The following SBPC Deep Dive is a preliminary economic analysis of the House Education & Workforce Committee’s legislation on student loan repayment.

Author: Jennifer Zhang, May 6, 2025.

Jump to:

- Introduction

- The House Education and Workforce Committee’s Reconciliation Bill Increases Costs and Reduces Access to College

- The Bill Will Lead to a Boom in Private Lending and Exclude Many Students from Higher Education

- The Bill Makes Working Families Pay Even MORE on Their Student Loan Bills

- The Bill Eliminates Vital Protections and Bans Future Efforts to Make Student Loan Payments More Affordable

- The Bill Worsens Medical Professional Shortages and Undermines Public Service Loan Forgiveness

- Endnotes

Introduction⬆

On April 29, the House Education & Workforce Committee advanced a reconciliation bill that cuts $351 billion in federal higher education funding that students and families rely on, to help pay for upwards of $4.5 trillion in tax relief for billionaires and large corporations. The bill, which includes $21 billion more in cuts than the initial amount directed by the House Budget Committee resolution, will make college more expensive, weaken the student loan safety net, force borrowers to pay even more on their monthly student loan bills, and make it harder for working families to achieve the American Dream—all while generating a massive windfall for the private student loan industry.

If signed into law, the 103-page bill will radically change federal financial aid programs, the student loan repayment system, and higher education policy. The following is a preliminary analysis of this proposal and the additional costs that it imposes on students and working families.

The House Education and Workforce Committee’s Reconciliation Bill Increases Costs and Reduces Access to College⬆

The bill eliminates federal Direct Subsidized student loans, which do not accrue interest while undergraduate students are in school. The bill also substantially cuts Pell Grants, which more than 6.8 million low-income students rely on to help cover the cost of college. Pell Grant recipients are more than twice as likely as other students to have loans and are disproportionately borrowers of color. A majority of Pell recipients come from families that make less than $40,000 annually, face food or housing insecurity, work 20 hours per week or more, and/or have higher student debt (with balances $2,069 higher than non-Pell borrowers on average). Cutting Pell Grants will substantially reduce college access and raise costs by thousands of dollars for the lowest-income students.

- Currently, undergraduate students can take out a maximum of $23,000 in subsidized federal Direct loans. The bill would push undergraduate borrowers who rely on those loans and spend four years in higher education to pay $2,873 in additional interest alone.1

- Over 61 percent of Pell Grant recipients (over 4 million low-income borrowers) could see their award reduced or eliminated. This is because the bill: (1) requires students to be enrolled in 30 credits per year, up from 24 credits, to receive the maximum Pell award; (2) eliminates eligibility entirely for students enrolled less than “half-time”; and (3) eliminates Pell Grant eligibility for students whose Student Aid Index is twice the maximum Pell award (which includes many lower-middle-class to middle-class families who struggle to afford college due to having multiple children).

- Approximately 1 in 7 Pell Grant recipients (nearly 1 million low-income borrowers) could have their award eliminated entirely. This is the number of Pell Grant recipients who enroll less than half-time at some point during the year, often because they are parents, working, and/or juggling other responsibilities.

- Approximately 1 in 4 Pell Grant recipients (over 1.5 million low-income borrowers) will see a $1,479 drop in their award. This is due to the bill increasing the requirement from 24 to 30 credits for students to receive the maximum Pell Grant.

- Even with these cuts to Pell Grant eligibility, the bill leaves the program overall drastically underfunded. It allocates $10.5 billion for FY 2026 through FY 2028, meaning it will cover less than a third of the anticipated Pell Grant shortfall in the upcoming fiscal year.

- The bill opens the Pell Grant program to extra-short workforce training programs, including at shady for-profit colleges and entirely online programs offered by private sector tech companies that leave students with low-wage jobs and worthless certificates.

