While polling and work on the value of higher education is common, these pieces rarely account for the ways that students’ debt load, and their specific experiences repaying debt, can color views of the college experience. For the first time, a novel set of research helps fill this void by investigating the perspectives of borrowers in various repayment plans on key issues, including (1) the value of their higher education experience, (2) the educational threshold for financial security, and (3) their trust in loan servicers and the federal government concerning loan repayment information.

Data presented here is part of a larger study, led by Dr. Dan Collier at the University of Memphis, focused on the subjective well-being (SWB) and attitudes of borrowers enrolled in an Income-Driven Repayment (IDR) plan, Public Service Loan Forgiveness (PSLF), or who have had their debts forgiven under these plans.

Authors: Dan Collier and Mark Huelsman, November 20, 2025.

Jump to:

- Introduction

- Findings

- Personal College Satisfaction

- Perceptions of the Value of College Degrees

- Trust in the Student Loan Repayment System

- Conclusion

- How You Can Participate

- Endnotes

Introduction⬆

Amidst the Trump Administration and Congress’s relentless attacks on colleges and universities, recent headlines suggest that Americans are losing confidence in the higher education system. For example, a recent Gallup poll found that, in 2010, 75% of polled individuals believed that a college education was “very important,” while in 2025, only 35% felt the same.1 At the same time, broader public trust in higher education remains only slightly above historic lows: 44% have confidence in four-year institutions and 56% in two-year institutions.2

Yet despite broad public discontent, families’ interest in pursuing postsecondary education for themselves or their children remains strong. Surveys indicate that 57% of adults not currently enrolled in college express interest in doing so.3 Furthermore, almost 60% of parents prefer their children to enroll in a two- or four-year institution.4 And over 61% of high school cohorts choose to enroll in college,5 a rate that has remained relatively steady since the COVID-19 pandemic.

Despite policymakers and media figures, many of whom themselves hold at least a four-year degree, if not graduate degrees, feeding narratives questioning the value of college, postsecondary education is a worthy societal investment. Compared to those without a college degree, graduates continue to experience higher wages (especially those with a 4-year a degree)6 and lower unemployment rates.7 Additionally, individuals with college degrees tend more likely to be homeowners,8 are more likely to have retirement plans,9 and are generally healthier.10

Vital as it may be, the path to attaining a degree carries a significant amount of risk as borrowers experience a broken student loan system that naturally may make them question their personal return on investment of their college education. Borrowers face significant challenges in repaying their loans, particularly given the current economic uncertainty and the increasing difficulty for new graduates to secure stable employment.11 In addition to external economic and financial factors, many borrowers express limited trust in both loan servicers and the federal government regarding the loan repayment process,12 often with justifiable reasons.13 These experiences are likely to influence how people perceive the value of their own education and desire similar outcomes for their children.

While polling and work on the value of higher education is common, these pieces rarely account for the ways that students’ debt load, and their specific experiences repaying debt, can color views of the college experience. For the first time, a novel set of research helps fill this void by investigating the perspectives of borrowers in various repayment plans on key issues, including (1) the value of their higher education experience, (2) the educational threshold for financial security, and (3) their trust in loan servicers and the federal government concerning loan repayment information.

Data presented here is part of a larger study, led by Dr. Dan Collier at the University of Memphis, focused on the subjective well-being (SWB) and attitudes of borrowers enrolled in an Income-Driven Repayment (IDR) plan, Public Service Loan Forgiveness (PSLF), or have had their debts forgiven under these plans.14

Findings⬆

With the financial support of Protect Borrowers and The Lumina Foundation, these data were collected from January 2025 until May 2025—with surveys still collecting data. Calls for participation have been shared across multiple organizations focused on assisting student borrowers and within mass media, it is a snowball sample. The parameters for participation are (1) Be in an IDR plan, (2) and/or be in PSLF, (3) paid your loans off while in an IDR plan or PSLF, (4) have your loans forgiven while in an IDR plan or via PSLF.15

Participants were asked about which repayment program they were in, with the following outcomes: (1) I am currently in IDR repayment, (2) I am in the SAVE forbearance, (3) I am waiting on a loan forgiveness decision, and (4) My loans have been forgiven via PSLF—which are the groups we report in this piece.16

