roll out new investigations focused on the explosion of Buy Now, Pay Later debt across the economy, the debts Americans take on to keep up with rising energy costs, and the role debt plays in helping families make rent.

Protect Borrowers’ focus on the economics and politics of debt will be further shaped by the addition of 17 new members of its advisory board, including senior leaders who recently served at the Consumer Financial Protection Bureau, the Federal Trade Commission, the National Labor Relations Board, the U.S. Department of Education, and in the White House. Protect Borrowers is also proud to add leaders from a diverse set of democracy, economy, competition, and workers’ rights advocacy organizations and think tanks who will help guide the organization’s work in the months ahead.

See a full list of Protect Borrowers’ new and continuing advisory board members here: https://protectborrowers.org/wp-content/uploads/2025/09/Protect-Borrowers-Advisory-Board.pdf

Protect Borrowers is also launching a new Substack, In Debt, covering the corrupt corporations and broken public programs driving Americans deep into debt. In Debt will also feature writing about the debts our government owes each of us, and the laws, policies, and practices that must change to make good on America’s central promise: that we should never put a price tag on opportunity.

Subscribe to In Debt, a substack by the team at Protect Borrowers here: https://indebt.substack.com

Read a roundup of quotes from leaders, advisors, and partners who support Protect Borrowers’ work: https://protectborrowers.org/top-policymakers-protect-borrowers-advisor-quotes/

Read a roundup of right-wing public figures sounding alarms about the rising burden debt poses on working families’ finances: https://protectborrowers.org/what-they-are-saying-right-wing-quotes/

###

About Protect Borrowers

Protect Borrowers (formerly Student Borrower Protection Center) is a nonprofit organization led by a team of experts, lawyers, and advocates fighting to build an economy where debt doesn’t limit opportunity. We investigate financial abuses, take predatory companies to court, and push for policies to protect working people from debt traps. We aim to deliver immediate relief to families while building power, driving systemic change, and fighting for racial and economic justice.

Learn more at protectborrowers.org or follow us on social @BorrowerJustice.