The Bill Will Lead to a Boom in Private Lending and Exclude Many Students from Higher Education⬆

The bill places a cap on annual federal student loans at the “median cost of college of the [student’s] program of study.” This data does not currently exist and will be an administrative nightmare to calculate, and the policy itself will make an already-complex system of financial aid nearly impossible to administer. Students and families will be subject to different aid limits on an annual basis, making it impossible to understand and budget for the cost of their program. Moreover, capping federal student loans does not address the root causes of rising college costs, which include insufficient state funding for higher education, underinvestment in need-based grant aid, labor market discrimination, and racial and gender wealth inequality. Rather, the bill will push students in half of all programs to potentially borrow private loans to cover the amount above the median cap. Since private student loan lenders primarily lend to more affluent students with cosigners and assets, many students without these advantages will have to choose between being denied financing and not attending, or taking on more predatory forms of debt.

- The bill will create windfall profits for private student loan lenders. Capping students’ ability to access aid above the median cost of attendance for their programs, by definition, ensures that students in half of all programs will have to find alternate financing, with many turning to riskier, high-cost private loans that do not include the same protections or Income-Driven Repayment options.

- The bill sets an extremely rigid $50,000 lifetime cap on undergraduate borrowing, which will force families—especially independent students—borrowing above that amount into the private student loan market. Nearly 10 percent of all bachelor’s degree recipients, including 1 in 6 Black bachelor’s degree recipients, borrow more than $50,000 for their undergraduate degree.

- Private student loans have an average interest rate of 10.09 percent, but can be as high as 18.5 percent for low-income borrowers. These loans cost 1.5 times to nearly 3 times as much as federal undergraduate subsidized and unsubsidized student loans, which currently have an interest rate of 6.53 percent.

- Many low-income borrowers and borrowers of color may not be able to get traditional private student loans, and will be forced to choose between dropping out or taking on more predatory forms of debt. Traditional private student loan lenders require a cosigner for as many as 90 percent of borrowers. Students who do not have a parent or guardian with good credit, assets, and a willingness to cosign will likely be denied and shut out of higher education.

- Parent PLUS loans will not bridge the gap. Many of the students who would be denied private loans may not have a parent or guardian able or willing to take out loans on their behalf. Additionally, the bill requires students to max out their borrowing limits before a parent can borrow a Parent PLUS loan, and it caps the maximum amount a parent may borrow at $50,000 regardless of how many dependents they have.

- Predatory lenders will seize on the opportunity to target desperate students. With a forced explosion of demand for private loans, unscrupulous actors will rush to fill the gap with products featuring high interest rates, excessive fees, misleading marketing, aggressive debt collection, and dangerous underwriting practices, as observed in the for-profit college context.