Personal College Satisfaction⬆

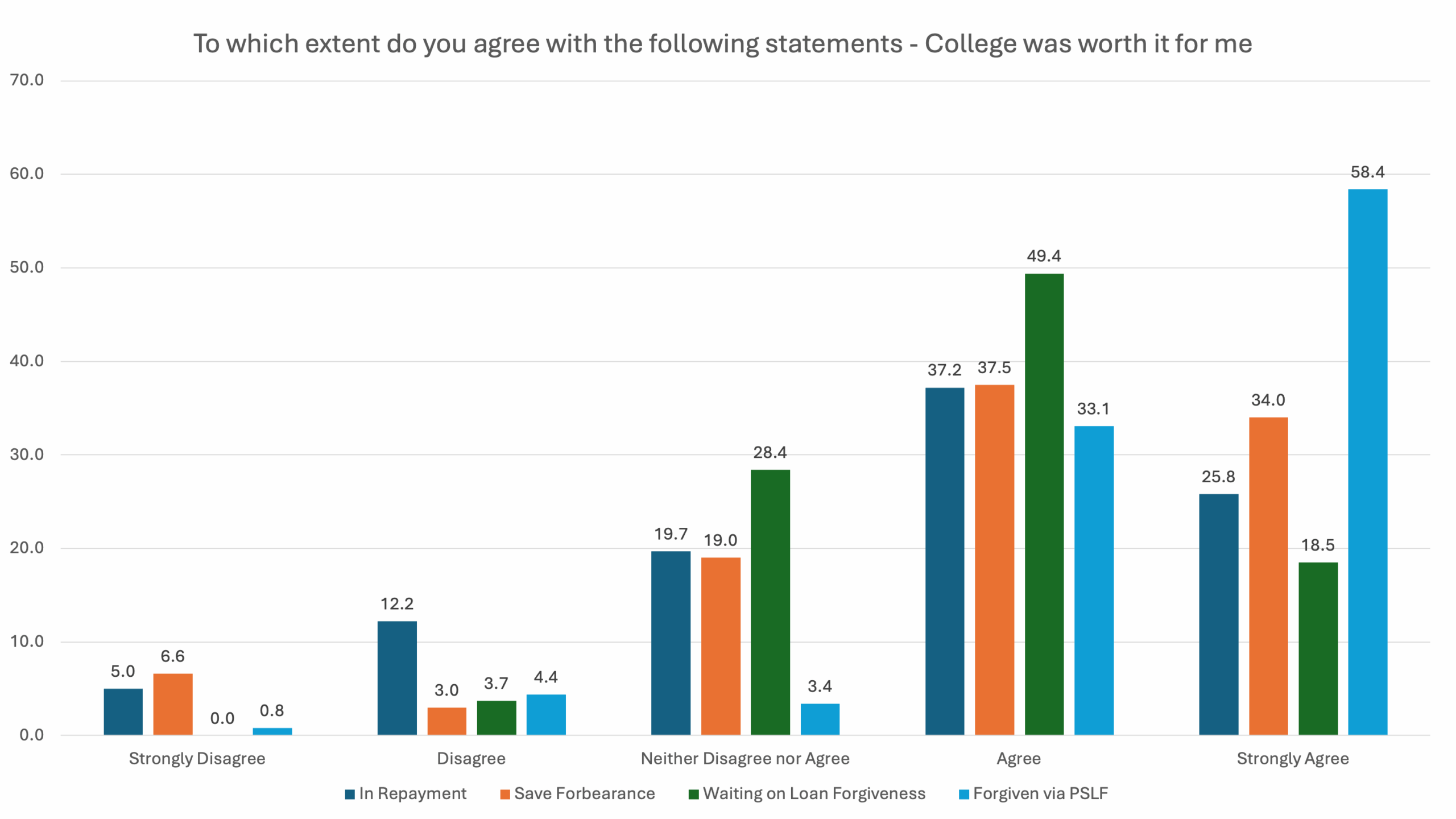

College was worth it for me: The first question we examine is whether borrowers felt that college was worth it to them. For the whole sample, 76.3% of borrowers agreed or strongly agreed that college was worth it. Those whose loans had been forgiven through PSLF overwhelmingly agreed or strongly agreed (91.5%) that college was worth it, followed by those in SAVE Forbearance (71.4%), Waiting on Forgiveness (67.9%), and Currently in Repayment (63.1%). Across various value-based responses a recurring theme emerges, those with forgiven loans hold distinct perspectives, which is to be expected given the transformative impact of debt relief.17