The Bill Makes Working Families Pay Even MORE on Their Student Loan Bills⬆

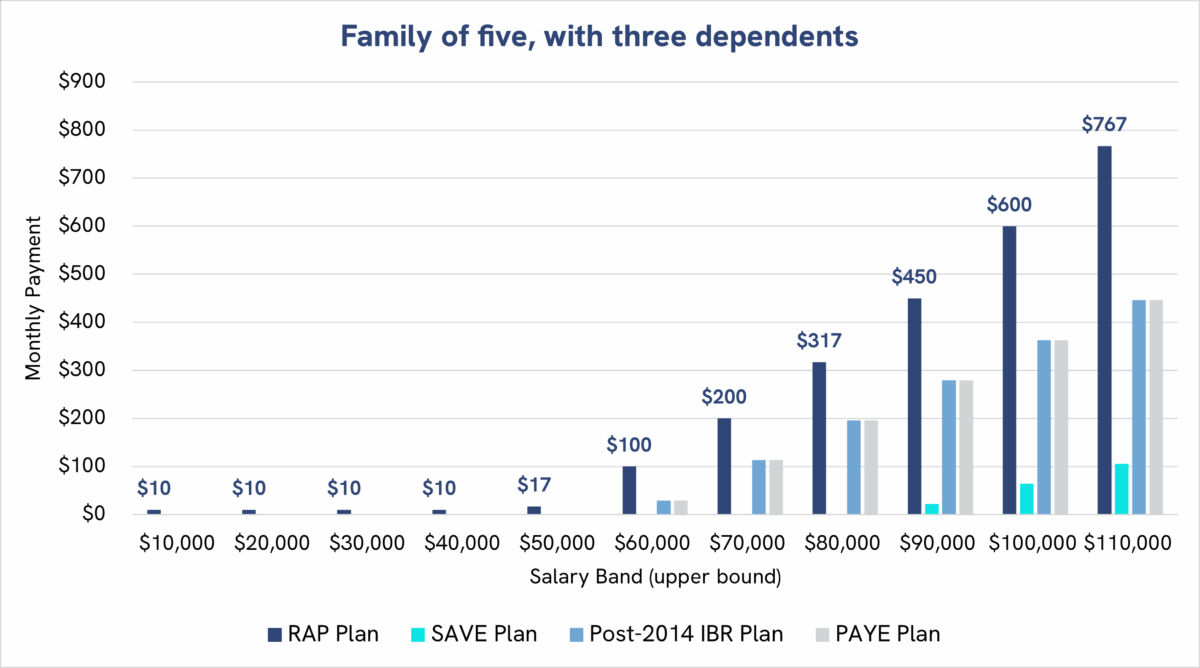

The bill substantially overhauls the existing framework of federal student loan repayment options by eliminating the Saving on A Valuable Education (SAVE) Plan, Income-Contingent Repayment (ICR) plan, and Pay As You Earn (PAYE) plan for all borrowers. It additionally requires all future borrowers to choose between either a standard repayment plan or a Repayment Assistance Plan (RAP) which costs more than almost every Income-Driven Repayment plan previously created and eliminates the ability of low-income borrowers to qualify for a $0 monthly payment, to which they are entitled currently under the law.

- The bill eliminates the SAVE Plan for 8 million borrowers currently enrolled, and will force them and their families to make $41.5 billion in loan payments in the first year alone.2

- The bill requires 1.3 million current borrowers enrolled in PAYE to pay more each month, or 15 percent of their income (up from 10 percent) by transferring them to the less generous Income-Based Repayment (IBR) plan. Approximately 1.2 million borrowers on ICR will also be placed on IBR.

- The bill eliminates all current Income-Driven Repayment plans for future borrowers. Future borrowers can choose between a standard repayment plan (which allows for longer periods of repayment depending on the outstanding principal balance), or a RAP that eliminates their ability to qualify for $0 payments and will cost thousands of dollars more each year than almost every current Income-Driven Repayment plan.

- A typical student loan borrower with a college degree will be forced to pay an additional $2,928 per year in student loan payments compared to the SAVE Plan.3

- A typical student loan borrower with some college but no degree will be forced to pay an additional $1,761 per year compared to the SAVE Plan.4

- A typical family of four headed by a borrower with a bachelor’s degree will be forced to pay an additional $4,786 per year when compared to the SAVE Plan.5

- A typical family of four headed by a borrower with some college and no degree will be forced to pay an additional $1,452 per year when compared to the SAVE Plan.6