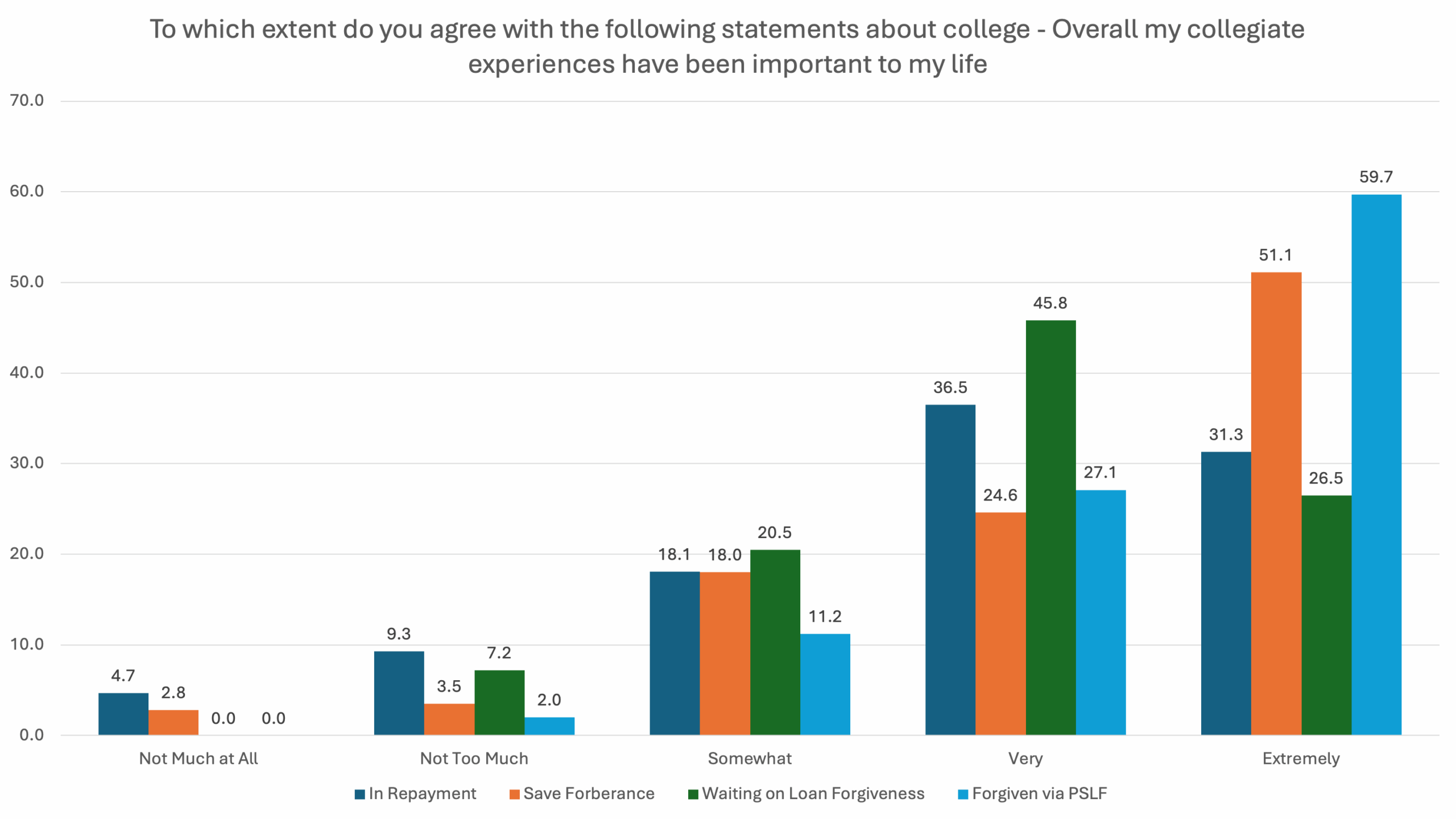

My collegiate experiences are important to my life: When asking borrowers if their collegiate experiences have been important to their lives, obvious majorities felt these experiences were “very” or “extremely” important—as 75.1% of the total sample expressed this view. By repayment groups, 86.8% of Forgiven borrowers noted the importance of college, followed by those in SAVE Forbearance (75.7%), Waiting on Forgiveness (71.3%), In Repayment (57.8%). Again, borrowers whose debts have already been forgiven tend to agree most strongly, likely reflecting both the personal significance of forgiveness and their ability to reflect on the experiences that led them to this point.

Perceptions of the Value of College Degrees⬆

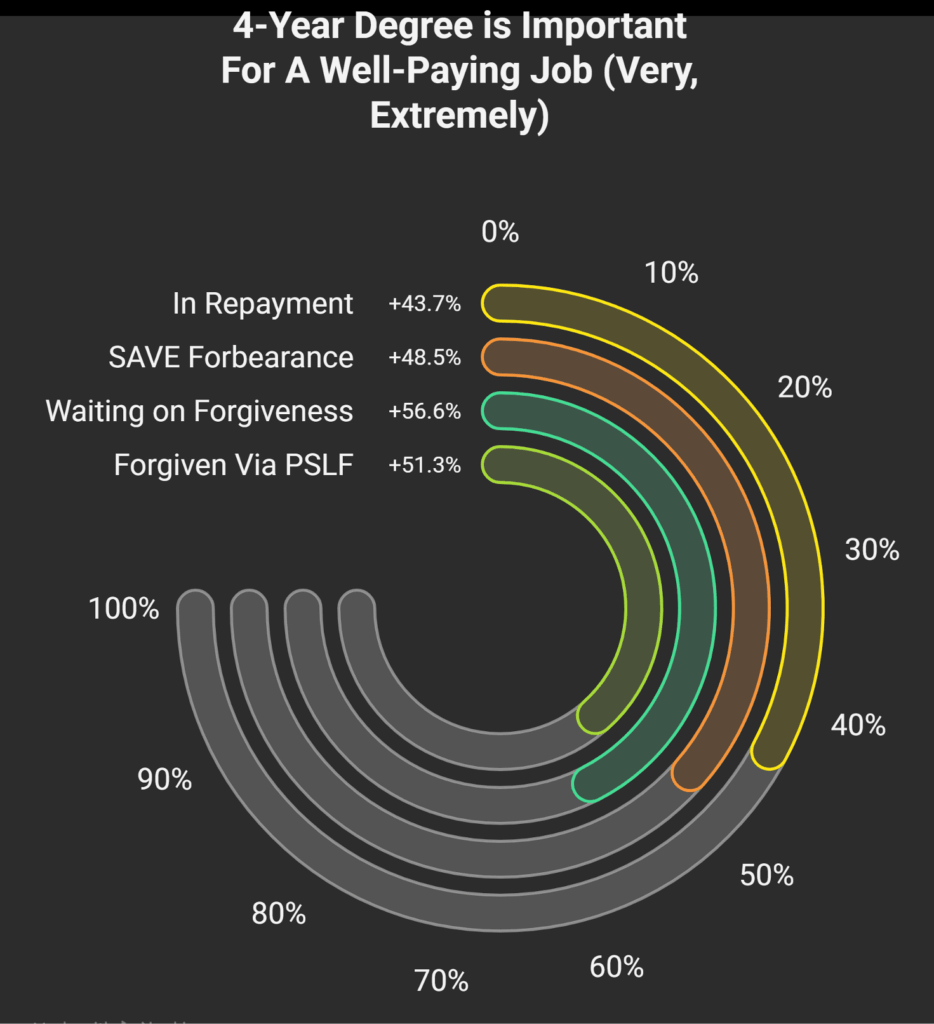

Four-year degree importance: Next, we examined how important borrowers felt that a four-year degree is to get a well-paying job today. Whereas borrowers overwhelmingly felt that college was worth it for themselves, a different trend emerges about the importance of a 4-year degree today, generally.18

For borrowers Waiting on Forgiveness (56.6%) and those whose loans were Forgiven (51.3%) a majority said having a 4-year degree was either “very” or “extremely” important—whereas, for those in the SAVE Forbearance (48.5%), and In Repayment (43.7%), less than half said so. Next, we shifted the questions’ focus on the individual by prompting them to consider their family members rather than the broader abstract, and a more nuanced picture emerges.