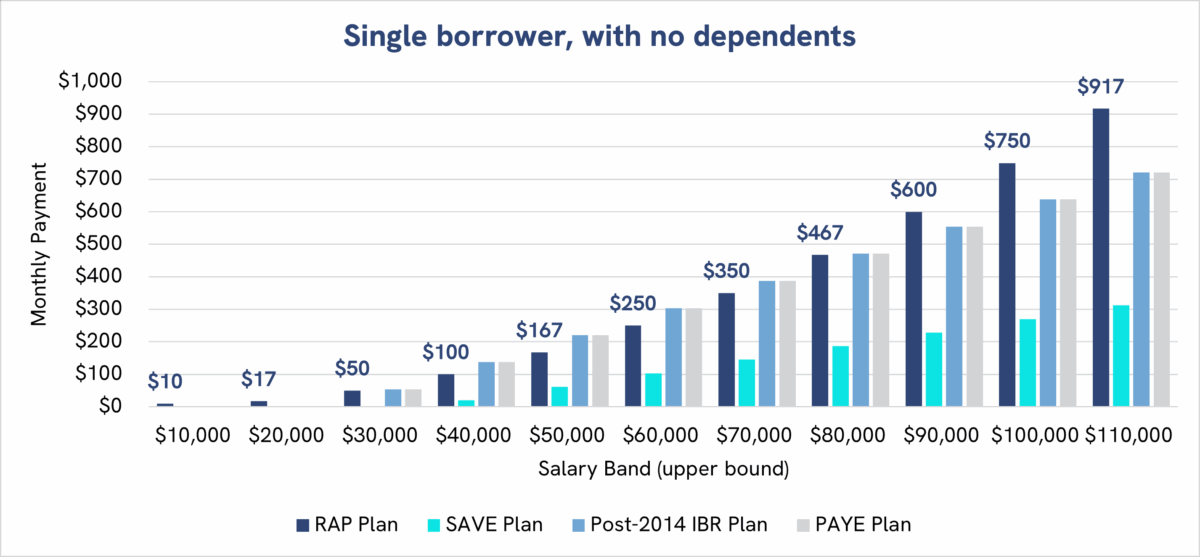

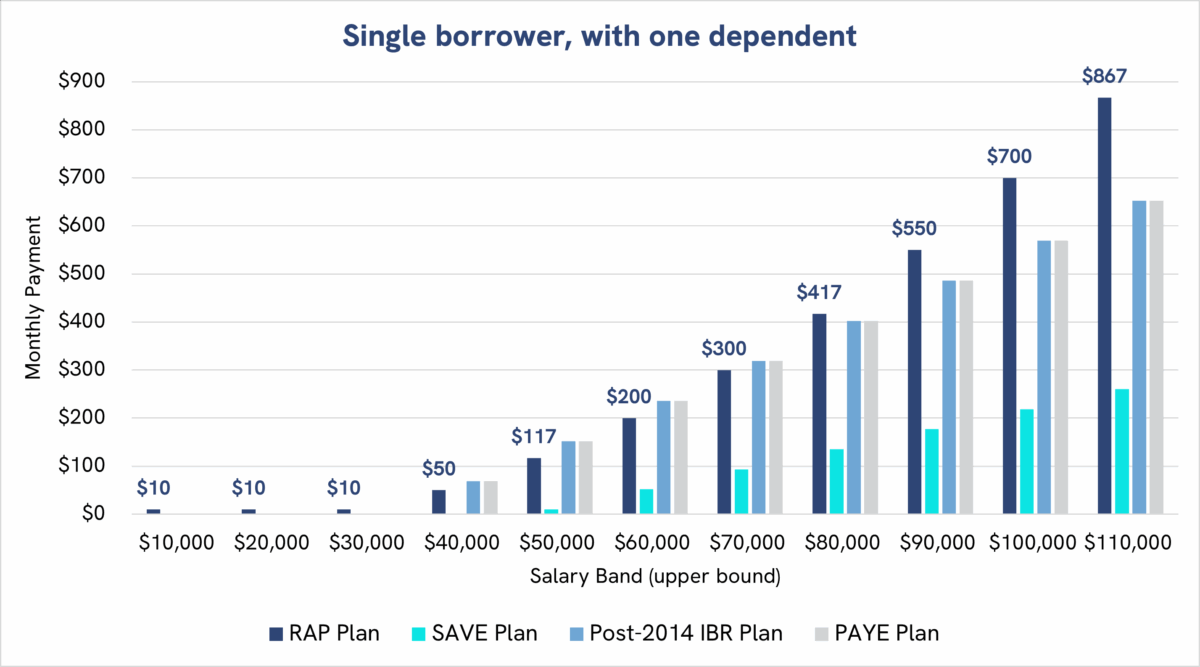

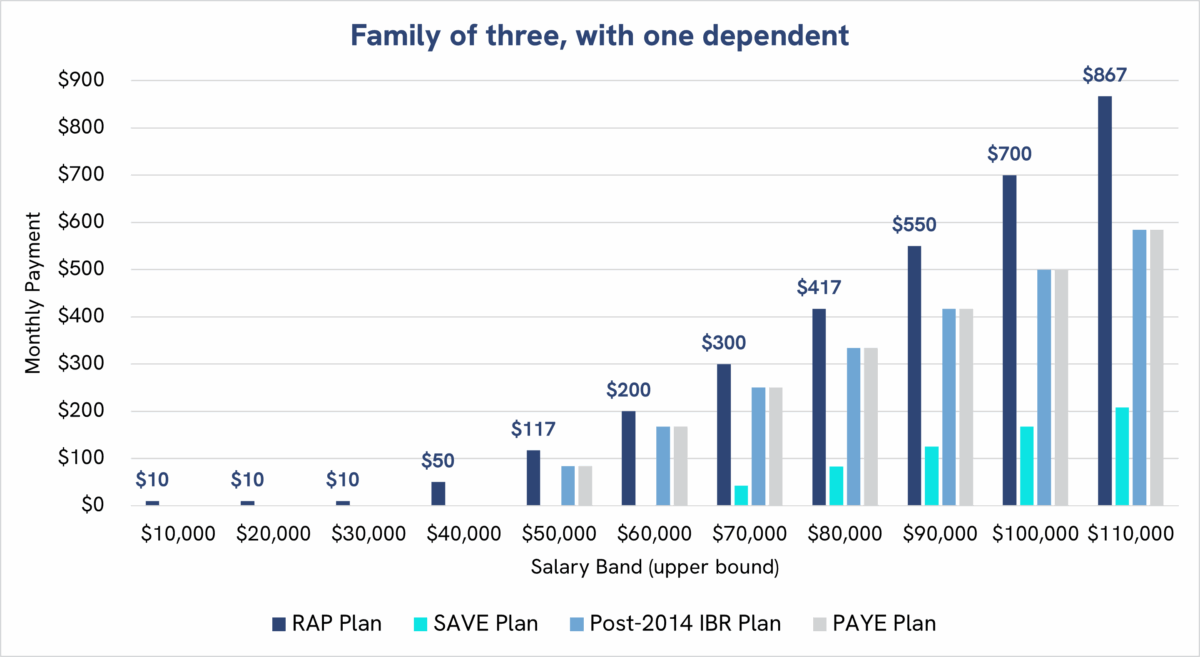

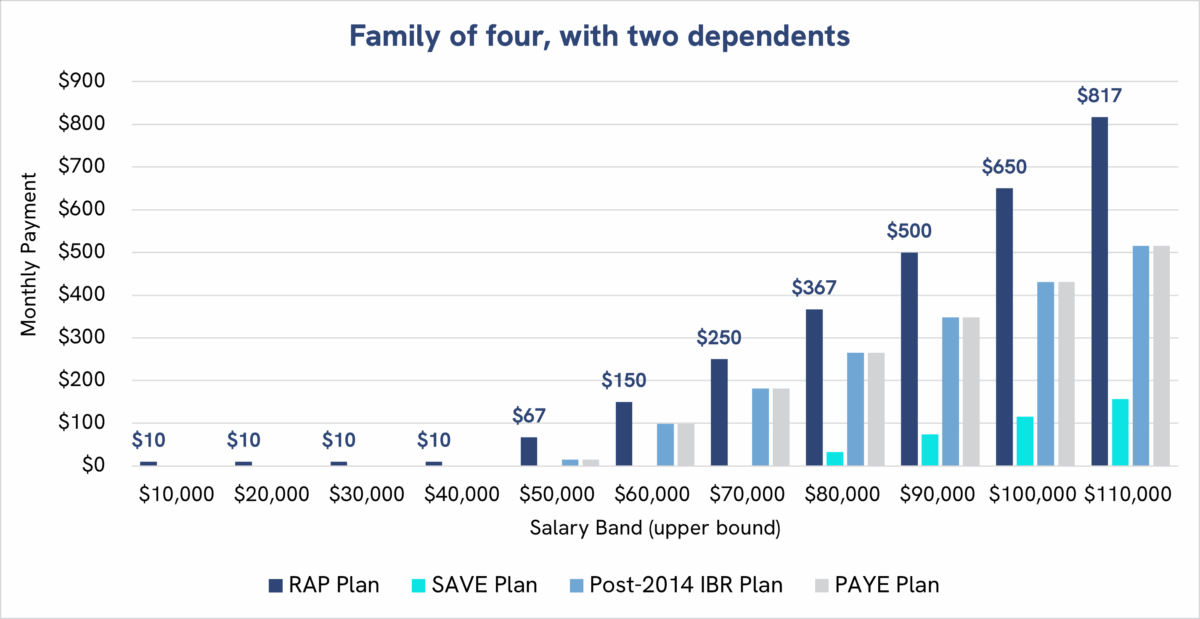

The following charts illustrate how the RAP proposal would impose higher monthly payments for borrowers and their families than almost every other payment plan.

- The bill requires new borrowers to keep making payments even if they lose their job or cannot afford their monthly bills, by eliminating the ability for new borrowers to access deferment and hardship forbearances. The bill also bars future borrowers from accessing discretionary forbearances longer than 9 months over a 2-year period.

The Bill Eliminates Vital Protections and Bans Future Efforts to Make Student Loan Payments More Affordable⬆

- The bill destroys critical consumer protections that help cancel loans for borrowers who attended fraudulent, for-profit schools. Under current law, borrowers can have their loans cancelled if they were tricked into attending schools that do not provide a quality education under the 90/10 rule, gainful employment, closed school discharge, and borrower defense to repayment. The bill restores the 2019 versions of the latter two programs, which imposed procedural barriers and had evidentiary standards that were impossible for defrauded students to meet.

- The bill bans future administrations from taking regulatory action to make repayment more affordable or cancel debt, as it prohibits the Department of Education from issuing any rule under the Higher Education Act that is “economically significant,” or has an annual effect on the economy of $100 million or more.

The Bill Worsens Medical Professional Shortages and Undermines Public Service Loan Forgiveness⬆

The bill eliminates the Graduate PLUS loan program, which has helped put nearly 2 million current borrowers through graduate school, and which borrowers must take on because the limits of unsubsidized loans are too low to finance the cost of a graduate degree. Over 442,000 borrowers took out $31,978 on average in Graduate PLUS loans in the 2023-2024 academic year. For degree-holders who rely on Grad PLUS, it makes up nearly half (47 percent) of the typical graduate borrower’s loan package. In its place, the bill places $100,000 aggregate borrowing caps on many graduate programs and $150,000 on professional programs, and caps annual borrowing at the median cost of a particular graduate degree program.

- This proposal would require many graduate students to take out thousands of dollars in additional private loans with substantially higher interest rates. Private student loans are not eligible for Public Service Loan Forgiveness (PSLF) and lack critical protections, such as the ability to tie monthly payments to a borrower’s income. Below are preliminary estimates for how much in private student loans that certain graduate borrowers will be pushed to take.7

| Profession & Degree | Current Avg. Total Federal Loans | New Federal Loan Cap | New Additional Avg. Private Loans* |

| Doctors (DO, MD) | $175,357 | $150,000 | $25,357 |

| Dentists (DDS, DMD) | $333,040 | $150,000 | $183,040 |

| Veterinarians (DVM) | $170,149 | $150,000 | $20,149 |

*These figures are likely an underestimate of how much in private loans a borrower must take out, as it assumes that borrowers do not have loans from their undergraduate degree. The bill places an aggregate cap of $200,000 on combined undergraduate and graduate federal student loans per borrower.

- This proposal bars medical and dentistry residency time from qualifying as eligible employment time for relief under PSLF, but does allow borrowers to access 4 years of interest-free forbearances during a residency. This will likely worsen the shortage of medical professionals and continue placing upward pressure on the cost of healthcare.

- Students looking to work in traditionally lower-paying public service fields may be less inclined to do so if they will not be able to have all their loans canceled through PSLF due to having to borrow private student loans, and they will be forced to pay higher monthly payments and interest.

The proposed legislation will have devastating consequences for borrowers, students, and their families by pushing them toward costlier federal loan repayment plans, more expensive private student loans, and predatory debt traps. In the weeks ahead, other committees in the House of Representatives will consider proposals that will cut safety net programs, such as SNAP and Medicaid, and further jack up costs for working families—all to pay for massive tax cuts for billionaires and corporations. For the millions of families struggling to pay for college, keep up with their student loans, and simply make ends meet, the House Education and Workforce Committee’s reconciliation bill will only push the prospects of economic mobility and the American Dream further out of reach.

Jennifer Zhang is a Research Associate at the Student Borrower Protection Center. Prior to joining SBPC, she was a Director’s Financial Analyst at the CFPB, where she worked with the Student Loan Ombudsman’s office, the Policy Planning & Strategy team of the Director’s front office, and the Quantitative Analytics team of the Enforcement Division.