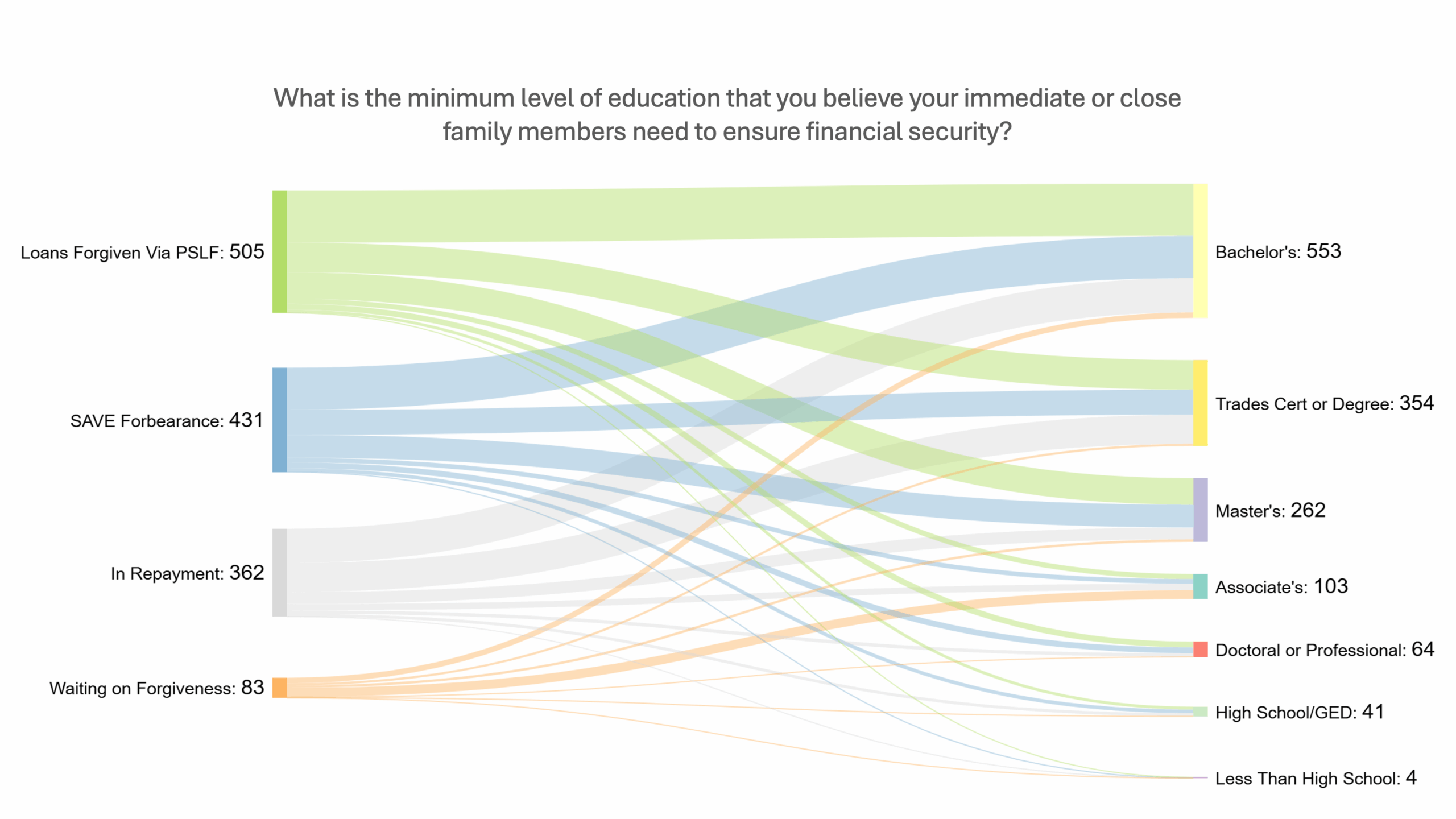

Minimum level of education for close family financial security: Next, we shifted the questions’ focus on the individual by prompting them to consider their family members rather than the broader abstract, and a more nuanced picture emerges. Roughly 40% of the sample believed the minimum level of education for close family members was a bachelor’s degree—followed by a technical certificate or degree (25%), then a master’s degree (19.4%). The proportion of respondents who believed a bachelor’s degree was necessary was rather consistent among those in Forgiveness via PSLF (42.6%), SAVE Forbearance (40.4%), and In Repayment (39%). Interestingly, only 27.7% of those Waiting on Forgiveness shared this belief.

Considering the prevailing narratives that individuals with at least a four-year degree may not value the degrees or jobs associated with these certificates, it is surprising that, on average, borrowers ranked a trades certificate or degree as the next most important level. Those In Repayment (33.1%) were most likely to suggest such, followed by Forgiven via PSLF borrowers (24.2%), then those in the SAVE Forbearance (23.9%). Curiously, only 10.8% of those Waiting on Forgiveness suggested such. However, this group generally felt that having an associate’s degree (44.5%) was the minimum level, which is unaligned with the remaining groups at between 4.2% and 7.2%.

Importance of a trade certificate or degree for future/current children: When examining attitudes toward trade certificates or degrees, we asked how important it was for borrowers’ children to obtain such credentials. Overall, 47.5% of the total sample believed a trades certificate or degree was “very” or “extremely” important for their children. In comparison, when asked about the importance of a 4-year degree, 53.9% felt it was “very” or “extremely” important. Given the well-known differences in outcomes between technical and 4-year degrees and noting that this sample on average, holds a master’s degree, it is understandable that more respondents value a 4-year degree. Nevertheless, it is notable that nearly half of the sample also considers a trade certificate or degree to be important.

Similarly to previous questions, those Waiting on Forgiveness (36.2%) showed the lowest belief in the importance of this degree. In contrast, over half of the SAVE Forbearance group (52.2%) considered it important, followed by those In Repayment (45.9%) and Forgiven borrowers (45.2%).

Trust in the Student Loan Repayment System⬆

Federal Government: Overall, borrowers suggest a very limited degree of trust in the messaging regarding student loans and repayment from the federal government. For the total sample, when asked if they agreed that the federal government provided them with clear information to confidently repay their loans, just 7.5% agreed or strongly agreed to such (66.2% disagreed/strongly disagreed). Although a higher percentage (17.8%) trusted the federal government guidance on navigating and repaying their loans—a majority still did not agree (67.5%).