Endnotes: ⬆

- The four-year interest figure is calculated by assuming that a borrower maxes out the first-year annual loan limit of $3,500; second year of $4,500; and third and fourth years of $5,500 each, with a 6.53 percent simple interest for each loan disbursement. ↩︎

- We assume that a typical student loan borrower on the SAVE Plan earns the median income for a bachelor’s degree recipient in 2024, according to the Bureau of Labor Statistics ($80,263), and owes an average amount of student debt for a borrower in Q4 2024, according to the Office of Federal Student Aid ($38,374). We also assume that this debt has an interest rate of 6.3 percent. For this borrower, the proposed legislation would not offer any payment relief under the new RAP, defaulting the borrower to a standard 10-year payment plan monthly payment ($432/month or $5,181.96 annually). We multiply the annual loan burden by 8 million borrowers to yield $41.5 billion in loan payments during the first year. ↩︎

- We assume that a typical student loan borrower earns the median income for a bachelor’s degree recipient in 2024, according to the Bureau of Labor Statistics ($80,263), and owes an average amount of student debt for a borrower in Q4 2024, according to the Office of Federal Student Aid ($38,374). We also assume that this debt has an interest rate of 6.3 percent. For this borrower, the proposed legislation would not offer any payment relief under the new RAP, defaulting the borrower to a standard 10-year payment plan monthly payment ($432/month or $5,181.96 annually). We contrast this payment with the payment owed under the SAVE Plan ($188/month or $2,256 annually), finding that under the current proposal a typical single borrower with a bachelor’s degree would repay $244 more per month, or $2,928/year. ↩︎

- We assume that a typical student loan borrower with some college and no degree earns the median income for a worker with some college in 2024, according to the Bureau of Labor Statistics ($53,040) and owes an average amount of student debt for a borrower in Q4 2024, according to the Office of Federal Student Aid ($38,374). We also assume that this debt has an interest rate of 6.3 percent. For this borrower, the proposed legislation would offer some payment relief under the new RAP ($221/month or $2,652 annually) when compared to a standard 10-year payment plan monthly payment ($431.83/month or $5,181.96 annually). We contrast the RAP payment with the payment owed under the SAVE Plan ($74/month or $891 annually), finding that under the current proposal a typical single borrower with debt and no degree would repay $147 more per month or $1,761 per year. ↩︎

- We assume that a typical student loan borrower earns the median income for a bachelor’s degree recipient in 2024, according to the Bureau of Labor Statistics ($80,263), and owes an average amount of student debt for a borrower in Q4 2024, according to the Office of Federal Student Aid ($38,374). We also assume that this debt has an interest rate of 6.3 percent. For this borrower, the proposed legislation would not offer any payment relief under the new RAP, defaulting the borrower to a standard 10-year payment plan monthly payment ($431.83/month or $5,181.96 annually). We contrast this payment with the payment owed under the SAVE Plan ($33/month or $396 annually), finding that under the current proposal a typical single borrower with a bachelor’s degree would repay $399 more per month, or $4,786/year. ↩︎

- We assume that a typical student loan borrower with some college and no degree earns the median income for a worker with some college in 2024, according to the Bureau of Labor Statistics ($53,040) and owes an average amount of student debt for a borrower in Q4 2024, according to the Office of Federal Student Aid ($38,374). We also assume that this debt has an interest rate of 6.3 percent. For this borrower, the proposed legislation would offer some payment relief under the new RAP ($121/month or $1,452 annually) when compared to a standard 10-year payment plan monthly payment ($431.83/month or $5,181.96 annually). We contrast the RAP payment with the payment owed under the SAVE Plan ($0/month or $0 annually), finding that under the current proposal a typical single borrower with debt and no degree would repay $121 more per month or $1,452 per year. ↩︎

- We generously assume that the borrower has no undergraduate student debt that lowers their eligibility for federal student loans due to the bill’s proposed borrowing caps. Figures in the “Current Avg. Total Federal Loans” column are calculated by taking the average annual cumulative graduate federal loans for borrowers who have completed each degree program (as reported by the National Center for Education Statistics 2020 National Postsecondary Student Aid Survey) and multiplying by the number of years required to complete each degree (4). The average loans currently taken out by students in each program far exceed the $150,000 federal borrowing cap for professional graduate school, which we note in the “New Federal Loan Cap” column. Figures in the “New Additional Avg. Private Loans” column are calculated by taking the difference between the new federal loan cap and the current average cumulative federal loans required to complete each degree. ↩︎