Trust in the federal government’s guidance on navigating and repaying student loans shows some notable differences. The group with the highest level of distrust is those in the SAVE Forbearance (81.6%), which is understandable given the uncertainty surrounding the program. The elimination of the REPAYE plan forced affected borrowers into a repayment scheme that has been under court injunction for over a year.19 Next are those whose debts were forgiven through PSLF (74.2%), which also makes sense considering the documented difficulties PSLF borrowers faced in obtaining forgiveness until recently, when the Biden administration made efforts to address these issues. Prior to these changes, there was very little trust that the federal government would uphold its obligations to PSLF borrowers. Trust for this group has likely diminished further under the new administration. Additionally, those currently in repayment (52.2%) mostly distrusted the guidance provided.

Uniquely, 56.6% of those Waiting on Forgiveness trusted the government’s guidance (32.5% did not). We will ask these borrowers why they were most likely to trust the government here in future interviews. However, it is likely this trust hinges on the hopes and expectations that their applications for forgiveness will soon be granted.

Student Loan Servicers: Similar to trust in the federal government, confidence in servicers remains limited. Only 16.2% of the total sample agreed or strongly agreed that they trust their servicer, while 54.6% disagreed or strongly disagreed. Borrowers In Repayment (27.9%) and those Waiting on Forgiveness (26.4%) reported the highest levels of trust. In contrast, only 13.9% of those in SAVE Forbearance and 8.5% of borrowers with loans forgiven through PSLF expressed trust in their servicers.

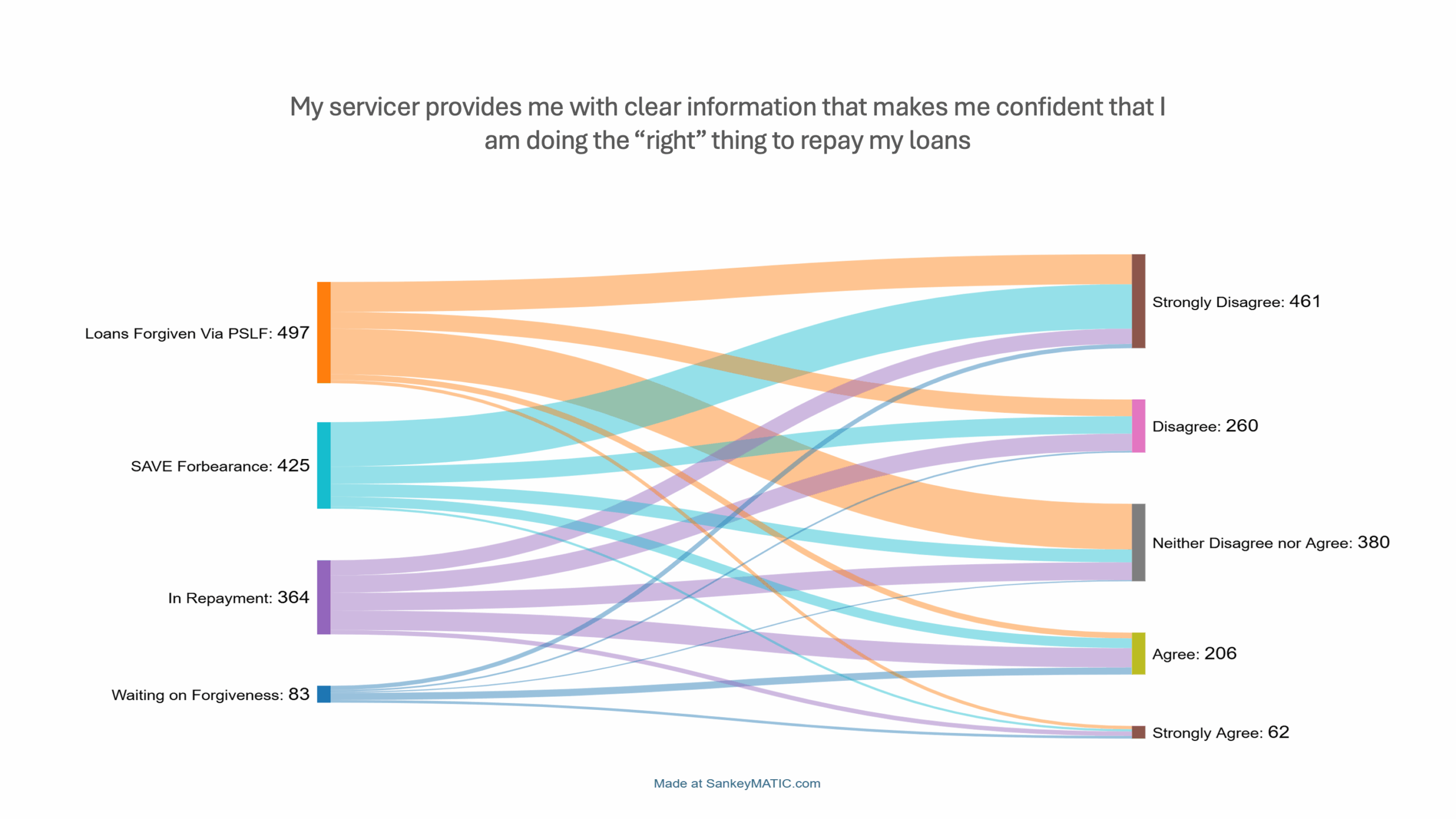

As related to believing that servicers provided clear information to generate confidence that borrowers are doing the “right” thing to repay loans—a slight majority (52.3%) disagreed or strongly disagreed with the sentiment. In this case, 29.2% neither disagreed nor agreed, suggesting confusion generally exists. Analyzed by repayment groups, most borrowers in SAVE Forbearance (71.3%) disagreed or strongly disagreed that their servicers provided proper information. Similarly, 46.1% of borrowers Forgiven via PSLF and 41% of those in repayment also reported disagreement. In contrast, those Waiting on Forgiveness (34.9%) were the only group with the lowest level of disagreement.

Confusion and Uncertainty: Finally, we asked borrowers if they felt confusion and uncertainty when repaying their loans. Based on the findings discussed above, it is not surprising that a clear majority of the sample (63.5%) agreed or strongly agreed that they feel uncertainty and confusion. As would be expected, those in the SAVE Forbearance (88.3%) report the highest degree of confusion or uncertainty.

Despite generally having higher confidence in federal and servicer guidance with 80.7% of those Waiting on Forgiveness reporting uncertainty and confusion. Prior research indicates that they experience significant anxiety and distrust while awaiting forgiveness decisions.20 This suggests that the increased trust observed earlier may stem from hopeful thinking,21 while their feelings of uncertainty reflect the actual experience of waiting.

Conclusion⬆

Over the past several years, we have expanded our understanding of the profound financial and non-financial impacts of student debt, including its relationship to family financial stability, career choice and satisfaction, and mental health. This new research adds to our understanding of the ways that student debt informs borrowers’ very perceptions of higher education for themselves, their families, and society.

Unfortunately, Congress and the Trump Administration seem intent on making higher education more painful to finance and harder to access. The recent “One Big Beautiful Bill” places harsh caps on graduate and parent loan borrowing, which will force many borrowers into the private market where there are virtually no cancellation options, IDR plans, and far fewer consumer protections. Meanwhile, the new Repayment Assistance Plan (RAP) extends the window for cancellation to 30 years, effectively making debt a lifetime sentence for many. Meanwhile, the Trump Administration’s gutting of both the U.S. Department of Education and Consumer Financial Protection Bureau, and weaponization of the PSLF program, reduces the likelihood that borrowers will see cancellation that they are entitled to under the law, and are more likely to be exposed to scams promising them debt relief or advice.

This has major implications for both policy design and the politics of higher education. If policymakers care about rebuilding trust in higher education and ensuring our system remains a point of national pride, ensuring that student debt is not a life sentence for borrowers is a key step. As borrowers feel that the federal government or loan servicers are blocking them from their debt relief—their opinions of higher education, and investing in it, follow.

This research shows that we cannot only help people “manage” their monthly student loan payments. We must acknowledge that the very existence of student debt is a problem. The objective must be to ensure they have comprehensive pathways to being debt-free.

How You Can Participate in This Research⬆

We invite you to participate in a brief survey exploring how people experience IDR and PSLF processes. Your input will help shape better policies and support systems for public-service borrowers. 🙌

Click this link to access the survey – https://memphis.co1.qualtrics.com/jfe/form/SV_9BRm6ywNSOExVPg Password: REPAYE

Your participation is completely voluntary, confidential, and valuable. Thank you for helping improve understanding of public-service loan programs and repayment pathways.

Dr. Daniel A. Collier is an Assistant Professor of Higher and Adult Education in the Department of Leadership at the University of Memphis. Dan is also a research fellow for Davidson College’s The College Crisis Initiative (C2i) and the University of California Student Loan Law Initiative (SLLI).

Mark Huelsman has served as a Fellow at Protect Borrowers since 2021 and is also the Director of Policy & Advocacy at The Hope Center for Student Basic Needs at Temple University.

Endnotes:⬆

- Saad, L. (2025, Sept 11). Perceived importance of college hits new low. Gallup. https://news.gallup.com/poll/695003/perceived-importance-college-hits-new-low.aspx ↩︎

- Jones., J.M. (2025, July 15). U.S. public trust in higher ed rises from recent lows. Gallup. https://news.gallup.com/poll/692519/public-trust-higher-rises-recent-low.aspx ↩︎

- Ray, J. (2025). Interest in higher education remains high. Gallup. https://news.gallup.com/poll/660134/interest-higher-education-remains-high.aspx ↩︎

- Marken, S. (2025, Aug 6). Most parents prefer college pathway for their child. Gallup. https://news.gallup.com/poll/693047/parents-prefer-college-pathway-child.aspx ↩︎

- United States Bureau of Labor Statistics. (2024, May 10). TED: The economic daily. https://www.bls.gov/opub/ted/2024/61-4-percent-of-recent-high-school-graduates-enrolled-in-college-in-october-2023.htm ↩︎

- United States Bureau of Labor Statistics. (2025, April 29). TED: The economics daily. https://www.bls.gov/opub/ted/2025/median-weekly-earnings-by-educational-attainment-first-quarter-2025.htm#:~:text=In%20the%20first%20quarter%20of%202025%2C%20full-time%20workers,of%20%24953%2C%20up%20from%20%24901%20the%20prior%20year. ↩︎

- Federal Reserve Bank of St. Louis. (2025, August). Unemployment rate by educational attainment and age, monthly, not seasonally adjusted. https://fred.stlouisfed.org/release/tables?eid=1197546&rid=50 ↩︎

- Hernandez, E.L., & Mazur, C. (2022, Nov 17). Racial and ethnic disparity in homeownership continues even among highly educated. United States Census Bureau. https://www.census.gov/library/stories/2022/11/homeownership-by-young-households-below-pre-great-recession-levels.html [8]

- Gallup. (2025, June 2). What percentage of Americans have a retirement savings account? https://news.gallup.com/poll/691202/percentage-americans-retirement-savings-account.aspx ↩︎

- Haseltine, W.A. (2024, April 26). A college degree contributed in a major way to a healthier, longer life. Forbes. https://www.forbes.com/sites/williamhaseltine/2024/04/26/a-college-degree-contributes-in-a-major-way-to-a-healthier-longer-life/ ↩︎

- Federal Reserve Bank of New York. (2025, Aug. 1). The labor market for recent college graduates. https://www.newyorkfed.org/research/college-labor-market#–:explore:unemployment ↩︎

- Collier, D.A.,… Keyes, M. (2024). Informing trust: PSLF online communities fill communications gaps (Working Paper No. 4812853). SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4812853 ↩︎

- Protect Borrowers. (2024, Oct 16). Education department finds widespread servicing failures at MOHELA. https://protectborrowers.org/education-department-finds-widespread-servicing-failures-at-mohela/ ↩︎

- You can view research papers and listen to borrowers’ responses in the first wave of data examining only those in PSLF at this website – https://padlet.com/dcllier6/balancing-acts-narratives-from-student-loan-borrowers-in-pub-b79vcfao2eylpie5 ↩︎

- It is difficult to know if this sample matches the wider populations in IDR or PSLF—but the limited information we have from previous work suggests this IDR sample is like national samples related to loan balances see—Collier, D.A., Fitzpatrick, D., & Marsicano, D. (2021). Another lesson on caution in IDR analysis: Using the 2019 Survey of Consumer Finances to examine income-driven repayment and financial outcomes. Journal of Student Financial Aid, 50(2). https://ir.library.louisville.edu/jsfa/vol50/iss2/4/. The PSLF sample is less well understood as highlighted in my former work—Collier, D.A.,… Keyes, T. (2025, April 14). Pause and effect: Examining the dynamics of the student loan pause and the challenge of resuming payments for public service loan forgiveness (No. 5209842). SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5209843. ↩︎

- There are two other groups: (1) Paid-off loans while in IDR (N=23) and (2) Loans were forgiven but not though PSLF (N=16). Because of the limited sample size, we opted not to include these groups in reporting. ↩︎

- Collier, D.A.,… T.Keyes. (2024). Dub thee, the forgiven: A qualitative exploration of what achieving forgiveness through PSLF means to borrowers (No. 4812638). SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4812638 ↩︎

- Here, we note that 41% of the sample have a Masters’ degree followed by 19% with a Bachelors, then a Doctorate (Ph.D./Ed.D.) at 17% – this is a highly educated sample. ↩︎

- Walter, M. (2025). Court ruling affirms blocking of SAVE plan while next steps for the program remain uncertain. NASFAA. https://www.nasfaa.org/news-item/35688/Court_Ruling_Affirms_Blocking_of_SAVE_Plan_While_Next_Steps_for_the_Program_Remain_Uncertain ↩︎

- Collier, D.A.,… M. Keyes. (2025). An update to jubilee and jubilation: An examination of the relationship between Public Service Loan Forgiveness and measures of well-being (No. 5209831). SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5209831 ↩︎

- Miller, J.B., Rutledge, M., Yoquinto, L., & Coughlin, J. (2023). The magic and misdirection of public service loan forgiveness in the United States. Higher Education Quarterly, 77(1), 45-64. https://doi.org/10.1111/hequ.12364 ↩︎